- Freedom is that instant between when someone tells you to do something and when you decide how to respond. #

- RT @keepinspiringme: Win a Canon EOS 450D SLR camera by simply tweeting the #kimcanon hashtag. #

- RT @mbhunter Carnival of Personal Finance: Parts-of-speech abuse edition http://bit.ly/7cyAqV #

- Note to self: While misusing the faucet sprayer may make me giggle, my wife is not so appreciative. #

- RT @copyblogger On Dying, Mothers, and Fighting for Your Ideas http://bit.ly/7gZgW3 #

- Blackberry? Good or Evil? #

- Round 1: Me v Snow. Winner: Me. #

- RT @The_Weakonomist: Men, I've learned that in relationships, you can be happy, or you can be right. #

5 Ways to Change Your Spending Habits

If you keep doing what you’ve always done, you’re going to keep getting what you you’ve always gotten. One of the hardest things about getting out of debt is changing your habits. You need to break your habits if you’re going to get yourself to a new place, financially.

How can you do that? Habits aren’t easy to break. Ask any smoker, junkie, or overeater what it takes. There are a lot of systems to break or establish habits, but they don’t all work for everyone.

Here are my suggestions:

- Commit to just 30 days. I’m a big fan of doing new things for 30 days. If you can do it for a month, you can do it forever, no matter what “it” is. For just one month, don’t buy anything. I don’t mean avoid buying groceries or toiletries and I certainly don’t mean to stock up on new crap the day before your 30 day spending fast or rush out for a shopping spree on day 31. Just don’t buy anything for a month, no exceptions but the things necessary to stay alive and healthy. No movies, no games, no cars, no toys, and no expensive meals. Just 1 month.

- Switch methods. If you pay for everything with a credit card, restrict yourself to just cash. If you pay cash for everything, switch to a credit card. Breaking your long-established habits is a way to get used to spending consciously: taking the time to think about what you are doing, instead of just spending mindlessly.

- Identify your spending triggers. I can’t go into a book store and come out empty handed. So, I avoid bookstores. My wife has problems with clothing stores. A friend can’t walk out of a music store without some body piercing equipment. What are your triggers? What makes you spend money without thinking? Figure out what those things are and then avoid them like the plague…or the clap.

- Quit buying things for pleasure. Buying things makes us feel good. It sends a rush of endorphins through our bodies. The more we get that rush, the more we crave that rush, so the more we do to get it. You need to stop that. Before you buy something, ask yourself if it’s something you actually need, or if you just want a pick-me-up.

- Avoid shopping online. E-commerce sites make it far too easy to buy things at a moment’s notice. You don’t have to think about what you are doing or if you actually need whatever you are buying. You just buy. The best way too avoid them is to delete your credit card information from any site that save the information and delete the sites from your bookmarks. Whatever you can do to slow down the buying process will make it easier to avoid buying things, which can soon be stretched into NOT buying things at all.

Habits—especially bad habits—are hard to break. There is an entire self-help niche dedicated to breaking habits. Hypnotists, shrinks, and others base their careers on helping others get out of the grip of their bad habits, or conning them into thinking it is easy to do with some magic system. How do you avoid or break bad habits?

Net Worth and other stuff

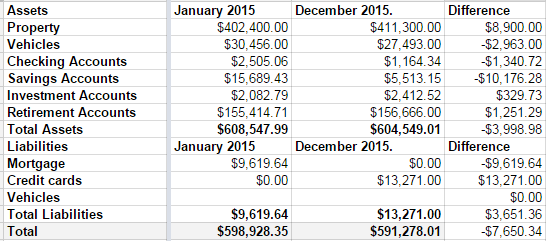

This was not a good year for our net worth.

Over the summer, we remodeled both of our bathrooms. At the same time.

1 out of 10: Don’t recommend.

We love the bathrooms, but–as with any project–it went over budget. Sucks to be us.

Then, towards the end of the year, we decided to push hard and pay off our mortgage in 2015. Part of doing that meant paying the credit card off slower than we’d like. It wasn’t the best long-term decision, but we’re mortgage-free now.

Those decision, coupled with a small slump in our investment accounts means we are worth $7650 going into 2016 than we were at the start of 2015.

Disappointing.

I’m also disappointed that our credit card discipline slipped last year.

New plan: No debt before tax day. Every cent of Linda’s paycheck, every cent of my monthly bonus checks, and every cent of any extra money we make is going into the remaining credit card debt. My math says that last debt will die on April 1st.

Then we get to talk about what to do with out money when there’s no debt. But never fear, I have a plan. A boring, boring plan.

- We’re going to save for college at a rate we should have started 10 years ago.

- We’re going to max out both of our retirement plans.

- We’re going to take some nicer family vacations.

- We’re going to buy a pony.

So not that boring.

And when our kids all decide to become certified sign-spinners, we’ll have a huge nest-egg in the college fund savings account to spend on lottery tickets.

Public Service Announcement: Anger, Children, and Cars

If, in the course of a basic morning, your three-year-old decides that you need to pick out her clothes, even though she’s been handling that every day for months, don’t be surprised if she rejects your first three choices. She’s just being lazy.

