- @ScottATaylor Thanks for following me. in reply to ScottATaylor #

- RT @ChristianPF: 5 Tips For Dealing With Your Medical Debt http://su.pr/2cxS1e #

- Dining Out vs Cooking In: http://su.pr/3JsGoG #

- RT: @BudgetsAreSexy: Be Proud of Your Emergency Fund! http://tinyurl.com/yhjo88l ($1,000 is better than $0.00) #

- [Read more…] about Twitter Weekly Updates for 2009-12-12

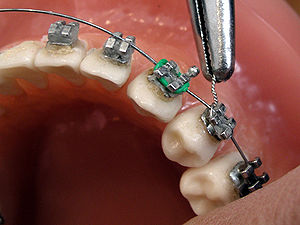

Braces

Grr!

Monday, I brought Punk #1 to the orthodontist. He’s got an underbite and some crooked teeth, but I didn’t realize how off it was until I saw the pictures they took. Some of the closeups could be inspiration for a Halloween mask.

It look like he started with a small underbite that made his teeth line up wrong, which–as they grew–accentuate the wrong. Now, it’s very, very wrong.

Next week he goes in to get his top teeth done.

At a cost of $5800.

If we pay up-front, they’ll knock 5% off, bringing it down to $5500. That covers everything, all of the follow-ups, broken hardware, every stage the whole way through. If we pay monthly, it will be $1450 down and $200 per month (interest free) for almost 2 years.

Almost six grand.

Fortunately, we knew this was coming, so we’ve been saving for this for a few years.

Unfortunately, we’ve only been saving $50-100 a month. We can’t wait much longer. With an underbite, you have more options if you do the work before the kid is done growing. I’d really like to avoid jaw surgery for him, so we have to make things happen.

Our braces account has $3100 in it. My HSA account has $875. That’s from my last job, so that’s as big as it gets. That leaves us almost exactly $1500 short.

I hate the idea of touching our emergency fund, although it does have enough money in it.

We’ve also got some money tucked away in an account leftover from my mother-in-law dying last year. I think that’s where we’re going to come up with the difference.

How else could we save money?

We could shop around, but this isn’t something I want to give to the lowest bidder. I want to do it right, and I know several people who have had braces put on by this office, either by this orthodontist or her father.

I asked about a cash discount and got turned down.

That’s it. Next week, I burn $5500. Hope the kid eventually appreciates it.

Top 7 Reasons To Trade Forex Over Other Financial Instruments

This is a guest post provided by ForexTraders.com

The foreign exchange market has literally exploded over the last 10 years. Before the 1990’s, the only players allowed to speculate in the forex market were banks, large hedge funds, and very wealthy individuals. The reason was simple. The minimum contract size was usually $100,000 and it ranged up to $1,000,000; therefore, most traders simply could not afford to trade in the market. The advance of technology and internet changed that. Today, traders can open an account with as little as $100 and begin trading in the spot fx market. This change has caused traders around the world to rush into the market and the Bank of International Settlements now estimates that average daily turnover in the fx market is around $4 trillion! Let’s examine a few of the top reasons why the fx market is drawing so many traders.

Leverage

In the United States, traders that engage in fx trading can leverage 50:1. Leverage was much higher in recent years, but government regulations have now capped leverage at 50:1 effective late October. This means that a forex trader can control a position of $50,000 with only $1,000 on deposit with his broker. Leverage is definitely a two-edged sword that can help a trader garner very quick and substantial profits, but it can also lead to debilitating losses and should therefore be used with caution.

Liquidity

The huge amount of volume that is present in the forex market each day makes it basically impossible for any single financial institution or even group of market participants to manipulate price movements. It also makes it much easier for large traders to enter and exit the market without trading against themselves, which is a common problem in the stock and commodity markets.

24 Hour Market

The forex market is a loosely connected network of international banks; therefore, the market never closes from Sunday evening until Friday afternoon. Liquidity simply flows from financial center to financial center as time zones open and close business operations for the day. This is a huge advantage for small, retail traders because those who still have full-time jobs can trade at night.

