What would your future-you have to say to you?

The no-pants guide to spending, saving, and thriving in the real world.

What would your future-you have to say to you?

Life is all about trade-offs. You trade your time for a paycheck. Your trade your paycheck for food, rent, and security. Don’t get so obsessed with saving and security that you forget to live your life. There are many good reasons to put your savings on hold in order to really live. Here are five of them:

1. You have an adequate emergency fund. You will never hear me advise against an emergency fund. If you don’t have one, stop reading this and get one. Go. Without an emergency fund, your budget is a financial crisis waiting to happen. With an emergency fund, you can weather life’s speed-bumps without watching them become total train-wrecks.

2. Your retirement is on autopilot. You are not allowed to stop saving and investing for retirement. Ever. Assuming you have a traditionally scheduled career that involves you working until you hit 65 and deferring a huge chunk of living until then, your income will cease when you retire. Do you know how long you will live? Do you want to spend your retirement broke and bored? Are you relying on the responsible financial management of the federal government to make sure you will still get your Social Security? Invest in your retirement and get this investment on autopilot so you can stop worrying about it.

3. Your income is set. I don’t believe in the fairy tale of a company being loyal to its employees. The aren’t. However, if you have a stable-ish job, an in-demand career, and some side-income coming from alternate sources, your emergency fund can be enough to carry you through the low times. That’s what it’s there for.

4. You have dreams. If you’ve always wanted to travel the world, follow a band on your, volunteer extensively, or anything else, it’s time to do it. Don’t postpone your passion.

5. Deathbed regrets suck. Very few people lie on their deathbed lamenting the things they did. Regrets tend to be focused on opportunities missed, skipped, or indefinitely postponed. Do the things that are important to you before it’s too late to do them. Don’t abandon your future in favor of current pleasures, but don’t forget to live, now.

Do you have any other reasons to stop saving?

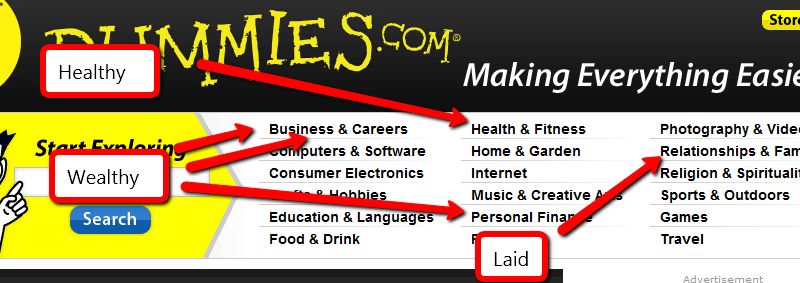

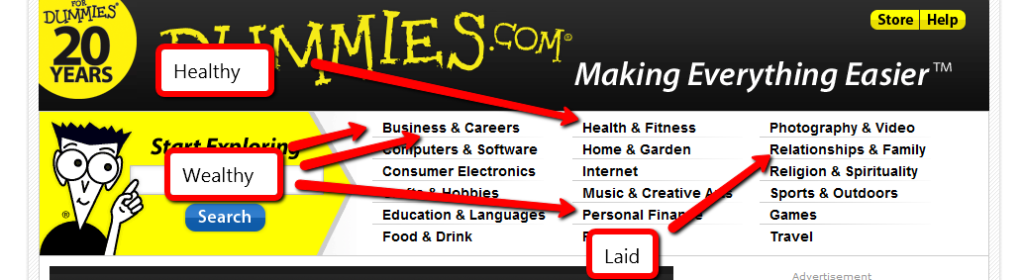

If you want to make money, help someone get healthy, wealthy or laid.

This section was quick.

Seriously, those three topics have been making people rich since the invention of rich. Knowing that isn’t enough. If you want to make some money in the health niche, are you going to help people lose weight, add muscle, relieve stress, or reduce the symptoms of some unpleasant medical condition? Those are called “sub-niches”. (Side question: Viagra is a sub-niche of which topic?)

Still not enough.

If you’re going to offer a product to help lose weight, does it revolve around diet, exercise, or both? For medical conditions, is it a way to soothe eczema, instructions for a diabetic diet, a cure for boils, or help with acne? Those are micro-niches.

That’s where you want to be. The “make money” niche is far too broad for anyone to effectively compete. The “make money online” sub-niche is still crazy. When you get to the “make money buying and selling websites” micro-niche, you’re in a territory that leaves room for competition, without costing thousands of dollars to get involved.

Remember that: The more narrowly you define your niche market, the easier it is to compete. You can take that too far. The “lose weight by eating nothing but onions, alfalfa, and imitation caramel sauce” micro-niche is probably too narrowly defined to have a market worth pursuing. You need a micro-niche with buyers, preferably a lot of them.

Now the hard part.

How do you find a niche with a lot of potential customers? Big companies pay millions of dollars every year to do that kind of market research.

Naturally, I recommend you spend millions of dollars on market research.

No?

Here’s the part where I make this entire series worth every penny you’ve paid. Times 10.

Steal the research.

My favorite source of niche market research to steal is http://www.dummies.com/. Click the link and notice all of the wonderful niches at the top of the page. Jon Wiley & Sons, Inc. spends millions of dollars to know what topics will be good sellers. They’ve been doing this a long time. Trust their work.

You don’t have to concentrate on the topics I’ve helpfully highlighted, but they will make it easier for you. Other niches can be profitable, too.

Golf is a great example. Golfers spend money to play the game. You don’t become a golfer without having some discretionary money to spend on it. I’d recommend against consumer electronics. There is a lot of competition for anything popular, and most of that is available for free. If you choose to promote some high-end gear using your Amazon affiliate link, you’re still only looking at a 3% commission.

