This is a conversation between me and my future self, if my financial path wouldn’t have positively forked 2 years ago. The transcript is available here.

What would your future self have to say to you?

The no-pants guide to spending, saving, and thriving in the real world.

This is a conversation between me and my future self, if my financial path wouldn’t have positively forked 2 years ago. The transcript is available here.

What would your future self have to say to you?

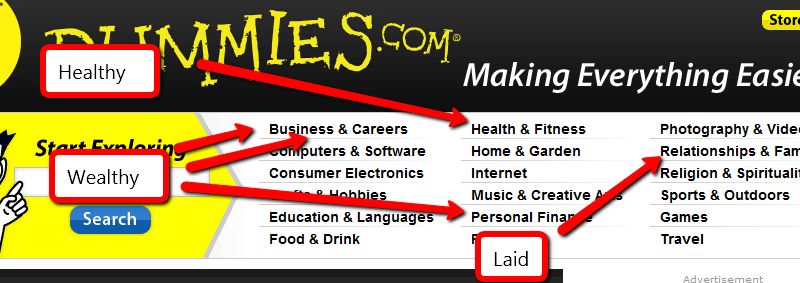

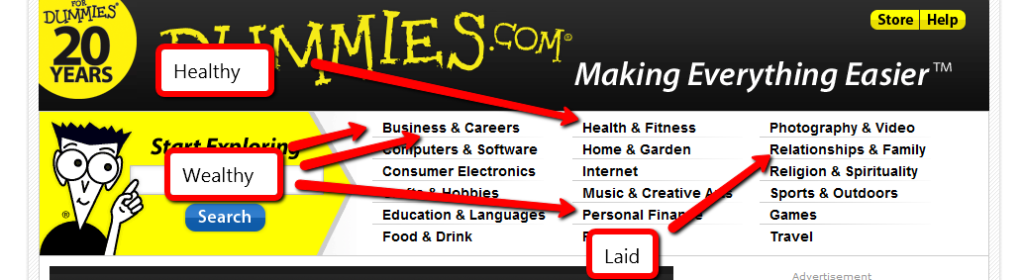

If you want to make money, help someone get healthy, wealthy or laid.

This section was quick.

Seriously, those three topics have been making people rich since the invention of rich. Knowing that isn’t enough. If you want to make some money in the health niche, are you going to help people lose weight, add muscle, relieve stress, or reduce the symptoms of some unpleasant medical condition? Those are called “sub-niches”. (Side question: Viagra is a sub-niche of which topic?)

Still not enough.

If you’re going to offer a product to help lose weight, does it revolve around diet, exercise, or both? For medical conditions, is it a way to soothe eczema, instructions for a diabetic diet, a cure for boils, or help with acne? Those are micro-niches.

That’s where you want to be. The “make money” niche is far too broad for anyone to effectively compete. The “make money online” sub-niche is still crazy. When you get to the “make money buying and selling websites” micro-niche, you’re in a territory that leaves room for competition, without costing thousands of dollars to get involved.

Remember that: The more narrowly you define your niche market, the easier it is to compete. You can take that too far. The “lose weight by eating nothing but onions, alfalfa, and imitation caramel sauce” micro-niche is probably too narrowly defined to have a market worth pursuing. You need a micro-niche with buyers, preferably a lot of them.

Now the hard part.

How do you find a niche with a lot of potential customers? Big companies pay millions of dollars every year to do that kind of market research.

Naturally, I recommend you spend millions of dollars on market research.

No?

Here’s the part where I make this entire series worth every penny you’ve paid. Times 10.

Steal the research.

My favorite source of niche market research to steal is http://www.dummies.com/. Click the link and notice all of the wonderful niches at the top of the page. Jon Wiley & Sons, Inc. spends millions of dollars to know what topics will be good sellers. They’ve been doing this a long time. Trust their work.

You don’t have to concentrate on the topics I’ve helpfully highlighted, but they will make it easier for you. Other niches can be profitable, too.

