- @fcn Yahoo Pipes into GReader. 50 news sites filtered to max 50 items/day–all on topic. in reply to fcn #

- @fcn You can filter on keywords, so only the topics you care about come through. in reply to fcn #

- It's a sad day when you find out that your 3 year old can access anything in the house. Sadder when she maces herself with hairspray. #

- 5 sets of 15 pushups to start my day. Only 85 to go! Last 5 weren't as good as first 5. #30DayProject #

- What happens to your leftover money in your flex-spending account? http://su.pr/9xDs6q #

- Enter to Win iPod Touch from @DoughRoller http://tinyurl.com/y8rpyns #DRiPodTouch #

- Arrrgh! 3 year old covered in nail polish. And clothes. And carpet. And sister. #

- Crap. 5 sets of 5 pushups. #30dayproject #

- Woo! My son just got his first pin in a wrestling meet! #

- RT @Doughroller: Check out this site that gives your free credit report AND score without asking for a cc# or social… http://bit.ly/bRhlMz #

- Breaking news! Penicillin cures syphilis, not debt. https://liverealnow.net/KIzE #

- Win a $25 Amazon GC via @suburbandollar RT + Fllw to enter #sd1Yrgvwy Rules -> http://bit.ly/sd1Yrgvwy2 #

- This won't be coming to our house. RT @FMFblog: Wow! Check out the new Monopoly: http://tinyurl.com/ygf2say #

- @ChristianPF is giving away a Flip UltraHD Camcorder – RT to enter to win… http://su.pr/2ZvBZL #

Credit Cards: How to Pick a Winner

We live in a decidedly credit-centric culture. Whip out cash to pay for $200 in groceries and watch the funny looks from the other customers and the disgust from the clerk. It’s almost like they are upset they have to know how to count to run a cash register.

If someone doesn’t have a credit card, everyone wonders what’s wrong, and assumes they have terrible credit. That’s a lousy assumption to make, but it happens. For most of the last two years, I shunned credit cards as much as possible, preferring cash for my daily spending. Spending two years changing my spending habits has made me comfortable enough to use my cards again, both for the convenience and the rewards.

Having a decent card brings some advantages.

Credit cards legally provide fraud protection to consumers. Under U.S. federal law, you are not responsible for more than $50 of fraudulent charges. many card issuers have extended this to $0 liability, meaning you don’t pay a cent if your card is stolen. Trying getting that protection with a wallet full of cash.

The fraud protection makes it easier to shop online, which more people are doing every day. At this point, there is no product you can buy in person that you can’t get online, often cheaper. How would you order something without a credit card? Even the prepaid cards you can buy and fill at a store will often fail during an online transaction because there is no actual person or account associated with the card. The “name as it appears on the card” is a protective feature for the credit card processors and they dislike accepting cards without it.

If you’re going to use a credit card, you need to make a good choice on which credit card to get. There are a few things to check before you apply for a card.

Annual fee. Generally, I am opposed to getting any card with an annual fee, but sometimes, it’s worth it. If, for example, a card provides travel discounts and roadside assistance with its $65 annual fee, you can cancel AAA and save $75 per year. A good rewards plan can balance out the fee, too. I’m using a travel rewards card that has a 2% rewards plan. That’s 2% on every dollar spent, plus discounts on some travel purchases. In a few months, I’ve accumulated $500 of travel rewards for the $65 fee that was waived for the first year. The math works. A card that charges an annual fee without providing services worth several times that fee isn’t worth getting.

Interest rate. This should be a non-issue. You should be paying off you card completely every month. In a perfect world. In the real world, sometimes things come up. In my case, I was surprised with a medical bill for my son that was 4 times larger than my emergency fund. It went on the card. So far, I’ve only had to pay one month’s interest, and I don’t see the balance surviving another month, but it’s nice that I’m not paying a 20% interest rate. Unfortunately, as a response the CARD Act, the days of fixed rate 9.9% cards seems to be over.

