- Up at 5 two days in a row. Sleepy. #

- May your…year be filled w/ magic and dreams and good madness. I hope you…kiss someone who thinks you’re wonderful. @neilhimself #

- Woo! First all-cash grocery trip ever. Felt neat. #

- I accidentally took a 3 hour nap yesterday, so I had a hard time sleeping. 5am is difficult. #

- Wee! Got included in the Carnival of Personal Finance, again. http://su.pr/2AKnDB #

- Son’s wrestling season starts in two days. My next 3 months just got hectic. #

- RT @Moneymonk: A real emergency is something that threatens your survival, not just your desire to be comfortable -David Bach # [Read more…] about Twitter Weekly Updates for 2010-01-09

Saturday Roundup

- Image via Wikipedia

Don’t miss a thing! Please take a moment to subscribe to Live Real, Now by email.

Holiday weeks are supposed to be short, aren’t they?

I’m 11 days into my 30 Day “Compact”. So far, it has gone well. Unfortunately, there have been a couple of books launched that I’d love to own, and a friend keeps showing me new gadgets that I’d love to get. Not shopping at all is harder than it sounds.

The Best Posts of the Week:

Brian Wood, without a doubt, understood the responsibility he took on as a father. The story makes me get all misty.

On Wise Bread, they asked if you are saving too much. Don’t save as an excuse to stop living your life.

Free Money Finance will help you save money on travel.

Parent Hacks has a great use for a Google Voice number. I have a spare, so I think I’ll start using it.

I’m a big fan of selling on Craigslist. I’ve never sold a car there, so this was informative.

Finally, a list of the carnivals I’ve participated in:

5 Reasons to Quit Saving and Start Living was included in the Carnival of Personal Finance.

Bonding Relationships was in the Carnival of Wealth.

Hippy Month was the Editor’s Pick in the Festival of Frugality!

If I missed a carnival, please let me know. Thanks to those who have included me!

Ending A Streak

The first year I decorated our yard for Halloween was 1999. The first year we through a Halloween party was 1998.

Our parties tend to fall on the legendary side. Between setup, cleanup, and out-of-town guests, the party is a 3-4 day affair. People reserve our spare beds a year in advance. The day of the party itself, we’re going from 10AM until 5AM, cooking, drinking, and talking. Over the 10 hours the party is actively going, we have 50-60 guests in and out.

Our yard is a neighborhood attraction. We’ve been on the news and in the newspaper. By the end of Halloween night, the path through the yard is nearly worn down to bare dirt. The spot the large coffin sits takes 6 weeks to rejuvenate in the spring. I’ve literally scared kids right out of their masks. Little old ladies have jumped out in the air, shrieking, only to ask me to hide again, so they can bring their husbands over to enjoy the startle.

This year, we end the 13-year unbroken streak of fear and debauchery. We’ve been doing this since before any my oldest kid was weaned.

It’s hard to take a break, but…

Dealing with my mother-in-law’s house has been far too much work for us. We spent all summer cleaning out the hoarding mess.

And fixing up the yard.

And replacing the boiler.

And fixing the plumbing.

And updating the electrical system.

And fixing up the basement.

And patching the walls.

And selling the cars.

And sorting through 30 years of every scrap of paper that has ever come through the house.

And dealing with all of the memories, and the pictures, and the past.

It’s been too much, and it’s not done.

Now, it’s the middle of October, and the idea of stealing the extra time to add the extra stress of setting up the yard and throwing a big party makes me want to break down.

Two days to set up the yard, only to have some kid steal my favorite, irreplaceable pieces, then two days to pack it all up.

A day of decorating inside, followed by a party and a hungover day of cleaning it all up.

All of that, while losing time from the side business and pushing through to the end of the property preparation from hell.

I can’t do it, so, as sad as it makes me, we’re taking the year off. No Halloween events at my house this year.

Is It Time For a New Car?

So far this summer, we’ve sold a 1984 Cadillac, a 1994 Mercury Sable, and a 1976 Lincoln Continental.

That’s most of the vehicles we inherited in April.

