- Getting ready to go build a rain gauge at home depot with the kids. #

- RT @hughdeburgh: "Having children makes you no more a parent than having a piano makes you a pianist." ~ Michael Levine #

- RT @wisebread: Wow! Major food recall that touches so many pantry items. Check your cupboards NOW! http://bit.ly/c5wJh6 #

- Baby just said "coffin" for the first time. #feelingaddams #

- @TheLeanTimes I have an awesome recipe for pizza dough…at home. We make it once per week. I'll share later. in reply to TheLeanTimes #

- RT @bargainr: 9 minute, well-reasoned video on why we should repeal marijuana prohibition by Judge Jim Gray http://bit.ly/cKNYkQ plz watch #

- RT @jdroth: Brilliant post from Trent at The Simple Dollar: http://bit.ly/c6BWMs — All about dreams and why we don't pursue them. #

- Pizza dough: add garlic powder and Ital. Seasoning http://tweetphoto.com/13861829 #

- @TheLeanTimes: Pizza dough: add lots of garlic powder and Ital. Seasoning to this: http://tweetphoto.com/13861829 #

- RT @flexo: "Genesis. Exorcist. Leviathan. Deu… The Right Thing…" #

- @TheLeanTimes Once, for at least 3 hours. Knead it hard and use more garlic powder tha you think you need. 🙂 in reply to TheLeanTimes #

- Google is now hosting Popular Science archives. http://su.pr/1bMs77 #

- RT @wisebread 6 Slick Tools to Save Money on Car Repairs http://bit.ly/cUbjZG #

- @BudgetsAreSexy I filed federal last week, haven't bothered filing state, yet. Guess which one is paying me and which one wants more money. in reply to BudgetsAreSexy #

- RT @ChristianPF is giving away a Lifetime Membership to Dave Ramsey’s Financial Peace University! RT to enter to win… http://su.pr/2lEXIT #

- RT @MoneyCrashers: 4 Reasons To Choose Community College Out Of High School. http://ow.ly/16MoNX #

- RT @hughdeburgh:"When it comes to a happy marriage,sex is cornerstone content.Its what separates spouses from friends." SimpleMarriage.net #

- RT @tferriss: So true. "Nearly all men can stand adversity, but if you want to test a man's character, give him power." – Abraham Lincoln #

- RT @hughdeburgh: "The most important thing that parents can teach their children is how to get along without them." ~ Frank A. Clark #

Black Friday

- Image by Getty Images via @daylife

Today being the biggest shopping day of the year, I thought I’d get in the game.

First, instead of helping you spend money, I’m going to help you save it. As I’ve mentioned before, I am a big fan of INGDirect. They make it easy to create savings accounts for specific savings goals and they have a decent interest rate. I’ve never had a problem with any of my accounts.

For Black Friday(through Sunday!), they are offering the following:

- Earn $103. Open Electric Orange November 26th – 28th, and make a total of 7 purchases using your Electric Orange Card or Person2Person Payments (or any combination of the two) within 45 days.

- Open a Kids Savings Account November 26th – 28th and we’ll(ING) put a $25 bonus into your new account.

- Use your Electric Orange Debit MasterCard® at least one time from 8:00 AM ET, November 26th – 7:59 PM ET, November 26th, and you’ll be automatically entered into the 100% Cash Back Giveaway.

- Open a 36-month IRA CD with ING DIRECT November 26th – November 28th and get 2.00% Annual Percentage Yield (APY). Ask them about work at home moms and dads spousal IRA.

- Apply online November 26th – 28th for Easy Orange or the Orange Mortgage or call a Mortgage Specialist at 1-866-327-4599 and get up to $2,000 off closing costs. If your costs are less than $2,000, you pay nothing.

- 25% rebate on Sharebuilder trades that execute today or Monday.

Click here to open an account with the best bank to ever hold my money.

Now, to help you spend some money.

All of my websites are hosted by HostGator. I’ve never had noticeable downtime or any technical problems. The one issue I had that couldn’t be controlled by their interface was fixed by technical support in minutes. Not hours, minutes. They are having an amazing deal today. From 5AM to 9AM CST, all of their products are 80% off. The rest of the day, it’s all 50% off. Unfortunately, this doesn’t apply to existing customers, but if you are looking for a website host, paying $35 for 3 years of hosting can’t be beat.

3 Things You Need to Know About Homeowner’s Insurance

- Image by ecstaticist via Flickr

If you are a homeowner, you need homeowner’s insurance. Period. Protecting what is mostly likely the biggest investment of your life with a relatively small monthly payment is so important, that, if you disagree, I’m afraid we are so fundamentally opposed on the most basic elements of personal finance that nothing I say will register with you.

If, however, you have homeowner’s insurance, or–through some innocent lapse–need homeowner’s insurance and you just want some more information, welcome!

