- Getting ready to go build a rain gauge at home depot with the kids. #

- RT @hughdeburgh: "Having children makes you no more a parent than having a piano makes you a pianist." ~ Michael Levine #

- RT @wisebread: Wow! Major food recall that touches so many pantry items. Check your cupboards NOW! http://bit.ly/c5wJh6 #

- Baby just said "coffin" for the first time. #feelingaddams #

- @TheLeanTimes I have an awesome recipe for pizza dough…at home. We make it once per week. I'll share later. in reply to TheLeanTimes #

- RT @bargainr: 9 minute, well-reasoned video on why we should repeal marijuana prohibition by Judge Jim Gray http://bit.ly/cKNYkQ plz watch #

- RT @jdroth: Brilliant post from Trent at The Simple Dollar: http://bit.ly/c6BWMs — All about dreams and why we don't pursue them. #

- Pizza dough: add garlic powder and Ital. Seasoning http://tweetphoto.com/13861829 #

- @TheLeanTimes: Pizza dough: add lots of garlic powder and Ital. Seasoning to this: http://tweetphoto.com/13861829 #

- RT @flexo: "Genesis. Exorcist. Leviathan. Deu… The Right Thing…" #

- @TheLeanTimes Once, for at least 3 hours. Knead it hard and use more garlic powder tha you think you need. 🙂 in reply to TheLeanTimes #

- Google is now hosting Popular Science archives. http://su.pr/1bMs77 #

- RT @wisebread 6 Slick Tools to Save Money on Car Repairs http://bit.ly/cUbjZG #

- @BudgetsAreSexy I filed federal last week, haven't bothered filing state, yet. Guess which one is paying me and which one wants more money. in reply to BudgetsAreSexy #

- RT @ChristianPF is giving away a Lifetime Membership to Dave Ramsey’s Financial Peace University! RT to enter to win… http://su.pr/2lEXIT #

- RT @MoneyCrashers: 4 Reasons To Choose Community College Out Of High School. http://ow.ly/16MoNX #

- RT @hughdeburgh:"When it comes to a happy marriage,sex is cornerstone content.Its what separates spouses from friends." SimpleMarriage.net #

- RT @tferriss: So true. "Nearly all men can stand adversity, but if you want to test a man's character, give him power." – Abraham Lincoln #

- RT @hughdeburgh: "The most important thing that parents can teach their children is how to get along without them." ~ Frank A. Clark #

Twitter Weekly Updates for 2010-07-17

- RT @mymoneyshrugged: The government breaks your leg, and hands you a crutch saying "see without me, you couldn't walk." #

- @bargainr What weeks do you need a FoF host for? in reply to bargainr #

- Awesome tagline: The coolest you'll look pooping your pants. Yay, @Huggies! #

- A textbook is not the real world. Not all business management professors understand marketing. #

- RT @thegoodhuman: Walden on work "spending best part of one's life earning money in order to enjoy (cont) http://tl.gd/2gugo6 #

The Evils of a Reverse Mortgage

Picture it: Sicily, 1922.

Sorry, wrong channel. Let’s try again.

Picture it: 20, 30, 50 years from now. You’re old. The money you’ve been failing to save so you could stock up on Fritos and obsolete video game consoles(to survive the zombie apocalypse in style) would come in handy about now, since the end of the world never happened. Note to self: Never trust an ancient Mayan.

You’re 70, with no savings and no income aside from the Social Security check that hasn’t been adjusted for inflation since the Palin(Bristol) administration.

But you own your house and that nice young man down at Yersk Rude Bank recommended a reverse mortgage. That could give you all of the money you need to live a comfortable retirement and pay for a bit of a funeral.

Right?

Nazzofast.

Of all of the possible social security strategies, this is one of the worst.

What is a reverse mortgage?

In a traditional mortgage, you’re given a chunk of money guaranteed by your home. You have to pay that money back over time, or you’ll lose your house. In a reverse mortgage, you’re still converting your home’s equity into cash, but you don’t have to pay it back until you die or move, including moving into a nursing home. You are effectively abandoning future-house in exchange for now-money.

Who qualifies for a reverse mortgage?

If you are 62 or older, and live in a home you own, you qualify. Credit and income are not considered.

