- Up at 5 two days in a row. Sleepy. #

- May your…year be filled w/ magic and dreams and good madness. I hope you…kiss someone who thinks you’re wonderful. @neilhimself #

- Woo! First all-cash grocery trip ever. Felt neat. #

- I accidentally took a 3 hour nap yesterday, so I had a hard time sleeping. 5am is difficult. #

- Wee! Got included in the Carnival of Personal Finance, again. http://su.pr/2AKnDB #

- Son’s wrestling season starts in two days. My next 3 months just got hectic. #

- RT @Moneymonk: A real emergency is something that threatens your survival, not just your desire to be comfortable -David Bach # [Read more…] about Twitter Weekly Updates for 2010-01-09

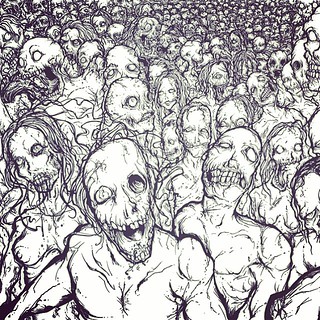

Walking Dead: Would You Be Ready for the Apocalypse?

Would you be ready for the apocalypse? The Walking Dead asks that question every week. There is a great deal of human intrigue in the show, but the show is always asking you, the viewer, if you would be ready to deal with an apocalypse on that order. The idea goes much farther than dealing with zombies. Truly, zombies are the easy part of the apocalypse.

Lost People

We live in a world where we are very connected. You know people from all over the world, and it the entire world has been overrun by an apocalypse at once, all the people you are connected to around the world are effectively gone. There is no chance you will ever see them again. The people on the show deal with those ideas every day. There are so many people they miss that they never go to to say goodbye to.

Insecurity

The one thing that the apocalypse creates is insecurity. You will have no idea what is going to happen the next morning. You never know when someone in your crew is going to be bitten or killed. You have no idea when you will run into other humans you cannot trust. There is not a safe place on Earth. Even if you lock down a house, there is no way to know for sure that zombies would not get in.

Violence

The Walking Dead graphically depicts the violence that is necessary to kill zombies. You would have to “kill” thousands of people who have become zombies. You can see their wedding rings. You can see them in their uniforms, and you know that they used to be somebody. However, you have to end them in order to save yourself. Many of us believe we could do that, but we need to think twice before we assume we could be that violent.

Order

The lack of order in the world is the thing that would break most of us. We can reconcile loss, but that loss is hard to reconcile when there is no order in the world. There is not one authority on the planet that is still operating. How would you be able to resolve problems without such a structure?

On the show, all these problems are handled violently. Murdering violent people is all part of the job if you want to stay alive. It is one thing to kill a zombie that is no longer a person, but it is something else to kill a real person who is simply a thieving criminal.

You might think that you would do just fine when you are watching The Walking Dead, but you would not know unless it happened in real life. The zombie apocalypse is not all fun and games. At its heart is a tense human emotion called loss that we would all have to confront head on.

AAA – Save Some Cash

- Image via Wikipedia

Have you ever driven off the road at 100 miles per hour into a grove of trees at midnight, only to have 2 cops and your father spend 2 hours looking for your car with high-powered spotlights? Let me tell you–from experience–that a free two will, in fact, make that night a little bit better.

Enter AAA.

At its most basic level, AAA is just a roadside assistance service. If your car breaks down, you lock your keys in, or run out of gas, you call AAA from the side of the road and they send a hero at any time of day or night. I’ve used the service to get a car pulled out of an impound lot and out of a ditch. They’ve helped move broken-down cars from my driveway to the mechanic.

We pay $85 per year for the basic service, which includes 5 miles of towing, up to 4 timers a year; lockout service; gas delivery; “stuck in a ditch” service; free maps, trip planning and trip interruption protection. Higher membership levels boost those services and include things like free passport photos, complimentary car rental when you use the tow service, concierge service and more.

I’ve been a member since I got my driver’s license at 16, and over the years, just the roadside assistance has paid for my lifetime of membership several times over.

But–as the man said–wait, there’s more!

They certify mechanics. Not for skill, but reputation. It’s harder to get screwed by a AAA mechanic.

Then there are the discounts.

Most chain hotels, some oil-change shops, and a lot of car-rental services have AAA discounts. Combined with the trip planning, the discounts can easily pay for themselves, if you travel even once a year.

There are also discounts at a ton of restaurants and attractions, sometimes adding up to savings of $50 or more. I don’t think I’ve ever had a year where AAA didn’t pay for itself, and I don’t even use the services efficiently.

For example:

- 10% off Target.com

- Discounts on Magellen GPS units

- Theater(stage and screen) discounts

- Discounts on minor league baseball and college football tickets

- Prescription savings plan

- $3 of at our local for-profit aquarium

- 10-30% discounts from Dell

- 5% off at UPS

- 20% off at Sirius Satellite Radio

- 10% off PODS(hoarders take notice!)

- 10% at Amtrak

- Up to $200 off at DirecTV

- A crapload more

I know I sound like a salespitch, but they didn’t pay for this post. I’m just a happy customer.

Do you use a roadside assistance or a discount-from-a-million-places membership?

Is It Time For a New Car?

So far this summer, we’ve sold a 1984 Cadillac, a 1994 Mercury Sable, and a 1976 Lincoln Continental.

That’s most of the vehicles we inherited in April.

Now, we’ve got a 2005 Chrysler Pacifica, a 2001 Ford F150, a 2009 Dodge Caliber, and a 1986 Honda Shadow.

