- RT @ScottATaylor: The Guys on "Pickers" should just follow the "Hoarders" teams around- perfect mashup #

- PI/PNK test: http://su.pr/2umNRQ #

- RT @punchdebt: When I get married this will be my marital slogan "Unity through Nudity" #

- http://su.pr/79idLn #

- RT @jeffrosecfp: Wow! RT @DanielLiterary:Stats show 80% of Americns want to write a book yet only 57% have read at least 1 bk in the last yr #

- @jeffrosecfp That's because everyone thinks their lives are unique and interesting. in reply to jeffrosecfp #

- @CarrieCheap Congrats! #CPA in reply to CarrieCheap #

- @prosperousfool I subscribe to my own feed in google reader. Auto backup for in between routine backups. Saved me when I got hacked. in reply to prosperousfool #

- @SuzeOrmanShow No more benefits? I bet the real unemployment rate goes down shortly thereafter. in reply to SuzeOrmanShow #

- Losing power really make me appreciate living in the future. #

Saturday Roundup

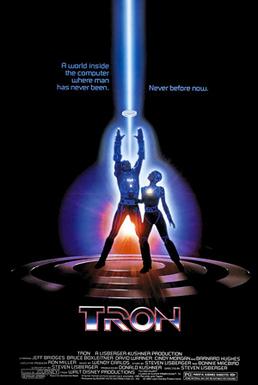

- Image via Wikipedia

I wrote this yesterday. According the forecast, when this post goes live, I’ll be moving 5-8 inches of snow off of my driveway.

That, or watching TV and thinking about moving snow.

Maybe I’ll just sleep in and wait for spring to melt the snow.

Don’t forget to enter my drawing for a $100 Amazon gift card! Go here for details. It ends on the 15th, so don’t wait too long.

Best Posts

Crazy-easy ice cream bread. How could this possibly be bad?

Tron comes out in 2 weeks. I’d love to show up on a custom street-legal Troncycle.

Arsenic-based lifeforms are shaking up the way we understand life to work. I’m of the opinion that life will probably exist almost everywhere that isn’t a completely dead dry rock. I say that as an expert in…well, nothing related to astrobiology.

Following Erica’s advice is currently making me a few hundred dollars per month, with every sign of growing as time goes on. I hate to sound like a fanboy, but if she pimps a product, I’m at least going to give it some serious consideration.

Carnivals I’ve Rocked

10 Dumb Money Moves was featured in the Carnival of Debt Reduction.

Book Review: The Art of Non-Conformity was included in the Carnival of Personal Finance.

Things You Should Buy Online to Save Money was included in the Festival of Frugality.

Thank you! If I missed anyone, please let me know.

LRN Timewarp

This is a new feature to share the gift that is me with anyone new to LRN. This week, I’m going to share some posts from my first week blogging here.

The $10 College Fund. In the last year, not only have I not changed my mind about the $10 college fund, but I haven’t raised the amount. The point is to just get started. I’ve done that. I’ll raise the amount when my debt is paid off. We are now up to $166.09. The numbers are off because I stuck a little bit extra in one month.

In the last year, our dreams haven’t changed. We haven’t made any direct progress, but indirectly we are doing well. First things first. We need to pay the debt off before we look at a hobby farm.

My second day blogging, I wrote about why we handled money so poorly.

What D&D Taught Me About Finance

I admit it: I’m a geek. I’m not a hobby geek who only geeks on the weekends. I’m a full-fledged, licensed and certified geek. I am a geek about so many wondrous things that it’s hard to list them all. My wife knows, my kids know. It’s not much of a secret. One of my many geek qualifications is my sordid history of gaming. Role-playing, tabletop only. If that’s gibberish, it’s okay. Nobody needs to understand my geekitude but me.

I started playing Dungeons and Dragons more than 15 years ago. There were no live chickens or human sacrifice. Just a small group of geeks, proto-geeks, pseudo-geeks, and the occasional nerd playing DnD in a poorly lit room for several hours. We laughed, we cried, we fought evil, saved the world, and raised the stock price of an assortment of caffeinated beverage companies.

As the man said, I told you that, so I could tell you this:

DnD taught me many things. It taught me THAC0 calculation, dice-identification, and the fact that no woman, anywhere, considers tabletop roleplaying to be an alpha-male trait. “I’m a level 73 kinder warrior-mage-thief” is not a pickup line anywhere in the world, even Gen-Con. Remember that. Also remember, the singular of dice is die. If your are talking about one, it’s a die. Get it wrong and I will throw a bag full of dice at you and make you dig out the purple, sparkles-like-a-vampire, 27-sided die from among the hundreds of other dice.

