- @ScottATaylor Thanks for following me. in reply to ScottATaylor #

- RT @ChristianPF: 5 Tips For Dealing With Your Medical Debt http://su.pr/2cxS1e #

- Dining Out vs Cooking In: http://su.pr/3JsGoG #

- RT: @BudgetsAreSexy: Be Proud of Your Emergency Fund! http://tinyurl.com/yhjo88l ($1,000 is better than $0.00) #

- [Read more…] about Twitter Weekly Updates for 2009-12-12

Making Up Stories

Saturday night, as I was walking out of the pizza place, I saw a beautiful young brunette standing on the sidewalk talking on her cell phone.

As I walked past, I heard, “I could pay my rent if they’d just give me my last paycheck! They owe me like $200.”

That’s it.

Have you ever heard a tiny piece of a conversation and used that to build a back story in your own mind?

I do that all of the time.

In fact, I’m going to do that now.

First, what can I know from those two sentences?

- She was unemployed. She was more worried about her last paycheck than her next one.

- She had worked for a scummy, fly-by-night, something-or-other. Good companies don’t withhold paychecks.

- She had no emergency fund. If she had one, $200 would be an inconvenience, not a disaster.

- She rented, and had roommates. This conversation occurred in the parking lot of a pizza place in a reasonably affluent suburb. For $200, she wasn’t living alone. Whether she rented a room or shared an apartment would be a mere guess.

Those items can–I believe–be taken as fact, given the evidence at hand.

Now for the conjecture:

- She was a waitress. A $200 final paycheck probably means her hourly wage was low. Besides, pretty, young, unskilled girls often become waitresses. It’s one of the few ways to make good money without a degree of any kind.

- The restaurant wasn’t a chain. Chain stores have lawyers and procedures. They don’t withhold final paychecks.

- She invites drama into her life. When you work for a company that makes a habit of shady practices, like withholding final paychecks out of spite, you know it happens. It’s not a surprise. If you continue working there, you are just waiting in line for your turn to have problems.

- She wasn’t close to her family. In an emergency, $200 from Mom & Dad is nothing. In my mind, she only has one parent and isn’t close to that parent, but that’s purely invention.

- Her friends are in the same boat. Short-term planning, no reserve cash, no room to let a friend couch-surf for a couple of weeks.

- Next month, she’ll be having the same problems, but she’ll find someone else to blame. Her ex owes her money, or her roommate stole the last of her cash.

That’s my entirely unsupported guess of a young stranger’s life story. My opinion isn’t flattering, but how could it be, when $200 is enough to make the young woman panic?

Have you ever played this game?

Snip!

News flash!

Incubating my third half-clone was my major motivation to get out of debt. I wasn’t sure how we were going to be able afford her without pawning one of her kidneys.

We managed, though. She’s intact.

The idea of squeezing a fourth little monster into our budget scared me right out of the gene pool. I got a vasectomy.

Interesting fact: When the doctor says “I’m going to cut your vas deferens, now. It’s going to feel like you got kicked in the crotch, but don’t move”, he’s right. It does. And you shouldn’t. My doctor complimented me on my ability to not flinch. I reminded him that he had my fun bits in one hand and a scalpel in the other. That’s a sure way to have both my attention and my obedience.

It costs money to have a baby, particularly if you do so in a hospital. Our cheapest birth cost us $250 out-of-pocket, but that was because my wife was covered by two health insurance plans. Adding her to my plan for a couple of months cost us a few hundred in premiums. We’ll call it $500 to get the baby into the world.

My vasectomy cost $125 out-of-pocket. That’s easy math.

What if you don’t have insurance, or are covered by a lousy plan? Baby #2 fit that category. We got a bill for $8500. After begging the charity department of the hospital for help, our actual out-of-pocket was about $2500.

The bill cost of my vasectomy was $1500. Again, easy math.

Clearly, getting snipped is cheaper than having a baby, even without considering food, diapers, crib, nanny-dog, toys, padded cardboard boxes for those rare date-nights, and everything else that you have to spend with a baby.

But wait, what about condoms?

While I find it odd that you can buy condoms online, I will use Amazon’s numbers.

You can buy a pack of 72 condoms for about $18, $15 if you use Subscribe-And-Save. That brings the price down to 21 cents per condom. According to Amazon, the most popular subscription option is one delivery every five months, which comes out to one condom every other day.

If that’s you, then yay!

At $15 per delivery, it would take 9 deliveries to make up the cost of an insurance-covered vasectomy. According to Amazon, that would take 45 months, or almost 4 years.

Without insurance, it would take 41 years to make up the difference.

Condoms are cheaper.

On the other hand, a vasectomy is pretty well guaranteed. I went to the best I could find. No back-alley doctor with a hedge-clipper for me. He guaranteed his work, provided I came in for two follow-up visits to check his work.

Now, I have no risk of expanding the budget for another ankle-biter and I don’t have to worry about random 3AM trips to the pharmacy.

