- Up at 5 two days in a row. Sleepy. #

- May your…year be filled w/ magic and dreams and good madness. I hope you…kiss someone who thinks you’re wonderful. @neilhimself #

- Woo! First all-cash grocery trip ever. Felt neat. #

- I accidentally took a 3 hour nap yesterday, so I had a hard time sleeping. 5am is difficult. #

- Wee! Got included in the Carnival of Personal Finance, again. http://su.pr/2AKnDB #

- Son’s wrestling season starts in two days. My next 3 months just got hectic. #

- RT @Moneymonk: A real emergency is something that threatens your survival, not just your desire to be comfortable -David Bach # [Read more…] about Twitter Weekly Updates for 2010-01-09

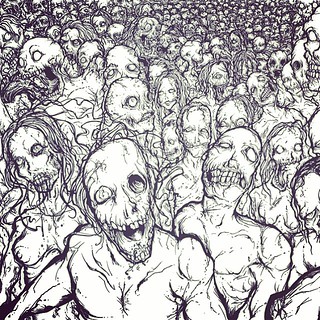

Walking Dead: Would You Be Ready for the Apocalypse?

Would you be ready for the apocalypse? The Walking Dead asks that question every week. There is a great deal of human intrigue in the show, but the show is always asking you, the viewer, if you would be ready to deal with an apocalypse on that order. The idea goes much farther than dealing with zombies. Truly, zombies are the easy part of the apocalypse.

Lost People

We live in a world where we are very connected. You know people from all over the world, and it the entire world has been overrun by an apocalypse at once, all the people you are connected to around the world are effectively gone. There is no chance you will ever see them again. The people on the show deal with those ideas every day. There are so many people they miss that they never go to to say goodbye to.

Insecurity

The one thing that the apocalypse creates is insecurity. You will have no idea what is going to happen the next morning. You never know when someone in your crew is going to be bitten or killed. You have no idea when you will run into other humans you cannot trust. There is not a safe place on Earth. Even if you lock down a house, there is no way to know for sure that zombies would not get in.

Violence

The Walking Dead graphically depicts the violence that is necessary to kill zombies. You would have to “kill” thousands of people who have become zombies. You can see their wedding rings. You can see them in their uniforms, and you know that they used to be somebody. However, you have to end them in order to save yourself. Many of us believe we could do that, but we need to think twice before we assume we could be that violent.

Order

The lack of order in the world is the thing that would break most of us. We can reconcile loss, but that loss is hard to reconcile when there is no order in the world. There is not one authority on the planet that is still operating. How would you be able to resolve problems without such a structure?

On the show, all these problems are handled violently. Murdering violent people is all part of the job if you want to stay alive. It is one thing to kill a zombie that is no longer a person, but it is something else to kill a real person who is simply a thieving criminal.

You might think that you would do just fine when you are watching The Walking Dead, but you would not know unless it happened in real life. The zombie apocalypse is not all fun and games. At its heart is a tense human emotion called loss that we would all have to confront head on.

AAA – Save Some Cash

- Image via Wikipedia

Have you ever driven off the road at 100 miles per hour into a grove of trees at midnight, only to have 2 cops and your father spend 2 hours looking for your car with high-powered spotlights? Let me tell you–from experience–that a free two will, in fact, make that night a little bit better.

Enter AAA.

At its most basic level, AAA is just a roadside assistance service. If your car breaks down, you lock your keys in, or run out of gas, you call AAA from the side of the road and they send a hero at any time of day or night. I’ve used the service to get a car pulled out of an impound lot and out of a ditch. They’ve helped move broken-down cars from my driveway to the mechanic.

We pay $85 per year for the basic service, which includes 5 miles of towing, up to 4 timers a year; lockout service; gas delivery; “stuck in a ditch” service; free maps, trip planning and trip interruption protection. Higher membership levels boost those services and include things like free passport photos, complimentary car rental when you use the tow service, concierge service and more.

I’ve been a member since I got my driver’s license at 16, and over the years, just the roadside assistance has paid for my lifetime of membership several times over.

But–as the man said–wait, there’s more!

They certify mechanics. Not for skill, but reputation. It’s harder to get screwed by a AAA mechanic.

Then there are the discounts.

Most chain hotels, some oil-change shops, and a lot of car-rental services have AAA discounts. Combined with the trip planning, the discounts can easily pay for themselves, if you travel even once a year.

