Am I the only one who just noticed that it’s Wednesday? The holiday week with the free day is completely screwing me up.

Just to make this a relevant post:

Spend less!

Save more!

Invest!

Wee!

The no-pants guide to spending, saving, and thriving in the real world.

If you don’t know why you are hear, please read about the 21 Day Happiness Training Challenge.

After months of research and planning I recently had a successful garage. Here’s my how-to yard sale manual.

Step 1: Preparation. You can never be too prepared. I detail advertising, setup, planning and more.

Step 1.5: Marketing. Here is the text of the ads I placed.

Step 2: Management. Pricing, haggling, staffing, and other “Day Of” issues.

Step 3: Wrap-up. It’s done. What now?

Finally, we’ve got a Page of Tips. This is sure to grow over time.

When you hire someone to work on your property or provide material to build or improve it, they are entitled to get paid. A mechanic’s lien is the method of enforcing that payment.

Here is what you need to know about mechanic’s liens.

A contractor must usually give you written notice of intent to file a lien if the contract isn’t paid. He needs to do this within a short time of beginning the work. The notice will include text to the effect that subcontractors also have the right to file a lien if they are not paid. This notice gives you two methods of defense: You can pay the subcontractors directly and withhold that amount from the payment to the contractor, or you can withhold the final payment until you have received a lien waiver from each of the subcontractors.

If the notice isn’t given correctly, the contractor forfeits his right to file a lien. Also, in most places, if a contractor is supposed to be licensed to do the work, but isn’t, he’s not able to file a lien.

Subcontractors must also provide notice on intent within about 45 days–depending on the state–of the time they first provide services or material, or the lien is not enforceable.

First, you only have to pay once. If you pay the contractor in full before getting the notice of intent from the subcontractors, you can’t be forced to pay again.

Next, make the contractor provide a list of all subcontractors and keep track of any notices of intent you get. Get lien waivers from everyone involved before you make the final payment to the contractor.

Finally, you have the rights defined in the notice of intent to file a lien. You can either pay the subcontractors directly, or you can withhold the final payment until you receive lien waivers from each subcontractor.

The lien holder has 120 days to file the lien and 1 year to enforce it. Enforcing simply means that it a suit has been filed. Once that happens, you can either pay the contractor, attempt to settle with the contractor, or you can take the contractor to court to determine the “adverse claims” on your property. There aren’t too many choices at this point.

Do yourself a favor and get lien waivers before you make the final payment on any work done on your property.

The idea of working from home is certainly appealing. You get to set your own hours, sleep in some days, and be there when the kids get home from school. You can be there when the packages get delivered and let the dog out before it’s too late. Who doesn’t see the attraction?

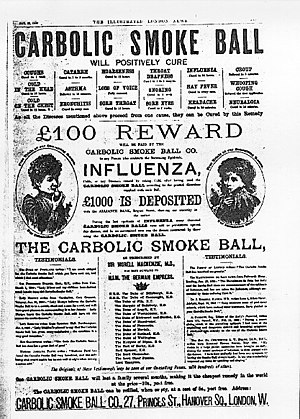

Unfortunately, when something is so enticing, there will always be predators looking to take advantage of the dreams of others. They dangle the “be your own boss” bait and reel in the people who their wishes overrule their judgment.

The ads are hard to resist. “Make $2800 per month without leaving your home!” or “Stuff envelopes in your home for $1 per envelopes.” I cases like these, the old saw tends to hold true: If it sounds too good to be true, it probably is.

Common work-at-home scams include:

For only $499.99, you can purchase a “business opportunity”. A lot of medical bill is actually done on paper so there is very real market for medical billing and processing. Unfortunately for the respondents to these ads, the vast majority of this market is already taken by large companies with huge marketing budgets. Finding enough customer to generate enough revenue to recover your investment is almost impossible, but you’ll never see that in an ad.

You answer an ad in the paper, sending $29.95 for a packet that will instruct you in the fine art of stuffing envelopes for $1 each. When you get the information, you find out it is a letter instructing you to place an ad in the papers stating “Stuff Envelopes for $1 Each. $29.95 for Information.” This forces you to become the scammer, just to recover your costs. Bad you.

This one actually sounds like a business. You invest in–for example–a sign-making machine for $1500. The selling company promises to buy a quota of signs from you each month. After you buy the equipment and materials you spend countless hours making the product only to find out that either a) the company has disappeared or b) their undefined “Quality Standards” has rejected the work. Nothing is ever up to standards.

That’s not to say there aren’t legitimate opportunities to make money at home. Bob at Christian Personal Finance recently listed 24 legitimate home-based businesses, including blogging, eBay selling, wedding planning, car mechanic, and mobile oil changes.

Are you exploring any home-based business opportunities?