Please email me at:

Or use the form below.

[contact-form 1 “Contact form 1”]

The no-pants guide to spending, saving, and thriving in the real world.

Welcome to the November 1, 2010 edition of the Carnival of Money Stories. One thing I didn’t do when volunteering to host this was to check my calendar. Did you know that November 1 follows October 31, every year? On Saturday, I had 30 people over for my annual Halloween party. On Sunday, I ran a haunt in my yard and coordinated to get a dozen kids out begging for candy while using my house as a base of operations. I’ve had guest from out-of-town since Friday. Halloween weekend is, by far, the busiest weekend of the year at my house.

J. Savings presents Side Hustle Series: I’m a Restaurant Server posted at Budgets Are Sexy, saying, “Is serving tables thankless work? Yes. Are customers sometimes unpleasant? Of course. But the benefits are plenty!”

Wenchypoo presents Marketing, Marketing Everywhere–There’s No Escape! posted at Wisdom From Wenchypoo’s Mental Wastebasket.

The Wise Squirrel presents Does it Matter Who is the Main Provider Between Husband and Wife? posted at Squirrelers, saying, “Money story about a dual-income couple in which the husband had the opportunity for a big promotion that would have required a move, AND his wife to leave her job. Their different viewpoints are discussed.”

Ryan @ CML presents Get a Tax Deduction for a Working Vacation posted at Cash Money Life, saying, “Tips on how to write off a business trip as a tax deduction.”

Jeff Rose, CFP presents How to Pass the CPA Exam and Become a Certified Public Accountant posted at Jeff Rose, saying, “If you are interested in becoming a CPA, here are some of the experiences of someone who just recently passed the CPA exam.”

Jason @ Redeeming Riches presents What Sam Walton Teaches Us About Money, Success, and Family posted at Redeeming Riches, saying, “Sam Walton had it all – or did he? Find out the biggest regret he had on his death bed.”

Mr Credit Card presents Cash Vs. Credit, A Real World Experiment posted at Ask Mr Credit Card.

The Family CEO presents Debt Snowflakes: Or How I Made $821.73 in Extra Credit Card Payments This Month posted at The Family CEO.

Kaye presents Stuck in the Middle posted at Mrs Nespy’s World, saying, “The beginning of the journey was excited, the end will be exhilarating, but this “in the middle” stuff is for the birds.”

Kate Kashman presents Why Not To Bounce Checks posted at The Paycheck Chronicles, saying, “An accidental bounced check in college is still causing trouble, 20 years later.”

Michael Pruser presents Managing $225,000 in Debt Is Starting to Ware on Me posted at The Dough Roller, saying, “My struggles on managing a ton of debt!”

PT presents 5 Lessons Learned From Filing Bankruptcy posted at Prime Time Money, saying, “Lessons learned from an actual account of going through a bankruptcy.”

Silicon Valley Blogger presents Should You Pay Off Loans or Invest Your Money? posted at The Digerati Life, saying, “So you’ve got some money. Should you pay off your debt with it or invest the money? Here’s a personal account on what I’ve done.”

BWL presents Success Story: Paying Off A House In 5 Years While Tithing posted at Christian Personal Finance, saying, “This is an encouraging story of a woman who stuck to her convictions about giving 10% of her income and still managed to pay off her house in less than 5 years!”

Miranda presents Do I Really Want to Rent Out My House? posted at Personal Dividends – Money+Lifestyle.

2 Cents presents What Would Make Me Invest in the Stock Market? posted at Balance Junkie, saying, “We have not invested in the markets for a while now. A reader recently asked what it would take for us to get back in. Here’s my answer!”

FIRE Getters presents Early Retirement Case Study – Sandy Aldridge and Dale Lugenbehl posted at FIRE Finance, saying, “At times the fast pace of our city lives appear stifling making us long for a slower pace of life with more exposure to clean air and green vegetation. Our souls yearn for a simple life which is in greater harmony with Mother Nature. Of late our work related health problems have been making us yearn, almost every morning, for a more relaxed life with greater freedom. So we were thrilled to read about Sandy Aldridge and Dale Lugenbehl who retired early (at ages 48 and 47 respectively) more than a dozen years ago to their eight-acre farm in Cottage Grove, Oregon …”

Neal Frankle presents Find A High Paying 2nd Job Using Craigslist posted at Wealth Pilgrim: Money Management Advice, Financial Stess Management, Addiction Recovery Plan & Resources, saying, “You Can Find A High Paying 2nd Job Using Craigs List If you’re looking for high paying 2nd jobs, look no further than your computer screen.”

