LRN got hacked this morning. Thankfully, I backup weekly and subscribe to my own RSS feed. 20 minutes to total restoration.

My New Windfall

Tax season is over.

This year, TurboTax and Amazon teamed up to offer me a 10% on up to $1200 of my refund if I took it as an Amazon gift card.

$120 free if I spend that money with a company I’m going to spend money with anyway?

Yes, please.

I spend lots of money with Amazon. I subscribe to many of my household items there, because I use them and I don’t want to have to think about buying them. I get my soap, shampoo, toilet paper, paper towels, and garbage bags automatically delivered. There’s a bunch of other stuff, too, but that’s what I remember off the top of my head. If I have 5 items in a monthly delivery, I get 20% off.

Free money, free shipping, and none of the hassles of shopping?

Yes, please.

So now I have a $1320 credit with the company I use for most of my non-grocery shopping.

I also have 962 items on my wishlist with Amazon.

To recap: $1320 burning a hole in my metaphorical pocket and 962 items that I have wanted at some time in the past, begging me to bring them home.

That’s a dilemma.

The smart answer is, of course, to let that money hide in Amazon’s system and slowly drain out to pay for the things I actually need.

The fun answer is to stock up on games and books and toys and gadgets and cameras and, and, and….

Some days, it’s hard being a responsible adult.

I think I’m going to compromise with myself. I’ll leave the vast majority of the money where it is, but I’ll spend a little bit of it on fun stuff, and a little bit more on stuff I don’t quite need, but would be useful, but not so useful that I’ve already bought it.

A new alarm clock to replace the one next to my bed that automatically adjusts for daylight savings time but was purchased before they changed the day daylight savings time hit so I have to adjust the time 4 times per year instead of never. That’s on the list of not-quite-needs.

The volume 2 book of paracord knots is on the list of wants that can’t possibly be considered a need, but it’s going to come home, anyway.

I figure, if I spend a couple of hundred dollars on things I really, really want, I’ll scratch that itch and leave most of the money alone.

What would you do with a $1300 gift card at a store you shop at every week that sells every conceivable thing? Spend it right away, or stretch it out, or something else?

Credit Card Glossary

As evil as credit cards are, most adults have one. Have you ever wondered what percentage of those people know the details of[ad name=”inlineright”] their credit card agreement, or even what all of the terms mean?

Here’s a quick list of the terms and their definitions.

- Average daily balance – This is the balance most card companies use to calculate your interest. They add the balance each day and divide it by the number of days in the billing cycle. This number times the interest rate is (roughly) the interest you have to pay.

- Annual Percentage Rate(APR) – This is the interest rate expressed as the interest accrued in one year. The actual calculation is much more complicated.

- Balance transfer – If you’ve ever paid your VISA with your Mastercard, you’ve done a balance transfer. These often have a great introductory rate and a lousy permanent rate.

- Cardholder agreement – This is the contract that defines all of the terms of your card: interest, default consequences, payment terms, and everything else. You should never sign for a card without reading and understanding this document.

- Charge-back – If you dispute a charge on your card, the issuer may issue a charge-back, and take the money back from the merchant to return to you.

- Credit line – This is the amount you are able to charge. You should fear this number and stay as far away from it as possible.

- Default – When you stop paying your card, you become delinquent. If it goes on too long, you will be in default. Read: screwed. This is when they crank your interest rate to the sky and cut your limit to match your balance. It’s also the point that affects your credit rating.

- Due date – This is the day which, if you miss it, will cause you to acquire an extra $15-39 fee for the privilege of misreading your calendar. Always pay your bill before this date.

- Finance charge – This is the actual interest accrued for the billing period. This is money you are paying for the privilege of borrowing the rest of the money. Next month, you’ll pay a finance charge on this money, too. Yay!

- Grace period – For most cards worth owning, you get 20-25 days before the issuer starts charging interest. The best way to manage your card is to pay it off completely twice a month. That way, you’ll never use up your grace period and never pay a cent of interest.

