Please email me at:

Or use the form below.

[contact-form 1 “Contact form 1”]

The no-pants guide to spending, saving, and thriving in the real world.

I keep calling these lessons, but they are examples and explanations, more than lessons. Names aside, please see Part 1 and Part 2 to catch up. The Google Doc of this example is here.

This time, I’m going to review my non-monthly bills. These are the bills that have to be paid, but not on a monthly basis. Some are annual, others are quarterly, or even weekly. Every month, the amount–adjusted to the monthly equivalent–is set aside in Quicken.

There aren’t too many items here that can be legitimately and responsibly trimmed.

Today, I am continuing the series, Money Problems: 30 Days to Perfect Finances. The series will consist of 30 things you can do in one setting to perfect your finances. It’s not a system to magically make your debt disappear. Instead, it is a path to understanding where you are, where you want to be, and–most importantly–how to bridge the gap.

I’m not running the series in 30 consecutive days. That’s not my schedule. Also, I think that talking about the same thing for 30 days straight will bore both of us. Instead, it will run roughly once a week. To make sure you don’t miss a post, please take a moment to subscribe, either by email or rss.

Today we’re going to look at ways to boost your income.

People spend a lot of time talking about ways to reduce your expenses, but there is a better way to make ends meet. If you make more money, you will—naturally—have more money to work with, which will make it easier to balance your expenses. I’ve found it to be far less painful to make more money than to cut expenses I enjoy.

I can hear what you’re thinking. It’s easy to tell people to make more money, but what about telling them how? Guess what? I’m going to tell you how to make money because I rock.

By far, the simplest way to make more money is to convince whoever is paying you to pay you more for what you are already doing. In other words, get a raise. I know that’s easy to say. Money’s tight for a lot of companies and layoffs are common. None of that matters. Your company knows that hiring someone new will involve a lot of downtime during training. If you’ve been visibly doing your job, and the company isn’t on the brink of failure, it should be possible to get a bit of the budget tossed your way.

Another simple idea is to get a second job. Personally, I hate this idea, but it works wonders for some people. Gas stations and pizza stores offer flexible schedules and they are always hiring. If they aren’t willing to work with your schedule, or it doesn’t work out, you can always quit. This isn’t your main income, after all.

My favorite option is to create a new income stream. What can you do?

Take a piece of paper and a close friend and brainstorm how you can make some money. Write down every type of activity you have ever done or ever wanted to do. Then write down everything you can think of that other people who do those activities need or want. Remember, during a brainstorming session, there are no stupid ideas. Take those two lists and see if there is any product or service you can provide.

You can start a blog—although don’t expect to generate much money early—or try writing for some revenue-sharing article web sites, like hubpages or squidoo. Other options include affiliate marketing, garage sale arbitrage(buying “junk” at garage sales, fixing it up and selling it), or even doing yard work for other people.

One interesting business I’ve seen lately is a traveling poop-scooper. These people travel around and scoop poop out of ddog-owners’ yards. Business booms in the spring when the snow melts, but it can be an ongoing income, since dogs don’t stop pooping.

Raising your income can make it easier to pay your bills, pay off your debt, or even taking nice vacations. How have you made some extra cash?

This is a guest post.

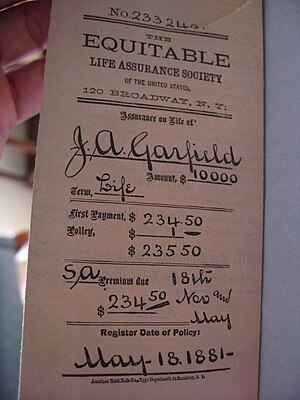

Life cover insurance acts as a safety net to pay for a family’s expenses should a wage earner become critically ill or die prematurely. Life cover includes life insurance as well as disability, critical illness, mortgage and income protection insurance policies.

In most families, at least one adult is a wage earner and uses their income to pay for necessities such as food, clothing and rent or mortgage. If the wage earner becomes disabled, too ill to work, or dies, life cover insurance can pay for these expenses.

Stay-at-home parents provide valuable, though unpaid, services to the family. Without that person, the family would have to pay for childcare, household upkeep, errand running, and every other chore the stay-at-home parent did. If the stay-at-home parent has life insurance, these expenses can be covered.

Life cover insurance can pay off mortgages and education loans.

Live cover insurance policies will pay funeral costs, which can be substantial.