Grace period. This is the amount of time you have when the credit card company isn’t charging you interest. Most cards offer a 20-25 day grace period, but still bill monthly. That means that you’ll be paying interest, even if you pay your bill on time. To be safe, you’ll need to either find a card that has a 30 day grace period, or pay your balance off every 15-20 days. Some of the horrible cards don’t offer a grace period of any length. Avoid those.

Activation fees. Avoid these. Always. There’s no card that charges an activation fee that’s worth getting. An activation fee is an early warning sign that you’ll be paying a $200 annual fee and 30% interest in addition to the $150 activation fee.

Other fees. What else does the card charge for? International transactions? ATM fees? Know what you’ll be paying.

Service. Some cards provide some stellar services, include concierge service, roadside assistance, and free travel services. Some of that can more than balance out the fees they charge. My card adds a year to the warranty of any electronics I buy with it, which is great.

Credit cards aren’t always evil, if you use them responsibly. Just be sure you know what you’re paying and what you’re getting.

What’s in your wallet?

A Moment of Clarity

- Image by Matt Stratton via Flickr

Ten years ago, I buried myself in debt. There was no catastrophic emergency or long-term unemployment, just a series of bad decisions over the course of years.

We bought a (short) series of new cars, a house full of furniture, electronics, hundreds of books and movies, and so much more. We threw a wedding on credit and financed an addition on our house. We didn’t gamble or drink it away, we just spent indiscriminately. We have a ton of stuff to show for it and a peeling credit card to prove it.

What changed?

In October 2007, we found out brat #3 was on the way. Don’t misunderstand, this was entirely intentional, but our…efficiency caught us by surprise. It took several years to get #2. We weren’t expecting #3 to happen in just a couple of weeks. #2 wasn’t even a year old when we found out she was going to be a big sister. That’s two kids in diapers and three in daycare at the same time.

The technical term for this is “Oh crap”.

I spent weeks poring over our expenses, trying to find a way to make our ends meet, or at least show up in the same zip code occasionally.

I finally made my first responsible financial decision…ever. I quit smoking. At that point, I had been smoking a pack a day or more for almost 15 years. With the latest round of we’re-going-to-raise-the-vice-tax-to-convince-people-to-drop-their-vices-then-panic-when-people-actually-drop-their-because-we-made-them-too-expensive taxes, I was spending at least $60 per week, at least.

Interesting side story: A few years ago, Wisconsin noticed how many Minnesotans were crossing the border for cheap smokes and decided to cash in by raising their cigarette taxes. The out-of-state market immediately dried up. Econ 101.

So I quit, saving $250 per month.

Our expenses grew to consume that money, which we were expecting. (Remember, we were expecting a baby!) Unfortunately, our habits didn’t change. We still bought too much, charged too much on our credit cards, and used our overdraft protection account every month. At 21% interest!

Nothing else changed for another year and a half. My wife would buy stuff I didn’t like and we’d fight about it. I’d buy stuff she didn’t like and we’d fight about it. When we weren’t arguing about it, we’d just silently spend it all as fast as we could.

Bankruptcy was looming. We had $30,000 on our credit cards and our overdraft protection account was almost maxed out. Have you ever thought you’d have to sell your house quickly?

One day, while I was researching bankruptcy attorneys, I ran across Dave Ramsey. When I got to daycare that evening to pick up the kids, I noticed they had The Total Money Makeover on the bookshelf, so I asked to borrow it.

I read the book twice, had a very frank discussion with my wife about the possibility of bankruptcy, and we set out on the path to financial freedom together.

What made you decide to handle your finances responsibly? Or, perhaps more importantly, what’s holding you back?

All About Tax-Sheltered Annuity Plans

This is a guest post.

If you’ve previously heard of tax-sheltered annuity plans but are unsure of what they are, let this guide help you. Here’s what you need to know about tax-sheltered annuity plans.

What is it?

