- Getting ready to go build a rain gauge at home depot with the kids. #

- RT @hughdeburgh: "Having children makes you no more a parent than having a piano makes you a pianist." ~ Michael Levine #

- RT @wisebread: Wow! Major food recall that touches so many pantry items. Check your cupboards NOW! http://bit.ly/c5wJh6 #

- Baby just said "coffin" for the first time. #feelingaddams #

- @TheLeanTimes I have an awesome recipe for pizza dough…at home. We make it once per week. I'll share later. in reply to TheLeanTimes #

- RT @bargainr: 9 minute, well-reasoned video on why we should repeal marijuana prohibition by Judge Jim Gray http://bit.ly/cKNYkQ plz watch #

- RT @jdroth: Brilliant post from Trent at The Simple Dollar: http://bit.ly/c6BWMs — All about dreams and why we don't pursue them. #

- Pizza dough: add garlic powder and Ital. Seasoning http://tweetphoto.com/13861829 #

- @TheLeanTimes: Pizza dough: add lots of garlic powder and Ital. Seasoning to this: http://tweetphoto.com/13861829 #

- RT @flexo: "Genesis. Exorcist. Leviathan. Deu… The Right Thing…" #

- @TheLeanTimes Once, for at least 3 hours. Knead it hard and use more garlic powder tha you think you need. 🙂 in reply to TheLeanTimes #

- Google is now hosting Popular Science archives. http://su.pr/1bMs77 #

- RT @wisebread 6 Slick Tools to Save Money on Car Repairs http://bit.ly/cUbjZG #

- @BudgetsAreSexy I filed federal last week, haven't bothered filing state, yet. Guess which one is paying me and which one wants more money. in reply to BudgetsAreSexy #

- RT @ChristianPF is giving away a Lifetime Membership to Dave Ramsey’s Financial Peace University! RT to enter to win… http://su.pr/2lEXIT #

- RT @MoneyCrashers: 4 Reasons To Choose Community College Out Of High School. http://ow.ly/16MoNX #

- RT @hughdeburgh:"When it comes to a happy marriage,sex is cornerstone content.Its what separates spouses from friends." SimpleMarriage.net #

- RT @tferriss: So true. "Nearly all men can stand adversity, but if you want to test a man's character, give him power." – Abraham Lincoln #

- RT @hughdeburgh: "The most important thing that parents can teach their children is how to get along without them." ~ Frank A. Clark #

Saturday Roundup: Evil Dead

- Image via Wikipedia

Last night, my wife and I went to see Evil Dead: The Musical. I’m a die-hard zombie-movie fan, and the Evil Dead Trilogy is among my favorites. I don’t recognize a difference between Candarian demons and zombies, so it still fits the genre.

The musical beats either of the first two movies, hands down. I was rolling. If you are in the Minneapolis area tomorrow, check it out at the Illusion Theater. If you are elsewhere, watch for it. It’s entirely worth the time and money.

Best Posts:

Sometimes, shopping can save you money, but don’t let it get out of hand.

I’ve never had food poisoning, but my wife has. It was unpleasant.

Bacon soda. Yum. No further comment.

Bad marketers. No donut.

Carnivals I’ve been in:

AAA – Save Some Cash was included in the Festival of Frugality.

The Spending Styles of the Rocky Horror Picture Show was included in the Carnival of Personal Finance.

Crack was included in Foodtastic Favorites.

If I missed anyone, please let me know. Thanks for including me!

IRA or Powerball?

“When I win the Powerball, I’m going to buy that house and kick him out. I play diligently, so you know it’s going to happen.”

I had a friend say this to me this week. He’s poor–living on about $500 per month–and he was recently evicted from his apartment.

His plans for the future involve taking nearly 20% of his income and burning it playing the lottery. When he found out that I don’t play, he looked at me like I was stupid.

The odds of winning a life-changing amount of money are 1 in 5,153,632.65. That’s for a $1,000,000 prize. The next step down is $10,000, which, while helpful, won’t change many people’s situation for long. One in 5 million. That’s 5 times worse than your odds of being hit by lightning this year. It is, however, 4 times better than your odds of being sainted and 12 times worse than your odds of dating a supermodel.

It’s not going to happen.

Sure, play for fun–because turning cash into valueless slips of paper is a blast–but don’t play the lottery instead of working to improve your future. The lottery is NOT a retirement plan.

Instead, a much more reasonable plan is to date a millionaire. The odds of making that happen are just 215 to 1, and you can do things to improve your chances.

Improving the odds of dating a millionaire:

- Hang out where millionaires go. Yacht clubs, nice restaurants, rehab, that dark corner of their bedroom where the lamp never quite reaches that just looks perfect for a stalker-cam.

- Do what millionaires do. Golf, high-stakes poker, oppress third-world countries, Centrifugal Bumblepuppy.

- Look like millionaire-bait. For my friend, the 50-year-old black man, it might be hard to look like a 23-year-old blonde hardbody, but it’s worth the effort.

- Be nice, be polite, give good h…nevermind.

Seriously, getting a regular job and socking money away every month will give you a far better return on your investment than playing the lottery. Even if you’re saving it in a mayonnaise jar buried in the backyard next to that obnoxious guy who used to live next door, you will be building security and peace of mind. Every month, you will be better prepared for the storm of crap life tends to throw around.

Do you play the lottery? Why or why not?