Why would you want a reverse mortgage?

If money is tight and you have no prospects, a reverse mortgage may be a valid consideration. A better consideration would be to take out a traditional loan and make monthly payments out of that lump sum, or sell your house outright and move someplace more affordable.

What are the downsides of a reverse mortgage?

You lose your house. Technically, your heirs lose your house. A reverse mortgage becomes due when you die. If your heirs can’t cover the loan, the house will be foreclosed. Also, this is a loan. It accumulates interest, even if you aren’t paying it back. If you borrow $200,000 and die in 10 years, your estate may owe $400,000 on the reverse mortgage. If this is a treasured family home, losing it could come as a shocking blow at a time when your family would already be reeling from the loss of, well, you.

What if you really don’t like your heirs?

I’d still recommend getting a traditional mortgage. You can throw a killer party and then, you’ll rebuild equity over time. That way, if you live longer than you expect, you can refinance and throw another killer party. If you go this route, don’t invite the kids, but be sure to hire a videographer so they can see how you’re spending their inheritance.

I’m not a banker or a financial advisor, but I’d recommend against a reverse mortgage in almost all circumstances.

How about you? Would you get one, or recommend one? What’s your preferred method to hurt your ungrateful heirs?

Why I Hate Payday Loans

I hate payday loans and payday lenders.

The way a way a payday loan works is that you go into a payday lender and you sign a check for the amount you want to borrow, plus their fee. They give you money that you don’t have to pay back until payday. It’s generally a two-week loan.

Now, this two week loan comes with a fee, so if you want to borrow $100, they’ll charge you a $25 fee, plus a percent of the total loan, so for that $100 loan, you’ll have to pay back $128.28.

That’s only 28% of actual interest; that’s not terrible. However, if you prorate that to figure the APR, which is what everyone means when they say “I’ve got a 7% interest rate”, it comes out to 737%. That’s nuts.

They are a very bad financial plan.

Those loans may save you from an overdraft fee, but they’ll cost almost as much as an overdraft fee, and the way they are rigged–with high fees, due on payday–you’re more likely to need another one soon. They are structured to keep you from ever getting out from under the payday loan cycle.

For those reasons, I consider payday loan companies to be slimy. Look at any of their sites. Almost none are upfront about the total cost of the loan.

So I don’t take their ads. When an advertiser contacts me, my rate sheet says very clealy that I will not take payday loan ads. The reason for that is–in my mind–when I accept an advertiser, I am–in some form–endorsing that company, or at least, I am agreeing that they are a legitimate business and I am helping them conduct that business.

In all of the time I’ve been taking ads, I’ve made exactly one exception to that rule. On the front page of that advertiser’s website, they had the prorated APR in bright, bold red letters. It was still a really bad deal, but with that level of disclosure, I felt comfortable that nobody would click through and sign up without knowing what they were getting into. That was a payday lender with integrity, as oxymoronic as that sounds.

Net Worth Update – January 2014

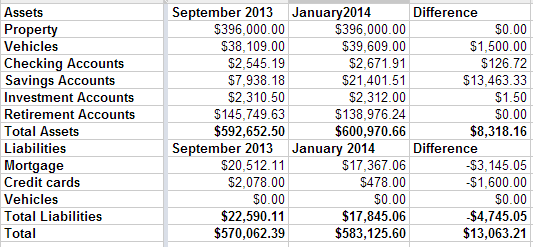

This may be the most boring type of post I write, but it’s important to me to track my net worth so I can see my progress. We are sliding smoothly from debt payoff mode to wealth building mode.

Our highlights right now are nothing to speak of. We did let our credit card grow a little bit over the last couple of months, but paid it off completely at the end of December. It grew mostly as a matter of not paying attention while we were doing our holiday shopping and dealing with some car repairs.

That’s it. We haven’t remodeled our bathrooms yet, but we have the money sitting in a savings account, waiting for the contractor. We haven’t bought a pony yet, but we did decide that a hobby farm wouldn’t be the right move for us. We’ll be boarding the pony instead of moving, at least for the foreseeable future.

Our net worth is up $13,000 since September. Our savings are up and our retirement accounts are down because there are two inherited IRAs that we need to slowly cash out and convert to regular IRAs.