There comes a time when it’s too late to tell people how you feel.

There will come a day when the person you mean to talk to won’t be there. Don’t wait for that day.

“There’s always tomorrow” isn’t always true.

The no-pants guide to spending, saving, and thriving in the real world.

I once worked for a company that was so confused that, not only did I not meet my last immediate supervisor for 6 months, but he didn’t know what I did or who I supported. He was my supervisor on paper for payroll and organizational purposes only.

Does your boss know what you do?

More recently, I was called into my current boss’s office to get scolded for low productivity since I don’t produce as much as the other programmers.

That’s not my favorite thing to do in the afternoon. I’d rather spend the afternoon playing Angry Birds improving our software.

In response, I spent the week logging my time. Before I left on Friday, I sent my boss an email that started out with:

When we spoke on Monday, you compared my productivity unfavorably to the other developers. I don’t think that’s a fair comparison as I do more categories of tasks than the others. I don’t think you realize how many additional responsibilities I’ve taken on over the years.

I continued from there with a summary of each day’s work last week. The short version is that, while being productive, I spend less than half of my time on my primary job function because I’ve slowly taken on a managerial role.

I’m on vacation this week, so it will be a few days before I find out if my email will make a difference.

Now, this scolding was my fault. I know I spend my day doing much more than just writing code. I’ve told my boss that before, but I’ve never made sure he understands the scale of the extra work, and I’ve never proven it with a detailed log.

This was poor personal marketing.

In the future, I have to make sure that I keep him in the loop with a summary of the extra work I do, like the training, product demos, sales calls, and estimates I’m involved in.

We’ll see how well that works.

How would you handle a situation like this? Daily emails? Whining? Kicking a garbage can across the room?

Last weekend, we held a garage sale at my mother-in-law’s house. It was technically an estate sale, but we treated it exactly as a garage sale.

A week before we started, a friend’s mother came to buy all of the blankets and most of the dishes, pots, and non-sharp utensils so she could donate them all to a shelter she works with. She took at least 3 dozen comforters and blankets away.

Even after that truckload, we started with two double rows of tables through the living room and dining room. The tops of the tables were as absolutely full as we could get them, and the floor under the tables was also used for displaying merchandise.

Have you ever had to display 75 brand-new pairs of shoes in a minimal about of space? They claimed about 16 feet of under-table space all by themselves. Thankfully, the blankets weren’t there anymore.

We also had half of the driveway full of furniture, toys, and tools.

We had a lot of stuff.

Now, most people hold a sale to make some money. Not us. We held a sale to let other people pay us for the privilege of hauling away our crap. As such, it was all priced to move. The most expensive thing we sold was about $20, but I can’t remember what that was. Most things went for somewhere between 25 cents and $1.

At those prices, we sold at least 2000 items. That isn’t a typo. We ended the day with $1325. After taking out the initial seed cash, lunches we bought for the people helping us, and dinner we bought one night, we had a profit of $975.

At 25 cents per item.

We optimized to sell instead of optimizing for profit. At the end of a long summer of cleaning out a hoarding house, it all needed to go.

In the next part, I’ll explain exactly how we made it work.

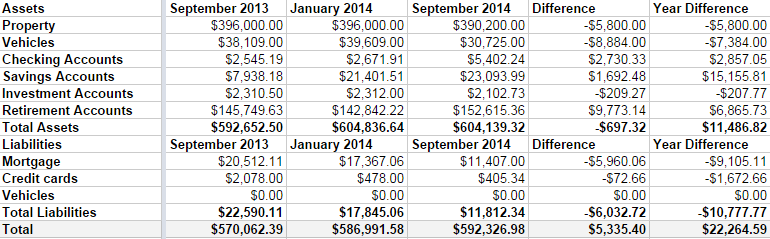

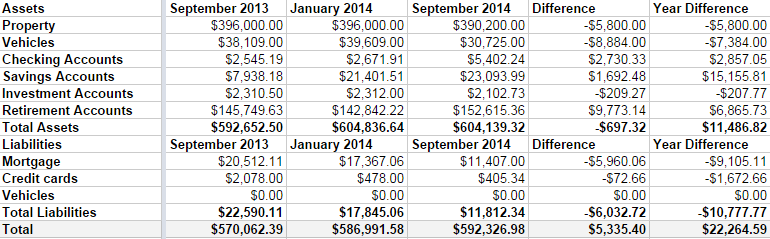

It’s time for my irregular-but-usually-quarterly net worth update. It’s boring, but I like to keep track of how we’re doing. Frankly, I was a bit worried when I started this because we’ve been overspending this summer and Linda was off work for the season.

But, all in all, we didn’t do too bad.

Some highlights:

I can’t say I’m upset with our progress. We’ve paid down $6000 in debt in 2014, including 3 months with 1 income. We aren’t maxing our retirement accounts, yet, but I’d like to be completely debt free before I do that. It’s bad math, but having all of my debt gone will give me such a warm fuzzy feeling, I can’t not do it.

My immediate goal is to hit a $600,000 net worth by my next update in January. I’m only about $7000 off.

Time to hit the casino. Err, I mean, time to up my 401k contribution from 5% to 7%.