- RT @ScottATaylor: The Guys on "Pickers" should just follow the "Hoarders" teams around- perfect mashup #

- PI/PNK test: http://su.pr/2umNRQ #

- RT @punchdebt: When I get married this will be my marital slogan "Unity through Nudity" #

- http://su.pr/79idLn #

- RT @jeffrosecfp: Wow! RT @DanielLiterary:Stats show 80% of Americns want to write a book yet only 57% have read at least 1 bk in the last yr #

- @jeffrosecfp That's because everyone thinks their lives are unique and interesting. in reply to jeffrosecfp #

- @CarrieCheap Congrats! #CPA in reply to CarrieCheap #

- @prosperousfool I subscribe to my own feed in google reader. Auto backup for in between routine backups. Saved me when I got hacked. in reply to prosperousfool #

- @SuzeOrmanShow No more benefits? I bet the real unemployment rate goes down shortly thereafter. in reply to SuzeOrmanShow #

- Losing power really make me appreciate living in the future. #

20 Happy Thoughts

Since I’ve been on a bit of a death theme lately, I thought I post something purely happy.

Here it is. In no particular order, twenty unequivocated things that make me happy.

- My three year old has the most beautiful blue/silver/gray eyes I have ever seen.

- In the past 32 months, I’ve reduced my total debt load by $42,859.70. That’s an average reduction of $1,339.37 per month.

- My insane work schedule is paying off. I’m more than halfway to making my day job’s income redundant.

- My preteen son is currently showing none of the signs of the horrible rebellion that I put my parents through.

- The world hasn’t imploded, exploded, or tilted its axis recently.

- My parents did a good job of raising me.

- I haven’t touched my overdraft line of credit in more than 2 years.

- My wife loves me.

- I love her.

- Wrestling season starts tomorrow, and Punk ended last season with real promise.

- I’ve dropped 12 pounds in the last 16 days.

- Bacon is good.

- Daughter #1 is starting kindergarten in September and excited about it.

- Our cars are paid off.

- This site helps me stay motivated to eliminate my debt.

- You rock.

- I may get out of debt just before the world ends.

- The Yakezie Network has helped get this blog to where it is. If you’ve got a finance blog, join today. You won’t regret it.

- FINCON 2012 is is Denver and I won’t be napping on my motorcycle on the way there, like I did the last time I went to Denver. It’s not something I recommend, but it makes a neat story.

- I have 20 things to be happy about. That’s a recursive happy-maker right there.

Can Bad Credit Cost You Your Job?

Did you know that having a bad credit history could cost you your job? An increasing number of American employers have turned to running credit checks to screen job

applicants. Some companies even evaluate existing employees on a regular basis by checking their credit reports. If you have outstanding debts, you might consider getting one of those credit cards for bad credit to clean up your report before you apply for your dream job.

Not all companies run your credit history when you apply for a position. However, if you’re applying for a job that entails working with money or valuables, it’s a safe bet that they’ll be checking your credit history. Financial institutions, brokerage companies and jewelry manufacturers all run credit checks, as do hotels, accounting firms, human resource departments and government agencies.

Companies run credit checks because they want to hire employees who won’t be tempted to embezzle company funds to pay off large debts. Some companies fear that employees who carry large debt loads are susceptible to blackmail or bribery. The federal government carries this concern even further, indicating that citizens who owe large debts are considered national security risks.

Many companies feel that your credit report gives them a sneak peak at your true character. Having a good credit history indicates that you are a responsible person with excellent character. Having a bad credit history means that you are an unreliable person of poor character. True or not and fairly or not, this is the current belief running throughout company hiring departments.

Unfortunately, you can’t relax about your credit report even after you’ve been hired for a position. Once you’ve given a company written permission to check your credit report, they can recheck it at a later date. Government and financial organizations often run periodic credit checks on all of their employees. Some companies only recheck your credit history if you are up for a promotion. It’s a good idea, therefore, to keep your credit history squeaky clean.

Keep in mind that having a couple of late payments probably won’t kill your chances of employment or promotion. Most employers look for the really big issues, such as high credit card balances, defaulted student loans, repossessions and foreclosures. Some companies also look for charge-offs and consistent late payments as well.

Steps You Can Take

Financial experts suggest checking your credit report before you start your job search. Read your credit report carefully and make sure that all of the information is accurate. If your report contains incorrect details or any unauthorized charges, dispute these errors immediately and have them corrected to raise your credit score.

If you have a host of unpaid bills, find a way to settle those debts to improve your credit history before applying for jobs. Many people turn to credit cards for bad credit consumers. These cards allow you to consolidate all of your debts into a single debt. Just don’t forget to make the payments on this card.

Be upfront with potential employers about any negative marks on your credit history. Just tell them that you have had past issues with your credit and are now working to clear up all of your debt. There’s no need to go into explicit detail.

Once you have a job, be sure that you check your credit report at least every six months to ensure it contains only correct information. Pay all of your creditors on time. Never take out any new lines of credit unless you are absolutely positive that you can pay it back in a timely manner.