First things first, what are tax-sheltered annuity plans? A tax-sheltered annuity plan, or a 403(b) plan, is a retirement plan for some employees of various institutions to participate. This plan allows employees to contribute a portion of their salary to the plan. The employer may also contribute to the employee’s plan.

Who is Eligible?

Eligible Code Section 501(c)(3) employees tax-exempt organizations may participate, an employee of a public school, a state college, or a university, and eligible employees of churches. Employees of public school systems organized by Indian tribal governments, Ministers employed by Code Section (501)(c)(3) organizations, and self-employed ministers may also participate. Ministers must be employed by organizations that are not Code Section 501(c)(3) tax-exempt organizations, and they must function as ministers in their day-to-day professional responsibilities with their employers.

What are the Benefits of a 403(b) plan?

In a 403(b) plan, contributions are tax deductible. Taxes are paid on distributions in retirement, which is when a lot of people are in a lower tax bracket. As mentioned earlier, employers can match 403(b) contributions on a pretax basis. Loans can be taken against a 403(b) plan, which will help in certain situations, like buying your first home.

What types of contributions can be made?

In a 403(b) plan, you can have several types of contributions:

- Elective Deferrals – These are contributions made by the employee under a salary reduction agreement. This allows an employer to withhold a certain amount of money from an employee’s salary to deposit it in their 403(b) account.

- Nonelective Employer Contributions – These are any contributions to the 403(b) plan that were not made under a salary reduction agreement, which include matching contributions, discretionary contributions, and certain mandatory contributions that were made by the employer. The employee will pay income tax on all of these contributions, but only when they’re withdrawn.

- After-Tax Contributions – These are contributions made by an employee, which are reported as compensation in the year they were contributed and are included in the employee’s gross income for income tax purposes.

- Designated Roth contributions – These are elective deferrals that the employees elects to include in their gross income. The plan must keep separate accounting records for all contributions and for all gains and losses in the designated Roth account.

Can Employees Exclude Employees From Contributing?

Absolutely. The 403(b) plan must allow allow employees to make elective deferrals under the plan, but under the universal availability rule, if the employer permits one employee to defer salary by contributing it to a 403(b) plan, they must extend the offer to all of their employees. The only exceptions are employees who would contribute less than $200 annually, those employees who work less than 20 hours a week, employees who participate in a 401(k) or 457(b) plan, or students performing services that are described in Code Section 3121(b)(10).

So When Can Employees Get the Dollars?

Employees may withdraw from the 403(b) plan when the reach the age of 59 and a half, have a severance from employment, have a financial hardship, or become disabled. Money can also be taken out if an employee passes away. The employee will have to pay taxes on the amount of the distribution that was not from designated Roth or after-tax contributions, and they may have to pay an additional ten percent early distribution tax.

Are There Rules for In-Service Transfers or Exchanges?

Yes. Contract exchanges with a non-payroll slot vendor are permitted only if the plan permits it, the accumulated benefit after the exchange is, at the very least, the same as before the exchange, if the employer and the non-payroll slot vendor agree to share information regarding the plan’s terms, if any pre-exchange benefit restrictions are maintained after the exchange, and if the vendor complies with the terms outlined in the plan.

How Much Can be Contributed Annually? Does the Employee Have to be Current?

As of 2013, the maximum combined amount that an employer and an employee can contribute to a 403(b) plan is $51,000. That number may go up, depending on the annual cost-of-living.

If the plan allows, an employer can contribute up to the annual limits for an employee’s account for up to five years after the date of severance. No portion of the contributions can come from money that was due to be paid to the former employee, and these contributions must cease if the employee passes away.

There’s much more to learn about a 403(b) plan, but these are the basics. Does your company have a 403(b) plan?

