- Getting ready to go build a rain gauge at home depot with the kids. #

- RT @hughdeburgh: "Having children makes you no more a parent than having a piano makes you a pianist." ~ Michael Levine #

- RT @wisebread: Wow! Major food recall that touches so many pantry items. Check your cupboards NOW! http://bit.ly/c5wJh6 #

- Baby just said "coffin" for the first time. #feelingaddams #

- @TheLeanTimes I have an awesome recipe for pizza dough…at home. We make it once per week. I'll share later. in reply to TheLeanTimes #

- RT @bargainr: 9 minute, well-reasoned video on why we should repeal marijuana prohibition by Judge Jim Gray http://bit.ly/cKNYkQ plz watch #

- RT @jdroth: Brilliant post from Trent at The Simple Dollar: http://bit.ly/c6BWMs — All about dreams and why we don't pursue them. #

- Pizza dough: add garlic powder and Ital. Seasoning http://tweetphoto.com/13861829 #

- @TheLeanTimes: Pizza dough: add lots of garlic powder and Ital. Seasoning to this: http://tweetphoto.com/13861829 #

- RT @flexo: "Genesis. Exorcist. Leviathan. Deu… The Right Thing…" #

- @TheLeanTimes Once, for at least 3 hours. Knead it hard and use more garlic powder tha you think you need. 🙂 in reply to TheLeanTimes #

- Google is now hosting Popular Science archives. http://su.pr/1bMs77 #

- RT @wisebread 6 Slick Tools to Save Money on Car Repairs http://bit.ly/cUbjZG #

- @BudgetsAreSexy I filed federal last week, haven't bothered filing state, yet. Guess which one is paying me and which one wants more money. in reply to BudgetsAreSexy #

- RT @ChristianPF is giving away a Lifetime Membership to Dave Ramsey’s Financial Peace University! RT to enter to win… http://su.pr/2lEXIT #

- RT @MoneyCrashers: 4 Reasons To Choose Community College Out Of High School. http://ow.ly/16MoNX #

- RT @hughdeburgh:"When it comes to a happy marriage,sex is cornerstone content.Its what separates spouses from friends." SimpleMarriage.net #

- RT @tferriss: So true. "Nearly all men can stand adversity, but if you want to test a man's character, give him power." – Abraham Lincoln #

- RT @hughdeburgh: "The most important thing that parents can teach their children is how to get along without them." ~ Frank A. Clark #

Anna Chapman and Edward Snowden: How to afford a long-distance romance?

Recently Russian spy Anna Chapman tweeted a proposal to fellow spy Edward Snowden, as in a marriage proposal. News reports covering the Internet event report that Chapman would not reveal whether she was serious but asked reporters to use their imaginations. So it is yet to be seen whether there will be spy marriage ahead for the two notorious leakers. What is true, however, is that no nuptials can take place at the moment, even if Anna Chapman were serious and Edward Snowden. That is because the United States has revoked Snowden’s U.S. passport, and marriage ceremonies cannot take place in the airport where Snowden is trying to buy time. So how can Chapman and Snowden afford a long-distance relationship? Follow this quick guide of tips for helping the spies survive what could be a long road ahead!

Finding Deals

Anna Chapman has the most mobility right now, so she should be looking out for cheap flights to where Snowden is hiding out. A long-distance relationship can be expensive, so that is why finding deals on air travel is key. She can drop into the airport for a quick rendevouz. Why not?

Saving Money

These two potential spy lovers and super team need to save their money at every turn. Hiding out in secrete is costly, so they should create a special account that they both can add to for getaway and meeting expenses. Meeting at the airport is going to get old after a while, so they need to find a safe space where they can enjoy one another and sustain their relationship. Long-distance relationships are known for their difficulty because a couple spend so much time trying to reconnect every time they see one another.

Pick Your Fights

Long-distance relationships have little room for petty fighting. You see each other so infrequently that you have to cherish the time you have together. Instead of talking spy business, Anna Chapman and Edward Snowden should make sure they are focusing on each other by getting to know each other and focusing on the small things that make them happy together. Petty fighting will destroy a long-distance relationship. Chapman and Snowden should part each meeting feeling good about the other instead of feeling frustrated.

