- Screw April Fool's Day. I'm about ready to clear my entire feed queue. #

- I definitely need a reason to get up at 5 or I go back to sleep. #

- Bank tried to upsell me on my accounts today…through the drivethru. #

- Motorcycle battery died this morning. Surprise 4 mile hike. #

- RT @ramseyshow 'The rich get richer &the poor get poorer' is true! Rich keep doing what rich people do & poor keep doing what poor people do #

- RT @ramit: "How do you know if someone is a programmer?" I cannot stop laughing imagining half my programmer friends – http://bit.ly/9MOipi #

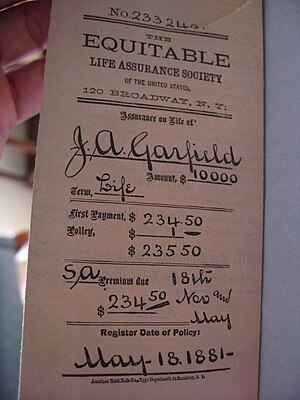

A Problem With Life Insurance

It’s pretty common for someone to buy a life insurance policy and make a minor child or grandchild the beneficiary.

Bad idea.

The reasoning is usually something along the lines of making sure the money goes with the kid, no matter where he ends up, but that money is mostly worthless until the kids grows up. With the UGMA/UTMA (Universal Gift/Transfer to Minors Act) laws, depending on your state, it can be nearly impossible to access that money or use it for the support of the child.

- For example, in Minnesota, I would have to go through the following steps:

- Complete a Petition for Appointment of Guardian and Conservator with a $322 filing fee and request it be reviewed without a hearing.

- Notify any interested parties.

- Consent to and pay for a background study.

- Establish a custodial account at the bank and maintain separate accounting for the money.

That’s just to access the money. As a conservator, I’d be able to use the money for “support, maintenance, and education”, but that does not include investing in a 529 college fund. I could theoretically invest in ultra-conservative growth funds, but if the investments shrink, I could be on the hook for the difference. I’d be a “conservator”, charged with conserving the asset.

After all of that, when the kid turns 18 (or 21 depending on the setup), the money is his to do with as he pleases.

Have you ever met an 18 year old who made really good decisions about money? I had a friend who had a settlement trust pay her a lump sum at 18, 21, and 25. Each time, she bought a new car and partied with her friends for a month before the money was gone. That was nearly $100,000 down the drain.

It’s a much better idea to visit an attorney and set up a trust. Make the trust the beneficiary of your life insurance policies. Then, define who will be the trustee under what circumstances. That way, you can make sure your kids and grandkids can actually be supported by your money.

Credit Peril

When my mother-in-law died, we went through all of her accounts and paid off anything she owed.

The Discover card she’d carried since the 80s–a card that had my wife listed as an authorized user–had a balance of about $700. We paid that off with the money in her savings account. They cashed out the accumulated points as gift cards and closed the account.

A few months ago, we decided it was time to buy an SUV, to fit our family’s needs. We financed it, to give us a chance to take advantage of a killer deal while waiting for the state to process the title transfer on an inherited car we have since sold.

Getting good terms was never a worry. Both of us had scores bordering on 800. Since our plan was to pay off the entire loan within a few months, we asked for whatever term came with the lowest interest rate.

Then the credit department came back and said that my wife’s credit was poor. I chalked it up to a temporary blip caused by closing the oldest account on her credit report and financed without her. No big deal.

Since we decided to rent our my mother-in-law’s house, we’ve discussed picking up more rental properties. That’s a post for another time, but last week, we went to get pre-approved for a mortgage. During the process, the mortgage officer asked me if my wife had any outstanding debt that could be ignored if we financed without her.

Weird.

A few days ago, we got the credit check letter from the bank. Her credit score? 668.

What the heck?

I immediately pulled her free annual credit report from annualcreditreport.com, which is something I usually do 2-3 times per year, but had neglected for 2012.

There are currently two negatives on her report.

One is a 30 day late payment on a store card in 2007. That’s not a 120 point hit.

The other is an $8 charge-off to Discover. As an authorized user. On an account that was paid.

Crap.

We called Discover to get them to correct the reporting and got told they don’t have it listed as a charge-off. They did agree to send a letter to us saying that, but said they couldn’t fix anything with the credit bureaus.

Once we get that letter, it’s dispute time.

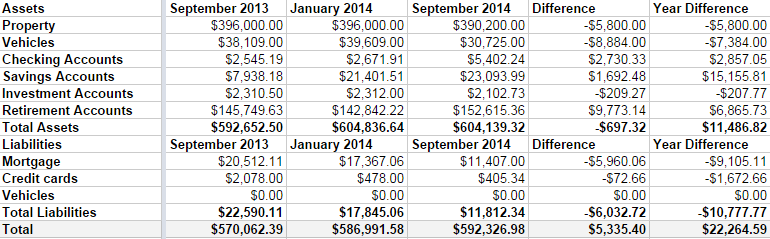

Net Worth Update – September 2014

It’s time for my irregular-but-usually-quarterly net worth update. It’s boring, but I like to keep track of how we’re doing. Frankly, I was a bit worried when I started this because we’ve been overspending this summer and Linda was off work for the season.

But, all in all, we didn’t do too bad.

Some highlights:

- Both of our properties lost around $3000 in value. I’m not worried, because we are keeping them both for the long haul. The rental is basically on auto-pilot, so that’s free money every month.

- We sold a boat that appraised for much less I had estimated in the last few updates. I had it listed for $5000, but it was worth $2000.