Golf is a great example. Golfers spend money to play the game. You don’t become a golfer without having some discretionary money to spend on it. I’d recommend against consumer electronics. There is a lot of competition for anything popular, and most of that is available for free. If you choose to promote some high-end gear using your Amazon affiliate link, you’re still only looking at a 3% commission.

I like to stick to topics that people “need” an answer for, and can find that answer in ebook form, since I will be promoting a specific product.

With that in mind, pick a topic, then click one of the links to the actual titles for sale. The “best selling titles” links are a gold mine. You can jump straight to the dummies store, if you’d like.

Of the topics above, here’s how I would narrow it down:

1. Business and Careers. The bestsellers here are Quickbooks and home buying. I’m not interested in either topic, so I’ll go into “More titles”. Here, the “urgent” niches look like job hunting and dealing with horrible coworkers. I’m also going to throw “writing copy” into the list because it’s something I have a hard time with.

2. Health and Fitness. My first thought was to do a site on diabetic cooking, but the cooking niche is too competitive. Childhood obesity, detox diets and back pain remedies strike me as worth pursuing. I’m leaning towards back pain, because I have a bad back. When you’ve thrown your back out, you’ve got nothing to do but lie on the couch and look for ways to make the pain stop. That’s urgency.

3. Personal Finance. The topics that look like good bets are foreclosures and bankruptcies. These are topics that can cost thousands of dollars if you get them wrong. I hate to promote a bankruptcy, but some people are out of choices. Foreclosure defense seems like a good choice. Losing your home comes with a sense of urgency, and helping people stay in their home makes me feel good.

4. Relationships and Family. Of these topics, divorce is probably a good seller. Dating advice definitely is. I’m not going to detail either one of those niches here. Divorce is depressing and sex, while fun, isn’t a topic I’m going to get into here. I try to be family friendly, most of the time. Weddings are great topic. Brides are planning to spend money and there’s no shortage of resources to promote.

So, the niches I’ve chosen are:

I won’t be building 9 niche sites in this series. From here, I’m going to explore effective keywords/search terms and good products to support. There’s no guarantee I’ll find a good product with an affiliate program for a niche I’ve chosen that has keywords that are both highly searched and low competition, so I’m giving myself alternatives.

For those of you following along at home, take some time to find 5-10 niches you’d be willing to promote.

The important things to consider are:

1. Does it make me feel dirty to promote it?

2. Will there be customers willing to spend money on it?

3. Will those customers have an urgent need to solve a problem?

I’ve built sites that ignore #3, and they don’t perform nearly as well as those that consider it. When I do niche sites, I promote a specific product. It’s pure affiliate marketing, so customers willing to spend money are necessarily my target audience.

As parents, it is our job to teach our kids about a lot of things: driving, reading, manners, sex, ethics, and much, much more. How many of us spend the time and effort to teach our kids about money? A basic financial education would make money in early(and even late) adulthood easier to deal with. Unfortunately, money is considered taboo, even among the people we are closest to.

It’s time to shatter the taboo, at least at home. Our kids need a financial education at least as much as they need a sex education, and—properly done—both educations take place at home.

How do you know what to teach? One method is to look back at all of the things you’ve struggled with and make sure your kids know more than you did. If that won’t work, you can use this list.

Those are the lessons that I am working to instill in my children, a little at a time. Am I missing any?

Pre-sale preparation and marketing are important, but ultimately, the money comes from how you manage the sale.

How many people will you have staffing the sale? There are a few considerations here. How many people are involved in the sale? How many people can take the time off? It’s best to have three people at the sale at all times. Two people can manage the money while the third plays salesman and security. Staffer #3 is in charge of watching for price-tag swaps or other theft, answering questions, and trying to upsell. It also allows for breaks, which, if you’ve ever spent a day in a garage drinking coffee, is important.