Family owned businesses can be insured and protected if the owner dies.

Life cover insurance is too expensive.

Insurance companies have plans to suit every budget and life circumstance. While young and healthy adults will generally receive the most affordable policies, older adults have plenty of reasonably priced options as well.

Disability or severe illness is unlikely.

Actually, 32% of men and 25% of women, ages 40 to 70, will experience a critical illness or disability. http://www.healthinsuranceguide.co.uk/statistics_mainbody.asp

Discussing disability or death is awkward and uncomfortable.

Agreed, but avoiding the topic puts loved ones into economic jeopardy. Without the wage earner’s life cover, a family could lose their home and have to lower their standard of living.

Life Insurance

Term insurance is a protection policy, paid for during a specific time period (term), and is active during that time only. Permanent, whole, variable, universal and universal variable life insurance policies all are investment policies. They combine a death benefit (the amount paid out when the insured person dies) with an investment account. Licensed and experienced life insurance agents can help individuals make the best choice for their life situation.

Critical Illness/Disability Insurance

This type of insurance pays for living expenses if a person is diagnosed with a serious illness or disabled and can no longer work.

Mortgage Insurance

This is paid when the mortgage owner dies. This could help prevent the surviving family from having to sell the home.

The time to buy life cover insurance is now!

A 2010 survey (http://www.prnewswire.com/news-releases/ownership-of-individual-life-insurance-falls-to-50-year-low-limra-reports-101789323.html) stated that individual life insurance ownership was at a 50 year low in the United States. An estimated 35 million (30% of households) Americans do not have life insurance, and 11 million of these households have children under 18. Already living paycheck to paycheck, any debilitating injury or death of a wage earning adult could spell financial disaster to the family. Buying life cover insurance is a vital part of caring for loved ones. Just as a wage earner provides a home, food and daily necessities for their family, life cover insurance can take over and provide for the family if the wage earner unable to do so.

Effective next week, we are officially a single-income family.

If you can count all of my side-hustles as “single income”.

This week, my wife did the paperwork for her final week of state-sponsored unemployment. She also applied for the federal extension, but that’s not automatic.

In a nutshell, this reduces our monthly income by $1340.

What does that mean for us?

1. Our truck, which I was hoping to have paid off by March(3 months ago), still has about 7 regular-sized payments left. Instead of making double payments, we’re now making the schedule amount. The reason for the payoff delay is another post entirely. Savings: $400. In a pinch, we could stop making payments for almost 3 years due to how much we’ve already paid.

2. The riding lessons I use to spoil my girls are cut in half. Instead of weekly lessons, we’re going bi-weekly. Savings: $100. In a pinch, this could go away completely.

3. We had a conversation that included, “Honey, when I complain that you bought more than our weekly budget of food in one trip, I’m not being a dick. Here’s how much money we have.” That conversation appears to have been productive.

4. No vacation this year. We let our spending jump a couple of times this year, so last week, I dropped most of our vacation fund to make up for it. The expense of being matron-of-honor at a wedding will be an upcoming post, too.

[Edit]

5. My wife is working at our daycare provider 2 days per week in exchange for daycare discounts. Financially, this isn’t perfect, but it cuts the cost and gets the girls out of the house. I work from home and have a hard time keeping them out of the office.

6. We are considering long-term stay-at-home status for my wife.

[End Edit]

Right now, our budget says we make $100 more than we spend. That includes all of our savings goals, and setting aside money for some luxuries like our Halloween party. We’re not hurting–which makes me happy–but we do have to watch our expenses in a way that has just become mandatory.

I can’t tell you how happy I am to have renters. Between our roommate here and the renters in the house we fixed up last year, we’re adding about $1000 to our income. Rent is keeping us cash-flow positive.

It’s been a month(again!) since I’ve written a post for the budget series, so I’ll be continuing that today. See these posts for the history of this series.

This time, I’m looking at how to reduce my “set aside” funds. These are the categories that don’t have specific payout amounts and happen at irregular intervals. One of the convenient features of our set-aside funds–also a feature of our non-monthly bills–is that the money sits in our checking account, providing a buffer against overdrafts. The buffer is big enough that I can withdraw our entire month’s discretionary budget on the first of the month.

I’ve taken a hard look at most of the bills over time, so there isn’t always a lot to cut. Next time, I’ll be addressing our discretionary spending.