I like to stick to topics that people “need” an answer for, and can find that answer in ebook form, since I will be promoting a specific product.

With that in mind, pick a topic, then click one of the links to the actual titles for sale. The “best selling titles” links are a gold mine. You can jump straight to the dummies store, if you’d like.

Of the topics above, here’s how I would narrow it down:

1. Business and Careers. The bestsellers here are Quickbooks and home buying. I’m not interested in either topic, so I’ll go into “More titles”. Here, the “urgent” niches look like job hunting and dealing with horrible coworkers. I’m also going to throw “writing copy” into the list because it’s something I have a hard time with.

2. Health and Fitness. My first thought was to do a site on diabetic cooking, but the cooking niche is too competitive. Childhood obesity, detox diets and back pain remedies strike me as worth pursuing. I’m leaning towards back pain, because I have a bad back. When you’ve thrown your back out, you’ve got nothing to do but lie on the couch and look for ways to make the pain stop. That’s urgency.

3. Personal Finance. The topics that look like good bets are foreclosures and bankruptcies. These are topics that can cost thousands of dollars if you get them wrong. I hate to promote a bankruptcy, but some people are out of choices. Foreclosure defense seems like a good choice. Losing your home comes with a sense of urgency, and helping people stay in their home makes me feel good.

4. Relationships and Family. Of these topics, divorce is probably a good seller. Dating advice definitely is. I’m not going to detail either one of those niches here. Divorce is depressing and sex, while fun, isn’t a topic I’m going to get into here. I try to be family friendly, most of the time. Weddings are great topic. Brides are planning to spend money and there’s no shortage of resources to promote.

So, the niches I’ve chosen are:

I won’t be building 9 niche sites in this series. From here, I’m going to explore effective keywords/search terms and good products to support. There’s no guarantee I’ll find a good product with an affiliate program for a niche I’ve chosen that has keywords that are both highly searched and low competition, so I’m giving myself alternatives.

For those of you following along at home, take some time to find 5-10 niches you’d be willing to promote.

The important things to consider are:

1. Does it make me feel dirty to promote it?

2. Will there be customers willing to spend money on it?

3. Will those customers have an urgent need to solve a problem?

I’ve built sites that ignore #3, and they don’t perform nearly as well as those that consider it. When I do niche sites, I promote a specific product. It’s pure affiliate marketing, so customers willing to spend money are necessarily my target audience.

If you keep doing what you’ve always done, you’re going to keep getting what you you’ve always gotten. One of the hardest things about getting out of debt is changing your habits. You need to break your habits if you’re going to get yourself to a new place, financially.

How can you do that? Habits aren’t easy to break. Ask any smoker, junkie, or overeater what it takes. There are a lot of systems to break or establish habits, but they don’t all work for everyone.

Here are my suggestions:

Habits—especially bad habits—are hard to break. There is an entire self-help niche dedicated to breaking habits. Hypnotists, shrinks, and others base their careers on helping others get out of the grip of their bad habits, or conning them into thinking it is easy to do with some magic system. How do you avoid or break bad habits?

There are two options to choose from.

When I was in high school and working 15 to 20 hours a week, my mom gave me free rein to use the money I earned as I would like. Actually, she said nothing to me about saving for college or putting some money into savings.

When I had friends who complained that they had to put away some of their earnings, I commiserated with them. How unfair of their parents to make them save some of their money! They worked hard for their money, often at crappy part-time jobs. They deserved to spend the money any way they saw fit.

The way I saw it, why save for college? According to financial aid rules, if the student has any savings, she would have to use the majority of it to pay for college. How unfair. To add insult to injury, if prospective college students have some savings, they would qualify for less financial aid, which often meant fewer student loans.

The injustice.

Yes, it was better to spend my hard earned money than save it and be penalized.

No one told me differently. In fact, many people in my family agreed with me and encouraged me to buy a used car to get to and from my job. Of course, I paid the loan payments for the car, the gas I used and my insurance out of money from my job. That was a responsible use of money, but I also went out to eat with friends, a lot. At 16, I was going out to eat with my friends twice a week at least.

However, my plan worked perfectly. When I went to college, I didn’t have to use any of my hard earned cash. No, not me, because I hadn’t saved anything. Instead, I left college with nearly $20,000 in student loan debt. I took two years off and paid down as much student loan debt as I could, getting it down to about $8,000, but then I went to graduate school and took on more student loan debt. I graduated with nearly $25,000 in debt total. I am still paying on it today, 13 years later.

Now that I am the parent, I am one of those “awful” parents who makes her kids save. My son knows when he gets his allowance, some goes to save, some goes to donate, and some goes to spend. True, it makes me cringe when he uses his spend money on little trinkets like temporary tattoos, stickers, and gum, but I keep silent. He did the work to earn the money, and he can spend it as he likes. However, I am inflexible with saving; that money must be set aside. When he goes to college, I expect that he will have to use the majority of that money. Rather than seeing it as a waste, I see it as an important component of his financial education. Spending his money to pay a portion of his college education will hopefully make him take college more seriously.

Meanwhile, I have already begun having chats with him about money, spending, and budgeting. He watches his dad and I work hard to pay down our debt with gazelle intensity. He sees me use a calculator at the grocery store to see how much our groceries will be.

Ultimately, he will make his own financial decisions as he grows up, but I plan to teach him throughout these important years so that even if he turns into a spendthrift, he will have a firm financial understanding to revert to as he ages. While my mom taught me how to stretch money further, she never taught me how to save; I hope saving is a lesson my son takes with him throughout his adulthood.

How do you teach your kids about money management?

Melissa writes at Fiscal Phoenix where she encourages people to rise from the ashes of their financial mistakes as she and her husband are doing.