- Watching Gamers:Dorkness Rising #

- Charisma? Weee! #

- Tweeting a dork movie? I'm a bit of a geek. #

- We just met and the first thing you do, after boinking a stranger in the presence of the king, is to murder a peasant? #

- Every movie needs a PvN interlude. #

- Everything's better with pirates. #

- Waffles? Recognize. #

- The Spatula of Purity shall scramble the eggs of your malfeasance. #

- Checkout clerks licking their fingers to separate bags or count change is gross. #

- Watching Sparkles the Vampire, Part 2: Bella's Moodswing. #twilight #

- @penfed was a waste of money. $20 down the drain to join, wouldn't give a worthwhile limit, so I can't transfer a balance. #

- @JAlanGrey It's pretty lame. The first one was ok. This one didn't improve on the original. in reply to JAlanGrey #

- RT @tferriss: Are you taking snake oil? Beautiful data visualization of scientific evidence for popular supplements: http://ping.fm/pqaDi #

- Don't need more shelves, more storage, more organization. Just need less stuff. #

- @BeatingBroke is hosting the Festival of Frugality #226 http://su.pr/80Osvn #

- RT @tferriss: Cool. RT @cjbruce link directly to a time in a YouTube video by adding #t 2m50s to end of the URL (change the time). #

- RT @tferriss: From learning shorthand to fast mental math – The Mentat Wiki: http://ping.fm/fFbhJ #

- RT @wisebread: How rich are you? Check out this list (It may shock you!!!) http://www.globalrichlist.com/ #

- RT @tferriss: RT @aysegul_c free alternative to RosettS: livemocha.com for classes, forvo.com for pronunc., lang8.com for writing correction #

- Childish isn't an insult. http://su.pr/ABUziY #

- Canceled the Dish tonight. #

Anchor Price Your Salary

- Image by Dalboz17 via Flickr

Conventional wisdom says that, when negotiating your salary or a raise, you should make whatever crazy ninja maneuvers it takes to get the other person to name a number first.

Horse pellets.

Have you ever watched an infomercial? Those masters of of impulse marketing geared towards insomniacs, invalids, and inebriates?

“How much would you pay for this fabulous meat tenderizer/eyelash waxer? $399? $299? No! If you call within the next 73 seconds, we will let you take this home for the low, low price of just $99.99!”

That’s the magic of anchor pricing.

The first number you hear is the number you will base all further numbers on. If you hear a high number, other lower numbers will feel much lower by comparison. The number doesn’t even have to be about money.

There was a study done that had the subjects compare a price to the last two digits of their social security numbers. Those with higher digits found higher prices to be acceptable, while those with lower prices only accepted cheaper prices.

What does an infomercial marketing ploy have to do with your salary?

If you are negotiating your salary and your potential employer gives a lowball offer, every higher counteroffer after that will much, much higher than than it would otherwise. On the other hand, if you start with your “perfect” salary, they amount you will be happy to settle for won’t seem to be nearly as high to the employer. At the same time, you will be less likely to accept a lowball offer if you set your anchor price high.

For example, if you are looking to make $50,000:

The employer offers you $40,000. $60,000 seems too high by comparison, so you counter with $50,000, then compromise and settler for $45,000. Or, you could start at $60,000, making the employer feel that $40,000 is too low, so he counters with $45,000, leaving a compromise at $52,000. That’s a hypothetical $7,000 boost, just for bucking conventional wisdom and taking a cue from the marketing industry.

How have you negotiated your salary?

The Obligatory Thanksgiving Post

Tomorrow is Thanksgiving. Tomorrow is also Thursday, and I don’t post on Thursdays, so I’ll be posting about Thanksgiving today.

Thanksgiving is a day to be thankful for–first and foremost–capitalism.

When the Pilgrims first landed, they set up a communal farming arrangement, figuring that a good Christian community could take care of its own. From each according to his ability, to each according to his need, and all that. Everyone worked for the good of everyone else, so everyone benefited, right?

The Pilgrims, like every other group that has ever advocated communism, neglected to consider human nature. If you have no incentive to work, you don’t. If sleeping in and making babies still gets you fed and clothed, why work?

On the other side, if you work hard, only to see your hard work go to benefit your lazy neighbor, sleeping in and rattling the headboard, but never doing anything productive, why bother?