When are you going to be open? You don’t want to open so early you don’t have time to wake up and get ready for the sale, but you don’t want to open so late the professional garage-salers drive past and forget about you. Plan to open sometime between 7 and 9. When will you close? Staying open until 6 will catch most of the after-work crowd, but it makes for a long day, but closing at four cuts out a lot of the late-day shoppers. Our hours were 8-5, which seemed to be a good compromise between a long day and the best sale.

[ad name=”inlineleft”]Don’t be afraid to shut down. The first day of our sale was cold, wet, and miserable. We had to canopies in the driveway, but everything was getting wet, anyway. Traffic was slow and we weren’t enjoying ourselves, so we shut down. Lunch and a nap improved our outlook considerably. At the end of the day, we start packing up, even if people were there. We tried to only pack what they had looked at, and we didn’t try to rush the potential customers, but we did let them know that the sale was ending for the day. The folks who came in half an hour after close on the last day seemed upset that we didn’t unpack everything for their amusement.

Our layout was designed to get everything easily visible while maximizing traffic. The first day, we were confined to the garage and tents, so space was limited. There were baskets under each of the tables. That forced people to crouch and block each other. The second day, we expanded to fill the driveway. Our tables were organized in 3 rows–a “U” shape with a double-wide row of tables in the middle. This allowed people to see everything in one pass. The middle row had periodic breaks so we could move around to help the customers. The pay table was in the middle of one of the outer rows, which let us monitor the entire sale.

Find someone to watch the kids and pets. If you have to keep an eye on your children, you aren’t watching the customers or giving them the attention they need. Your dog–no matter how well-behaved–is a liability. It will be stressed at the people. Some customers will be allergic or afraid. Just don’t do it.

Ideally, you will have someone who isn’t taking money, knows a little bit about most of the merchandise, and isn’t too shy to talk to strangers. His job is to wander around, answer questions, and help people decide if they want an item. He’s the sales-weasel. If he’s pushy, he’ll chase off the customers, but if he’s hiding, he isn’t making any money. Unusual items should have a sign attached explaining why they are special, so the sales-weasel doesn’t have to explain it to everyone.

Every single item should be priced, but not everything needs to be priced individually. We priced all of the movies in a group. “VHS: $0.50 or 5 for $2, DVD $3 or 4 for $10”. Nobody should have to ask what an item costs. If there are multiple people doing a sale together, make sure everyone is using colored price tags to identify who is selling what.

People come to garage sales expecting to find good deals. If they don’t, they’ll leave. Our rule of thumb for pricing was about 25% of retail, with wiggle-room for the item’s condition. New-in-the-box sometimes made it up to 50% of retail. Our goal was primarily to reduce clutter, so a lot of items were priced at 10%. You have to keep in mind that, if you price things too low, people will assume there is something wrong with it and not assign a value in their own minds. Price it at what you would be willing to pay in a garage sale, then mark it up–just a bit–to account for haggling.

People love to haggle at garage sales. It gives them an opportunity to brag about the great deal they fought for. Try to accommodate them. One of the people participating in our sale was selling antiques with a definite value. She didn’t want to haggle on any prices, so we simply hung up a sign that read “All white-tagged prices are firm.” Everyone else was willing to accept almost any reasonable offer. Our most important rule for accepting a price? If you pissed me off, I didn’t budge on price. Insult me, or offer 1/10 of the price, and my defenses go up, bringing your final price with it. Talk nice and use some common sense while haggling, and you got what you asked for.

[ad name=”inlineright”]Could we have maximized the sale more? Probably. I had intended to hang up a sign that simply said “$100” to set a high anchor-price on everything, but I forgot.

Note: The entire series is contained in the Garage Sale Manual on the sidebar.

Update: This post has been included in the Carnival of Personal Finance.

In April of 2009, I told my wife we were either going to straighten out our finances or file bankruptcy. At that time, we had $90,394 in total debt, including $30,000 in credit card debt. It hasn’t been easy, but we are working out way out of that hole. Since then, we have paid down more than $30,000. That’s not $30,000 in payments, but $30,000 less debt. We are now less than $60,000 in debt. We have entirely stopped accumulating more and I don’t remember the last time we carried a new balance on a card or had to use our overdraft protection. Next month, my car will be paid off, 10 months early.

