- RT @Dave_Champion Obama asks DOJ to look at whether AZ immigration law is constitutional. Odd that he never did that with #Healthcare #tcot #

- RT @wilw: You know, kids, when I was your age, the internet was 80 columns wide and built entirely out of text. #

- RT @BudgetsAreSexy: RT @FinanciallyPoor "The real measure of your wealth is how much you'd be worth if you lost all your money." ~ Unknown #

- Official review of the double-down: Unimpressive. Not enough bacon and soggy breading on the chicken. #

- @FARNOOSH Try Ubertwitter. I haven't found a reason to complain. in reply to FARNOOSH #

- Personal inbox zero! #

- Work email inbox zero! #

- StepUp3D: Lame dancing flick using VomitCam instead or choreography. #

- I approve of the Nightmare remake. #Krueger #

Lost Wallet: What to Do Before It’s Gone

I’ve never been mugged. Hopefully, fate has decided that I never will be. Given my habits, it is far more likely that my money clip will fall out of my wallet without me noticing.

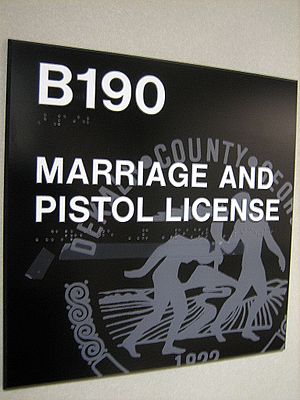

That’s a significant piece of my life. That would mean I lost my driver’s license, my debit card, my business credit card, my insurance cards, my carry permit, and the only credit card I carry.

What happens when you lose your wallet? You go to the DMV and get your driver’s license replaced. You call your credit card companies and ask them to invalidate your credit card numbers and send you new cards. You write off the missing cash and hope you don’t need the business cards that you tucked in behind the photo of your great-grand-uncle’s neighbor’s cousin’s mistress’s puppy.

How do you reach your credit card company? You take the card out of your wallet, flip it over, and call the number on the back. But you lost your wallet? What now?

Do you have every statement, that comes with the phone numbers you need to call? I don’t. At this moment, I do not have the phone number for the bank that issues the debit card for my Health Savings Account. I don’t actually know who issued the card. I don’t even know who I would call to report the card missing.

How do you prepare for that? What can you do do make your life much less miserable when your wallet walks aways with a pickpocket, or falls out of your pocket while you’re tooling down the highway on the back of a motorcycle doing 100 miles per hour, dodging the police and winking at the innocent passerby rocking out to really bad back-room country western music in a late model orange convertible? (That’s probably just me.)

How would you prepare for a lost wallet?

There is an 6 step solution to remove all of the worry about someone finding your wallet and using your credit card to fund a Russian adult chat membership, the only site where basement-dwelling losers can talk to someone pretending to be the cooperative mail-order bride they are about to order.

- Take everything that matters out of your wallet.

- Find a copy machine or a scanner.

- Put everything from your wallet on the scanner.

- Scan it.

- Flip the cards over and scan again.

- Either print the scan and put it in a fire-proof safe, or encrypt it and email it to someone you trust who does NOT live in the same house you do. If your house burns down, you want to have access to the files.

Depending on the number of things you keep in your wallet, you might have to repeat the steps a few times to get it all copied. You definitely want to copy both sides, so you can have the card numbers and the phone numbers saved.

Now, if you lose your wallet, you have all of the information you need to deal with the problem and get those cards cancelled.

How do you track your cards and contact information?

ING Rocks

I just got an email from INGDirect. To celebrate Independence Day, they are having a sweet, sweet sale.

You can:

- Open a checking account and get between $50 and $126 for doing so.

- Open a Sharebuilder account and get $76 to start buying stocks.

- Get $1776 knocked off the closing costs of a mortgage.

- Get $76 in a new IRA, to give you a little boost for retirement.

Take advantage of all of that and you’ll get $2054 in cash or discounts.

Seriously, this deal rocks. If you don’t have an INGDirect account, get one. There are no overdraft fees and no monthly fees.

The sale ends tomorrow at midnight, so hurry.

4 Ways to Flog the Inner Impulse Shopper

Welcome to the time machine! This was originally posted on December 16, 2009.

Impulse shopping kills. Not literally, of course, but it stings. You need to stop. I need to stop. We all need to stop.

Here’s how:

1. Use a list. Everybody tells you to shop with a list. Nobody has problems shopping with a list. How, exactly, does a list prevent you from buying something on a whim? A list keeps you from forgetting things, it doesn’t stop your from putting Terminator:Salvation in your cart. Skip this one. It doesn’t count. No beatings for the inner impulse shopper means no honorable mention here.