- Introductory rate – Many cards will offer a crazy-low interest rate for six months to lure you in…like crack. They’ll get you hooked, then raise the rate and force you to charge new toys at the higher rate. Ideally, you’ll never carry a balance, so you’ll never have to worry about the introductory rate.

- Minimum payment – If debt has an evil heart, this is it. If you pay nothing but the minimum required payment, you will be in debt for the rest of your life. Always pay more, even if it’s just an extra $20.

- Over-the-limit fee – If you ignore your credit limit and keep spending, you’ll get hit with another $15-39 fee for the privilege of not controlling your irresponsible impulses.

- Periodic rate – This is your APR expressed in relation to a specific time frame, usually as a daily periodic rate. For example, if your interest rate is 18%, your daily periodic rate is 18/365 or 0.0493%

- Pre-approved – When you get a pre-approved card, you are actually just getting a notice that you have been pre-screened as not being too much of a deadbeat for that particular card. You will still have a full credit check before the card is issued.

- Secured card – If you’ve got lousy credit, sometimes your only choice to repair it is to get a prepaid card. You give the company $200 and they will let you charge $200. They are almost always loaded with fees and are usually a very bad deal, but if it’s the only game in town…?

- Universal default – Sometimes, if you default on one card, every other card you have decides to gang up on you, because your “risk profile” has changed. Yet more proof of the evil that is credit-card debt.

- Variable interest rate – Some card tie your rate to the Prime interest rate, so when that changes, your rate does, too.

Did I miss any terms?

8 painless ways to save money

I saw this list on US News and thought I’d give my take on it.

- Get healthy. They are right. It is cheaper to be healthy…in the long run. Short-term, eating crap food is cheaper and obesity doesn’t get expensive until you are older. But remember, long-term planning is important. I intend to enjoy my old age, so I am working on losing weight and exercising. Fat and lazy is easy, but it won’t be in 50 years.

- Rethink your auto insurance. I don’t have an argument here. When I established my initial emergency fund, I set my deductibles to match it. We regularly review our policies to make sure they match what we need.

- Improve your credit scores. I don’t know what they were thinking with this one. If you’ve got lousy credit, it’s hardly painless to improve it. Digging out of a pit of debt hurts.

- Invest on the cheap. This is another one that’s hard to argue with. Low-fee funds are, by definition, cheaper. Will you get a better return on a fund with higher fees? It’s worth checking the historical return to see if the fee is justified.

- Think triple play. They recommend bundling your internet, TV, and phone. It is cheaper, but I don’t recommend it. I don’t like putting all of my eggs in one basket. If the cable goes down, or the the power goes out, I’d still like to be able to make a phone call, if I have to. My landline is independently powered, and I always make sure there is a corded phone plugged in somewhere. My basic landline only runs $35/month, so a bundle won’t save anything for me, anyway.

- Go prepaid with your cell phone. I have a coworker who pays, on average, $5/month for his cell phone. I use mine far more than he does. If you don’t talk much and don’t use data or texting, this can work out well for you.

- Shop online. I do shop online for a lot. I even buy my toilet paper online. For some things, I prefer to shop locally. When a store owner gets to know you, he can get you some fantastic deals, and give you advice that can save you a ton of money.

- Get cash back. I have a couple of decent cash-back credit cards, but I won’t use them. Until all of our credit card debt is paid, I won’t consider making regular use of any form of credit. Your mileage may vary, but that’s the condition I had to set on myself to make our debt plan work.

How many of these ideas do you use?

Saturday Roundup

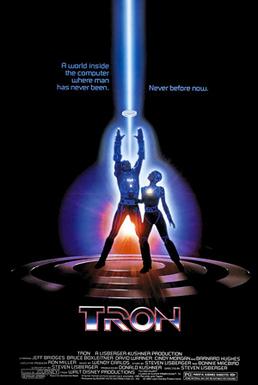

- Image via Wikipedia

I wrote this yesterday. According the forecast, when this post goes live, I’ll be moving 5-8 inches of snow off of my driveway.

