- Bad. My 3yr old knows how the Nationwide commercial ends…including the agent's name. Too much TV. #

- RT @MoneyCrashers: Money Crashers 2010 New Year Giveaway Bash – $9,100 in Cash and Amazing Prizes http://bt.io/DZMa #

- Watching the horrible offspring of Rube Goldberg and the Grim Reaper: The Final Destination. #

- Here's hoping the franchise is dead: #TheFinalDestination #

- Wow. Win7 has the ability to auto-hibernate in the middle of installing updates. So much for doing that when I leave for the day. #

- This is horribly true: Spending Other People's Money by @thefinancebuff http://is.gd/75Xv2 #

- RT @hughdeburgh: "You can end half your troubles immediately by no longer permitting people to tell you what you want." ~ Vernon Howard #

- RT @BSimple: The most important thing about goals is having one. Geoffry F. Abert #

- RT @fcn: "You have enemies? Good. That means you've stood up for something, sometime in your life." — Winston Churchill #

- RT @FrugalYankee: FRUGAL TIP: Who knew? Cold water & salt will get rid of onion smell on hands. More @ http://bit.ly/WkZsm #

- Please take a moment and vote for me. (4 Ways to Flog the Inner Impulse Shopper) http://su.pr/2flOLY #

- RT @mymoneyshrugged: #SOTU 2011 budget freeze "like announcing a diet after winning a pie-eating contest" (Michael Steel). (via @LesLafave) #

- RT @FrugalBonVivant: $2 – $25 gift certificates from Restaurant.com (promo code BONUS) http://bit.ly/9mMjLR #

- A fully-skilled clone would be helpful this week. #

- @krystalatwork What do you value more, the groom's friendship or the bride's lack of it?Her feelings won't change if you stay home.His might in reply to krystalatwork #

- I ♥ RetailMeNot.com – simply retweet for the chance to win an Apple iPad from @retailmenot – http://bit.ly/retailmenot #

- Did a baseline test for February's 30 Day Project: 20 pushups in a set. Not great, but not terrible. Only need to add 80 to that nxt month #

Are We Facing a Financial Crisis Today?

This is a guest post.

It is hard to deny, that we are currently in a financial crisis. This is true not just in the United States but in the entire world! Indeed if

you look at what has been happening in Europe, the United States is not even in the worst shape among the advanced countries. Ireland, Portugal and especially Greece are suffering slow economic growth and crippling debt, with many other European countries not far behind them. Even countries that are still experiencing strong growth like China and India have no insurance against suffering a slow down in their rate of expansion.

However the United States is the world’s largest economy, so our milder economic problems have a larger proportional effect on the rest of the world. As the saying goes among economists, “When the U.S. catches a cold, the rest of the world gets pneumonia!” Therefore there is tremendous pressure on the United States to resolve the current financial crisis. America is trying to lower its debt and balance its budget before a serious financial crisis develops here like in Europe. If Congress and the President can agree on how this can be done then strong U.S. growth may return and thereby stimulate economic growth worldwide.

Alas, this debt cutting and budget balancing is easier said than done. Cutting spending means reducing or even eliminating government services that people have become accustomed to and prefer not to give up. Social Security for retirement, Medicare for health insurance, food stamps for the poor and many other spending programs all have people who depend on them and who are not happy to have them curtailed or eliminated. When such cuts were attempted in Greece and Great Britain, rioting broke out in major cities by those opposed to the cutbacks. Such violence is not expected in the United States, but it is still politically very difficult to make the kinds of cuts required for fiscal recovery. In fact the U.S. recently had one of its major credit ratings lowered because of skepticism that America has the political will to make the necessary changes.

On the plus side the United States has always managed to gets its financial house in order in the past, and most observers believe it will do so again, although there may be some spectacular political fireworks along the way! In the meantime many are wondering how to enhance their safety against today’s uncertainty and how to achieve financial freedom and peace of mind until better times arrive. While it is not possible to shield oneself completely from the financial crisis, it may be wise to get some cheap insurance quote to discover what types of insurance policies may give you some protection.

Whatever your financial status, there are always ways to protect what you own if you are willing to shop around. But whether one receives cheap insurance quotes or higher ones, now is the time to protect your assets until today’s financial crisis passes.

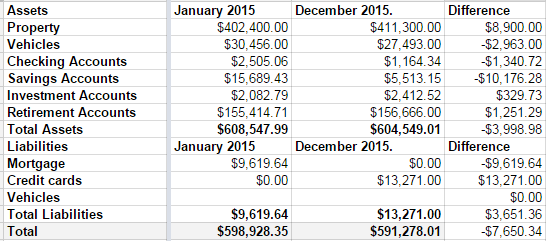

Net Worth and other stuff

This was not a good year for our net worth.