The basic principle of insurance is simple. You bet against the insurance company that you or your property are going to get hurt. If you’re right, you win whatever your policy limit is. If you’re wrong, the insurance company cleans up with your monthly premium. Insurance is gambling that something bad will happen to you. If you lose, you win!

Now, there are some things about homeowner’s insurance that you may not realize.

1. Homeowner’s insurance will not protect you against a flood. For that you need flood insurance. The easiest way to tell which policy covers water damage is to see if the water touched the ground before your house. An overflowing river, or heavy rain that seeps through the ground and your foundation are both considered flooding. On the other hand, hail breaking your windows and allowing the rain in or a broken pipe are both generally covered by your homeowner’s policy.

Do you need flood insurance? I would say that, if you live on the coast below sea level, you should have flood insurance. If you’re on a flood plain, you need flood insurance. If you’re not sure, use the handy tool at http://www.floodsmart.gov to rate your risk and get an estimate on premium costs. My home is in moderate-to-low risk of flooding, so full coverage starts at $120.

2. You can negotiate an insurance claim. When you have an insurance adjuster inspecting your home after you file a claim, most of the time they will lowball you. Generous adjusters don’t get brought in for the next round of claims. If you know the replacement costs are higher than they are offering, or even if you aren’t sure, don’t sign! Once you sign, you are locked into a contract with the insurance company. Take your time and do your research. Get a contractor out to give you a damage estimate, if you can.

3. Your deductible is too low. If you’ve built up an emergency fund, you can safely boost your deductible to a sizable percentage of that fund and save yourself a bunch of money. When we got our emergency fund up to about $2000, we raised our deductible from $500 to $1000 and saved a couple of hundred dollars per year. That change pays for itself every 2 years we don’t have a claim. I absolutely wouldn’t recommend this if you don’t have the money to cover your deductible, but, if you do, it can be a great money-saver.

Bonus tip: If you get angry that your homeowner’s insurance doesn’t cover flooding, even if you haven’t had to deal with a flood, and you cancel your insurance out of spite, and you subsequently have a ton of hail damage, your insurance company won’t cover the crap that happened during the window where you weren’t their customer.

Are you one of the misguided masses who prefer to trust their home to fate?

Do you have an insurance horror story?

The Evils of a Reverse Mortgage

Picture it: Sicily, 1922.

Sorry, wrong channel. Let’s try again.

Picture it: 20, 30, 50 years from now. You’re old. The money you’ve been failing to save so you could stock up on Fritos and obsolete video game consoles(to survive the zombie apocalypse in style) would come in handy about now, since the end of the world never happened. Note to self: Never trust an ancient Mayan.

You’re 70, with no savings and no income aside from the Social Security check that hasn’t been adjusted for inflation since the Palin(Bristol) administration.

But you own your house and that nice young man down at Yersk Rude Bank recommended a reverse mortgage. That could give you all of the money you need to live a comfortable retirement and pay for a bit of a funeral.

Right?

Nazzofast.

Of all of the possible social security strategies, this is one of the worst.

What is a reverse mortgage?

In a traditional mortgage, you’re given a chunk of money guaranteed by your home. You have to pay that money back over time, or you’ll lose your house. In a reverse mortgage, you’re still converting your home’s equity into cash, but you don’t have to pay it back until you die or move, including moving into a nursing home. You are effectively abandoning future-house in exchange for now-money.

Who qualifies for a reverse mortgage?

If you are 62 or older, and live in a home you own, you qualify. Credit and income are not considered.

Why would you want a reverse mortgage?

If money is tight and you have no prospects, a reverse mortgage may be a valid consideration. A better consideration would be to take out a traditional loan and make monthly payments out of that lump sum, or sell your house outright and move someplace more affordable.

What are the downsides of a reverse mortgage?

You lose your house. Technically, your heirs lose your house. A reverse mortgage becomes due when you die. If your heirs can’t cover the loan, the house will be foreclosed. Also, this is a loan. It accumulates interest, even if you aren’t paying it back. If you borrow $200,000 and die in 10 years, your estate may owe $400,000 on the reverse mortgage. If this is a treasured family home, losing it could come as a shocking blow at a time when your family would already be reeling from the loss of, well, you.

What if you really don’t like your heirs?

I’d still recommend getting a traditional mortgage. You can throw a killer party and then, you’ll rebuild equity over time. That way, if you live longer than you expect, you can refinance and throw another killer party. If you go this route, don’t invite the kids, but be sure to hire a videographer so they can see how you’re spending their inheritance.

I’m not a banker or a financial advisor, but I’d recommend against a reverse mortgage in almost all circumstances.

How about you? Would you get one, or recommend one? What’s your preferred method to hurt your ungrateful heirs?