DnD also taught me some surprising things about the world of personal finance, which is not a part of a planar campaign.

All the best toys cost too much. At the current exchange rate of 10 silver pieces(sp) to 1 gold piece(gp), potions of extra healing will drive you into debtor’s prison. Just as a sword of extra-slaying +10 will cost you everything you earned raiding that castle for the last 6 Wednesday evenings, so will a big screen TV set you back a full month’s salary. Don’t risk your life or sell your life’s energy for something fleeting, just because it’s “the best” or the newest gadget, geegaw, or artifact.

Never sell your soul for a castle or a horse. When the Baatezu come to offer you a “no money down, 0% for a year, all-expenses-paid, surrender-your-first-born” deal for a castle or the prettiest horse in the park, take a cue from the former First Lady. Just say no. Spending money today that you have to pay for tomorrow is almost always a bad idea. Don’t spend your soul, spend your savings. Don’t buy something until you can afford it. A Lexus or an Arabian, a mansion or a rambler. Are any of them worth auctioning your future?

Your armor isn’t stronger just because it’s shiny. A suit of Full-Plate of Protection-From-the-Charms-of-Bar-Wenches +5 may look pretty, but it’s not going to help against the orcs, kobolds, or trolls unless, of course, they are wearing skirts and sitting on a bar-stool above a sawdust-covered floor. Does the shiny new iPod really provide a benefit, or is it just a shiny gadget to woo the ladies?

A good sword is necessary to keep your stuff. This is a not a call to self-defense, or mugger, err, orc-slaying–though why that’s ever viewed as a negative is beyond me. You need to be aggressive in defending your loot. Call your credit card companies and demand they turn over the booty, err, lower your rates. Tell your friends to step away from the Diamond Ray of Disappearance, err, expensive outings or you will chop off their heads, err…no wait, that one can stay. I think my friends may be scared of me.

[ad name=”inlineleft”]The promised reward for completing an adventure isn’t the only way to make money. Sure, the local duke(your boss), may be willing to pay you a chest of gems(your salary) for defending the town from the ravages of the Tarrasque(your job), but that isn’t the only way to make money. You could do your job, collect your pay, and go home at night, but why? Don’t forget to pick up the loot along the way. If you spot the shiny penny, grab it, whether it’s abandoned gold, a new idea for a niche-blog, or a chance to turn your leisure hobbies into money. There are thousands of ways to make money outside of your day job. Every one will help your bottom line.

It takes cunning to slay the dragon. When tackling your debt(dragon), wading in swinging your sword may be emotionally satisfying, in the short term, but long term, it’s just a painful method of reminding yourself that you are crunchy and taste good with ketchup. Make plans. Have a strategy. Come out a winner. Then, sit down for beer and dragon steak. Goal-less, plan-less attacks fail in the long-term.

Update: This post has been included in the Carnival of Personal Finance.

Making the Sale: How to Alienate Your Customers

Have you ever walked into a store only to be instantly surrounded by salespeople trying to sell you whatever their corporate office has decided is the most important thing for them to sell this week?

I remember walking into a big blue electronics store to buy a TV. The beautiful corner-unit entertainment center that perfectly matches my living room will fit–at most–a 32″ screen. Unfortunately, any questions I asked were answered with an attempted upsell to a big screen. I don’t want a fancy TV. I don’t have room for it. It doesn’t fit my needs.

Why do the salespeople persist in strong-arming me into something I can’t use?

Later, I’ll be visiting a couple of potential customers. I know from talking to them that they are expecting a hard sell and a push to sign a contract today.

I don’t do that. I can’t do that.

My goal for these meetings is to find out what these people want, and–more important–what they need. How can I know what they need before I have a chance to sit down and ask them? Even bringing a proposal to the meeting would show that I cared less about them than I do about their checkbooks.

Here’s my checklist of items to bring:

- Notebook

- Pen

- Spare pen

- Business card

- My winning personality

That’s it.

I can accomplish more with “How can I help you succeed?” than I can with “You really need to buy this from me, today.”

If the high-pressure sales-weasels at the big blue electronics store had been taught that lesson, I may have gone home with a high-end (though smaller) TV, rather than going home to buy online.

Have you ever had a sales-weasel try to convince you that you want something you don’t need or need something you don’t want?

Delayed Gratification

I work daily to raise my kids to be more financially responsible than I have been. One of the most difficult pieces has been to explain the benefits of delayed gratification to my children. It’s hard enough, as an adult, to take delayed gratification to heart. For a child? It seems to be almost impossible.

