- "The best way to spend your money is to spend it on time, not on stuff." http://su.pr/2tr5iP #

- First bonus by stock options today. Not sure I'm impressed. #

- RT @chrisguillebeau: US border control just walked the train asking "Are you a US citizen?" Native American guy says: "One of the originals" #

- @FARNOOSH My credit score is A measure of my integrity not THE measure. in reply to FARNOOSH #

- I'm listening to a grunge/metal cover of "You are my sunshine" #

- There's something funny about a guy on reality TV whining about how private he is. #LAInk #

Twitter Weekly Updates for 2010-04-24

- Watching Gamers:Dorkness Rising #

- Charisma? Weee! #

- Tweeting a dork movie? I'm a bit of a geek. #

- We just met and the first thing you do, after boinking a stranger in the presence of the king, is to murder a peasant? #

- Every movie needs a PvN interlude. #

- Everything's better with pirates. #

- Waffles? Recognize. #

- The Spatula of Purity shall scramble the eggs of your malfeasance. #

- Checkout clerks licking their fingers to separate bags or count change is gross. #

- Watching Sparkles the Vampire, Part 2: Bella's Moodswing. #twilight #

- @penfed was a waste of money. $20 down the drain to join, wouldn't give a worthwhile limit, so I can't transfer a balance. #

- @JAlanGrey It's pretty lame. The first one was ok. This one didn't improve on the original. in reply to JAlanGrey #

- RT @tferriss: Are you taking snake oil? Beautiful data visualization of scientific evidence for popular supplements: http://ping.fm/pqaDi #

- Don't need more shelves, more storage, more organization. Just need less stuff. #

- @BeatingBroke is hosting the Festival of Frugality #226 http://su.pr/80Osvn #

- RT @tferriss: Cool. RT @cjbruce link directly to a time in a YouTube video by adding #t 2m50s to end of the URL (change the time). #

- RT @tferriss: From learning shorthand to fast mental math – The Mentat Wiki: http://ping.fm/fFbhJ #

- RT @wisebread: How rich are you? Check out this list (It may shock you!!!) http://www.globalrichlist.com/ #

- RT @tferriss: RT @aysegul_c free alternative to RosettS: livemocha.com for classes, forvo.com for pronunc., lang8.com for writing correction #

- Childish isn't an insult. http://su.pr/ABUziY #

- Canceled the Dish tonight. #

Why I Hate Payday Loans

I hate payday loans and payday lenders.

The way a way a payday loan works is that you go into a payday lender and you sign a check for the amount you want to borrow, plus their fee. They give you money that you don’t have to pay back until payday. It’s generally a two-week loan.

Now, this two week loan comes with a fee, so if you want to borrow $100, they’ll charge you a $25 fee, plus a percent of the total loan, so for that $100 loan, you’ll have to pay back $128.28.

That’s only 28% of actual interest; that’s not terrible. However, if you prorate that to figure the APR, which is what everyone means when they say “I’ve got a 7% interest rate”, it comes out to 737%. That’s nuts.

They are a very bad financial plan.

Those loans may save you from an overdraft fee, but they’ll cost almost as much as an overdraft fee, and the way they are rigged–with high fees, due on payday–you’re more likely to need another one soon. They are structured to keep you from ever getting out from under the payday loan cycle.

For those reasons, I consider payday loan companies to be slimy. Look at any of their sites. Almost none are upfront about the total cost of the loan.

So I don’t take their ads. When an advertiser contacts me, my rate sheet says very clealy that I will not take payday loan ads. The reason for that is–in my mind–when I accept an advertiser, I am–in some form–endorsing that company, or at least, I am agreeing that they are a legitimate business and I am helping them conduct that business.

In all of the time I’ve been taking ads, I’ve made exactly one exception to that rule. On the front page of that advertiser’s website, they had the prorated APR in bright, bold red letters. It was still a really bad deal, but with that level of disclosure, I felt comfortable that nobody would click through and sign up without knowing what they were getting into. That was a payday lender with integrity, as oxymoronic as that sounds.

7 Benefits of Investing Internationally

When it comes to financial investments, it’s always better to go with an informed decision than one that relies merely on chance – besides, gambling only works when luck’s on your side. Fortunately, international investments are a financially secure and reliable form of investing as long as you know your limitations. So, in keeping with the idea of sound financial decisions, here are seven benefits of investing internationally:

When it comes to financial investments, it’s always better to go with an informed decision than one that relies merely on chance – besides, gambling only works when luck’s on your side. Fortunately, international investments are a financially secure and reliable form of investing as long as you know your limitations. So, in keeping with the idea of sound financial decisions, here are seven benefits of investing internationally:

Diversification of Your Funds

A diversified financial portfolio gives investors options in terms of economic fluctuations and, by investing internationally, your finances will have alternative sources of stability. In other words, if your money is spread out among various countries, then an economic crash in one country won’t affect other investments.

It goes without saying that with diversification also comes a learned understanding of various global economies and markets, but with the help of a financial adviser or with a little research, you’ll have the ability to make informed global investments, which is always better than the “eggs in one basket” approach.

Investing Abroad Means More Options

Just like there’s diversification with investing internationally, there are also many options when it comes to the way you want to invest your finances. And, with international investing growing in popularity, the investment options available in today’s market are quickly becoming commonplace.

Three of the most popular forms of international investments are mutual funds, exchange traded funds (ETFs), and American depository receipts (ADRs). And, although mutual funds are a common form of investment, ETFs and ADRs trade much like stocks and therefore take a little more financial knowledge to navigate.

