What would your future-you have to say to you?

The no-pants guide to spending, saving, and thriving in the real world.

What would your future-you have to say to you?

If you are looking to get out of debt, or you are currently debt-free and want to stay that way, then it is important that you get a grip of your financial situation and live within your means.

A good way to do this is to create a budget as this gives you a clear indication of how much money is coming in, how much is going out and also highlights any areas where you may need to make cut backs should you be falling short each month.

Once you have sorted out the figures and made necessary amendments, for example paying bills by direct debit in order to make savings or cutting existing debts by carrying out a balance transfer to a lower rate credit card, it is time to start focussing on the lifestyle changes.

As you will find, it is one thing to create a budget and quite another to stick to it, but by adhering to the following steps and exercising a certain amount of will power, you should be able to ensure that you live within your means and resist the urge to reach for that credit card.

Keep focussed

Before you start to look at how you can stick to your budget you need to clarify why you need to stick to your budget!

A budget can initially seem like something that has been devised with the sole intention of stopping you having fun and buying or doing the things that you want. So it is important to remember that, though some cutbacks may be necessary in the short term, a budget is a long-term strategy that will allow you to take control of your finances and, all being well, live a happy life that is free from the worry of excessive debt.

Change your habits

Unfortunately, a successful budget can require a change in lifestyle and this can be one of the most difficult things to adhere to.

For example, if you have previously enjoyed eating out regularly then you may have to make cut backs in this area to ensure that you are living within your means. But, instead of seeing this as a negative, try to focus on the positives and remember the reasons why you are budgeting.

And a change in habits doesn’t necessarily mean that you have to cut back on your enjoyment of life and it may actually open your eyes to other pursuits you may not have previously considered.

For example, instead of eating out try preparing a meal at home and turn your dining room into a restaurant. This means that you can still have the fine dining experience but at a fraction of the price and without the worry of making a reservation!

Shop smarter

Lists figure heavily when creating a personal budget and list-making is a habit that you should get used to when trying to stick to your budget.

When budgeting it is vitally important to avoid impulse buying and a great way to do this is to always make a list of things you need before you go shopping.

This means that you will have a clear idea of what you need and you will be less inclined to make random purchases that may just turn out to be an unnecessary drain on your finances. It’s also worth mentioning at this point that you should always differentiate and prioritise the things you need over the things you simply want.

If you are unsure how to make the distinction then put off making the purchase for a couple of days and then reconsider if you actually need it. This cooling off period will often convince you that you can do without it and save you money.

In addition, savings can be made on your shopping by simply swapping big name brands for supermarket own varieties, using discount coupons and looking for any special offers.

Overall, it is important to be fully focussed and committed to your budget plan and to be aware that a change in finances may require a change in lifestyle. But a few short term changes may well add up to better finances in the long term.

Article written by Les Roberts, budget reporter at Moneysupermarket.com.

Three years ago, we sat down and built our budget. We spent 9 months adding the non-monthly bills that we forgot about when we created the budget. Setbacks and shortfalls almost killed the budgeting plan completely. It took almost an entire year to get our budget right.

Unrelated ImageNow? I refer to the budget once per month. No more. I don’t check it at bill-paying time. I don’t think about it daily. It’s there as a reference when I need it, but it no longer drives our finances. How did we get to that point?

First, we firmly established our budget. We know exactly what we need to cover our expenses. None of the predictable bills catch us by surprise any more. This is important.

Once we had the budget established, the rest was easy. I moved almost every bill to US Bank’s online bill-pay system and switched to electronic billing and automatic payments. The automatic payments are all through US Bank. I only allow my mortgage to be set up with the merchant. I want total, instant control over the rest. I won’t call a merchant to ask them to change a payment if something comes up. The bank sends me an email when a payment is automatically scheduled, and again when it is paid.

Once I got comfortable with the automatic payments, I switched to electronic billing. I don’t need to see the bill or waste the paper if I know it is being handled for me which is why I encourage you to manage all your finances online. I do check the few bills that may change, like the credit card and cell phone. Now, I see few of my bills. They are all sent electronically to my bank, automatically paid, and scheduled in Quicken–all without intervention from me.