If, after you’ve settled on clothes, you tell her to pick out some socks, expect the same behavior. She’ll lie on the living room floor saying “You pick them out” for 20 minutes, only to throw a fit if you don’t pick the ones with fairies. At this point, it’s okay to yell at her. Really.

When she tears them off and throws them across the room, you don’t even have to be gentle when you put them back on and strap her shoes down to keep her socks on.

Then, when you’re walking across the yard, and she refuses because she’s mad, it is again okay to hold her hand to guide assist drag her to the car, but it works best if you are strong enough to keep her suspended above the ground when she tries to sit down to stop you.

Of course, when you get to the car, she’s going to run back to the front door because she can walk by herself.

Literally throwing her into the car at this point isn’t okay. Tempting, but not okay.

As the man said, I told you that so I could tell you this:

It would seem, now, that it would be a good idea to flip the child latch on the door to keep the contrary little brat from escaping while you circle the car to the driver’s door, or worse, slow down for a stop sign. It is a good idea.

The thing to remember is that, in your anger, when the world has gone red and you are cheering on the biological traits that make it nearly impossible to hurt your children, it is easy to stick the screwdriver in the wrong slot in the door and jam your door latch.

When that happens your door won’t close. Your little monster won’t stop aggravating you, and the child who has chosen to play the role of little angel this morning will start getting crabby about the wait. That doesn’t help.

After you throw the kids in the spare car–the car which doesn’t have air conditioning on the hottest day of the year, so far–and get the brats to daycare, the internet can show you what does help.

If, when you close your car door, it bounces back open because the latch is jammed, no amount of poking at it with a screwdriver will fix it. You’ll bleed for no good reason. Grab the door handle and hold it in the open position. Then, when you poke the latch with a screwdriver, it will pop into the correct position with very little effort.

It’s amazing what a door that closes will do for your morning.

So You’re Getting Evicted…

Last week, I had the opportunity to visit eviction court, though not for anything having to do with my properties.

It was an interesting experience. Eviction court is a day when nobody is at their best. Landlords are fighting to remove bad tenants, sometimes questioning their desire to be a landlord, while tenants are fighting to keep their homes, often with no backup plan. Occasionally, you get someone who just wants to get out of their lease because the landlord is a creepy peeper who digs through the dirty laundry.

Nobody goes to eviction court in a good mood.

If you ever find yourself in eviction court, here are some things to remember:

Everyone

- If you don’t show up, you lose. Period. Landlord or tenant, judges don’t like waiting around. You will get the worst possible outcome if you stay home.

- The first day is a hearing. The judge will either accept a settlement between the two parties, or he’ll check if there is a valid reason for a full trial. The trial will be schedule for another day. In Minnesota, that happens within 6 days of the hearing.

- Don’t make faces at the other side while they are talking to the judge. Do you want to go to jail for being a smartass? It’s called contempt of court.

Landlords

- Fix the mold, rot, and other habitability issues. You’ll have a hard time getting your rent back if you are a slumlord forcing your tenants to live in a biohazard.

- If you’ve got an automatically renewing lease, don’t file the eviction notice with the renewed lease for violations that happened under the old lease. If you do, you’ll be handing a win to your tenant.

- Make sure you lease has an eviction clause. If it doesn’t, you may not have the right to kick out your tenant for any reason.

- Your tenant’s dirty underwear is not a toy for you to play with. Creep.

Tenants

- Pay your rent. If you are withholding rent to get something fixed, you’ll be expected to put that in escrow the day of the hearing, so don’t spend it on vodka or a new stereo.

- Read your lease and the filing. It may have a backdoor that lets you escape the eviction.

- Try not to get evicted. An unlawful detainer can make it hard to rent again for a couple of years.

- Dress nice. I’m amazed by how many people showed up in ratty jeans and uncombed hair. Look professional. The judge will appreciate the effort.

All in all, it’s best if landlords and tenants try to keep each other happy. The whole business relationship will go much smoother if you do.

Delayed Gratification, Take II

How much would you pay for a kiss from the world’s sexiest celebrity?

That was the focus of a recent study that I can’t find today. There is no celebrity waiting in the wings to deliver the drool, and the study doesn’t name which celebrity it is. That’s an exercise for the reader.

This was a study into how we value nice things.

The fascinating part of the study is that people would be willing to pay more to get the kiss in 3 days than they would to get the tongue slipped immediately.

Anticipation adds value.

Instant gratification actually causes us to devalue the object of our desire.

This goes well beyond “Will you respect me in the morning?”

The last time I talked about delayed gratification, it was in the context of my kids. That still holds true. Kids don’t value the things that are handed to them.

The surprising–and disturbing–bit is that adults don’t, either. If I run out to the store to buy an iPad the first day I see one, I won’t care about it nearly as much as if I spend a week or two agonizing over the decision.

The delay alone adds to the perceived value. The agony turns the perceived value into gold.

If I spend a month searching for the perfect car, the thrill of the successful hunt adds less value than the time it took to do the hunting.

Here’s my frugal tip for today: Delay your purchases. While it may not actually save you any money, you will feel like you got a much better deal if you wait a few days for something you really want.