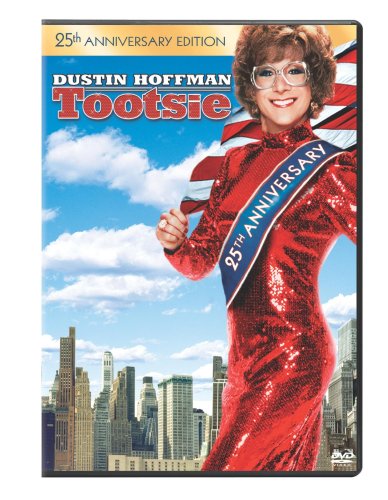

Tootsie – Does Beauty Have to be Expensive?

Many remember Dustin Hoffman dressed in drag in the classic film Tootsie, a movie that he now says made him realize how many women he’s missed out on meeting in life simply because he judged them by their looks. Every year women spend thousands of dollars on beauty products and cosmetics, hoping to increase their appearance and become attractive enough to the outside world. Although there are various degrees of beauty, it undoubtedly is usually determined by the amount of money spent to enhance features and upkeep the overall look.

The length of a woman’s hair often creates a more attractive look in the U.S., which is difficult to achieve with flat irons and curlers that create breakage and brittle hair from the heat. Women are now resorting to having hair extensions installed every three to five months to achieve beautiful hair that has a fuller texture and longer length, costing an average of $700. They can resort to shorter hair that saves a large amount of money, but they’re ultimately compromising a large part of their looks.

There’s a reason that celebrities appear more beautiful than the rest of the population, as their high school photos often show them to look like typical people. By spending thousands of dollars on personal trainers, stylists, and makeup artists, their appearance is immediately enhanced with the finest tools and products on the market. They are also able to have help with experts who have more knowledge on what creates the best look for their features.

Although beauty does not have to be expensive (just look at exotic women in Columbia and Brazil who are anything but high maintenance), it unfortunately is a requirement in the U.S. where rich housewives rule the reality shows and runways. True beauty is often defined by breast and waist sized, which few women can live up to, resulting in thousands of dollars spent on breast implants and liposuction, often impossible to attain otherwise.

Beauty may be in the eye of the beholder, but few men will argue that Angelina Jolie is unattractive or that Heidi Klum looks homely. The majority of men can agree when a woman is beautiful, and few women catch attention with a homemade manicure and dyed hair that came from a box. Perhaps going au natural will become a new trend in the coming years, but for now it’s expensive to be a woman, and even more costly to be a beautiful one.

Related articles

Ditch Cable and Still Enjoy TV

- Image via Wikipedia

Cable is expensive. If you have more than just basic cable, you are probably paying at least $65 per month or more, just for TV. How can you save on television, without stealing cable?

The good news is that, in the internet age, it is possible to fully enjoy TV without having to pay exorbitant fees to the cable company.

Basic Cable

Basic cable generally runs about $15 per month, but it usually comes with a $10 per month discount on internet access if you use cable for that. For $5 per month, you can get all of the local broadcast channels, including the news and weather, which we use in the morning while getting ready for work.

Netflix

We watch movies. We watch lots of movies. Spending $14 per month for an unlimited 2-at-a-time plan is a no-brainer for us. It has also enabled us to scratch the movie itch without resorting to HBO or incessant movie purchases, which used to run $100+ each month. When you include Netflix instant in the equation, which gives us a ton of older movies to choose from at a moment’s notice, we are more than covered for our movie obsession.

Hulu

Hulu.com has a metric crapload of TV shows and movies available for free. They are moving towards a partial pay model, but most of their content will still be free. But, you don’t want to crowd your family around a 15-inch laptop screen to watch something, you say? Fine. We went to our local computer parts store and bought cables and converters to go from the video-out and headphone jacks on the laptop to the inputs on our VCR. That cost about $30 for 2 extension cords and 2 converters. We use the analog outputs, which allows for cheaper converters. The quality after conversion is no worse than watching a movie in the VCR.

TiVo

TiVo comes with a Video-On-Demand(VOD) section, if you connect it to the internet. It’s mostly free, with hundreds of channels to choose from, ranging from trailers to full shows and movies. I have a season pass to TEDTalks, which are always impressive and usually inspirational. There are many more channels to choose from.

Torrent

I’m kidding. I’m not advocate piracy. This is just search-engine bait.

As you can see, it’s entirely possible to save money on cable, without missing out on anything you care about. How do you save money on TV and movies?

My Credit Cards

This announcement is a bit premature, but not everything that’s premature has to end in an evening of disappointment.

At the beginning of the year, I transferred the balance of my last credit card onto two different cards, each with a 0% interest rate. One card got a $4,000 transfer and the other got $13,850. The approximately $415 in fees I paid for the transfer saved me nearly $1500 in interest this year.

The card that got the big balance is the card we use for a lot of our daily spending. On my statement dated 2/18/2012, the balance on the this card was $14,865.23. At the same time, the smaller card had a balance of $3,925.09, for a total of $18,790.32. When I started my debt-murder journey in April 2009, it had peaked at just under $30,000.

When my payments clear later today, that balance will be gone.

That is nearly $19,000 paid down in 8 months.

Now, the inheritance we picked up did accelerate our repayment a bit, but only by a few months.

Starting from $90,394.70 in April 2009, we have paid down $63,746.70, leaving $26,648.00 on our mortgage.

I’m more than a little excited, which–as usual–is the cause for the prematurity.

New goal: pay off the mortgage in 2013.