- RT @MoneyMatters: Frugal teen buys house with 4-H winnings http://bit.ly/amVvkV #

- RT @MoneyNing: What You Need to Know About CSAs Before Joining: Getting the freshest produce available … http://bit.ly/dezbxu #

- RT @freefrombroke: Latest Money Hackers Carnival! http://bit.ly/davj5w #

- Geez. Kid just screamed like she'd been burned. She saw a woodtick. #

- "I can't sit on the couch. Ticks will come!" #

- RT @chrisguillebeau: U.S. Constitution: 4,543 words. Facebook's privacy policy: 5,830: http://nyti.ms/aphEW9 #

- RT @punchdebt: Why is it “okay” to be broke, but taboo to be rich? http://bit.ly/csJJaR #

- RT @ericabiz: New on erica.biz: How to Reach Executives at Large Corporations: Skip crappy "tech support"…read this: http://www.erica.biz/ #

Saturday Roundup

- Image via Wikipedia

I’ve got a birthday party today and a class to teach tomorrow. Sometimes I think I take on too much, but it’s hard to roll that back when the side-hustles are all making a bit of money. What I need to do is make the side-hustles profitable enough that my straight job is optional.

In other news, I’m 10 days away from my first blogging anniversary(here). I’ll have to come up with a way to celebrate that.

Favorite posts this week:

GOOG-411 is shutting down, but there are alternatives. My favorites are Google SMS and Bing-411.

I’m a Zimbabwean quadrillionaire due to their version of “quantitative easing”. If you’re not pushing an agenda, QE is also known as devaluing the dollar.

I’m happy to be living in the future. When I told my wife this story, she was ready to cry at the beginning, but had to see the pictures by the end. Yay, technology!

And finally, thanks to Chris, here’s a primer on the absurdities of the security theater known as TSA:

Carnivals I’ve rocked:

Experiences v Stuff was included in the Carnival of Debt Reduction.

Thank you!

If I’ve missed anyone, please let me know.

Charity is Selfish

I try to give 10% of my income to charity. I don’t succeed every year, but I do try.

I don’t give because I’m generous. I give because I’m selfish.

If you give to charity, you are too.

I’m not talking about people who give to charity strictly for the tax deduction, though that is selfish too. I’m referring specifically to the people who give to charity out of the goodness of their hearts.

If I give a thousand dollars worth of clothes to a homeless shelter, I get a warm fuzzy feeling knowing that I helped people stay warm.

If I send $100 to the Red Cross for whatever terrible disaster happened shortly before I made the donation, it makes me feel good to have contributed to saving those lives.

The put-the-inner-city-kids-on-a-horse thing we do? Makes me happy to get those kids into a positive situation.

Donating blood? Yay, me! I’m saving lives!

While it’s nice to help other people, that’s not the ultimate reason I’m doing it. I do it because it makes me feel good about myself to help other people, particularly people who–for whatever reason–can’t help themselves.

That’s the basis of altruism. It’s not about helping others, it’s about feeling good about helping others.

The truly selfish, the evil dogooders, are the ones who want to raise taxes to give it away as “charity”. They get to feel like they are doing something and helping others while not actually contributing themselves and, at the same time, stealing that warm fuzzy feeling from the people who are providing the money to start with.

Evil.

Charity has to be done at a personal, local level or the benefits to the giver are eliminated while the benefits to the receiver are lessened. Bureaucracy doesn’t create efficiency.

For the record, if it’s taken by force, by tax, it isn’t charity. Charity cannot be forced. Forcing charity is, at best, a fraudulent way for petty politicians, bureaucrats, lobbyists, and activists to feel they have power over others.

Again, evil.

How to Prioritize Your Spending

Don’t buy that.

At least take a few moments to decide if it’s really worth buying.

Too often, people go on auto-pilot and buy whatever catches their attention for a few moments. The end-caps at the store? Oh, boy, that’s impossible to resist. Everybody needs a 1000 pack of ShamWow’s, right? Who could live without a extra pair of kevlar boxer shorts?

Before you put the new tchotke in your cart, ask yourself some questions to see if it’s worth getting.

1. Is it a need or a want? Is this something you could live without? Some things are necessary. Soap, shampoo, and food are essentials. You have to buy those. Other things, like movies, most of the clothes people buy, or electronic gadgets are almost always optional. If you don’t need it, it may be a good idea to leave it in the store.

2. Does it serve a purpose? I bought a vase once that I thought was pretty and could hold candy or something, but it’s done nothing but collect dust in the meantime. It’s purpose is nothing more than hiding part of a flat surface. Useless.

3. Will you actually use it? A few years ago, my wife an cleaned out her mother’s house. She’s a hoarder. We found at least 50 shopping bags full of clothes with the tags still attached. I know, you’re thinking that you’d never do that, because you’re not a hoarder, but people do it all the time. Have you ever bought a book that you haven’t gotten around to reading, or a movie that went on the shelf, still wrapped in plastic? Do you own a treadmill that’s only being used to hang clothes, or a home liposuction machine that is not being used to make soap?