According to Kelly Blue Book, the Caliber has a resale value of $10,065 and a trade-in value of $8470.

The F150 is worth $6,418/4,923.

The Pacifica is worth $7,738/$6,093.

The bike is worth about $1,500.

We own all of them, free and clear, right now.

With our current situation, the F150 and the Caliber aren’t working. We have 3 kids. The oldest is 12 and pushing 6 feet tall. He barely fits in the backseat of either and is forced to wedge himself against a car seat if we take either of these vehicles anywhere. Even the front seats don’t have a lot of leg room, and I’m not exactly short or small.

We are also a popular place to hang out and almost always have an extra kid or two on the weekends. Right now, that means we take two cars if we have to go somewhere.

On top of that, my girls ride in a saddle club on borrowed horses. We are planning to buy a horse trailer and (shudder) lease a couple of ponies next summer.

So, our requirements are:

- Seat 7-8 people

- Full-sized 3rd row

- Towing capacity of at least 5000 pounds

- More than 20mpg highway

- Comfortable front seat

Based on our initial research, the Chevy Traverse meets our needs. Depending on the configuration, it seats 7 or 8 people with a full-sized 3rd row, has a 5200 pound towing capacity, and is rated for 24 mpg on the highway. Locally, there is a 2010 model with 50,000 miles for $19,000, which is dead-on with blue book. For another $1500, we can make it all wheel drive and 2011, which is below blue book. Consumer reports rates it pretty high, but Edmunds has some mixed reviews.

We should be able to sell the F150 and the Caliber for $12-13,000. That only leaves about $6,000 left, which we should have after the remodel on our rental property. I’m almost positive we’ll pull the trigger on a new car in the next month or two.

What do you think? Am I missing anything? Any experience with a Traverse? Have a better idea for something that meets our needs? Please leave a comment and help me out.

Paying For Heart Surgery When You’re Not as Rich as Randy Travis

Very sad news broke this week about Randy Travis. The country crooner, whose hits ironically include a song titled “From the Hard Rock Bottom of my Heart,” was hospitalized with a life-threatening heart problem that arose from viral cardiomyopathy, a condition that is characterized by a weakening of the heart muscle due to a virus. The virus that caused this disease is usually pretty harmless, but in some patients, extremely dangerous complications can arise. For Travis, the complications weakened his heart, and he required hospitalization and emergency heart surgery.

The easiest way to pay for a heart surgery is to let someone else pay for it. This tip may sound like a joke, but it is the way most people pay for heart surgery. Insurance is a risk management system in which many people pay premiums so that they do not have to bear the entire brunt of a financial loss. Some will come out ahead by paying less in premiums than the amount of the health benefits they will receive. Others will be on the opposite end of the stick. Health insurance can come from the private market or the public coffers through programs like Medicare and Medicaid. While there might be a copay for these procedures with insurance, the insured will not have to pay the whole tab.

Another way to pay for heart surgery is by raiding a retirement account. This is not really advisable in most instances, but desperate times can call for desperate measures. The money can then be paid back over time in the best-case scenario, and getting the doctors paid off will take a major burden off of the back of any heart patient.

Taking out a home equity loan can also be a way to pay for a heart surgery. Those who have some equity built up in their home can sometimes find enough to pay off some emergency bills. Of course, it usually takes years to build up this equity, so many will not have this option available to them.

One final way to pay off a heart surgery without being rich like Randy Travis would involve getting a second job. This might cut down on the amount of time available for cardiac rehab, but the doctor will want his or her cut. It is likely that the hospital will be even more serious about getting paid. This will especially be the case if the hospital is for-profit. It might take some time, but those who are able to survive the extra work should be able to eventually pay off their bills.

Related articles

Getting Out of Debt: The Prime Rule

The American Dream has been perverted. Life, liberty, and the pursuit of happiness has been cruelly warped to mean

“Toys, free stuff provided at the expense of others, and the ability to buy and do anything I want without regard for the consequences.” To fund this horrible new dream, the people who can’t convince a government program to finance it for them often turn to credit. Credit is the art of putting your future into hock for something that you probably don’t need or want and that won’t work by the time you are finished making payments.

Ick. I’ve chosen not to live my life that way. Every day, more people are waking from the consumerism fog and deciding to reel their lifestyles back in and take control of their lives. They take a look at the world around them, compare it to their check register, and realize that it’s just not sustainable. You can’t survive on credit forever. Eventually, you will realize that there isn’t enough money to continue to buy things today on tomorrow’s paycheck.

What’s the first thing you should do when you decide that a “normal” life—a life in debt—isn’t the way you are going to live your life?

Well, when you find yourself standing in a grave, stop digging. You can’t dig yourself out of a hole and you can’t borrow your way out of debt. If you want to get out of debt, you need to stop using more debt. Period.

It may seem impossible, and the people around you may try to convince you that you are crazy. It is not impossible, just time-consuming. Short of finding an insane amount of money hiding under your front step or a winning lottery ticket blowing across the sidewalk, there are no shortcuts to getting out of debt. It’s just a matter of making the payments and not using more credit.

As far as the haters, screw ‘em. They are brainwashed into thinking their unsustainable and insane lifestyle is not only normal, but necessary. You don’t get life advice in a padded room, and you don’t plan your finances with a debt-addict.

Getting out of debt is a simple process, but that doesn’t make it easy. It only has two real steps: stop using debt, and keep making the payments.