Corporate Bankruptcy Hurts Employee’s Most

This is a guest post from Hunter Montgomery. He writes for Financially Consumed on every-day personal finance issues. He is married to a Navy meteorologist, proud father of 3, a mad cyclist, and recently graduated with a Master’s degree in Family Financial Planning. Read his blog at financiallyconsumed.com.

Bankruptcy has evolved from something that people and businesses were deeply ashamed of a few decades ago, to a seemingly acceptable path to restructuring; towards a more sustainable future. Bankruptcy is so common in corporate America that it is referred to by some as an acceptable and necessary business tool.

This bothers me on a number of levels, but mainly because corporate bankruptcies hurt the humble employee the most. The laws are supposedly designed to help the company stay in business, and continue to provide jobs. But at what cost to those employees?

When a company declares bankruptcy, they are essentially admitting to the world that they failed to compete. Their business model was flawed, they were poorly managed, and they simply did not organize their resources appropriately to meet their consumer needs.

Given this failure, it shocks me, that bankruptcy laws are designed to allow management to get together with their bankers. They essentially protect each other. Management is obsessed with holding on to power. The bankers are obsessed with avoiding a loss.

The bankruptcy produces a document called first-day-orders. This is a blueprint for guiding the organization towards future prosperity. But this is essentially drafted by the existing company management, and their bankers. Do you see any conflict of interest emerging here?

Bankers are given super-priority claims to the money they have loaned the company. Even before employee pension fund obligations. This is absurd. Surely if they loaned money to an enterprise that failed, they deserve to lose their money.

Management generally rewards itself with large bonuses, after declaring failure, paying off their bankers, shafting the employees, and finally re-emerging with a vastly smaller company. This is ridiculous.

The humble employee pays the highest price. Assuming there is even a job to return to after restructuring they have likely given up pay, working conditions, healthcare benefits, and pension benefits.

This is exactly what happened at United Airlines in 2002 after they filed for chapter 11 bankruptcy protections. The CEO received bonuses, and was entitled to the full retirement package. The banker’s enjoyed super-priority claims over company assets to cover their loans. Meanwhile, the employees lost wages, working conditions, healthcare benefits, and a 30% reduction in pension benefits.

An adjustment like this would force a serious re-evaluation of retirement plans. For most people, it would require additional years in the workforce before retirement could even be considered a real possibility.

Employees of General Motors, which recently went through bankruptcy proceedings, also had to give up significant healthcare benefits, and life insurance benefits. Entering bankruptcy, it was the objective to reduce retiree obligations by two-thirds. That’s a massive cut.

The warning to all of us here is that we must do everything possible not to fall victim to corporate restructuring. Save all you can, outside of your expected pension plan, because you never know when poor management, or a terrible economy, will force your employer to file bankruptcy. Always plan for the worst possible outcome.

It’s a competitive world and it’s quite possible that the traditional American system of benefits is uncompetitive, and unsustainable in the global market place. The tragedy of adjusting to a more sustainable system is that the employee suffers the most.

Make Extra Money Part 4: Keyword Research

In this installment of the Make Extra Money series, I’m going to show you how I do keyword research.

Properly done–unless you get lucky–this is the single most time-consuming part of making a niche site. If you aren’t targeting search terms that people use, you are wasting your time. If you are targeting terms that everybody else is targeting, it will take forever to get to the top of the search results.

Spend the extra time now to do proper keyword research. It will save you a ton of time and hassle later. This is time well-spent.

If you remember from the last installment, when we researched products to promote, we narrowed our choices down to a few products.

What I’ve done is create a spreadsheet to score the products. You can see the spreadsheet here. I’ll explain the columns as we populate them.

The first column contains the name of the product. Easy. We’ve got 10 products. I’m going to walk through scoring 1 product, then, through the magic of the internet, I’ll populate the rest, and you’ll get to see the results instantly. Wow.

The second column is the global search volume for the exact search term. I base my product niche sites primarily on the demand for a given product. Everything else is a secondary consideration.

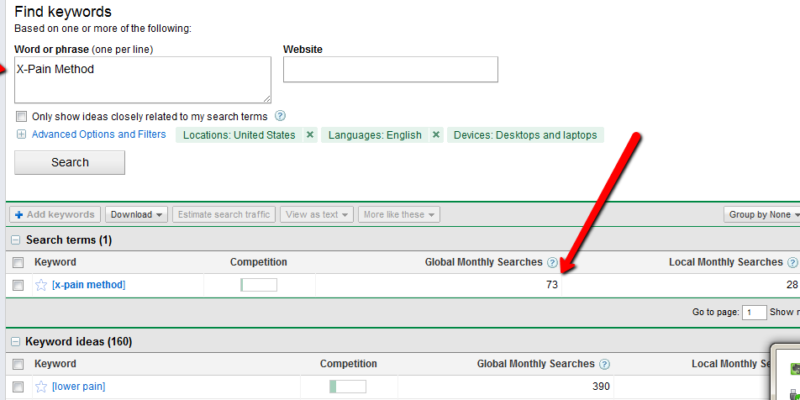

To find the demand for a product, go to the Google Adwords Keyword Tool. In the “word or phrase” box, enter your product name, exactly. In this case, it’s “X-Pain Method”. When the search results come up, change the match type to “Exact”. You should have something like this:

Enter the global search volume in column 2. In this case, it’s 73. Keep this window open, because we’ll be coming back to it.