3. Is it a fad? Beanie babies, iPads, BetaMax, and bike helmets. All garbage that takes the world by storm for a few years then fades, leaving the distributors rich and the customers embarrassed.

4. Is it something you’re considering just to keep up with the Joneses? If you’re only buying it to compete with your neighbors, don’t buy it. You don’t need a Lexus, a Rolex, or that replacement kidney. Just put it back on the shelf and go home with your money. Chances are, your neighbors are only buying stuff so they can compete with you. It’s a vicious cycle. Break it.

5. Do you really, really want it? Sometimes, no matter how worthless something might be, whether it’s a fad, or a dust-collecting knick-knack, or an outfit you’ll never wear, you just want it more than you want your next breath of air. That’s ok. A bit disturbing, but ok. If you are meeting all of your other needs, it’s fine to indulge yourself on occasion.

How do you prioritize spending if you’re thinking about buying something questionable?

Why I Hate Payday Loans

I hate payday loans and payday lenders.

The way a way a payday loan works is that you go into a payday lender and you sign a check for the amount you want to borrow, plus their fee. They give you money that you don’t have to pay back until payday. It’s generally a two-week loan.

Now, this two week loan comes with a fee, so if you want to borrow $100, they’ll charge you a $25 fee, plus a percent of the total loan, so for that $100 loan, you’ll have to pay back $128.28.

That’s only 28% of actual interest; that’s not terrible. However, if you prorate that to figure the APR, which is what everyone means when they say “I’ve got a 7% interest rate”, it comes out to 737%. That’s nuts.

They are a very bad financial plan.

Those loans may save you from an overdraft fee, but they’ll cost almost as much as an overdraft fee, and the way they are rigged–with high fees, due on payday–you’re more likely to need another one soon. They are structured to keep you from ever getting out from under the payday loan cycle.

For those reasons, I consider payday loan companies to be slimy. Look at any of their sites. Almost none are upfront about the total cost of the loan.

So I don’t take their ads. When an advertiser contacts me, my rate sheet says very clealy that I will not take payday loan ads. The reason for that is–in my mind–when I accept an advertiser, I am–in some form–endorsing that company, or at least, I am agreeing that they are a legitimate business and I am helping them conduct that business.

In all of the time I’ve been taking ads, I’ve made exactly one exception to that rule. On the front page of that advertiser’s website, they had the prorated APR in bright, bold red letters. It was still a really bad deal, but with that level of disclosure, I felt comfortable that nobody would click through and sign up without knowing what they were getting into. That was a payday lender with integrity, as oxymoronic as that sounds.

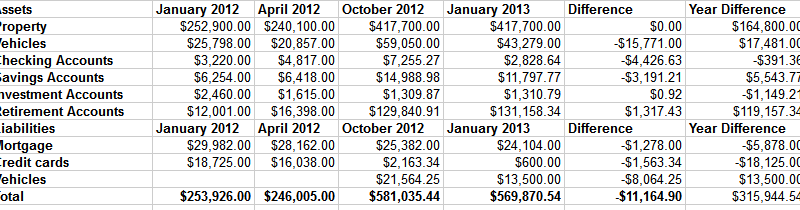

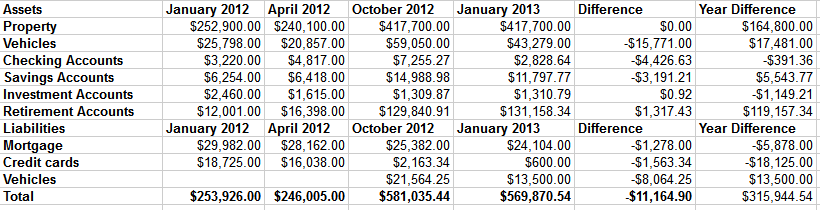

Net Worth Update

Welcome to the New Year. 2013 is the year we all get flying cars, right?

Here is my net worth update, along with the progress we made over the course of 2012.

As you can see, our net worth contracted by about $11,000. Part of that difference is due to selling our spare cars and–against my better judgement–taking payments with a lien on one of them. That is supposed to be paid off within a couple of months. If not, I’ll play repo man again.

The other part of the difference is in the final preparations for our rental property. The only things left to do are sanding and polishing the hardwood floors and cleaning the living room carpet. The final push to get to this point cost some money. All told, we’re nearly $30,000 into getting the house ready to rent. For the naysayers who think we should have sold it, we would have spent more getting it ready to sell.

Other than that, we’re not doing poorly. Our credit card is still being paid off every month and our mortgage is shrinking. If things continue to go well, we’ll have our truck paid off in a couple of months and the mortgage by mid summer.