My son wants an XBox 360 Elite. Good for him. He wants to renegotiate the terms of his allowance to get it faster. Currently, every other time he gets an allowance paid out, it goes into his bank account, to be mostly untouched. The other times he can do as he pleases with his money. We are enforcing a 50% long term savings plan. Now, with a medium-term goal in mind, he wants to keep all of his money, and only put gift money into the bank account.

Should we let him tap his bank account for a shiny new bauble? It’s been building for a while, so it’s delayed, right? I don’t think that would accomplish much. Like any other 10-year-old, his interests change often.

Should we let him change the terms of our agreement, speeding a medium-term goal at the expense of his long-term savings? My wife and I haven’t had a chance to discuss this, but my initial reaction is not to allow it. His savings has the potential to turn into a decent car in a few years, if he wants. That would be a car he knows he earned.

Last week, when we were at the store, he asked if he could borrow some money to buy a game. I don’t expect him to carry his money around everywhere, so I would have allowed it, if he would have had the money at home. He didn’t. His plan was to pay me what he did have as soon as we got home, then work his butt off for a few days to earn enough extra to pay it back. I won’t be a credit agency for my kids, so I said no. He was disappointed, but, by the time he had earned the money, he no longer wanted the game. I consider that a win, but I don’t know that he learned any lesson other than “Dad’s a jerk.”

Someday, when his life launch is smooth due to a lack of debt-dependence, he’ll look back on these lessons and smile.

I hope.

Decluttering the House – April 30 Day Project Update

My 30 Day Project for April is to declutter my entire house. That’s every room, every dresser, every drawer. We’ve got 12 years of jointly accumulated clutter.

Our progress so far has been wonderful. The main level of our house is almost done.

In our daughters’ room, we put in bunk beds and pulled out a dresser. With the crib, changing table, and toddler bed removed, they actually have room to play on the floor. Their closet has been emptied and repurposed as scrapbooking and blanket storage. Cost: $140 for the bunk beds.

Our son’s room has had a dresser, a desk, and a bed replaced with a loft bed. Even with the 6 foot tall monstrosity of a bed, his room looks so much bigger. We still have to clean out his closet, which is mostly artifacts of a business we no longer have, leftovers from when his bedroom was our office. Cost: $260 for the loft bed.

Our room was depressing. Never dirty, but oh-so-full. The closet was jam-packed. The top shelf was full of towels and sheets. The closet rod couldn’t fit another shirt. There was a modular shelving system on the floor of the closet–full. We had three full dressers. The headboard has 5 foot tall cabinets, half of which were full of makeup and jewelry, the other half with books. Now, there is 1 empty dresser. It belonged to my great-grandmother, so it’s going to the shop to be refinished, instead of the garage sale to be sold. Another dresser has spare room in it. There’s no need to rearrange the cabinets to get to anything. The closet is less than half full and there is almost nothing on the floor of the closet. Gear for my side-line business is stored out of sight and out of the way. This is so much more relaxing.

We’ve tackled the kitchen, except for 1 cabinet, which is mostly cookbooks and booze. That will be fun to clean out.

Our front closet was worthless. It was so full we put hooks on the outside of the door to hang our coats. We pulled out a dozen coats we never wear. At least 20 pairs of shoes, some belonging to roommates gone 1o years. We can actually use the closet now. The shoes and boots all have homes. Our coats all fit…inside.

We have 1 closet and 1 cabinet left to address on the main level. There are also 3 small rooms in the basement that need to be gutted–the laundry room, the family room, and a room that has been designated for storage and the litter box. The last one will be the hardest. It’s full of remnants of hobbies past and failed ventures. I’m expecting some fights, flowing every possible direction.

In the process, we’ve filled our dining room with stuff for our garage sale…twice. It’s all getting priced and boxed as we go through it. We thrown away anything we won’t be able to sell. We’ve done all of this with the mutual understanding that nothing is coming back in the house. After the sale, it will be donated or sold on Craigslist, but it won’t become a part of our lives again. We are successfully purging so much. The “skinny clothes” are gone. When the time comes, they’ll be replaced. In the meantime, they can be put to better use on someone else. Hobbies that never took, games that are never played, it’s all going. We are getting down to the things that are actually used and useful.

It’s interesting to note that the process is getting easier as the month goes by. My Mother-in-Law is a hoarder. Those habits get passed down, but what was originally a source of stress has turned into a pleasant chore.

The most wonderful discovery of all? It turns out we don’t need a better storage system, we just need less stuff.

Update: This post has been included in the Money Hacks Carnival.