[ad name=”inlineleft”]We also use an envelope system. I know how much we need for groceries, baby crap, clothes, etc. At the beginning of the month, I take out all of that money in cash and put it into the appropriate envelopes. Other than this money, almost everything else takes care of itself. I don’t need to pay attention to by bills on a day-t0-day basis. Any extra money that comes in gets divided among our debt repayment and savings goals, which only takes a few minutes to arrange.

I glance over my budget at the beginning of every month, but I only review it when something changes. If we change our cell phone, or our budgeted gas bill changes, I make the change to our budget. Other than that, it’s not even an afterthought.

That’s how we do it.

Another option includes the Sloppy Math System. This consists simply of rounding deposits down and rounding expenses up. The more you round, the better the system works. If you round every deposit down $50, and round every expense up to the next $10, you are naturally building more room for error. Given enough time, you will have enough of a slush fund to handle emergencies and the occasional impulse purchase.

My son, at 10 years old, is a deal-finder. His first question when he finds something he wants is “How much?”, followed closely by “Can I find it cheaper?” I haven’t–and won’t–introduced him to Craigslist, but he knows to check Amazon and eBay for deals. We’ve been working together to make sure he understands everything he is looking at on eBay, and what he needs to check before he even thinks about asking if he can get it.

The first thing I have him check is the price. This is a fast check, and if it doesn’t pass this test, the rest of the checks do not matter. If the price isn’t very competitive, we move on. There are always risks involved with buying online, so I want him to mitigate those risks as much as possible. Pricing can also be easily scanned after you search for an item.

The next thing to check is the shipping cost. I don’t know how many times I’ve seen “Low starting price, no reserve!” in the description only to find a $40 shipping and handling fee on a 2 ounce item. The price is the price + shipping.

Next, we look at the seller’s feedback. The feedback rating has a couple of pieces to examine. First, what is the raw score? If it’s under 100, it needs to be examined closer. Is it all buyer feedback? Has the seller sold many items? Is everything from the last few weeks? People just getting into selling sometimes get in over their heads. Other people are pumping up their ratings until they have a lot of items waiting to ship, then disappear with the money. Second, what is the percent positive? Under 95% will never get a sale from me. For ratings between 95% and 97%, I will examine the history. Do they respond to negative feedback? Are the ratings legit? Did they get negative feedback because a buyer was stupid or unrealistic? Did they misjudge their time and sell more items than they could ship in a reasonable time? If that’s the case, did they make good on the auctions? How many items are they selling at this second?

[ad name=”inlineright”] After that, we look at the payment options. If the seller only accepts money orders or Western Union, we move on. Those are scam auctions. Sellers, if you’ve been burned and are scared to get burned again, I’m sorry, but if you only accept the scam payment options, I will consider you a scammer and move on.

Finally, we look at the description. If it doesn’t come with everything needed to use the item(missing power cord, etc.), I want to know. If it doesn’t explicitly state the item is in working condition, the seller will get asked about the condition before we buy. We also look closely to make sure it’s not a “report” or even just a picture of the item.

Following all of those steps, it’s hard to get ripped off. On the rare occasion that the legitimate sellers I’ve dealt with decide to suddenly turn into ripoff-artists, I’ve turned on the Supreme-Ninja Google-Fu, combined with some skip-tracing talent, and convinced them that it’s easier to refund my money than explain to their boss why they’ve been posting on the “Mopeds & Latex” fetish sites while at work. Asking Mommy to pretty-please pass a message about fraud seems to be a working tactic, too. It’s amazing how many people forget that the lines between internet and real life are blurring more, every day.

If sending them a message on every forum they use and every blog they own under several email addresses doesn’t work and getting the real-life people they deal with to pass messages also doesn’t work, I’ll call Paypal and my credit card company to dispute the charges. I only use a credit card online. I never do a checking account transfer through Paypal. I like to have all of the possible options available to me.

My kids are being raised to avoid scams wherever possible. Hopefully, I can teach them to balance the line between skeptical and cynical better than I do.