There are also discounts at a ton of restaurants and attractions, sometimes adding up to savings of $50 or more. I don’t think I’ve ever had a year where AAA didn’t pay for itself, and I don’t even use the services efficiently.

For example:

- 10% off Target.com

- Discounts on Magellen GPS units

- Theater(stage and screen) discounts

- Discounts on minor league baseball and college football tickets

- Prescription savings plan

- $3 of at our local for-profit aquarium

- 10-30% discounts from Dell

- 5% off at UPS

- 20% off at Sirius Satellite Radio

- 10% off PODS(hoarders take notice!)

- 10% at Amtrak

- Up to $200 off at DirecTV

- A crapload more

I know I sound like a salespitch, but they didn’t pay for this post. I’m just a happy customer.

Do you use a roadside assistance or a discount-from-a-million-places membership?

How to Prioritize Your Spending

Don’t buy that.

At least take a few moments to decide if it’s really worth buying.

Too often, people go on auto-pilot and buy whatever catches their attention for a few moments. The end-caps at the store? Oh, boy, that’s impossible to resist. Everybody needs a 1000 pack of ShamWow’s, right? Who could live without a extra pair of kevlar boxer shorts?

Before you put the new tchotke in your cart, ask yourself some questions to see if it’s worth getting.

1. Is it a need or a want? Is this something you could live without? Some things are necessary. Soap, shampoo, and food are essentials. You have to buy those. Other things, like movies, most of the clothes people buy, or electronic gadgets are almost always optional. If you don’t need it, it may be a good idea to leave it in the store.

2. Does it serve a purpose? I bought a vase once that I thought was pretty and could hold candy or something, but it’s done nothing but collect dust in the meantime. It’s purpose is nothing more than hiding part of a flat surface. Useless.

3. Will you actually use it? A few years ago, my wife an cleaned out her mother’s house. She’s a hoarder. We found at least 50 shopping bags full of clothes with the tags still attached. I know, you’re thinking that you’d never do that, because you’re not a hoarder, but people do it all the time. Have you ever bought a book that you haven’t gotten around to reading, or a movie that went on the shelf, still wrapped in plastic? Do you own a treadmill that’s only being used to hang clothes, or a home liposuction machine that is not being used to make soap?

3. Is it a fad? Beanie babies, iPads, BetaMax, and bike helmets. All garbage that takes the world by storm for a few years then fades, leaving the distributors rich and the customers embarrassed.

4. Is it something you’re considering just to keep up with the Joneses? If you’re only buying it to compete with your neighbors, don’t buy it. You don’t need a Lexus, a Rolex, or that replacement kidney. Just put it back on the shelf and go home with your money. Chances are, your neighbors are only buying stuff so they can compete with you. It’s a vicious cycle. Break it.

5. Do you really, really want it? Sometimes, no matter how worthless something might be, whether it’s a fad, or a dust-collecting knick-knack, or an outfit you’ll never wear, you just want it more than you want your next breath of air. That’s ok. A bit disturbing, but ok. If you are meeting all of your other needs, it’s fine to indulge yourself on occasion.

How do you prioritize spending if you’re thinking about buying something questionable?

Credit Card Pitfalls You Have To Avoid

The idea of a credit card is appealing. You don’t have to have the money to pay for things; you can just use the card. It creates instant gratification and you start to get used to the idea of getting what you want when you want it. Unfortunately, this can be a disaster waiting to happen.

If you get in over your head and begin to negatively affect your credit rating, it is not the end of the world. By looking at things like bad credit credit cards at Money Supermarket you can start to make things right again. Watch out for these pitfalls that could cause you to stumble into a bad credit card situation.

Enticing Rewards

You see the commercial or advertisement online and reward credit cards make it seem like you will be drowning in points that can be redeemed for airline miles or gift cards. Initially, you may think that this is a great reason to sign up for a card. Then, you begin to use the card often in order to earn points.

The problem comes when you start spending just to get the rewards and you can’t or don’t make payments to return to a zero balance every month. You may end up with a hefty annual fee on top of everything else. Don’t let the temptation of getting a reward create a problem with your credit score.

Maxing Out the Credit Card

When someone hands you $5,000, you will be tempted to spend it. Why not enjoy the new money? The problem is that a $5,000 credit card balance needs to be paid back. Don’t fall into the trap of spending the entire line of credit immediately.

If you do run into some financial difficulty or you really need a credit card for something, you will have nothing left to use. If you go over the limit, you can be sure that there will be some fees that come along with it. Use it wisely. Charge something and pay it off.