Kiss and Makeup

The key to long-distance relationships is always to kiss and makeup before leaving. No matter what the spies face together or apart, they cannot let their professions and media scrutiny come between them. Instead, they need to focus on their love and passion. Make sure to share a passionate kiss before leaving each meeting so that the memory of love and admiration is fresh on the mind. With a little effort in the romance department, Chapman and Snowden will be well on their way to creating harmony in their relationship. Moving from shallow levels to more deeper levels, however, is going to take time.

Related articles

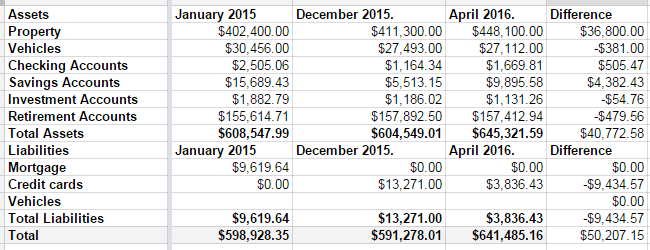

Net Worth, April 2016

Last year wasn’t a good year for my net worth. It came with a $7000 drop.

Q1 2016, however, was a great quarter.

In December, we had $13,271 in credit card debt. At the time I took this screenshot, it was down to $3836.43. As of this moment, it’s down to $2640.91. If things go as expected this week, I should wake up on Friday to a paid-off credit card. I had to raid some of our savings accounts to make it happen, but it’s happening. Some of it was a tax refund, some of it was the fact that my mortgage payment went away in December.

That’s seven years of hard work, almost to the day. Seven years ago, I was researching bankruptcy, and stumbled across Dave Ramsey. Seven years ago, we were drowning in debt.

Next week, we’re free. No more debt, hanging over our heads. We’re free to take vacations. We’re free to finally save for college, when my son is 16, and stand a chance of being able to pay for it for him. We’re free to do…whatever we want to do. Our monthly nut after the debt is paid–only in fall/winter/spring when my wife is working–is roughly 1/3 of our take-home pay.

That’s how hard we’ve cut to make sure we can pay our bills and make debt die. We do have some things that would be considered extravagant. We’re not savages. But my car is 10 years old. My wife’s is 7. My motorcycles are 35 and 30; one of them was purchased before we cared about our debt.

Back to the net worth….

The biggest change came from our property values, which sucks. That was $36,000 of the difference, which comes with the painful tax bump to go with it. A large chunk of the savings increase was the money we set aside every month to cover the property tax bill, and that will go away next month.

Still, $641,000 dollars is a long way from nothing. I’m pretty happy.

More Debt

Even though we just paid off our credit cards in August and have started competing to pay off our mortgage, we opened a new debt account on Monday.

We’ve been shopping for a new(to us) car for a while. Simply put, we’ve outgrown our current vehicles.

As I said last week, these are our needs:

- We have 5 people in our family. My 13-year-old son is bordering on 6 feet tall and shows no sign of not growing.

- Every weekend, we have at least 1 extra kid, sometimes 2.

- We still have a giant(24 foot) boat that we won’t be selling until spring.

- My wife wants to lease a couple of ponies next summer, which will mean a horse trailer to haul them in.

We were looking for a GMC Acadia, which would meet our needs, but after talking to my brother–an Acadia owner–and the dealer, we decided it wouldn’t be the best fit. It would be marginal for towing the horses and the back row of the older models isn’t as roomy as the new one I sat in.

Saturday, we went to test drive an Acadia, which is where we had the conversation with the dealership. We ended up test-driving a Chevy Tahoe instead of the Acadia. With the options and mileage, it bluebooks for $27531, but they were using it as an online price leader and had it priced at $25000. Maybe I missed something, but the thing ran well, handled great, and the engine sounded good. As a way to get people on the lot, it worked.

Our plan was to put $5000 down, and see about trading in our Dodge Caliber and Ford F150. We brought the Caliber with us. Its bluebook value is $9,969. They offered us $5500, so we went home.

Sunday, we decided to sell the car and truck ourselves. We texted the salesman and offered $24,500. He accepted, we got a new truck that will fit our family and our needs.

With taxes, fees, and our down payment, we now have a car loan for $21564. Our plan is to sell the Caliber for $9500 and the F150 for $6800. That will leave $5354. We have a beneficiary IRA that has to be cashed out relatively soon, so we’re planning to do that early in January to push the tax burden to next year, which will end the loan.