Small Initial Account Size

Traders can open accounts with as little as $1 at some brokers, and then trade positions where each 1 point movement is equivalent to $0.01 (in the U.S. this would be lower since the leverages are capped at 1:50). This will obviously never get a trader rich, but it does allow traders a very low risk entrance into the market. Traders generally need $20,000 in order to day trade the stock market. This very low account size at an online forex broker is a big draw for many traders.

Long Trends

The currency market tends to develop very clear, long trends. It is not uncommon for specific currencies to head in the same direction for 5+ years. Of course, there are many dramatic price swings that make real-time trading difficult and challenging, but a quick look at longer-term currency price charts makes it clear that currencies develop strong trends.

Macro Economics

The currency market is very big picture-based. This means there are not a million and one little things that a trader has to track as is common in other financial markets. Currencies react to major macroeconomic developments around the world. Seasoned fx professionals argue that this makes the job of economic analysis much different in the currency market.

Continued Growth and Volatility

The foreign exchange market is expected to continue to grow in coming years, and volatility is expected to remain quite strong as the world continues to move toward a more globalized economy. As globalization continues to change the world economy, investor interest in currencies will most likely continue to grow steadily.

Jason’s commentary: I’ve never looked into forex trading, mostly because I’m not in the “invest & grow rich” stage of my financial life. Have you invested in the forex market?

Saturday Roundup

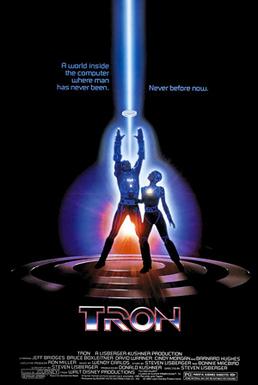

- Image via Wikipedia

I wrote this yesterday. According the forecast, when this post goes live, I’ll be moving 5-8 inches of snow off of my driveway.

That, or watching TV and thinking about moving snow.

Maybe I’ll just sleep in and wait for spring to melt the snow.

Don’t forget to enter my drawing for a $100 Amazon gift card! Go here for details. It ends on the 15th, so don’t wait too long.

Best Posts

Crazy-easy ice cream bread. How could this possibly be bad?

Tron comes out in 2 weeks. I’d love to show up on a custom street-legal Troncycle.

Arsenic-based lifeforms are shaking up the way we understand life to work. I’m of the opinion that life will probably exist almost everywhere that isn’t a completely dead dry rock. I say that as an expert in…well, nothing related to astrobiology.

Following Erica’s advice is currently making me a few hundred dollars per month, with every sign of growing as time goes on. I hate to sound like a fanboy, but if she pimps a product, I’m at least going to give it some serious consideration.

Carnivals I’ve Rocked

10 Dumb Money Moves was featured in the Carnival of Debt Reduction.

Book Review: The Art of Non-Conformity was included in the Carnival of Personal Finance.

Things You Should Buy Online to Save Money was included in the Festival of Frugality.

Thank you! If I missed anyone, please let me know.

LRN Timewarp

This is a new feature to share the gift that is me with anyone new to LRN. This week, I’m going to share some posts from my first week blogging here.

The $10 College Fund. In the last year, not only have I not changed my mind about the $10 college fund, but I haven’t raised the amount. The point is to just get started. I’ve done that. I’ll raise the amount when my debt is paid off. We are now up to $166.09. The numbers are off because I stuck a little bit extra in one month.

In the last year, our dreams haven’t changed. We haven’t made any direct progress, but indirectly we are doing well. First things first. We need to pay the debt off before we look at a hobby farm.

My second day blogging, I wrote about why we handled money so poorly.

2012: The Year the World Ended

December 21st marks the day that Mayan calendar-makers decided was far longer than they needed to waste their time carving

days into stone.

More importantly, it marks the beginning of the week before my birthday. No self-respecting civilization would end the world just a week before my birthday.

This is traditionally the time that people look back at the previous year, and make resolutions they don’t intend to keep in the following year.

Who am I to buck tradition?

In 2011, I became a bit of a workaholic.

This site has taken off a bit. I’m not about to retire off of the proceeds, but it has turned into a nice little side income. Thank you for that.

I launched a marketing company. We do web design/development, social media work, and search engine marketing. It’s strictly a part-time gig right now, but it’s growing and taking up most of my free evenings and weekends.

