- I miss electricity. #

- @prosperousfool Do you still need a dropbox referral? in reply to prosperousfool #

- @prosperousfool Dropbox: https://www.dropbox.com/referrals/NTE1Mjk2OTU5 in reply to prosperousfool #

- Don't let anyone tell you otherwise: Electricity is the bee's knees, the wasp's nipples and lots of other insect erogenous zones. #

- @prosperousfool Throw in a Truecrypt partition and the PortableApps launcher and it gets really neat. in reply to prosperousfool #

- @prosperousfool Universal accessibility. I put an encrypted partition on it so any receipts or credit card info or login info would be safe in reply to prosperousfool #

- RT @untemplater: RT @jenny_blake: Deep thought of the day: "How people treat you is their karma; how you react is yours." -Wayne Dyer #quote #

- @FARNOOSH So what's happening to the one good show on SOAPNet? in reply to FARNOOSH #

- RT @flexo: RT @mainstr: 1 million Americans have been swindled in an elaborate credit card scam and they may not know http://bit.ly/cr8DNK #

Resisting Temptation

This guest post was written as a guest post (by me!) in 2010.

There I was, minding my own business, when suddenly, Sumdood came out came out of nowhere and forced me to buy a new flat-panel TV, a time share in St. Thomas, and join one of those overpriced underwear-of-the-month clubs. Talk about a bad day, rivaled only by the day the odd, lacy package gets delivered on the first of the month.

No, really, as I go about my business each day, the temptation to spend my money can be almost irresistible. Yet somehow, I manage. Is it because I have superhuman willpower? I don’t. Is it because I’m chased by a leather-clad, sjambok-wielding pixie who chastises me for every unbudgeted purchase? That’s not it either, but it makes for a fun picture.

What’s my secret?

I follow a principle I like to call “Don’t buy that!” Don’t buy that! is a simple plan that is surprisingly hard to implement, mostly because following the plan means delaying gratification for a while. Delayed gratification is never as much fun as instantly indulging every whim.

I can hear your shouts of protest. If it’s so hard, how can I expect you to do it? Easy. Just follow the rules. There are a few things you can do to make Don’t buy that! a realistic plan of action for you.

1. Find a slap-me-upside-the-head buddy. I use my wife. It works for me and she tends to enjoy it. If I’m in a store and I get tempted to buy something awesome, I call her for a reality check. Sometimes, it’s as straight-forward as my calling her and saying “Honey, tell me ‘no’.” Other times, she actually has to talk me down using–horror of horrors–logic and reasoning. Usually, she just invokes rule #2.

2. If you have to check if you can afford it, you can’t. If I’m not immediately sure that we have the money to buy something, it is far too big of a purchase to buy on an impulse. Big purchases need to be planned. “Honey, I found this great TV on sale!” “Can we afford it?” “I don’t know, let me che…crap. Nevermind.”

3. You can have anything you want, but you can’t have everything. We could afford a fancy vacation in Paris every year, but not if we also pay for extended super-cable, Netflix, dinner out every night, and a new car every three years. Expenses need to be prioritized.

4. The little things can ruin you. There’s a story about a nail missing from a horse’s shoe, which lamed the horse, which made the knight miss a battle, which was lost, which led to the loss of the war, which led to the loss of the kingdom. For want of a single nail, a nation fell. If I buy a new book or movie every week, will I end up short on my mortgage payment? It’s far easier to pick up some of the little things after the necessities are met than it is to try to pay the mortgage after squandering your paycheck on lottery tickets and Mad Dog. Handle your needs before you worry about your wants. Sometimes, that means putting off the things you want, but having the things you need makes it worthwhile.

5. Remember the past. When I bought a bunch of movies a few months ago, I was happy. New movies go great the the movie screen and projector in my living room. Want to take a guess at how many of those movies I’ve taken the time to watch? I certainly enjoyed the act of buying the movies and the anticipation of watching them far more than I’ve enjoyed seeing them site on the shelf, unopened. What a waste. It happens regularly. Often, we get far more enjoyment out of the idea of doing something that the actual doing. If I can remember that the anticipation is better than the act, before I buy whatever is tempting me, I can usually avoid buying it.

These 5 rules have helped me to follow my master plan of Don’t buy that! That plan is the single most useful thing I have ever used to save money.