That, or watching TV and thinking about moving snow.

Maybe I’ll just sleep in and wait for spring to melt the snow.

Don’t forget to enter my drawing for a $100 Amazon gift card! Go here for details. It ends on the 15th, so don’t wait too long.

Best Posts

Crazy-easy ice cream bread. How could this possibly be bad?

Tron comes out in 2 weeks. I’d love to show up on a custom street-legal Troncycle.

Arsenic-based lifeforms are shaking up the way we understand life to work. I’m of the opinion that life will probably exist almost everywhere that isn’t a completely dead dry rock. I say that as an expert in…well, nothing related to astrobiology.

Following Erica’s advice is currently making me a few hundred dollars per month, with every sign of growing as time goes on. I hate to sound like a fanboy, but if she pimps a product, I’m at least going to give it some serious consideration.

Carnivals I’ve Rocked

10 Dumb Money Moves was featured in the Carnival of Debt Reduction.

Book Review: The Art of Non-Conformity was included in the Carnival of Personal Finance.

Things You Should Buy Online to Save Money was included in the Festival of Frugality.

Thank you! If I missed anyone, please let me know.

LRN Timewarp

This is a new feature to share the gift that is me with anyone new to LRN. This week, I’m going to share some posts from my first week blogging here.

The $10 College Fund. In the last year, not only have I not changed my mind about the $10 college fund, but I haven’t raised the amount. The point is to just get started. I’ve done that. I’ll raise the amount when my debt is paid off. We are now up to $166.09. The numbers are off because I stuck a little bit extra in one month.

In the last year, our dreams haven’t changed. We haven’t made any direct progress, but indirectly we are doing well. First things first. We need to pay the debt off before we look at a hobby farm.

My second day blogging, I wrote about why we handled money so poorly.

2012: The Year the World Ended

December 21st marks the day that Mayan calendar-makers decided was far longer than they needed to waste their time carving

days into stone.

More importantly, it marks the beginning of the week before my birthday. No self-respecting civilization would end the world just a week before my birthday.

This is traditionally the time that people look back at the previous year, and make resolutions they don’t intend to keep in the following year.

Who am I to buck tradition?

In 2011, I became a bit of a workaholic.

This site has taken off a bit. I’m not about to retire off of the proceeds, but it has turned into a nice little side income. Thank you for that.

I launched a marketing company. We do web design/development, social media work, and search engine marketing. It’s strictly a part-time gig right now, but it’s growing and taking up most of my free evenings and weekends.

I’ve been working 50-60 hours a week at my day job.

The plus side? I’ve also paid off almost $20,000 of my debt in 2011, bringing my total to $47,535 left.

It’s been a lot of work, but the harder I hustle, the sooner I can stop hustling.

What’s in store for 2012?

On the work front, I plan to cut my weekly load down to 40-45 hours again. Life it to short to work all of the time.

I want to expand my new company to the point that my day job is optional. I’m projecting that by spring. Call it June 1st.

Here, I want to double the size of my audience. I don’t just want random people popping in, I want to grow an engaged audience. That means more comments and more discussion. Expect to see more along those lines.

I’ve also got a couple of products under development. By year-end, I’d like to have them both released.

On a personal level, my biggest goal is to carve out a regular chunk of time to spend with my wife. Working all of the time has cut into our quality time together. I want to find a way to schedule date nights at least twice a month. It will cost more money, but that’s part of why I’m working so much.

Financially, I want to kill the last of my credit card debt. That’s down to about $17,000. We’ll need to keep working at it, but it’s a reachable goal. That means we still don’t get cable, I still avoid buying books every week, and my kids still have to live with not getting every whim fulfilled.

To recap: I’m going to work smarter, grow my side projects, and make this site better for you. In the process, I’m going to kill the last of my unsecured debt, and drag my mortgage down to it’s last gasping breaths.

Here’s to the end of the world….