It didn’t take long for the Pilgrims to notice this tragedy of government wasn’t working.

The strong, or man of parts, had no more in devission of victails and cloaths, then he that was weake and not able to doe a quarter the other could; this was thought injuestice. The aged and graver men to be ranked and equalised in labours, and victails, cloaths, etc., with the meaner and yonger sorte, thought it some indignite and disrespect unto them. And for mens wives to be commanded to doe servise for other men, as dresing their meate, washing their cloaths, etc., they deemd it a kind of slaverie, neither could many husbands well brooke it. Upon the poynte all being to have alike, and all to doe alike, they thought them selves in the like condition, and ove as good as another; and so, if it did not cut of those relations that God hath set amongest men, yet it did at least much diminish and take of the mutuall respects that should be preserved amongst them.

It didn’t take long before nobody was working. Neighbors resented each other, because everyone had a right to the work of the other, with no need to compensate each other. That’s a case of “I’m starving because you aren’t working hard enough, but it’s not my fault you’re starving.”

At one point, the production of the colony was down so much that the colonists’ ration of corn was just 4 kernels per day. That’s how you kill a colony.

But they learned from their mistakes before they all died.

Yet notwithstanding all those reasons, which were not mine, but other mens wiser then my selfe, without answer to any one of them, here cometh over many quirimonies, and complaints against me, of lording it over my brethern, and making conditions fitter for theeves and bondslaves then honest men, and that of my owne head I did what I list. And at last a paper of reasons, framed against that clause in the conditions, which as they were delivered me open, so my answer is open to you all. And first, as they are no other but inconvenientes, such as a man might frame 20. as great on the other side, and yet prove nor disprove nothing by them, so they misse and mistake both the very ground of the article and nature of the project. For, first, it is said, that if ther had been no divission of houses and Lands, it had been better for the poore. True, and that showeth the inequalitie of the condition; we should more respecte him that ventureth both his money and his person, then him that ventureth but his person only.

The slavery of working for the benefit of others didn’t work, unless you were “theeves and bondslaves”. Then, it was great, living off of the sweat of others.

To make a long story short, the starvation ended when the Pilgrims were given parcels of land and told they could keep what they built from it. They went from the edge of extinction to being prosperous in a short time. The old and weak were cared for, not by the governor’s decree, but by the generosity of their neighbors.

Everybody in the colony won.

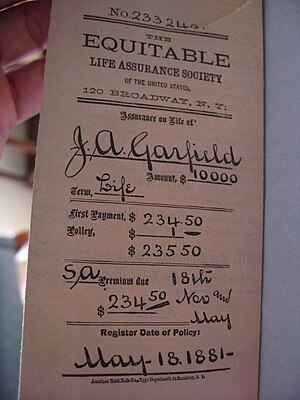

BUYING LIFE INSURANCE ONLINE: THE PROS & CONS

This is a guest post.

In today’s day and age, nearly everything that we do in our day-to-day lives can be done online and we’ve come to not only expect that, but somewhat rely on that convenience. Insurance, however, is kind of a grey area when it comes to online purchases – no matter what kind of insurance you’re purchasing. After all, an insurance policy is no small purchase; it’s major and can have a profound financial effect on your life, and the lives of your loved ones.

Think about it like this – how wary are you of even just making a small eBay purchase? Most of us look at the seller’s rating, read their feedback, and try to accurately gauge what the risk is compared to the reward. This same mentality should apply to making a life insurance policy online and is far more deserving of it. You can follow this link to learn more from Suncorp today.

This isn’t to say that making an online life insurance purchase can’t be beneficial; depending on your situation, it can be very beneficial, indeed. However, it is going to take substantially more research on your part to get to where an insurance agent might be able to get you, sometimes in half the time.

Pros of Buying Online

One of the most alluring reason for life insurance seekers to buy online are the prices, the comparing conveniences, and sometimes the lack of medical exam. There’s plenty of aggregator sites out there that can take a sampling from across the internet and return you a quote within a matter of seconds – how’s that for convenience?

Probably the most favored feature, though, is the comparison shopping. Once an aggregator provides you with a slew of options, with a wide variety of price points, you’re able to compare all of the details among them, quickly and easily. Something that would easily take your hours if you were having to do all of that research yourself, one by one.