Super Saver presents Retiree Financial Lessons from the Recession posted at My Wealth Builder, saying, “Although I wish this recession had not happened, I am glad that it happened early in our retirement, while we were better able to meet the financial challenges.”

Craig Ford presents Medi-Share Medical Sharing | A Health Insurance Substitue posted at Money Help For Christians, saying, “Medical sharing is a great way to reduce your health insurance costs.”

passive family income presents Cutting Out Wasted Expenses to Save More Income posted at Passive Family Income, saying, “How many wasted expenses are you paying for? After sorting through my family’s past years credit card and bank statements, I have found several small money leaks in our personal finances.”

Kristina presents Our Parents Estate posted at Dual Income No Kids, saying, “If your parents are divorced, how has their separation affect the way you have planned your estate?”

Donna Freedman presents Rockin’ the surveys — when it’s worth it. posted at Surviving and Thriving, saying, “Online surveys can be a nice source of extra income — except when they aren’t.”

Joe Plemon presents My Car Needs an Engine. Should I Sell it, Fix it or Junk it? posted at Personal Finance By The Book, saying, “What do you do when your beloved car needs an engine: sell it, fix it or junk it? This post explores the options.”

FMF presents My Type of Couple posted at Free Money Finance, saying, “Story of a couple who collected 400k cans to pay for their wedding.”

Lindy presents Once Upon a Time…I Used an Iron posted at Minting Nickels, saying, “One of the likely first stops in expense-slashing is the luxury of paying for laundered shirts. This is a tale of my ironing saga (yes, it qualifies as a saga). And it’s not as boring as this description sounds. Thanks!”

Sandy presents One Disaster Away posted at Yes, I Am Cheap, saying, “We sometimes pass judgment on others for the financial situation, but most of us need to realize that all it takes is one disaster to be in the same situation.”

Bucksome presents Top 7 Ways I Budget My Time posted at Buck$ome Boomer’s Journey to Retirement, saying, “Budgets are needed for more than money in this story about 7 ways to budget time.”

Tom @ Canadian Finance Blog presents How to Watch Cheap and Free TV in Canada posted at The Canadian Finance Blog, saying, “Want to know how to see free TV in Canada? You have a few options with over the air free HDTV, broadcaster’s websites and cheap services like Netflix!”

Lauren Mendel presents A Very Scary Money Story posted at Richly Reasonable – Successes and failures, all in the name of living reasonably., saying, “This Halloween week read the true, terrifying tale of how Husband and I almost lost literally every important document that we have. Muahahaha! You might want to lock your doors and close the blinds before reading this one…”

Sun presents What’s in My Wallet? posted at The Sun’s Financial Diary.

Money Beagle presents Costco Coupon Policies – Truth or Fiction? You Decide posted at Money Beagle.

ctreit presents Our family budget has to accommodate this chocolate snob posted at Money Obedience, saying, “Name brands versus store brands.”

Rachel presents Sometimes Less Is More | MomVesting posted at MomVesting, saying, “Melinda talks about how the value of many things isn’t necessarily determined by their cost.”

That concludes this edition. Submit your blog article to the next edition of Carnival of Money Stories using the carnival submission form. Past posts and future hosts can be found on the blog carnival index page. Thank you, everyone, for participating!

In this installment of the Make Extra Money series, I’m going to show you how to set up a WordPress site. I’m going to show you exactly what settings, plugins, and themes I use. I’m not going to get into writing posts today. That will be next time.

I use WordPress because it makes it easy to develop good-looking sites quickly. You don’t have to know html or any programming. I will be walking through the exact process using Hostgator, but most hosting plans use CPanel, so the instructions will be close. If not, just follow WordPress’s 5 minute installation guide.

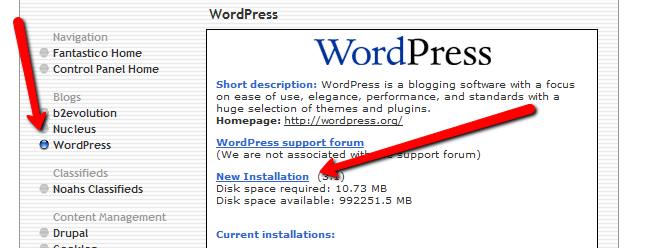

Assuming you can follow along with me, log in to your hosting account and find the section of your control panel labeled “Software/Service”. Click “Fantastico De Luxe”.