Post by Moneysupermarket

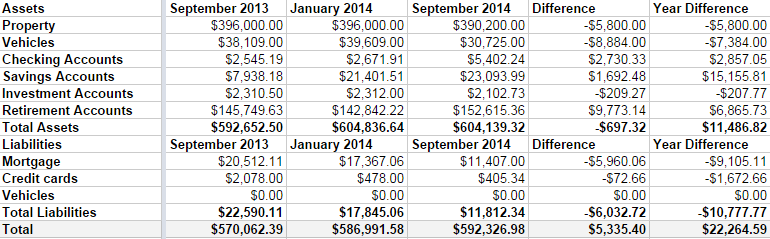

Net Worth Update – September 2014

It’s time for my irregular-but-usually-quarterly net worth update. It’s boring, but I like to keep track of how we’re doing. Frankly, I was a bit worried when I started this because we’ve been overspending this summer and Linda was off work for the season.

But, all in all, we didn’t do too bad.

Some highlights:

- Both of our properties lost around $3000 in value. I’m not worried, because we are keeping them both for the long haul. The rental is basically on auto-pilot, so that’s free money every month.

- We sold a boat that appraised for much less I had estimated in the last few updates. I had it listed for $5000, but it was worth $2000.

- I do have a credit card balance at the moment, but that goes away as soon as my expense check clears the bank, which will be in a day or two.

- We’re in the home stretch with the mortgage. There is $11,407 left to go, and we’ve paid down $9105 in the last year. By this time next year, I want that gone, gone, gone.

I can’t say I’m upset with our progress. We’ve paid down $6000 in debt in 2014, including 3 months with 1 income. We aren’t maxing our retirement accounts, yet, but I’d like to be completely debt free before I do that. It’s bad math, but having all of my debt gone will give me such a warm fuzzy feeling, I can’t not do it.

My immediate goal is to hit a $600,000 net worth by my next update in January. I’m only about $7000 off.

Time to hit the casino. Err, I mean, time to up my 401k contribution from 5% to 7%.

Welcome to Unemployment

Last week, I was let go from my job. The reasons are unimportant.

http://gty.im/167334756

So now, I am unemployed right before Christmas.

And my renters are moving out at the end of the month.

Normally, this should be a time for panic, but strangely, it’s not.

It actually came with a feeling of relief. Again, the reasons are unimportant.

But still, my predictable income has suddenly become unpredictable.

It is times like this that I’m glad I’ve spent the last 5 years crushing my debt. I currently have about $1000 on a credit card from my monthly expenses and around $10,000 on my mortgage.

That’s it. There’s no soul-destroying credit card debt. No car payment.

Trimming down to the not-painful-but-not-barebones basics puts my monthly nut at $3300. Leaving a bit of comfort and savings in place, that jumps to $4000.

Our income from my wife’s job and the renter in our home comes to about $1600 per month. That’s $1700 per month that we’re off from the basics and $2400 we’re off from a comfortable level.

However, I expect to have our rental house rented by the end of the year. There are some repairs we have to make after the current tenants leave. That will bring in a minimum of $1200 per month, hopefully $1500. That closes the gap to $500-1200.

Now, aside from the biggest benefit of killing out debt(no monthly payments!), we’ve also been saving about 20% of our income outside of our retirement accounts. We have enough to bridge that gap for 25-60 months. Unemployment will also provide enough to cover the difference for about 6 months. That means without doing any side work…sitting on my butt playing video games…I could cover my bill comfortably for two and a half years. If I cut down to bare minimum expenses, I can stretch that to nearly 7 years.

That’s why I don’t drive a new car or wear expensive clothes. That’s why I don’t vacation on my credit cards. That’s why my kids don’t have the latest, greatest video game systems and we don’t have a big screen TV.

It’s because we chose to prioritize our financial security over pure luxuries. We chose to sacrifice optional things now so we wouldn’t have to sacrifice things like food if life took a surprise turn down a bad road.

Now, before anybody reads this and understands it as “Jason’s taking a decade off”, in the week I’ve been unemployed, I’ve had 2 phone interviews, and a request for another. One of those has turned into a tentative job offer already. I expect to remain unemployed for less than a month.

Naked Money

In our house, the bills don’t get hidden. I’ve never tried to hide our finances from our children. I believe doing that is part of the reason I reached adulthood with no brakes. Growing up, finances were almost entirely invisible. Now, I believe is financial transparency.

Now, as a father, I balance the checkbook and pay bills on the laptop in the living room where my children can see me. They see the stack of bills and they watch me balance the checkbook. We discuss how much things cost and how we can cut expenses while the bills are being paid. Even the toddlers know Daddy is doing something important.

My ten-year-old son knows what sales tax is and where to find it on a receipt. He knows what property taxes are and how much they are in our neighborhood. He knows roughly what percentage of a paycheck gets withheld. I work to make my son financially aware. My girls are too young to understand the concept of money, but they will be receiving a thorough financial education as soon as they are able to grasp the concepts.

The hard part is explaining to my son how we screwed up our finances. I’ve shown him my paycheck and discussed our debt. I have explained to him that we were making much less money when we accumulated our doom debt, while maintaining a higher standard of living. Now, when we go to the store, he doesn’t even ask if he can borrow money until we get to his bank account. He has learned to dislike debt in almost all forms. I’m fairly proud that my kid voluntarily practices delayed gratification.

What he doesn’t quite grasp is the idea of living within your means, even if your means are limited. “But, Dad, what if you don’t have much money? Then you have to borrow money for nice things, right?” I’m not sure how to break him of that. Delayed gratification is an understandable concept for him, but the difference between wants and needs seems to be missing. Any ideas?