Am I the only one who just noticed that it’s Wednesday? The holiday week with the free day is completely screwing me up.

Just to make this a relevant post:

Spend less!

Save more!

Invest!

Wee!

The no-pants guide to spending, saving, and thriving in the real world.

This is a guest post.

Improving your carbon footprint can fall low on the list of professional priorities for many business owners. Yet, as we all become increasingly aware of the implications of ecological practices, opting to go green is an appropriate business decision.

As suppliers and business to business contractors tailor their products in favour of conservational customs, it is likely that adopting eco-friendly operations within your company will benefit both your books as well as the environment.

By making small, uncomplicated steps, government research proposes that, together, UK businesses could save in the region of £23 billion per annum. This proposed figure suggests that snubbing sustainable efforts is at an economic cost to owners individually, in addition to any ecological expense.

As the importance of your carbon footprint is established, deciding which areas within your company can be conveniently ecologically enhanced is a simple way to get started.

Speak With Your Energy Provider

Many energy providers now offer guidance to their customers surrounding any eco-friendly improvements that could be made.

Business electricity from British Gas comes complete with free energy efficiency advice to help ‘cut down your energy consumption and reduce your electricity bill’. The advantages of this initial consultation are augmented by the ongoing provisions incorporated in all business electricity from British Gas packages.

Select a supplier who is willing to help you and your business reduce the impact of your Climate Change Levy (CCL) and is eager to invest in renewable energy resources.

Say ‘Goodbye’ to Guesstimates

According to research completed by British Gas in 2011 ‘companies typically spend as much as 46 per cent of their energy usage outside of business hours’.

Although it is relatively easy to predict the periods when your business’ energy usage is at its greatest, monitoring your actual consumption may highlight any unexpected wastage.

A facility such as Business Energy Insight™ – available with business electricity from British Gas – does exactly what it says on the tin, giving consumers an awareness of their confirmed energy consumption.

Combined with accurate meter readings from Smart Metering or similar, energy insights eliminate any estimation and uncertainty. Through this perceptiveness, business consumers are able to monitor, measure and model their energy utilisation, saving money and resources.

Don’t Go It Alone

Being unsure of how to go green is one of the reasons many businesses choose to linger with standard systems. As well as expert assistance from energy advisory services, schemes are in place which can structure your steps into the world of energy efficiency.

The IEMA Acorn Scheme presents a progressive profile of six stages for business owners to accomplish. These stages ensure that legal requirements are covered and can be completed over a phased period to fit with other business demands.

On completion of the scheme, an IEMA Acorn Certificate is attained to confirm your businesses compliance with British Standard (BS) 8555. Your details are also entered onto the IEMA Acorn Register.

Organically Positive PR

Every organisation needs their Unique Selling Points. Though your services, products or facilities may speak for themselves, going green is the current way to enrich your business.

Clients and customers want to buy from those they trust and often those who follow an ethical ethos. Choosing to ‘go green’ and consistently demonstrating and delivering ecological practises will verify the concerned culture of your company.

While investing your time into employing eco-friendly systems may not reap instant rewards, the positive connotations surrounding conservation will always ensure that you are ahead of the game when in competition with a company that doesn’t deliver on these principles.

Whether you choose to be officially certified via IEMA Acorn or you simply state your environmental policies on your website and company literature, being ecologically aware can cause an upturn in capital as well as cutting resource costs.

Taking Things Further

When you are hoping to tackle more than the basics and want to do more to aid our environment, there is a myriad of informational services willing to help.

Making this move doesn’t have to cost the earth, business grants are available to help you render these affirmative changes. Check online at www.grantsgreenmachine.com for any that may be applicable for your industry.

Locally, councils may be able to offer either erudition or funds specifically appropriate to your project within your region.

Conservation doesn’t have to be costly; check your books and you may find that going green could profit both your environment and your enterprise.

Grr!

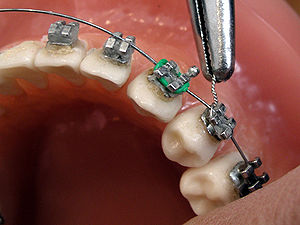

Monday, I brought Punk #1 to the orthodontist. He’s got an underbite and some crooked teeth, but I didn’t realize how off it was until I saw the pictures they took. Some of the closeups could be inspiration for a Halloween mask.

It look like he started with a small underbite that made his teeth line up wrong, which–as they grew–accentuate the wrong. Now, it’s very, very wrong.

Next week he goes in to get his top teeth done.

At a cost of $5800.

If we pay up-front, they’ll knock 5% off, bringing it down to $5500. That covers everything, all of the follow-ups, broken hardware, every stage the whole way through. If we pay monthly, it will be $1450 down and $200 per month (interest free) for almost 2 years.

Almost six grand.

Fortunately, we knew this was coming, so we’ve been saving for this for a few years.

Unfortunately, we’ve only been saving $50-100 a month. We can’t wait much longer. With an underbite, you have more options if you do the work before the kid is done growing. I’d really like to avoid jaw surgery for him, so we have to make things happen.

Our braces account has $3100 in it. My HSA account has $875. That’s from my last job, so that’s as big as it gets. That leaves us almost exactly $1500 short.

I hate the idea of touching our emergency fund, although it does have enough money in it.

We’ve also got some money tucked away in an account leftover from my mother-in-law dying last year. I think that’s where we’re going to come up with the difference.

How else could we save money?

We could shop around, but this isn’t something I want to give to the lowest bidder. I want to do it right, and I know several people who have had braces put on by this office, either by this orthodontist or her father.

I asked about a cash discount and got turned down.