Given my new-found fanaticism, I spent the next 6 months or so evangelizing about our debt repayment. Eventually, I decided to share my thoughts and progress with the world and launched this site on December 1, 2009. Today is my anniversary.

Here we are, 234 posts, 695 comments, and 17, 661 spam later. You all rock. Except the spammers.

To say thank you, I’m giving away a $100 Amazon gift card to some lucky reader. Yes, I rock, too.

There are several ways you can enter the drawing:

1. Subscribe to Live Real, Now, either by RSS or email. If you are already subscribed by email, you are automatically entered. To show me you have subscribed by RSS, there is a contest code in the feed. Just post that in the comments. (1 entry)

2. Follow me on twitter and tweet the following: “@LiveRealNow is giving away $100. Come get some! Follow and RT to enter! http://bit.ly/f1roKM #Giveaway #Yakezie” (1 entry possible per day. Every day you retweet this is another entry!)

3. “Like” LRN on Facebook. This is easy, just click the little ‘like’ button on the left. If you’ve already done that, you have already entered once.(1 entry)

4. Send me an email at Jason <AT> LiveRealNow <DOT> net telling me what you would like to see me write about more (or less!). You can also use the contact form. (1 entry)

I’m closing this down on the 15th. That’s 18 possible entries for $100 you may win early enough to help with some last-minute Christmas shopping.

UPDATE:

And the winner is…Claudia! Congratulations. Email sent.

Going green is about making changes, some of them very small, to lessen the impact you have on the planet and its precious resources. But if it can be both good for the planet and good for your pocket then who would seriously not want to ‘go green’?

Saving money is at the top of most people’s minds at the moment, so check out your credit card at Moneysupermarket to ensure you are getting the best deal and see how going green can affect the rest of your finances.

Most of the things we can do to reduce our consumption of both energy and materials are automatically going to save us money.

Some of the more obvious steps to make your home more energy efficient can result in substantial savings, such as fitting good insulation, having double glazing and putting up thick curtains to keep the heat inside.

These simple tips are not all that can be done in the home, as by starting to think differently about how you use the different areas of your home, you’ll find out how zonal living can save you even more.

Zonal living is about only using energy as you need it in the home. Heating can be varied from room to room, ensuring that the temperatures in each room are adjusted according to when and how the room is used.

Keeping bedrooms cool at night, for example, not only saves you money, but also promotes better sleep. You can achieve zonal heating by fitting thermostatic valves to your radiators and using electrical timers to switch heaters on and off at appropriate times.

Most of us now have more electrical appliances in our homes than we actually use and each of them can be steadily consuming energy even when not in use.

The worst culprits are probably the TV and DVD player, because it’s so convenient to use the remote to switch them off. You might think you’re turning them off, but all that’s happening is you’re putting them on standby. Spend a few seconds actually switching off appliances at the plug and you’ll be amazed at the savings over the course of a year.

The same applies to cell phones. Nowadays, most of them recharge in a couple of hours or less. If you leave them to charge overnight, you’re simply wasting energy and money.

Could you cut down on your usage of the tumble dryer? Nothing in the white goods department uses up quite so much energy as these noisy machines so, if you can, buy a washing line and rediscover the joys of laundry dried by the breeze and sun; your bank account will reap the benefits.

Fuel costs only ever seem to go up, so adopting a more efficient style of driving will help your pocket as well as the planet. The Drive 55 campaign claims that keeping within the speed limit of 55 mph can cut as much as 50% off your fuel bill.

When you move away from a junction or lights, you can use up large amounts of gas, so learning how to use your gears smoothly is another way of saving cash.

None of these steps require great changes but taking a little time and putting a little thought into your energy consumption will help save you money and help conserve energy and resources.

Post by Moneysupermarket.