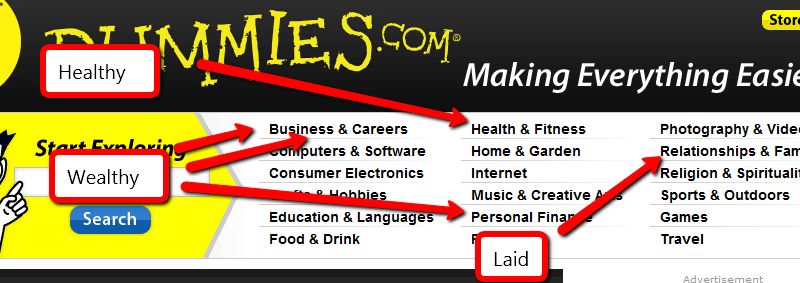

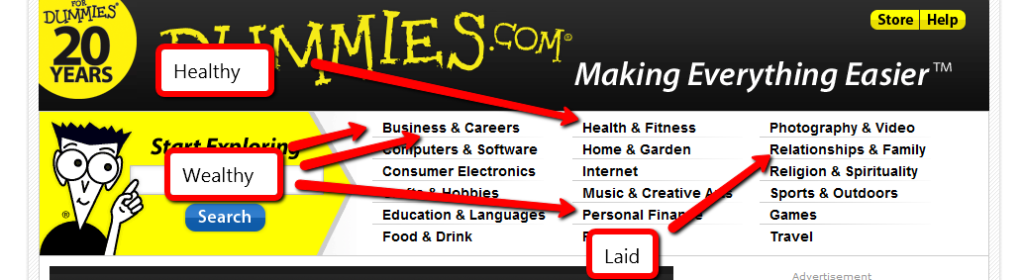

If you want to make money, help someone get healthy, wealthy or laid.

This section was quick.

Seriously, those three topics have been making people rich since the invention of rich. Knowing that isn’t enough. If you want to make some money in the health niche, are you going to help people lose weight, add muscle, relieve stress, or reduce the symptoms of some unpleasant medical condition? Those are called “sub-niches”. (Side question: Viagra is a sub-niche of which topic?)

Still not enough.

If you’re going to offer a product to help lose weight, does it revolve around diet, exercise, or both? For medical conditions, is it a way to soothe eczema, instructions for a diabetic diet, a cure for boils, or help with acne? Those are micro-niches.

That’s where you want to be. The “make money” niche is far too broad for anyone to effectively compete. The “make money online” sub-niche is still crazy. When you get to the “make money buying and selling websites” micro-niche, you’re in a territory that leaves room for competition, without costing thousands of dollars to get involved.

Remember that: The more narrowly you define your niche market, the easier it is to compete. You can take that too far. The “lose weight by eating nothing but onions, alfalfa, and imitation caramel sauce” micro-niche is probably too narrowly defined to have a market worth pursuing. You need a micro-niche with buyers, preferably a lot of them.

Now the hard part.

How do you find a niche with a lot of potential customers? Big companies pay millions of dollars every year to do that kind of market research.

Naturally, I recommend you spend millions of dollars on market research.

No?

Here’s the part where I make this entire series worth every penny you’ve paid. Times 10.

Steal the research.

My favorite source of niche market research to steal is http://www.dummies.com/. Click the link and notice all of the wonderful niches at the top of the page. Jon Wiley & Sons, Inc. spends millions of dollars to know what topics will be good sellers. They’ve been doing this a long time. Trust their work.

You don’t have to concentrate on the topics I’ve helpfully highlighted, but they will make it easier for you. Other niches can be profitable, too.

Golf is a great example. Golfers spend money to play the game. You don’t become a golfer without having some discretionary money to spend on it. I’d recommend against consumer electronics. There is a lot of competition for anything popular, and most of that is available for free. If you choose to promote some high-end gear using your Amazon affiliate link, you’re still only looking at a 3% commission.

I like to stick to topics that people “need” an answer for, and can find that answer in ebook form, since I will be promoting a specific product.