At the minimalist level, though, you’ll often find that some individuals just truly feel more comfortable making insurance purchases from the comfort of their own home, without any agents or appointments. Either because these situations make them nervous, or because they simply don’t have the time to sit down with an agent.

Cons of Buying Online

One of the big ones revolves around the last “pro” that I mentioned – if you don’t have the time to sit down with an agent for a limited amount of time, and let them do all of the work from there, you certainly don’t have the time to handle all of the research that comes along with going through this process on your own.

Also, you shouldn’t always assume that shopping around yourself is going to save you money with it comes to life insurance – after all, life insurance agents have personal connections, favors to call in, and think-on-their-feet knowledge that might drum up an innovative solution; something that online aggregators can’t do.

Furthermore, building that one-on-one relationship with your life insurance agent can be incredibly beneficial. For one thing, you can have every last little thing that you don’t understand about the fine print thoroughly explained to you – this is a big one. Another thing is having such a relationship with you agent, that you can call them at any time, when anything comes up, or when you need sound financial advice. Try calling an aggregator and see if you get much beyond the auto-answering system – I assure you, it’ll be a challenge.

If You Do Decide to Buy Online…

- Don’t Give Out all of your Personal Information – No matter what the insurer tells you, you don’t need to provide any crucial personal data just to obtain a quote.

- Enlist the Service of an Aggregator that Can Give You a Wide Variety of Options – Comparing an insurer there and an insurer there, means very little actually. You need a plethora of results in order to make a decision that will best be tailored to your situation.

- Don’t Get Swindled – Make sure that you’re getting the right information, from a reputable company, that doesn’t deal in the ole’ “Bait-and-Switch”; which refers to when crooked life insurance agents inflate your worth and buy you either a higher policy than requested, or even a different policy entirely – all for their commission!

- Thoroughly Research all Potential Candidates – Obtain the financial rating of any establishment, online or otherwise, to find out more about the reputability of both.

Twitter Weekly Updates for 2010-05-08

- The Festival of Frugality #278 The Pure Peer Pressure Edition is up. All of your friends are reading it. http://bit.ly/aqkn4K #

- RT @princewally: Happy StarWars Day!: princewally's world http://goo.gl/fb/rLWAA #

- Money Hacks Carnival #114 – Hollywood Edition http://bit.ly/dxU86w (via @nerdwallet) #

- I am the #1 google hit for "charisma weee". Awesome. #

Meal Plans

- Image by Getty Images via @daylife

When we don’t have a meal plan, food costs more.

Our regular plan is to build a menu for the week and go to the grocery store on Sunday. This allows planning, instead of scrambling for a a meal after work each night. It also give us a chance to plan for leftovers so we have something to eat for lunch at work.

We work until about 5 every weekday. When we don’t have the meal planned, it’s usually chicken nuggets or hamburger helper for dinner. Not only is that repetitive, but it’s not terribly healthy. It is, however, convenient. If we plan for it, we can get the ingredients ready the night before and know what we are doing when we get home, instead of trying to think about it after a long day of work.

If we don’t plan for leftovers, we tend to make the right amount of food for the family. When this happens, there’s nothing to bring to work the next day, which means I’ll be hungry about lunchtime with nothing I can do about it except buy something. Buying lunch is never cheaper than making it. I can get a sandwich at Subway for $5, but I could make a sandwich just as tasty and filling for less than half of that, using money that is meant to be used for food. All during wrestling season, we make 30-inch sandwiches on meet nights for a cost of about $5, feeding ourselves and at least a couple of others who didn’t have time to make their dinner before the 5:30 meet.

No leftovers also means no Free Soup, which is a wonderful low-maintenance meal that leaves everybody full. Nobody ever gets bored of Free Soup. (Hint: Don’t ever put a piece of fish in the Free Soup, or the flavor will take over the entire meal.)

Unhealthy, repetitive food for dinner. Over-priced, low-to-middle-quality food for lunch.

OR

We plan our meals right and have inexpensive, healthy food that doesn’t get boring for every meal.

It seems to be a no-brainer. Except, I don’t have lunch today because we didn’t plan our meals and used the last of the leftover hamburger helper for dinner last night.

Update: This post has been included in the Carnival of Personal Finance.