What’s your best tip to save money?

Identity Theft: What To Do When You’ve Been Victimized

Credit Card Theft” width=”240″ height=”189″ />

Credit Card Theft” width=”240″ height=”189″ />Have you ever been surprised by having a credit application denied? Or been told that you’re paying too much for your car insurance because you have bad credit?

There are 15 million victims of identity each year with an estimated loss of $50 billion. That’s a lot of cake. If you’re credit card gets stolen, you’re only liable for up to $50 of the theft, but what if your checking account is cracked or someone is opening accounts in your name? What is the indirect cost coming form higher interest rates?

Identity theft happens. It could happen to you.

What should you do if you become a victim of identity theft?

- File a police report. You’ve been victimized, make sure you have some documentation of that.

- Contact any credit card company that has possibly been affected. If you lost your wallet, call them all. If somebody has opening cards in your name, call all of those.

- Call the credit bureaus* and have a fraud alert put on your credit report. This will force any new creditor to take extra steps to verify your identity before opening a new account. Ideally, your identity thief won’t be able to make the grade. If that isn’t enough, look into an identity freeze. That will stop a lender from even seeing your credit report without your explicit permission.

- Close your bank accounts Depending on how severe the theft, you may need all new accounts at every level. If the thief has a box of your checks, or even your account and routing numbers, you need to close the accounts to protect your money.

- Report the theft to the FTC at 877.438.4338. You’ll get additional documentation of the theft, including an ID Theft Affidavit that can make it easier to clean up the mess.

- Hire a witchdoctor to curse the soul of your attacker. No, he probably won’t actually turn into a warty toad, but what if? Maybe the universe will wield the Magic Karma Hammer and beat him into a little greasy stain in the street.

The Obligatory Thanksgiving Post

Tomorrow is Thanksgiving. Tomorrow is also Thursday, and I don’t post on Thursdays, so I’ll be posting about Thanksgiving today.

Thanksgiving is a day to be thankful for–first and foremost–capitalism.

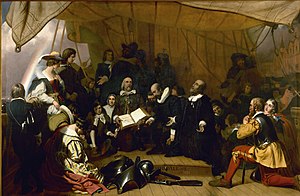

When the Pilgrims first landed, they set up a communal farming arrangement, figuring that a good Christian community could take care of its own. From each according to his ability, to each according to his need, and all that. Everyone worked for the good of everyone else, so everyone benefited, right?

The Pilgrims, like every other group that has ever advocated communism, neglected to consider human nature. If you have no incentive to work, you don’t. If sleeping in and making babies still gets you fed and clothed, why work?

On the other side, if you work hard, only to see your hard work go to benefit your lazy neighbor, sleeping in and rattling the headboard, but never doing anything productive, why bother?

It didn’t take long for the Pilgrims to notice this tragedy of government wasn’t working.

The strong, or man of parts, had no more in devission of victails and cloaths, then he that was weake and not able to doe a quarter the other could; this was thought injuestice. The aged and graver men to be ranked and equalised in labours, and victails, cloaths, etc., with the meaner and yonger sorte, thought it some indignite and disrespect unto them. And for mens wives to be commanded to doe servise for other men, as dresing their meate, washing their cloaths, etc., they deemd it a kind of slaverie, neither could many husbands well brooke it. Upon the poynte all being to have alike, and all to doe alike, they thought them selves in the like condition, and ove as good as another; and so, if it did not cut of those relations that God hath set amongest men, yet it did at least much diminish and take of the mutuall respects that should be preserved amongst them.

It didn’t take long before nobody was working. Neighbors resented each other, because everyone had a right to the work of the other, with no need to compensate each other. That’s a case of “I’m starving because you aren’t working hard enough, but it’s not my fault you’re starving.”

At one point, the production of the colony was down so much that the colonists’ ration of corn was just 4 kernels per day. That’s how you kill a colony.

But they learned from their mistakes before they all died.

Yet notwithstanding all those reasons, which were not mine, but other mens wiser then my selfe, without answer to any one of them, here cometh over many quirimonies, and complaints against me, of lording it over my brethern, and making conditions fitter for theeves and bondslaves then honest men, and that of my owne head I did what I list. And at last a paper of reasons, framed against that clause in the conditions, which as they were delivered me open, so my answer is open to you all. And first, as they are no other but inconvenientes, such as a man might frame 20. as great on the other side, and yet prove nor disprove nothing by them, so they misse and mistake both the very ground of the article and nature of the project. For, first, it is said, that if ther had been no divission of houses and Lands, it had been better for the poore. True, and that showeth the inequalitie of the condition; we should more respecte him that ventureth both his money and his person, then him that ventureth but his person only.