On the Fantastico screen, click WordPress, then “New Installation”.

On the next screen, select your domain name, then enter all of the details: admin username, password, site name, and site description. If you’ll remember, I bought the domain http://www.masterweddingplanning.net. I chose the site name of “Master Wedding Planning” and a description of “Everything You Need to Know to Plan Your Wedding”.

Click “install”, then “finish installation”. The final screen will contain a link to the admin page, in this case, masterweddingplanning.net/wp-admin. Go there and log in.

After you log in, if there is a message at the top of the screen telling you to update, do so. Keeping your site updated is the best way to avoid getting hacked. Click “Please update now” then “Update automatically”. Don’t worry about backing up, yet. We haven’t done anything worth saving.

Next, click “Settings” on the left. Under General Settings, put the www in the WordPress and site URLs. Click save, then log back in.

Click Posts, then Categories. Under “Add New Category”, create one called “Misc” and click save.

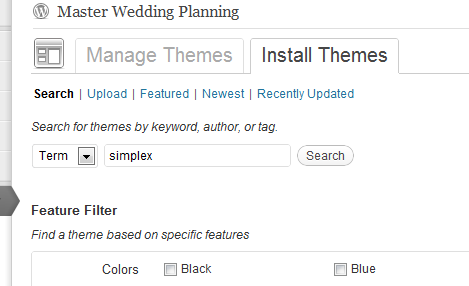

Click Appearance. This brings you to the themes page. Click “Install Themes” and search for one you like. I normally use Headway, but before I bought that, I used SimpleX almost exclusively. Your goal is to have a simple theme that’s easy to maintain and easy to read. Bells and whistles are a distraction.

Click “Install”, “Install now”, and “Activate”. You now have a very basic WordPress site.

A plugin is an independent piece of software to make independent bits of WordPress magic happen. To install the perfect set of plugins, click Plugins on the left. Delete “Hello Dolly”, then click “Add new”.

In the search box, enter “plugin central” and click “Search plugins”. Plugin Central should be the first plugin in the list, so click “install”, then “ok”, then “activate plugin”. Congratulations, you’ve just installed your first plugin.

Now, on the left, you’ll see “Plugin Central” under Plugins. Click it. In the Easy Plugin Installation box, copy and paste the following:

All in One SEO Pack Contact Form 7 WordPress Database Backup SEO SearchTerms Tagging 2 WP Super Cache Conditional CAPTCHA for WordPress date exclusion seo WP Policies Pretty Link Lite google xml sitemaps Jetpack by WordPress.com

Click “install”.

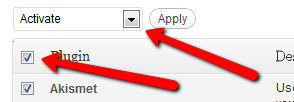

On the left, click “Installed Plugins”. On the next screen, click the box next to “Plugins”, then select “Activate” from the dropdown and click apply.

Still under Plugins, click “Akismet Configuration”. Enter your API key and hit “update options”. You probably don’t have one, so click “get your key”.

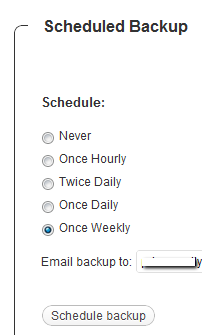

The only tool I worry about is the backup. It’s super-easy to set up. Click “Tools”, then “Backup”.

Scroll down to “Schedule Backups”, select weekly, make sure it’s set to a good email address and click “Schedule Backup”. I only save weekly because we won’t be adding daily content. Weekly is safe enough, without filling up your email inbox.

There are a lot of settings we’re going to set. This is going to make the site more usable and help the search engines find your site. We’re going to go right down the list. If you see a section that I don’t mention, it’s because the defaults are good enough.

Set the Default Post Category to “Misc”.

Visit this page and copy the entire list into “Update Service” box. This will make the site ping a few dozen services every time you publish a post. It’s a fast way to get each post indexed by Google.

Click “Save Changes”.

Uncheck everything under “Email me whenever…” and hit save. This lets people submit comments, without actually posting the comments or emailing me when they do so. Every once in a while, I go manually approve the comments, but I don’t make it a priority.