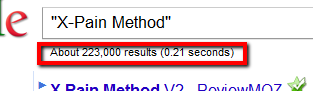

Column 3 is the search competition. Go to google and enter your product name, in quotes. In this case, “X-Pain Method”. Put the total number of search results in column 3: 223000.

Column 4 is the search competition, but only what appears in a page’s title. Your search query is intitle:”X-Pain Method”, which yields 4400 results.

The next column is for the average PageRank of the first page of search results. For this, I use Traffic Travis. I use the 4th edition, which is paid software, but you can get the free version of version 3, instead. I’ll use version 3 for this example. Open the software and click on “SEO Analysis” on the bottom left of the screen. Put your search term (“X-Pain Method”) in the “phrase to analyze” and set the “Analyze Top” to 10, then hit “Analyze”. When it’s done running, just add up all of the PRs and divide by 10. Ignore Travis’s difficulty rating.

Now, for the rest of the columns, we’re going to look at the keyword tool again. We’re going to pick 3 alternate search terms. Here are the criteria:

- At least 1000 global monthly searches. We want terms that people are searching for.

- Competition bar at medium or less. This bar is just a rough guess on competition, so it’s really an arbitrary exclusion factor, but it helps narrow down the choices.

- A “buying” keyword is preferred, but not necessary. This is a term that indicates people are looking to spend money. “Back pain doctor” is a buying keyword, but it’s not an indicator that someone wants to buy a product, so we’ll skip it. A buying keyword isn’t absolutely necessary, because these will also be the terms we’ll use to generate content later.

- It has to be related to our product.

Once we pick the keywords, we’ll throw them into google to get the competition, just like we did to populate column 2.

“Exercises for back pain” has medium competition and 1900 monthly searches. It also has an estimated cost-per-click of $3.02, which means people are paying for this.

“Lower back pain exercises” has 6600 searches and medium competition. It’s actually on the lower end of medium, so it looks really promising.

“Lower back” has 4400 searches and low competition, with a CPC of $6.24. This should be a good one. Scratch that. It has 40 million search results, but only 4400 searches. That’s a lot of competition for a small market.

Instead, I’m going to search for “cure back pain” in the keyword tool and see what I get. “Upper back pain” is better. Low competition, 18000 searches each month, and only 2000000 competing search results. Now, I’ll score it.

You really want at least 500 searches per month for the product name. More than 2500 is better. I’m going to assign 1 point per 500 monthly searches.

You also want a lower number of search results. Less than 10,000 is ideal. Less than 100,000 is still decent. More than 250,000, I’d walk. So, under 10,000 gets 5 points. Under 50,001 gets 4. Under 100,001 gets 3. Under 200,001 gets 2. Under 250,001 gets 1. Any higher gets 0.

The ideal intitle search will have less than 2000 results. More than 100,000 is too time-consuming to deal with. 0-2000: 5 points; 2001-10,000: 4 points; 10001-25000: 3 points; 25001-50000: 2 points; 50001 to 100000: 1 point.

The perfect product will have the first page of search result all with a PageRank of 0. That’s a 5 point product. I’ll knock off half a point for every point of average PR.

The related terms are more relaxed. They are what’s known as “Latent Semantic Indexing” (LSI) terms. We will be creating articles to match those search terms, mostly to make our niche site look as natural and real as possible. Any actual traffic those pages drive is just gravy. Points for the related searches start at 10 and get 1 point knocked off for each 3 million results. We’ll be treating the 3 terms as one for this score.

That gives us a perfect score of about 25. There’s no actual upper limit, since the score for the search volume has no upper limit. X-Pain Method scored 18.22.

Now, excuse me a moment while I score the rest.

I’m back. Did you miss me?

I’ve finished scoring each of the products and sorted the results by score. The clear winner is the back pain product, but the lack of searches bothers me. The wedding guide looks much nicer, especially if I target the phrase “wedding planning guide” during the SEO phase of the project. That change alone brings the score almost to first place.

Frankly, I’d take either 2nd or 3rd place over the back pain product. The bare numbers don’t support it, but my judgement tells me they are better products to promote.

There is one final step before deciding on the product. I have to buy it. I can’t review the product without seeing it and I can’t promote it without approving of it.

That’s the secret to ethical niche marketing, you know. Only promote good products that you’ve personally read, watched, or used.