The slavery of working for the benefit of others didn’t work, unless you were “theeves and bondslaves”. Then, it was great, living off of the sweat of others.

To make a long story short, the starvation ended when the Pilgrims were given parcels of land and told they could keep what they built from it. They went from the edge of extinction to being prosperous in a short time. The old and weak were cared for, not by the governor’s decree, but by the generosity of their neighbors.

Everybody in the colony won.

Good Friday

We don’t have daycare on Good Friday.

We do, however, both have to work today. Two rounds of little-girl tonsillitis have zapped our available vacation time.

On an entirely related note, we put our 12 year old son through Red Cross babysitter training a few weeks ago, just for something like this.

My wife gets nervous at the idea of leaving the girls with the boy for very long. I think she thinks the world will explode if he takes care of them correctly.

Our solution for today is to have a slightly older friend come over and help.

She’s 13 and she brought her 10 year old brother with her.

That’s kids aged 3,5,10,12, and 13 in my house today. Total Lord of the Flies.

Hold that thought.

My son, being 12, doesn’t feel it’s necessary to brush his hair for school, or change his clothes every day, and he needs to be reminded to brush his teeth.

This morning, he woke himself up and ran into the bathroom. He emerged with clean teeth and combed hair. I asked him if he was wearing the same shirt as yesterday, and he flew into his room to change.

Hmm. Something is afoot.

While I was putting my shoes on, I reminded him to take care of the house and his sisters, and he made some smart-aleck joke in response.

She giggled.

Watson, I think I’ve found a clue.

Her father told me, just yesterday, the she thinks boys are gross.

The boy has never shown an interest in girls, until this morning.

Grr. The next decade just got considerably more interesting.

Time to lock them both in their respective basements until college.

Credit Card Pitfalls You Have To Avoid

The idea of a credit card is appealing. You don’t have to have the money to pay for things; you can just use the card. It creates instant gratification and you start to get used to the idea of getting what you want when you want it. Unfortunately, this can be a disaster waiting to happen.

If you get in over your head and begin to negatively affect your credit rating, it is not the end of the world. By looking at things like bad credit credit cards at Money Supermarket you can start to make things right again. Watch out for these pitfalls that could cause you to stumble into a bad credit card situation.

Enticing Rewards

You see the commercial or advertisement online and reward credit cards make it seem like you will be drowning in points that can be redeemed for airline miles or gift cards. Initially, you may think that this is a great reason to sign up for a card. Then, you begin to use the card often in order to earn points.

The problem comes when you start spending just to get the rewards and you can’t or don’t make payments to return to a zero balance every month. You may end up with a hefty annual fee on top of everything else. Don’t let the temptation of getting a reward create a problem with your credit score.

Maxing Out the Credit Card

When someone hands you $5,000, you will be tempted to spend it. Why not enjoy the new money? The problem is that a $5,000 credit card balance needs to be paid back. Don’t fall into the trap of spending the entire line of credit immediately.

If you do run into some financial difficulty or you really need a credit card for something, you will have nothing left to use. If you go over the limit, you can be sure that there will be some fees that come along with it. Use it wisely. Charge something and pay it off.

Skipping a Payment or Paying Late

Once you have a credit card, everything is going to affect your credit score. If you miss a payment or pay late, you can be sure that this is going to show up against you. Aside from the damage to your credit score, most credit cards come with a substantial penalty in the form of a late fee that gets tacked onto the next payment.

Always pay on time. Pay in early if possible. Keeping up to date with your credit card will show up positively on your credit rating.

When Problems Arise

Even if you do your best to avoid these pitfalls, sometimes financial problems can be unavoidable. An unexpected emergency requires you to max out the card. You run into a problem at work and lose your main source of income.

If you see that your credit is starting to decline, it is always possible to build that score back up. Start over using bad credit credit cards to make a positive impact on your credit score. With this scenario, you get an opportunity to once again avoid these pitfalls and improve your credit.