Over the summer, we remodeled both of our bathrooms. At the same time.

1 out of 10: Don’t recommend.

We love the bathrooms, but–as with any project–it went over budget. Sucks to be us.

Then, towards the end of the year, we decided to push hard and pay off our mortgage in 2015. Part of doing that meant paying the credit card off slower than we’d like. It wasn’t the best long-term decision, but we’re mortgage-free now.

Those decision, coupled with a small slump in our investment accounts means we are worth $7650 going into 2016 than we were at the start of 2015.

Disappointing.

I’m also disappointed that our credit card discipline slipped last year.

New plan: No debt before tax day. Every cent of Linda’s paycheck, every cent of my monthly bonus checks, and every cent of any extra money we make is going into the remaining credit card debt. My math says that last debt will die on April 1st.

Then we get to talk about what to do with out money when there’s no debt. But never fear, I have a plan. A boring, boring plan.

- We’re going to save for college at a rate we should have started 10 years ago.

- We’re going to max out both of our retirement plans.

- We’re going to take some nicer family vacations.

- We’re going to buy a pony.

So not that boring.

And when our kids all decide to become certified sign-spinners, we’ll have a huge nest-egg in the college fund savings account to spend on lottery tickets.

The Spending Styles of the Rocky Horror Picture Show

- Image via Wikipedia

Everybody has a spending style. Like a fingerprint, it is unique to each individual, even if that individual is fictional.

Since it is the Halloween season, and The Rocky Horror Picture Show is a Halloween movie, I’m going to look at how those characters spend their money.

Janet Weiss – A Heroine

Janet is the stereotype of every suburbanite soccer-mom-who-hasn’t-gotten-married-and-had-kids-yet. She wants to keep up with the Joneses(“It’s nicer than Betty Monroe had! [Oh Brad!]”) and she is obviously impressed by and envious of people who have all of the trappings of the “finer things”. If she has a credit card, you can bet that it is peeling on the sides from over-use. While she wears conservative clothes and sensible shoes to go visit an old mentor, she’s almost definitely got a closet full of fancy shoes and a drawer full of real-baby-seal-skin g-strings. If Brad were smarter, he’d run, and not just because of her loyalty issues. She’ll never be content with a sensible car and modest house.

Brad Majors – A Hero

Brad is a pompous jerk who thinks he’s better than those around him. He’s also extremely conservative and slow to accept change. He’s going to give Janet an allowance and complain every time she spends a penny of it. His investment portfolio is well-balanced and configured for long-term growth and he’s going to rub your nose in it at the neighborhood barbecue. To shut him up, just ask why his kid was born with an accent and garters.

Magenta – A Domestic

What’s a domestic? Magenta is the most financially responsible person in the show. She’s third -in-command of an alien invasion, but still takes on a second job? That’s a woman planning for retirement. She’s not going to rely on anyone to support her. She knows how to enjoy a party, without having to spend all of her money on a glitter-suit.

Columbia – A Groupie (as Little Nell)

Columbia is incapable of making a decision that wasn’t pre-formed by her peer group. She’s doomed to chase every fad, hoping it will impress those around her. While she’ll always be remembered for her glitter-suit or the corset that isn’t quite tall enough, she’ll never be happy or have a spare penny in case of emergencies.

Riff Raff – A Handyman

Riff Raff has jealousy issues. He sees his boss and commander throwing a party and having a good time, but, instead of working towards being able to do that himself, he kills his boss and steals his house. He is greedy, jealous, and deceitful. Don’t ever turn your back on him, or he’ll steal your wallet, hit you over the head and bury you in the backyard just so he can pretend it’s his party.

Eddie – Ex Delivery Boy (as Meatloaf)

Eddie is out of his head (H-E-D). He’s the tag-a-long who will keep buying expensive dinners that he can’t afford in an attempt to impress whoever is around to see him pick up the check. He isn’t sure how to fit in, but he’s positive that he can buy his way there. In reality, he’s dead(spelled right) broke and will end up getting screwed.

Rocky Horror – A Creation

Here is the true blank slate. He’s just seven hours old, so he’s got no bad habits to break. Unfortunately, he’s never had to learn any hard lessons, so his head is easily turned by an glittered bauble or babbling, half-dressed flake. He’s incapable of making an informed decision about anything, so he follows everyone around getting whatever they like. He’ll spend his entire life getting by on his looks, which will almost always be successful, until life catches up to him and he dies broke and alone.