With that in mind, pick a topic, then click one of the links to the actual titles for sale. The “best selling titles” links are a gold mine. You can jump straight to the dummies store, if you’d like.

Of the topics above, here’s how I would narrow it down:

1. Business and Careers. The bestsellers here are Quickbooks and home buying. I’m not interested in either topic, so I’ll go into “More titles”. Here, the “urgent” niches look like job hunting and dealing with horrible coworkers. I’m also going to throw “writing copy” into the list because it’s something I have a hard time with.

2. Health and Fitness. My first thought was to do a site on diabetic cooking, but the cooking niche is too competitive. Childhood obesity, detox diets and back pain remedies strike me as worth pursuing. I’m leaning towards back pain, because I have a bad back. When you’ve thrown your back out, you’ve got nothing to do but lie on the couch and look for ways to make the pain stop. That’s urgency.

3. Personal Finance. The topics that look like good bets are foreclosures and bankruptcies. These are topics that can cost thousands of dollars if you get them wrong. I hate to promote a bankruptcy, but some people are out of choices. Foreclosure defense seems like a good choice. Losing your home comes with a sense of urgency, and helping people stay in their home makes me feel good.

4. Relationships and Family. Of these topics, divorce is probably a good seller. Dating advice definitely is. I’m not going to detail either one of those niches here. Divorce is depressing and sex, while fun, isn’t a topic I’m going to get into here. I try to be family friendly, most of the time. Weddings are great topic. Brides are planning to spend money and there’s no shortage of resources to promote.

So, the niches I’ve chosen are:

I won’t be building 9 niche sites in this series. From here, I’m going to explore effective keywords/search terms and good products to support. There’s no guarantee I’ll find a good product with an affiliate program for a niche I’ve chosen that has keywords that are both highly searched and low competition, so I’m giving myself alternatives.

For those of you following along at home, take some time to find 5-10 niches you’d be willing to promote.

The important things to consider are:

1. Does it make me feel dirty to promote it?

2. Will there be customers willing to spend money on it?

3. Will those customers have an urgent need to solve a problem?

I’ve built sites that ignore #3, and they don’t perform nearly as well as those that consider it. When I do niche sites, I promote a specific product. It’s pure affiliate marketing, so customers willing to spend money are necessarily my target audience.

You know exactly how much you make, to the penny. You’ve listed all of your bills in a spreadsheet, including the annual payment for your membership to Save the Combat-Wombat. You know exactly how much is coming in and how much has to go out each month. Your income is more than your expenses, yet somehow, you still have more month than money.

What’s going on?

The short answer is that a budget is not enough.

A budget is not…

…a checkbook register. Do you track everything you spend? Are you busting your budget on $10 lattes or DVDs every few days? Is the take-out you have for lunch every day adding up to 3 times your food budget? Are you sure? If you don’t track what you spend, how do you know what you’ve actually spent? You have to keep track of what you are spending. Luckily there are ways to do this that don’t involve complex calculation, laborious systems or even proper math. The easy options include using cash for all of your discretionary spending(no money, no spendy!), rounding your spending up so you always have more money than you think you do, or even keeping your discretionary money is a separate debit account. That will let you keep your necessary expenses covered. You’ll just have to check your discretionary account’s balance often and always remember that sometimes, things take a few days to hit your bank.

…a debt repayment plan. You may know how much you have available, but if you aren’t exercising the discipline to pay down your debt and avoid using more debt, you not only won’t make progress, but you’ll continue to dig a deeper hole. Without properly managing the money going out, watching the money coming in is pointless.

…an alternative to responsible spending. Your budget may say you have $500 to spare every month, but does that mean you should blow it on smack instead of setting up an emergency fund? I realize most heroin addicts probably aren’t reading this, but dropping $500 at the bar or racetrack is just as wasteful if you don’t have your other finances in order. Take care of your future needs before you spend all of your money on present(and fleeting) pleasures.

A budget is a starting point for keeping your financial life organized and measuring a positive cash flow. By itself, it can’t help you. You need to follow it up with responsible planning and spending.