Skipping a Payment or Paying Late

Once you have a credit card, everything is going to affect your credit score. If you miss a payment or pay late, you can be sure that this is going to show up against you. Aside from the damage to your credit score, most credit cards come with a substantial penalty in the form of a late fee that gets tacked onto the next payment.

Always pay on time. Pay in early if possible. Keeping up to date with your credit card will show up positively on your credit rating.

When Problems Arise

Even if you do your best to avoid these pitfalls, sometimes financial problems can be unavoidable. An unexpected emergency requires you to max out the card. You run into a problem at work and lose your main source of income.

If you see that your credit is starting to decline, it is always possible to build that score back up. Start over using bad credit credit cards to make a positive impact on your credit score. With this scenario, you get an opportunity to once again avoid these pitfalls and improve your credit.

10 Top Tips for Reducing Household Expenses

Regardless of the economic climate, it is always a savvy move to assess your expenditure and look for ways to cut your energy costs. Small changes can make a big difference to your energy efficiency and reduce your outgoings significantly.

1. Know Your Accurate Energy Usage

Do not pay for estimated resources. Using a smart meter will tell your exact energy consumption and means you simply pay for your actual confirmed gas usage. So many customers are unknowingly trapped into paying for estimated energy, which can be very costly.

2. Secure an Suitable Tariff

Once you have established your actual gas and electric consumption using a smart meter, speak your energy supplier regarding the various available tariffs.

There are over 120 tariffs available for energy in the UK and there is definitely one to suit all households. Being more assertive in this area can save you money instantly.

3. Let There Be (Energy Efficient) Light

Lighting accounts for up to 40 per cent of our individual electricity bills.

Change light bulbs to energy saving bulbs for a progressive way of reducing your energy expenses. As energy efficient bulbs last ten times longer than normal high-watt bulbs, any cost in making this switch will be quickly recuperated.

Although many days in the UK are dismal, cleaning windows and opening blinds means that rooms can generally be lit with natural light.

4. Don’t Tumble Dry

Tumble drying your clothes is one of the most financially and environmentally expensive appliance usages. Though energy efficient products are now available, try to make use of any other means you have for drying clothes.

During the winter months, fill indoor clothing racks and radiators within items to be dried. Summer washing is generally less of a problem, with warmer temperatures meaning you can hang loads of washing outside to dry naturally.

5. Switch Off Electrical Equipment

Turning your electronic equipment off at night can cause impressive yearly reductions in your expenditure. Encourage the family to turn all laptops, consoles and computers off during the night, and unplug phone chargers when not in use.

Simply switching off a computer overnight saves £35 on the cost of running the equipment 24 hours over the course of a year. Once you have factored in the number of computers and other electronic equipment in your home, this could amount to quite a saving.

6. Moderate Your Heating

Turn your heating down by just one degree. Such an unnoticeable alteration to your thermostat holds the potential to cut your energy bills by a whopping £55 per year.

Enhance your savings by becoming more energy efficient. Rather than switching on heating and cooling systems, use doors and windows to regulate temperature.

7. Invest In Energy Saving Appliances

Most appliances on the market now offer detailed insight into their environmental impact. Buying eco-friendly products not only benefits the climate, it also benefits your pocket. The lower the amount of energy the appliances consume always equals lower energy bills for your household.

8. Reduce Water Waste

A dripping tap can cost up to £400 per year. Paying out for plumbing services now will definitely save on your water bill.

Rather than bathing daily, swap alternate baths for showers. Showers typically use 35 litres of water, whereas baths take more than double this amount at 80 litre of water per tub. Though this varies depending on the type of your shower, according to South Staffs Water, power showers still save approximately 20 litres on the average bath.

9. Replace Your Old Boiler

If your home currently uses an old G-rated boiler, of 15 years of age or more, then you may find that investing in a new A-rated boiler will save you money long term.

Gas burning boilers eat energy and money and are a costly way of fuelling your home. The government currently offers £400 to those who are looking to purchase a new energy efficient boiler, with companies such as British Gas doubling this grant.

10. Insulate Your Home

Alongside grants for new A-rated boilers, companies are being encouraged by the government to offer discounted (and free) loft and wall cavity insulation. Take the time to see if you are eligible for this as it can make your home significantly warmer, reducing your reliance on central heating.

Be assertive to how you are using resources within your home, small changes can make a big ecological and economic difference.

This is a guest post.