Saturday Roundup

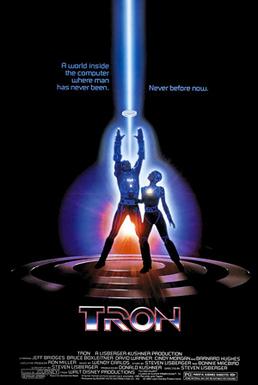

- Image via Wikipedia

I wrote this yesterday. According the forecast, when this post goes live, I’ll be moving 5-8 inches of snow off of my driveway.

That, or watching TV and thinking about moving snow.

Maybe I’ll just sleep in and wait for spring to melt the snow.

Don’t forget to enter my drawing for a $100 Amazon gift card! Go here for details. It ends on the 15th, so don’t wait too long.

Best Posts

Crazy-easy ice cream bread. How could this possibly be bad?

Tron comes out in 2 weeks. I’d love to show up on a custom street-legal Troncycle.

Arsenic-based lifeforms are shaking up the way we understand life to work. I’m of the opinion that life will probably exist almost everywhere that isn’t a completely dead dry rock. I say that as an expert in…well, nothing related to astrobiology.

Following Erica’s advice is currently making me a few hundred dollars per month, with every sign of growing as time goes on. I hate to sound like a fanboy, but if she pimps a product, I’m at least going to give it some serious consideration.

Carnivals I’ve Rocked

10 Dumb Money Moves was featured in the Carnival of Debt Reduction.

Book Review: The Art of Non-Conformity was included in the Carnival of Personal Finance.

Things You Should Buy Online to Save Money was included in the Festival of Frugality.

Thank you! If I missed anyone, please let me know.

LRN Timewarp

This is a new feature to share the gift that is me with anyone new to LRN. This week, I’m going to share some posts from my first week blogging here.

The $10 College Fund. In the last year, not only have I not changed my mind about the $10 college fund, but I haven’t raised the amount. The point is to just get started. I’ve done that. I’ll raise the amount when my debt is paid off. We are now up to $166.09. The numbers are off because I stuck a little bit extra in one month.

In the last year, our dreams haven’t changed. We haven’t made any direct progress, but indirectly we are doing well. First things first. We need to pay the debt off before we look at a hobby farm.

My second day blogging, I wrote about why we handled money so poorly.

March 30 Day Project

For March, my 30 Day Project is to do 100 sit-ups in a single set.

Based on the results of my February project, I will be doing 5 sets, morning and night, as follows:

Set 1: Half of my maximum amount.

Sets 2-4: 3/4 of my max.

Set 5: Do sit-ups until my abs start to cramp, thus setting my max for the next session.

This month, I only have one project.

5 Ways to Reduce Temptation and Have a Peaceful dinner

It never fails: you send the kids off to the salt mine babysitter for the evening, cook a nice dinner and light some candles. Then, just as you sit down, the phone rings.

Now you have 2 choices, you can do like me and ignore the phone if it’s inconvenient to answer or you can ruin a romantic dinner. The telemarketers know that, statistically, you are home at dinner time. They don’t care if you are celebrating an anniversary or just trying to connect with your loved one.

Why not preemptively stop the irritation? While you’re at it, stop the junk mail, too. It’s not as hard as you’d think. It’s a simple, almost free process that will not only eliminate the frustration of pointless calls and sorted junk mail, but will also cut down on the temptation of seeing something shiny to buy.

Here are the four steps to a leaner, greener and romantic dinner-making you:

1. Get on all of the Do Not Call lists.

- You can get on the federal list by visiting www.donotcall.gov or calling (888) 382-1222. The tele-sales weasels will have have a month to clear you out of their systems.

- If you still get calls–some calls are still allowed, including political calls, non-profit fundraisers, and surveys–they are still required to maintain an in-house do not call list. Tell them to put you on that list.

- Many states have a Do Not Call list that is entirely independent of the the federal list. This is redundant, but the more roadblocks you put up, the better you will be.

If you are still getting calls, report them to the FTC at:

Federal Trade Commission

Consumer Response Center

600 Pennsylvania Avenue, NW

Washington, D.C. 20580

1-877-FTC-HELP

www.ftc.gov

2. Opt out of junk mail. The Direct Marketing Association manages a list of people who do not want junk mail. This list only applies to members of the association, but most mass-mailers participate. Go to www.dmachoice.org to enroll. It costs $1 to get on the list and will stop most junk mail for 3 years.

3. Opt out of pre-approved credit card offers. Go to www.optoutprescreen.com to remove your name from the lists generated by the major credit bureaus to sell to marketing firms. You can put a halt to this breed of junk for 5 years or forever.

4. Ask them to stop. If you are getting catalogs from a company with which you have an existing relationship, ask them to knock it off. Virtually every one will stop sending you garbage to ensure a continuing business relationship with you.

5. Guerrilla Warfare. If none of this works, there are still a couple of options.

- Keep an airhorn by the phone. They won’t call twice.

- Take everything you receive from a company, stuff it all in the prepaid return envelope they helpfully included, and drop it back in the mail. They only get charged for the prepaid envelopes when they are used, so use them up. It’s illegal to alter them to send mail to other people, but it’s not illegal to mail them all of their own garbage. If you cost them enough money, they will eventually back down.