Select “Custom structure” and enter this: /%postname%/

Click save.

Set the status to “Enabled”, then fill out the site title and description. Keep the description to about 160 characters. This is what builds the blurb that shows up by the link when you site shows up in Google’s results.

Check the boxes for “Use categories for META keywords” and “Use noindex for tag archives”.

Click “Update Options”.

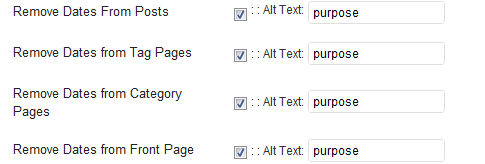

Check the boxes to remove each of the dates and set the alt text to “purpose” or something. This will suppress the date so your posts won’t look obsolete.

This plugin reinforces the searches that bring people to your site. It’s kind of neat. Skip the registration, accept the defaults and hit save.

Scroll to the bottom and click import. We’ll come back to this.

Select “Caching On” and hit save.

Across the top of the screen should be a giant banner telling you to connect to WordPress.com and set up Jetpack. You’ll need an account on WordPress.com, so go there and set one up. After authorizing the site, you’ll be brought back to the Jetpack configuration screen. Click “Configure” under “WordPress.com Stats”. Take the defaults and hit save.

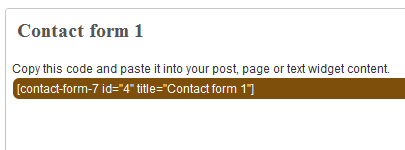

On the contact configuration page, copy the code in the top section. You’ll need this in a moment.

Now, we going to create a couple of static pages. On the left, click “Pages”, then “Add new”.

Name the first page “Contact” and put the contact form code in the body of the page. Hit publish.

Under Appearance, click “Menu”. Enter a menu name and hit save.

Then, under “Pages”, click the box next to “Contact”, “Disclaimer”, and any other policies you’d like to display. Hit save.

Also under Appearance, click “Widgets”. This is where you’ll select what will display in the sidebar. All you have to do is drag the boxes you want from the middle of the page to the widget bar on the right. I recommend Text, Search, Recent Posts, Popular Search Terms and Tag Cloud. In the text box, just put some placeholder text in it, like “Product will go here”. We’ll address this next time.

We’re not going to worry about getting posts in place, yet. That will be the next installment. However, the steps in the next installment could take 2 weeks to implement, and we want Google to start paying attention now. To make that happen, we need to get a little bit of content in place. This won’t be permanent content. It’s only there so Google has something to see when it comes crawling.

To get this temporary, yet legal content, I use eZineArticles. Just go search for something in your niche that doesn’t look too spammy.

Then, click “Posts”, then delete the “Hello World” post. Click “Add new”. Copy the eZine article, being sure to include the author box at the bottom, and hit publish.

To see your changes, you may have to go to Settings, then WP Cache and delete the cache so your site will refresh.

Congratulations! You now have a niche blog with content. It’s not ready to make you any money, yet, but it is ready for Google to start paying attention. In the next installment, I’ll show you how I get real unique content and set it up so Google keeps coming back to show me the love.

On the first and the fifteenth of every month, my paycheck is deposited into my bank account. Some fraction of it is saved, while another(larger) fraction is spent. They put the money in a vault and protect it from being stolen. Anything I manage to save and anything I haven’t managed to spend yet, will build interest. The bank pays me to keep my money there, even if it’s just for a short time. Why would they do that? If I asked you to hold on to $100 for me, in exchange for giving me $10 next week, you’d laugh at me. Right? If I told you that I was expecting you to keep that $100 heavily guarded in a locked room that requires a staff and utilities, you’d try to have me committed, yet that’s what banks do every day.

What’s in it for the bank?

Let’s start at the beginning. In the financial world, there are fundamentally two types of people: those who have money and those who need it.

The people who have money get it by producing something or otherwise providing value to someone for something. They then spend less than they made, leading to an accumulation of money. Woo! Rich people! Naturally, this money gets stuffed in a mattress for safe-keeping. Their money does nothing except collect dust and, occasionally, hungry insects. It is also used to soften a hard mattress.