I’ve been working 50-60 hours a week at my day job.

The plus side? I’ve also paid off almost $20,000 of my debt in 2011, bringing my total to $47,535 left.

It’s been a lot of work, but the harder I hustle, the sooner I can stop hustling.

What’s in store for 2012?

On the work front, I plan to cut my weekly load down to 40-45 hours again. Life it to short to work all of the time.

I want to expand my new company to the point that my day job is optional. I’m projecting that by spring. Call it June 1st.

Here, I want to double the size of my audience. I don’t just want random people popping in, I want to grow an engaged audience. That means more comments and more discussion. Expect to see more along those lines.

I’ve also got a couple of products under development. By year-end, I’d like to have them both released.

On a personal level, my biggest goal is to carve out a regular chunk of time to spend with my wife. Working all of the time has cut into our quality time together. I want to find a way to schedule date nights at least twice a month. It will cost more money, but that’s part of why I’m working so much.

Financially, I want to kill the last of my credit card debt. That’s down to about $17,000. We’ll need to keep working at it, but it’s a reachable goal. That means we still don’t get cable, I still avoid buying books every week, and my kids still have to live with not getting every whim fulfilled.

To recap: I’m going to work smarter, grow my side projects, and make this site better for you. In the process, I’m going to kill the last of my unsecured debt, and drag my mortgage down to it’s last gasping breaths.

Here’s to the end of the world….

Charity Scams

- Image by Emery Co Photo via Flickr

‘Tis the season to give away your stuff.

As Christmas rolls in, it’s common to see people ringing bells for charity outside of stores, or knocking on doors asking for your help with their pet causes. Phone and mail solicitations are up. You’ve got your pockets open and everybody’s hoping for some cash.

Good for you. Charity is wonderful.

I openly treat charity as the selfish act it truly is. Donating my time and money to causes I support makes me feel good about myself. I like feeling good about myself. The other reasons people give to charity are A) to make people like them, or B) to receive tax deductions. That’s it. There are 3 possible reasons to donate: to like yourself, to make others like you, or to save some tax money. I thought about adding guilt to the list, but that is covered by some blend of the first two reasons.

How can you know that the charity you are donating to is worth it? There are a ton of evil bastards out there trying to cash in on your desire to feel good. They want your money because rolling around naked in ill-gotten gains is what makes them feel good. Naked scammers sprawled across my cash isn’t a visual that makes me feel good.

Wait, you say? People use charities for cons, you ask? In 2005, The National Arthritis Association was busted for convincing people that it was somehow related to The Arthritis Foundation, when in reality, it was using the money for hookers and blow. Or something decidedly not arthritis-cure-related. If a charity sounds like something you know, but isn’t quite there, check into it before you donate.

It’s also common for scammers to run a phone campaign, pretending to be the Red Cross, the Salvation Army, or United Way. Those are all good charities, but they don’t benefit from the good intentions of the victims. The scammers just want the credit card information. Once they have that, it’s off to Rio for a crazy week of xxxxxx on a xxxxxx with a xxxxxxx for xxxxxx. (Editor’s note: This is a family-friendly blog.) Don’t give out your credit card information to anyone over the phone. Ever. Tell the caller to send you something in the mail, or promise to visit their website. But don’t give them the keys to your cash.

How can you avoid funding a Nigerian coup that will surely end in the downfall of the righteous king, causing all of his heirs to email me(as the only trustworthy person in the world) to help move the nation’s fortune out of the country in exchange for a mere 10% of the loot? I mean, how can you be sure you are donating to a good organization?

The easiest way is to ask the IRS. You can call them at 877-829-5500 or visit their website at http://www.irs.gov/charities/article/0,,id=96136,00.html to search for charities that have actually filed with the IRS. Not all charities have filed. Some state-based nonprofits don’t bother, but you can check with your Secretary of State to verify their status.

Always pay by check or credit card. Cash is untraceable. If a charity turns out to be a scam, leaving a trail makes it easier to prosecute.

Don’t give in to the guilt-tactics. If a charity is worth giving to today, it will be worth it tomorrow, too. There’s no rush. If the solicitor is trying to rush you, it’s probably a scam.

Remember, it’s your money. Take care of it.

What are your favorite charities?