International Protection and Confidentiality

If you’re the type of investor that’s worried about financial scares associated with foreclosures and lawsuits, investing internationally has an added advantage of asset protection. With investing abroad, many foreign financial institutions are able to protect your investments from seizure and other threats.

Likewise, investing internationally also comes with confidentiality concerning your finances. International financial institutions are not legally required to divulge your monetary details to anyone. Confidentiality isn’t to say that international investments are exempt from legalities, but they’re entitled to more freedoms.

Investment Growth on an International Level

In terms of household incomes, import/export strengths, younger working populations, and the lean toward free-market economic policies, investing internationally has the potential for more growth than investing in the United States alone, which translates to an increase in return potential in overseas investments.

In fact, according to the International Monetary Fund, the United States is expected to fall below the rest of the world for the next two years when it comes to economic growth. Because of this, companies like Fisher Investments Institutional Group are strategizing toward international investments in strong economic climates across the world.

Currency Diversification Strengthens Portfolios

Much like international investing gives your portfolio safety in numbers as opposed to having all assets invested in one country’s economy, so do currency differences from country to country. In relation to the US dollar, many countries across the world have stronger currencies, which helps boost returns over time.

The flip side of this coin is the idea that fluctuations in currency strengths can just as easily work against your portfolio as they can strengthen it. It’s wise to keep an eye on international currency rates and how they compare to the US dollar, but never invest solely based on rates as a country’s currency can drop in strength overnight.

A Reduction in Taxes

Otherwise known as tax havens, many countries across the world offer attractive tax incentives to foreign investors. These incentives are meant to strengthen other country’s investing environments as well as attract outside wealth.

These tax incentives are particularly attractive to US investors due to the increasingly high taxes in the country. As a result, the United States government is creating more defined restrictions and laws when it comes to international investment tax incentive regulations.

Investment Potential in the United States is Dwindling

Because the United States has both the world’s largest economy and stock market, financial opportunities are almost maxed out due to over-investing. On the other hand, emerging markets in other countries are growing in size and strength, which is quickly resulting in stronger economies and more investment opportunities.

By ignoring the potential of other world markets, you’re also ignoring global economies and stock markets that offer unforeseen investment potential when compared to the United States, which is something every investor should keep in mind.

So, from portfolio diversification to investment growth, investing internationally is a great way to expand your financial horizons.

This is a guest post.

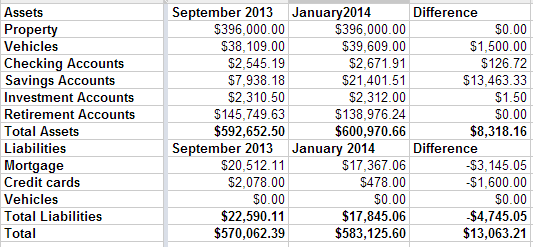

Net Worth Update – January 2014

This may be the most boring type of post I write, but it’s important to me to track my net worth so I can see my progress. We are sliding smoothly from debt payoff mode to wealth building mode.

Our highlights right now are nothing to speak of. We did let our credit card grow a little bit over the last couple of months, but paid it off completely at the end of December. It grew mostly as a matter of not paying attention while we were doing our holiday shopping and dealing with some car repairs.

That’s it. We haven’t remodeled our bathrooms yet, but we have the money sitting in a savings account, waiting for the contractor. We haven’t bought a pony yet, but we did decide that a hobby farm wouldn’t be the right move for us. We’ll be boarding the pony instead of moving, at least for the foreseeable future.

Our net worth is up $13,000 since September. Our savings are up and our retirement accounts are down because there are two inherited IRAs that we need to slowly cash out and convert to regular IRAs.

Paying For Heart Surgery When You’re Not as Rich as Randy Travis

Very sad news broke this week about Randy Travis. The country crooner, whose hits ironically include a song titled “From the Hard Rock Bottom of my Heart,” was hospitalized with a life-threatening heart problem that arose from viral cardiomyopathy, a condition that is characterized by a weakening of the heart muscle due to a virus. The virus that caused this disease is usually pretty harmless, but in some patients, extremely dangerous complications can arise. For Travis, the complications weakened his heart, and he required hospitalization and emergency heart surgery.

The easiest way to pay for a heart surgery is to let someone else pay for it. This tip may sound like a joke, but it is the way most people pay for heart surgery. Insurance is a risk management system in which many people pay premiums so that they do not have to bear the entire brunt of a financial loss. Some will come out ahead by paying less in premiums than the amount of the health benefits they will receive. Others will be on the opposite end of the stick. Health insurance can come from the private market or the public coffers through programs like Medicare and Medicaid. While there might be a copay for these procedures with insurance, the insured will not have to pay the whole tab.

Another way to pay for heart surgery is by raiding a retirement account. This is not really advisable in most instances, but desperate times can call for desperate measures. The money can then be paid back over time in the best-case scenario, and getting the doctors paid off will take a major burden off of the back of any heart patient.

Taking out a home equity loan can also be a way to pay for a heart surgery. Those who have some equity built up in their home can sometimes find enough to pay off some emergency bills. Of course, it usually takes years to build up this equity, so many will not have this option available to them.

One final way to pay off a heart surgery without being rich like Randy Travis would involve getting a second job. This might cut down on the amount of time available for cardiac rehab, but the doctor will want his or her cut. It is likely that the hospital will be even more serious about getting paid. This will especially be the case if the hospital is for-profit. It might take some time, but those who are able to survive the extra work should be able to eventually pay off their bills.