Now, we’ve got a 2005 Chrysler Pacifica, a 2001 Ford F150, a 2009 Dodge Caliber, and a 1986 Honda Shadow.

According to Kelly Blue Book, the Caliber has a resale value of $10,065 and a trade-in value of $8470.

The F150 is worth $6,418/4,923.

The Pacifica is worth $7,738/$6,093.

The bike is worth about $1,500.

We own all of them, free and clear, right now.

With our current situation, the F150 and the Caliber aren’t working. We have 3 kids. The oldest is 12 and pushing 6 feet tall. He barely fits in the backseat of either and is forced to wedge himself against a car seat if we take either of these vehicles anywhere. Even the front seats don’t have a lot of leg room, and I’m not exactly short or small.

We are also a popular place to hang out and almost always have an extra kid or two on the weekends. Right now, that means we take two cars if we have to go somewhere.

On top of that, my girls ride in a saddle club on borrowed horses. We are planning to buy a horse trailer and (shudder) lease a couple of ponies next summer.

So, our requirements are:

- Seat 7-8 people

- Full-sized 3rd row

- Towing capacity of at least 5000 pounds

- More than 20mpg highway

- Comfortable front seat

Based on our initial research, the Chevy Traverse meets our needs. Depending on the configuration, it seats 7 or 8 people with a full-sized 3rd row, has a 5200 pound towing capacity, and is rated for 24 mpg on the highway. Locally, there is a 2010 model with 50,000 miles for $19,000, which is dead-on with blue book. For another $1500, we can make it all wheel drive and 2011, which is below blue book. Consumer reports rates it pretty high, but Edmunds has some mixed reviews.

We should be able to sell the F150 and the Caliber for $12-13,000. That only leaves about $6,000 left, which we should have after the remodel on our rental property. I’m almost positive we’ll pull the trigger on a new car in the next month or two.

What do you think? Am I missing anything? Any experience with a Traverse? Have a better idea for something that meets our needs? Please leave a comment and help me out.

Money Crashers 2010 New Year Giveaway Bash

I sponsored a prize in the Money Crashers 2010 New Year Giveaway Bash. I’m giving away a $50 gift card to Alice.com. Other people, sites, and blogs are giving away a combined $7500+ in cash and prizes. There will be more than 100 winners and there are more than a dozen ways to enter.

Don’t miss out.

Net Worth and other stuff

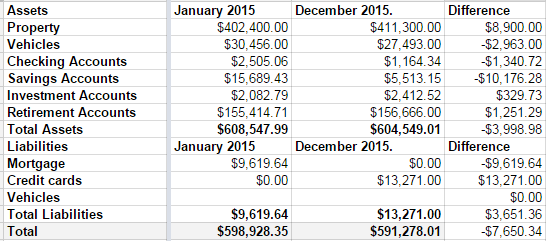

This was not a good year for our net worth.

Over the summer, we remodeled both of our bathrooms. At the same time.

1 out of 10: Don’t recommend.

We love the bathrooms, but–as with any project–it went over budget. Sucks to be us.

Then, towards the end of the year, we decided to push hard and pay off our mortgage in 2015. Part of doing that meant paying the credit card off slower than we’d like. It wasn’t the best long-term decision, but we’re mortgage-free now.

Those decision, coupled with a small slump in our investment accounts means we are worth $7650 going into 2016 than we were at the start of 2015.

Disappointing.

I’m also disappointed that our credit card discipline slipped last year.

New plan: No debt before tax day. Every cent of Linda’s paycheck, every cent of my monthly bonus checks, and every cent of any extra money we make is going into the remaining credit card debt. My math says that last debt will die on April 1st.

Then we get to talk about what to do with out money when there’s no debt. But never fear, I have a plan. A boring, boring plan.

- We’re going to save for college at a rate we should have started 10 years ago.

- We’re going to max out both of our retirement plans.

- We’re going to take some nicer family vacations.

- We’re going to buy a pony.

So not that boring.

And when our kids all decide to become certified sign-spinners, we’ll have a huge nest-egg in the college fund savings account to spend on lottery tickets.