Dr. Frank-N-Furter – A Scientist

Frank knows how to throw a party. He travels 12 billion light years brings not only a keg, but the entire party house with him. Who wouldn’t want to be his friend? There’s a fancy house, a room to stay in if you drink too much, pretty people being built in the lab, and gourmet corn-fed delivery-boy being served for dinner. Watch out, though. He doesn’t tend to his job. One day, the credit cards will be maxed, the bank will foreclose on the house and send it back to Sweet Transexual Transylvania, leaving Frank penniless. Who will be his friend then?

Which Rocky character are you?

Science Fiction

Double Feature.

Frank has built and

Lost his creature.

Darkness has conquered

Brad and Janet.

The servants gone to

A distant planet.

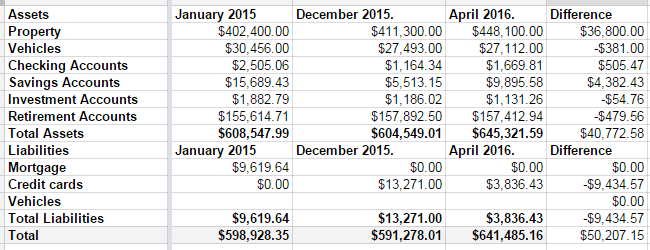

Net Worth, April 2016

Last year wasn’t a good year for my net worth. It came with a $7000 drop.

Q1 2016, however, was a great quarter.

In December, we had $13,271 in credit card debt. At the time I took this screenshot, it was down to $3836.43. As of this moment, it’s down to $2640.91. If things go as expected this week, I should wake up on Friday to a paid-off credit card. I had to raid some of our savings accounts to make it happen, but it’s happening. Some of it was a tax refund, some of it was the fact that my mortgage payment went away in December.

That’s seven years of hard work, almost to the day. Seven years ago, I was researching bankruptcy, and stumbled across Dave Ramsey. Seven years ago, we were drowning in debt.

Next week, we’re free. No more debt, hanging over our heads. We’re free to take vacations. We’re free to finally save for college, when my son is 16, and stand a chance of being able to pay for it for him. We’re free to do…whatever we want to do. Our monthly nut after the debt is paid–only in fall/winter/spring when my wife is working–is roughly 1/3 of our take-home pay.

That’s how hard we’ve cut to make sure we can pay our bills and make debt die. We do have some things that would be considered extravagant. We’re not savages. But my car is 10 years old. My wife’s is 7. My motorcycles are 35 and 30; one of them was purchased before we cared about our debt.

Back to the net worth….

The biggest change came from our property values, which sucks. That was $36,000 of the difference, which comes with the painful tax bump to go with it. A large chunk of the savings increase was the money we set aside every month to cover the property tax bill, and that will go away next month.

Still, $641,000 dollars is a long way from nothing. I’m pretty happy.

My New Windfall

Tax season is over.

This year, TurboTax and Amazon teamed up to offer me a 10% on up to $1200 of my refund if I took it as an Amazon gift card.

$120 free if I spend that money with a company I’m going to spend money with anyway?

Yes, please.

I spend lots of money with Amazon. I subscribe to many of my household items there, because I use them and I don’t want to have to think about buying them. I get my soap, shampoo, toilet paper, paper towels, and garbage bags automatically delivered. There’s a bunch of other stuff, too, but that’s what I remember off the top of my head. If I have 5 items in a monthly delivery, I get 20% off.

Free money, free shipping, and none of the hassles of shopping?

Yes, please.

So now I have a $1320 credit with the company I use for most of my non-grocery shopping.

I also have 962 items on my wishlist with Amazon.

To recap: $1320 burning a hole in my metaphorical pocket and 962 items that I have wanted at some time in the past, begging me to bring them home.

That’s a dilemma.

The smart answer is, of course, to let that money hide in Amazon’s system and slowly drain out to pay for the things I actually need.

The fun answer is to stock up on games and books and toys and gadgets and cameras and, and, and….

Some days, it’s hard being a responsible adult.

I think I’m going to compromise with myself. I’ll leave the vast majority of the money where it is, but I’ll spend a little bit of it on fun stuff, and a little bit more on stuff I don’t quite need, but would be useful, but not so useful that I’ve already bought it.

A new alarm clock to replace the one next to my bed that automatically adjusts for daylight savings time but was purchased before they changed the day daylight savings time hit so I have to adjust the time 4 times per year instead of never. That’s on the list of not-quite-needs.

The volume 2 book of paracord knots is on the list of wants that can’t possibly be considered a need, but it’s going to come home, anyway.

I figure, if I spend a couple of hundred dollars on things I really, really want, I’ll scratch that itch and leave most of the money alone.

What would you do with a $1300 gift card at a store you shop at every week that sells every conceivable thing? Spend it right away, or stretch it out, or something else?