Take 2:

3 Ways to Flog the Inner Impulse Shopper

1. Don’t Shop. I’ve found that it is almost impossible to leave Target for under $100. It’s too easy to grab a discount DVD or a small surprise for the kids. My solution is to use Alice.com. That’s right, I get my toilet paper by mail-order. With Alice, there are few opportunities for impulse purchases. I add the items I need, scan the deals for items I will need in the next few weeks, and have my wife review the cart for things I’ve either missed or don’t need. A few days later, there’s a big blue box full of deodorant, toilet paper and soap sitting on my front step. The manufacturer coupons are automatically applied and shipping is always free. I’ve easily saved $1000 in retail impulse purchases using Alice over the past few months. Alice is my favorite shopping-dom. Full disclosure: The Alice links are all referral links. If you click one and join, I will get 3% commission on your purchase for a year, and you will get a $10 credit after you spend $50 .

2. Set a goal and reward the goal – AFTER the goal is met. My wife and I have a goal to be out of debt in four years. We will enter 2014 free from debt. No car payment, credit cart, or mortgage. I have promised my wife that, in exchange for almost 5 years(we aren’t starting the process today) of frugal living, when we are done and have saved a bit at the other end of debt, I will take her on a cruise anywhere in the world. A real, debt-free vacation. AFTER we pay off all of our debt. AFTER we save enough to make the trip without sliding back into debt. This is the carrot instead of the stick. If the carrot doesn’t work, you can always try the stick. Not on your spouse, of course, but on the inner impulse shopper. Beat that little jerk ’til he cries.

3. Make yourself accountable. If you’re married, make yourself accountable to your spouse. If you’re single, go public with your frugality. “I’m a cheap bastard and I’m swearing off xxx until I’m out of debt.” Let your family and friends know what you are doing so they can be your support system. I regularly call my wife from a store, just so she can say “no” to me. When we are ready to check out at a store, we find some out of the way location and go through everything in the cart to see if we really need it or if it was simply an impulse grab.

How do you flog the masochistic little demon in your wallet?

Fighting Fair

This was a guest post on another site early last year.

Everyone, at times, has disagreements. How boring would life be if everyone agreed all of the time? How you handle those disagreements may mean disaster.

This is particularly true when you are arguing with your spouse. You spend most non-working moments with this one person, this wonderful, loving, infuriating person. Your emotions will naturally run high while discussing the things you care most about with the person you care most about. Arguments are not only natural, but inevitable.

How do you have an argument with someone you love without lasting resentment?

You have to argue fairly. There are a few principles to remember during an argument.

- When your partner is talking, your job is to listen with all of your energy. You are not interrupting. Your are not planning your rebuttal while waiting for your turn to talk. Your are listening, nothing else. If you don’t listen, you can’t understand. If you don’t understand, you can’t find a resolution.

- Remember that your partner cares. If she didn’t care, she wouldn’t feel so strongly about the argument. This isn’t a war, just an argument. She still wants to spend the rest of her life with you. Keeping this in mind will change the entire tone of the argument into a positive interaction. You will still disagree, but you will be looking for a solution together, instead of finding a “win” at any cost.

- Search for the best intent. Remember #2? There is an incredibly good chance that, if there are two ways to interpret something your partner has said–a good way and a bad way–your partner probably meant the good way. Even if you are wrong, it is far better to err on the side of resolution than the side of antagonism.

- When your partner has finished speaking, it’s still not your turn to argue. Your job now is to repeat your understanding of the issue, without worrying about problem-solving. Before you can refute the argument–or even establish your disagreement–you have to know that you understand her position and she has to know that you do. Without understanding, there can be no path to resolution that doesn’t cause resentment. If you have too much resentment, you won’t have a marriage.

After all of this, it will finally be your turn to make your point. Hopefully, your partner will be following the same rules so you can solve your problems together, without learning to hate each other.

Arguments in your marriage aren’t–or shouldn’t be–intended to draw blood. Fights happen. If your goal is to win at any cost, you will both lose, possibly everything.

Filing Bankruptcy: Pride or Shame?

I’m a big fan of personal responsibility. If you’ve promised to do something, you should do it. With that said, it seems odd to some people that I don’t have an ethical problem with bankruptcy. For some people, it is the only option after a long series of problems.

Don’t get me wrong, it should be a shameful decision. Reneging on your word should never be a source of pride. It should be a difficult decision to make. A couple of years ago, I came very close to making that decision myself.

It should not be a reason to celebrate and it should absolutely not be a reason to behave irresponsibly. Some people don’t see a need to take care of their responsibilities because, when it gets bad, they’ll be able to file bankruptcy and make the creditors go away. They are abusing a safety net. That abuse hurts everyone. Credit card companies have to charge higher interest rates so the paying customers can cover the risk of those who default or file bankruptcy.

There is one prominent local bankruptcy attorney who files every 10 years, and has filed consistently for decades. He runs a thriving practice, so it’s not a matter of poor choices, it’s a matter of deliberately living beyond his means and screwing his creditors. He’s one of the slime-balls that give lawyers a bad name. He is one of the many who abuse a lifeline designed to save people from a life of destitution they didn’t ask for, and he does it to finance his extravagant lifestyle.

If you have found yourself buried in a debt you didn’t plan for, if life threw you a curve-ball that you are entirely unable to deal with, if you have to file bankruptcy, it’s okay. Really. When you go in front of the judge, have the decency not to enjoy it, and try to learn from the experience.