Saturday Roundup

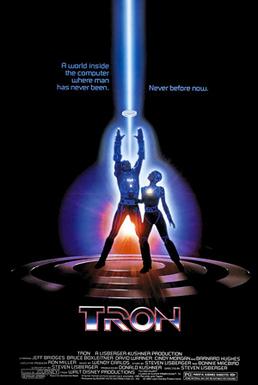

- Image via Wikipedia

Congratulations to Claudia for winning the $100 Amazon gift card.

This week started with my wife getting sick and ended with her passing it on to me. I hate being sick.

On a positive note, Tron is out this week, and is on IMAX 3D at a theater near me. I get to share a piece of my childhood with my son this afternoon.

Best Posts

When a guy named Dragon says, “Hold my beer a second,” you know something badass is about to happen.

Michael Moore’s Cuban healthcare lies propaganda is too much even for Cuba. Apparently, they are afraid the proles would revolt if they saw how good the ruling class has it in comparison to the 150-year-old rat-hole hospital the peasants are forced to use. But hey, it’s free!

I could think of worse ways to get laws passed than Last Man Standing. It would at least put a stop to frivolous crap that hurts everyone.

I had an eBay seller try to screw me once. I had access to a number of skiptracing tools at the time. When I sent him his phone number, his girlfriend’s phone number, his parents’ phone number, his place of employment, and all of those address, I got my refund the next day.

ChristianPF has a post on buying bulk herbs and spices. Not all spices can be stored for long, even in the freezer.

LRN Timewarp

This is where I revisit the posts I wrote a year ago.

4 Ways to Flog Your Inner Impulse Shopper was my first bondage-themed post. I still smile when I re-read it.

My post on cheap birthday parties is something I need to read every year. The party this fall wasn’t nearly as cheap as it has been in recent years.

And finally, my Grinch post on saving money on Christmas. My secret: buy less for fewer people.

Carnivals I’ve Rocked

First Steps – Ramsey Was Wrong was included in the Carnival of Personal Finance.

A Moment of Clarity was included in the Carnival of Money Stories.

Top 7 Reasons To Trade Forex Over Other Financial Instruments was included in the Festival of Frugality.

Thank you! If I missed anyone, please let me know.

Saturday Roundup

- Image via Wikipedia

I wrote this yesterday. According the forecast, when this post goes live, I’ll be moving 5-8 inches of snow off of my driveway.

That, or watching TV and thinking about moving snow.

Maybe I’ll just sleep in and wait for spring to melt the snow.

Don’t forget to enter my drawing for a $100 Amazon gift card! Go here for details. It ends on the 15th, so don’t wait too long.

Best Posts

Crazy-easy ice cream bread. How could this possibly be bad?

Tron comes out in 2 weeks. I’d love to show up on a custom street-legal Troncycle.

Arsenic-based lifeforms are shaking up the way we understand life to work. I’m of the opinion that life will probably exist almost everywhere that isn’t a completely dead dry rock. I say that as an expert in…well, nothing related to astrobiology.

Following Erica’s advice is currently making me a few hundred dollars per month, with every sign of growing as time goes on. I hate to sound like a fanboy, but if she pimps a product, I’m at least going to give it some serious consideration.

Carnivals I’ve Rocked

10 Dumb Money Moves was featured in the Carnival of Debt Reduction.

Book Review: The Art of Non-Conformity was included in the Carnival of Personal Finance.

Things You Should Buy Online to Save Money was included in the Festival of Frugality.

Thank you! If I missed anyone, please let me know.

LRN Timewarp

This is a new feature to share the gift that is me with anyone new to LRN. This week, I’m going to share some posts from my first week blogging here.

The $10 College Fund. In the last year, not only have I not changed my mind about the $10 college fund, but I haven’t raised the amount. The point is to just get started. I’ve done that. I’ll raise the amount when my debt is paid off. We are now up to $166.09. The numbers are off because I stuck a little bit extra in one month.

In the last year, our dreams haven’t changed. We haven’t made any direct progress, but indirectly we are doing well. First things first. We need to pay the debt off before we look at a hobby farm.

My second day blogging, I wrote about why we handled money so poorly.