Please email me at:

Or use the form below.

[contact-form 1 “Contact form 1”]

The no-pants guide to spending, saving, and thriving in the real world.

A few weeks ago, I discovered the queue at my public library’s website. The process is simple: Select your books, wait a few days, then pick them up. They are available from any library in the county, delivered to my local library. That’s awesome. Much more convenient-and cheaper-than Amazon.

So I moved a couple of pages of my Amazon wish-list into the library’s queue.

I must not have been thinking, because two days later, I got an email telling me that 19 books were ready to be picked up and 10 more were in transit.

In this county, each checkout is good for 21 days. For items that don’t have a waiting list, you can reserve 3 times. That’s 12 weeks for 29 books. Hopefully, I’m up to the challenge. Please keep in mind, I’m a father of three, two of whom are in diapers, and I’m married, and I have a full time job.

I have frugally blown every second of spare time for months.

Update: This was another post written in advance. When all of the books came in, I suspended my request list. Little did I realize, the suspension cancels itself after 30 days. That was 30 more books. Whee!

Satirical reports regarding George Zimmerman have been misconstrued as factual by several media outlets, which have led to the belief that the man who killed Trayvon Martin is now a multimillionaire due to a lucky lottery ticket. The improbability of the story is astounding, but the more inconceivable notion is that reporters actually believed it enough to pass it on to their audience. The origin of the hoax was the same source that profligates fake news items on a regular basis: The Onion.

was obviously meant to be disseminated as sarcasm, but the writers must feel tremendous pride in their ability to dupe the mainstream media. An unintended prank has a marvelous ability to generate a lasting reputation for the satirist. Notoriety is now something the author has in common with Zimmerman.

A stark contrast exists between lotteries and trials, and they are not equivalent. The justice system strides to avoid occurrences of random chance while lotteries promote the notion that anyone can win. The legal process is supposed to rely on evidence. Regardless of the circumstances, a victory in the courtroom has to be vigorously earned. Contrarily, there is nothing anyone can do to increase their chances in a lottery short of buying massive amounts of tickets. In a trial, the concept of reasonable doubt exists to exonerate the defendant, which should eliminate any potential for a toss-up. Courtrooms operate using evidence while lotteries are strictly statistical; therefore, the comparison is non-existent.

Even when it comes to jury selection, the process is not chaotically uncontrolled. Both sides have a general composition is mind, and they meticulously scrutinize prospective jurors as they whittle the numbers down. The pool is always sifted for bias. They are analyzed with hopes of picking people that will be sympathetically swayed towards a certain point of view. At the end, one side picked a better jury. Lotto victors cannot pick the numbers that will be responsible for their fate. Winners of lotteries do not stalk unarmed teenagers with a gun and fatally shoot them, but apparently winners of trials in Florida do.

Lotteries are often labeled as a tax for dumb people; coincidentally, this demographic is the same segment of the population that was targeted by the falsified journalism. In fact, real lottery odds are mathematically insignificant. An ABC News study declares it would take 1,684,841 years for the average lottery player to win a jackpot. Not even Zimmerman is that lucky.

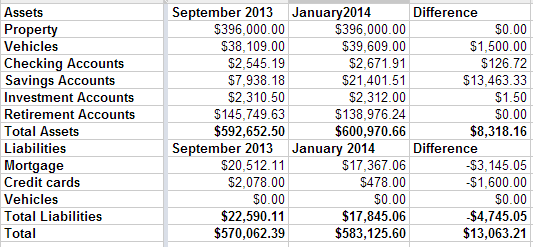

Now that my taxes are done and paid for, I thought it would be nice to update my net worth.

In January, I had:

Overall: $249,717.00

Overall: $240,805 (-8,912)

Well, I lost some net worth over the last quarter, but it’s still a good report. If I disregard the change in value of my house and cars–two thing I have no control over–my overall total would have gone up almost $9,000.

All in all, it’s been a good year for me, so far, though paying off that credit card by fall is going to be a challenge.

When my mother-in-law died, we went through all of her accounts and paid off anything she owed.

The Discover card she’d carried since the 80s–a card that had my wife listed as an authorized user–had a balance of about $700. We paid that off with the money in her savings account. They cashed out the accumulated points as gift cards and closed the account.

A few months ago, we decided it was time to buy an SUV, to fit our family’s needs. We financed it, to give us a chance to take advantage of a killer deal while waiting for the state to process the title transfer on an inherited car we have since sold.

Getting good terms was never a worry. Both of us had scores bordering on 800. Since our plan was to pay off the entire loan within a few months, we asked for whatever term came with the lowest interest rate.

Then the credit department came back and said that my wife’s credit was poor. I chalked it up to a temporary blip caused by closing the oldest account on her credit report and financed without her. No big deal.

Since we decided to rent our my mother-in-law’s house, we’ve discussed picking up more rental properties. That’s a post for another time, but last week, we went to get pre-approved for a mortgage. During the process, the mortgage officer asked me if my wife had any outstanding debt that could be ignored if we financed without her.

Weird.

A few days ago, we got the credit check letter from the bank. Her credit score? 668.

What the heck?

I immediately pulled her free annual credit report from annualcreditreport.com, which is something I usually do 2-3 times per year, but had neglected for 2012.

There are currently two negatives on her report.

One is a 30 day late payment on a store card in 2007. That’s not a 120 point hit.

The other is an $8 charge-off to Discover. As an authorized user. On an account that was paid.

Crap.

We called Discover to get them to correct the reporting and got told they don’t have it listed as a charge-off. They did agree to send a letter to us saying that, but said they couldn’t fix anything with the credit bureaus.

Once we get that letter, it’s dispute time.

This may be the most boring type of post I write, but it’s important to me to track my net worth so I can see my progress. We are sliding smoothly from debt payoff mode to wealth building mode.

Our highlights right now are nothing to speak of. We did let our credit card grow a little bit over the last couple of months, but paid it off completely at the end of December. It grew mostly as a matter of not paying attention while we were doing our holiday shopping and dealing with some car repairs.

That’s it. We haven’t remodeled our bathrooms yet, but we have the money sitting in a savings account, waiting for the contractor. We haven’t bought a pony yet, but we did decide that a hobby farm wouldn’t be the right move for us. We’ll be boarding the pony instead of moving, at least for the foreseeable future.

Our net worth is up $13,000 since September. Our savings are up and our retirement accounts are down because there are two inherited IRAs that we need to slowly cash out and convert to regular IRAs.