Effectively, we’re paying about $300 in interest to give us a chance to move our assets around to take advantage of an SUV meeting our needs for $3000 under blue book. Yes, we could have waited until the assets were ready, but this truck wouldn’t have been there, so we jumped on it.

John Kerry’s Wife Hospitalized: Can You Afford Health Insurance?

Even as a growing number of analysts are questioning the details of Obamacare, the sudden hospitalization of Teresa Heinz Kerry, the wife of former senator and current U.S. Secretary of State John Kerry, provides additional fodder to the ongoing healthcare debate.

Heinz, who is 74 years old, is the heir to the Heinz ketchup fortune. She is the widow of former Senator John Heinz, who was killed in 1991 in an aviation accident. Her marriage to Kerry in 1995 occurred when he was the senator from Massachusetts. Heinz was hospitalized on Sunday and is reported to be in critical condition after being flown to Massachusetts General Hospital in Boston.

Heinz was treated for breast cancer in December 2009 and went through two operations for lumpectomies. It is not known what specific health issues resulted in the current hospitalization. However, sources indicated that there was concern over the return of the cancer.

Regardless of the source of the current illness, it is taken for granted that Heinz will receive the very best of medical care, with cost being of no concern to treatments pursued. In the earlier process of treating her cancer, numerous doctors at the nation’s finest medical facilities were consulted. The issue of Heinz not having to worry about the costs of her care is the central theme of many who criticize our nation’s health care system.

For the millions of Americans who live daily without health insurance or any form of coverage, there is a constant concern over how they would deal with a medical emergency. These individuals know that they are one accident or serious illness away from devastating financial hardship. In fact, the single biggest reason for bankruptcy in the U.S. today is medical bills. According to the latest studies, the average hospital stay billed out at $15, 700, with an average daily cost of nearly $4,000.

These costs are onerous because so many people today find health insurance increasingly unaffordable. While the political debate over the current healthcare reform continues, there is one simple fact. That reality is that the annual cost of private health insurance, already out of the reach of many, has risen by as much as 50 percent in the last two years. Many plans for a family of four are now over $15,000 and it is predicted that a bronze plan under the implemented Obamacare will exceed $20,000 for that same family.

All of this brings us back to the hospitalization of Heinz. The reality we live in today means that many people diagnosed with cancer or other similar diseases have little hope of receiving the treatment or care that the wealthy can afford. Even with quality health care insurance, the co-pays and other costs create burdens that many cannot carry.

There are no simple or ready solutions to this situation. The morality of one patient dying because chemotherapy is too expensive while one with a large bank account survives is an issue that will see intensified debate in the coming months and years. Regardless of what caused the current hospitalization, Heinz is one of the lucky ones who will have superb medical care without financial considerations.

Related articles

Calendaring Life

I’m incredibly absent-minded. I get involved in something and forget about almost everything else. While that makes me productive at work and helps the time pass, it means I forget to do a lot of things. On the days I am supposed to pick up my son, I have to set reminders so I don’t get wrapped up in a project at work and forget to leave on time.

My solution has been to put everything into Google Calendar. I use 10 different calendars, five of which are mine. I have one for regular scheduling of appointments, one I use to take notes for 30 Day Projects, and one that is copied from the school calendar so I don’t forget late-start days and school vacations. I also use calendars to track the wrestling team’s schedule, family birthdays, and upcoming holidays. I’ve got all of these calendars synced to my phone, I get reminders a week in advance, and I get a daily agenda at 5AM, every day. I don’t forget much anymore.

Over the past few weeks, I’ve been working on a new project–a new calendar. I’ve been reviewing seasonal home-maintenance checklists, medical checkup recommendations, car maintenance lists, and more. All of this has been added to a new Google Calendar, the Home and Life Maintenance Calendar.

This calendar is designed to remind its users to do the things we all need to do, from biannual physicals to replacing your furnace filters, checking your tire pressure to cancer self-exams. The seasonal chores happen in the right seasons, and the monthly reminders happen monthly. It is a work-in-progress and I welcome any recommendations for the things I’ve missed.

So, here it is. Use it, set up reminders, smack me for missing something obvious and enjoy.

[google-calendar-events id=”1″ type=”ajax”]

Update: This post has been included in the Festival of Frugality.