That’s it. Next week, I burn $5500. Hope the kid eventually appreciates it.

I’m overbanked.

The National Bank, Oamaru, built 1871: a prostyle Palladian portico on a neoclassical facade (Photo credit: Wikipedia)I’ve mentioned that before.

I won’t give up my herd of CapitalOne 360 accounts. I use those to track my savings goals, all 17 of them. I can’t drop my business accounts, my kids’ savings accounts, or the personal accounts that I actually use to spend money.

I do, however, need to simplify a bit.

Last month, I went through the hassle of transferring my 401k from two jobs ago and my IRA from my last job. Now, I’m down to just two retirement accounts. One is for my current job, and the other is a self-managed IRA with Sharebuilder.

Two down.

A few months ago, I went to yet another bank to close an account. My last job offered crappy health insurance, but balanced it out with an HSA. It complicated things, but the actual costs came to almost the same as the previous plan that didn’t have a high deductible. When I left, my HSA just sat there.

Last year, my oldest got braces, so I cleaned out the HSA ahead of time so we could pay up front and save 5% without paying interest.

Another one down.

That’s three accounts down out of 34.

Thirty-four?

Crap. That’s retirement accounts, business accounts, and personal accounts for two adults and three kids.

Bank 1 has the checking account we use, plus two savings accounts, one of which is where we store the rent money until we take a payday.

Bank 2 has a checking account, 16 savings accounts, and stock-trading account, a CD, and two IRAs for my wife and I.

Bank 3 has a checking account, and savings account for each of two businesses I own, a spare set of personal accounts, a savings account for each of the kids, and a checking account for my teenager.

Bank 4 holds nothing but my current 401k.

The only thing I can simplify without sacrificing my organizational jungle is to combine the personal accounts from bank 1 and 3. The problem is that Bank 1 has all of my bill pay information and there is still an account open for my mother-in-law’s estate. We keep that open just in case we find any other checks we need to cash. Bank 3 has my business accounts tied to my personal account and is the bank that my business partner uses, so that’s convenient to move money around.

I may be stuck.

I have a confession, but it’s probably not going to be a big shocker if you read the title of this post.

I hide money from my wife.

Some of you just started screaming at your monitor that I’m a horrible person.

That’s cool.

You’re wrong, but the fact that I got that reaction out of you makes me smile.

Ok, I might be a little bit horrible, but not because I hide money.

My wife has an admitted shopping problem. If she thinks we’re broke, she shops less. That’s a win and allows me to save up for our long-term goals and provide for our financial security.

I don’t lie about it. If she asks how we’re doing, I tell her. At least in general terms.

But I didn’t tell her about my annual bonus, until we had a bunch of car repairs come up that would have swamped our emergency fund.

I also haven’t told her about the cash I’ve been stockpiling.

A couple of years ago, the power went out here for four days. It wasn’t just our house, it was 75% of everything within 5 miles of our house.

When the power came on in some places after a day or two, the phone lines were still down, which meant gas stations couldn’t process credit cards.

Quick, look in your wallet and tell me how much cash you have on you….

Most people live on their credit or debit cards.

Could you buy food or water if your plastic was gone?

I could that week, but not for long, so I started taking the cash payments from my side hustle and putting it aside. I’d come home, give my wife a little cash, keep a little cash for myself, and put at least 80% of it away. I absolutely refuse to touch that money for anything.

Part of the “set it aside and forget about” means not revealing its existence. It would be too easy to dip into it to pay the pizza guy or when we go to Rennfest.

So I don’t talk about, and it gets to sit all by itself in the safe, comfy and warm. It’s my security blanket, and nobody gets to touch my binky.

The publicly documented downward spiral of Amanda Bynes may be reaching its breaking point. She has been on psychiatric lockdown for the past three days, and her parents are petitioning for conservatorship in California

on the grounds that they believe she is suffering from acute schizophrenia. They claim that the troubled starlet is unable to make safe decisions regarding her own well-being, not to mention the safety of others. The issue is complex, but the former childhood star has demonstrated that she meets the criteria to have external guardians instated to protect her from unpredictably irrational behaviors.

This was not the first criminal case against Bynes; she is also dealing with hit-and-run allegations in California. It was also not her last interaction with the police. Most recently, the actress doused an elderly woman’s driveway in gasoline and set it ablaze. She accidentally covered a puppy in the flammable liquid, so she ran down the block looking for something to save the animal from catching fire. After ransacking a convenience store, officers accosted her. The exchange resulted in the psychiatric hold that has been placed on Bynes.

Unfortunately, grounds for conservatorship can be exceedingly challenging to meet. Clear proof of mental illness needs to provided, and the standards are rigidly strict; however, if anyone has showcased the fanatical craziness that constitutes a lack of personal responsibility, it is Amanda Bynes.

Her schizophrenia is no longer dormant. The actress has become obsessed with plastic surgery, and she has deformed her face with cheek piercings. She uses online social networks to decry public figures for their ugliness. Victims of this attack include even Barack and Michelle Obama. Furthermore, she makes offensive sexual remarks towards rappers, and she wants to be a hip-hop artist herself. She has spent fortunes on a wig collection, and she employs a different style at every court appearance. The actress even used one as a disguise for an incognito trip to a trampoline emporium.

Anyone that has seen her Nickelodeon program would not be shocked to learn that she was schizophrenic. The role had her switching between dozens of identities for different skits, and she even played a character that was, in effect, obsessively stalking the star herself. “The Amanda Show” was neurotically fast-paced. Ultimately, the entire program can now be viewed as an eerie foreshadowing to the budding of a latent psychological disorder. If the legal standards of insanity are not met, then she will be free to wreak havoc on herself and others.