- I do have a credit card balance at the moment, but that goes away as soon as my expense check clears the bank, which will be in a day or two.

- We’re in the home stretch with the mortgage. There is $11,407 left to go, and we’ve paid down $9105 in the last year. By this time next year, I want that gone, gone, gone.

I can’t say I’m upset with our progress. We’ve paid down $6000 in debt in 2014, including 3 months with 1 income. We aren’t maxing our retirement accounts, yet, but I’d like to be completely debt free before I do that. It’s bad math, but having all of my debt gone will give me such a warm fuzzy feeling, I can’t not do it.

My immediate goal is to hit a $600,000 net worth by my next update in January. I’m only about $7000 off.

Time to hit the casino. Err, I mean, time to up my 401k contribution from 5% to 7%.

Why Jodie Sweetin’s Latest Divorce Should Make You Start an Emergency Fund

There’s lots of people talking about former Full House star Jodie Sweetin these days. Recent news reports are telling us that this 31-year-old mother of two is now on her way to filing for her third divorce. Yep, that’s right. Divorce #3. Sweetin got married in 2012 to Morty Coyle, and reports say that she is already on her way to filing the legal documents necessary to ask for a separation, which she claims is due to irreconcilable differences.

It was in 2008 when Sweetin filed for divorce from husband number two, Cody Herpin. She blamed the breakup on an already rocky marriage, as well as extreme financial hardships. Sweetin’s first marriage to Shaun Holguin, who she married in 2002, ended when she entered a treatment center for her longtime drug abuse.

Divorce

Because the life of a celebrity is more often than not on display for the whole world to see, there tends to be a belief that famous people get divorced more often than us other ordinary everyday folks. Although this isn’t true, when the news is telling us about a celebrity who’s getting ready to file for their third divorce and they’re only in their early thirties, it tends to make people start thinking! Thinking about what they would do if they ended up being in a similar situation.

Emergency Fund

Although everyone of course intends to stay married forever once they exchange those sacred vows, reality tells as that of least half of all marriages are going to end in some type of separation or divorce. This is the reason why the vast majority of people who plan on getting married one day don’t even bother to plan for what they would do in case of a divorce. They simply don’t think that divorce is something that will happen to them, just everyone else.

Although Sweetin surely didn’t believe that she would have three failed marriages by the time she was 31, her failed marriage situation is helping other people by letting them understand how important it is to have in emergency fund in case such a situation comes up. An emergency fund is going to allow for a lot more freedom of choices if the instance of divorce does happen to come up.

Good to Know

Money struggles have been an issue in all three of Sweetin’s marriages, which is still the number one reason for divorce in America. It’s not hard to start an emergency fund and is something every newly married person should do asap. Well, waiting until they first return from their honeymoon might be a good idea.

Related articles

Side Hustle: Garage Sale Wrap-Up

We are now to the end of Garage Sale Week here at Live Real, Now. I hope you’ve enjoyed it.

After you shut down on the last day, take the evening off. You’ve just been hard at work for 2-3 days and need a break. Deal with the stuff tomorrow. Tomorrow–and probably the next few days–you’ve got work to do. What do you do with everything that didn’t sell? If you’re planning on making garage sales a regular side-hustle, just box it all up and put it to the side until next time. After all, it’s all priced, sorted, and ready-to-go, right? If, like me, your goal was to declutter, then it’s time for some serious downsizing. Let’s dump the crap.

The first thing we did was box up all of the books and movies to bring to the used book store. We dropped the items at the sell table and spent half an hour browsing a bookstore. That’s never a good way for me to save money. The store we went to checks the demand for everything you bring in. If there’s no demand, they donate or recycle the items and you don’t get paid. DVDs bring about $1 each. VHS is demand-based. Paperbacks are something less than half of the retail price. Hardcovers are demand-based. We were offered $28 and pointed to the huge pile of discard/recycle items that we were free to reclaim. I picked out 4-5 books and movies that I thought had value and left the rest. Bringing the clutter back home would defeat the purpose of going there.

The clothes were handled two ways. First, all of the little girl clothes were bagged and set aside for some friends with a little girl. The rest were bagged and loaded in the truck for a run to Goodwill. The clothes filled the box of our pickup.

The random knick-knacks were also boxed up and delivered to Goodwill, along with most of the leftover toys. This was another completely full truck box. We had a lot of stuff in our sale.

The beat-up or low-value furniture that didn’t sell was put on the curb with “FREE” signs. I posted the free items on Craigslist and they were gone in just a few hours. The Craigslist ad said “Please do not contact, I will remove the listing when the items are gone.” Otherwise, there are usually 10-15 emails per hour asking if the items are still available. The ad didn’t even have pictures and it worked quickly.

Some of the furniture–the toddler bed, changing table, china cabinet, and the good computer desk–were hauled back to our garage to post on Craigslist with a price-tag. They are too good to give away. If the camera wouldn’t have died two nights ago, the pictures would already be up. Some of the other items were also reserved for individual sale. The extra router, the 6 inch LCD screen, and a few other toys will go on Ebay.

Finally there was some stuff that we decided we weren’t going to get rid of. We kept a few movies, but only because I didn’t notice them until I got back from the bookstore. My wife kept a box of Partylite stuff–though most of the leftovers were donated. Very little of the things we had ready for sale are being kept in our lives. Almost all of it is gone, or will be soon.

All in all, this was a cathartic end to last month’s 30 Day Project. There was some surprising emotional attachment to some things I didn’t think I cared about. It’s good to see it gone.

Note: The entire series is contained in the Garage Sale Manual on the sidebar.