People who need money have a few choices. They can beg for it, work for it, or steal it. The third option leads to perforation or imprisonment, so we won’t address that one. Now, you can work for your paycheck, like most adults, or you can go, hat in hand, to a charity and ask for money. But what if you want to start a business? You’ve invented the super-widget, a device guaranteed to revolutionize the world more than anything since sliced bread or the USB-powered pet rock. You got a concept and a prototype, you just don’t have the tooling or manpower to produce the millions of super-widgets the world will soon be beating a path to your door to own. You also lack a marketing budget to tell the world to stock up on path-beaters to make it to your door. What do you do?

Enter banks.

A bank will approach the first class of people and talk their money out of the mattresses and mayonnaise jars. They offer to hold the money for the people who have it. They will protect it from theft and they will pay the owner a fee for the privilege of holding on to the cash safely. Of course savers jump at the chance. They can quit worrying about the maid making the bed and becoming a millionaire and they can build wealth with no work. But wait…TANSTAAFL, right? You can’t get something for nothing. The world doesn’t work that way.

The bank takes your money–and the money of thousands of people like you–for safe-keeping. They pay you a fee, called interest. The rest, the loan out to the second group of people, the ones who need the money. They set aside some of the deposits so the owners can make withdrawals, but the rest goes into the loan-pool. People who need money come to the bank, explain their needs and demonstrate their ability to repay the loan, then they are given money for a fee, also called interest. The interest rate for the borrower is significantly higher–sometimes 20 times higher–than the interest paid to depositors. The difference between interest earned and interest paid is what pays the bank’s bills. That gap pays for the rent, taxes, and payroll.

Ultimately, a bank’s job is to connect the savers with the spenders in a way that’s reliable enough to ensure everybody benefits. If anybody in the chain ceases to benefit, the system collapses. Depositors switch back to using mattresses, borrowers go back to their loan-shark grandparents, and banks close their doors. This is the system that allows the entrepreneurial spirit to thrive, while making money for everyone involved.

This is a guest post written by Andreas Nicolaides, a financial author for UK based MoneySupermarket.com.

Whether your aim is to save money for a special occasion or you just want to make sure you don’t have to struggle financially when it comes to the end of the month, a budget can be a saving grace. Budgets help us quickly and easily identify our total income and all our expenditure, allowing us to plan for the best and prepare for the worst financial situations.

Set yourself a target

If you have decided to set up a budget, then there must be a reason. Are you looking to save for an upcoming event? Or maybe you have realised that you are struggling to make your payments every month and you would like to feel more financially secure. Based on what you would like to get out of your budget, you should set yourself a specific, measurable objective.

My first objective I set for myself was to save $100 every month for a year. This sort of objective is easy to manage and easy to monitor and this is what we are trying to achieve. One important thing I would mention here is to ensure your objective is achievable; don’t set yourself a target that is too far out of your reach, being realistic is extremely important.

How do you set up your budget?

The main key thing when you start to put your budget together is to make sure you’re as honest as possible. Get yourself a pen and some paper and on one page detail all of your income. Include the obvious and also remember to include any benefits you are entitled too. Then grab another piece of paper and detail all of your monthly outgoings, remember to be honest and thorough and try not to forget anything. Once you have both figures, deduct your expenditure from your monthly income that will give you your monthly figure.

You have some extra cash?

If when you have your figure you realise that there is some cash left over, you can then decide what you want to do with it. My advice here depends on your own personal circumstances, for example if you have high levels of debt, your main aim should be tackle your high interest debt aggressively and as often as possible.

If you have some money left over and your aim is to save, then set up an interest bearing bank account. If you are based in the US then you could look to set up an LSA or lifetime savers account. In the UK we have the equivalent, that is called a cash ISA saving account.

No money left over?

If after working out your budget you find you have no money left over, then you need to do something about it. Debt is one of those things that won’t just disappear overnight; it’s something that takes time and commitment, but not giving up is paramount.

How to cut down your expenditures?

One of the main things you can do when you realise you are in a bad situation is to try and cut down on your expenditure. Here’s a couple of quick ways:

A budget is used by many just to monitor what they spend month to month, but I hope I have detailed how it can be a helpful financial tool that can help you reach your financial goals. I hope my tips to budget successfully will help you get started on your way to financial freedom.

Today, I am continuing the detailed examination of my budget. Please see part one to catch up.

This time, I’m going to look at my monthly bills. These are predictable and recurring expenses, though not all of them are entirely out-going.

Let’s dig in: [Read more…] about Budget Lesson, Part 2