Am I the only one who just noticed that it’s Wednesday? The holiday week with the free day is completely screwing me up.

Just to make this a relevant post:

Spend less!

Save more!

Invest!

Wee!

The no-pants guide to spending, saving, and thriving in the real world.

How much would you pay for a kiss from the world’s sexiest celebrity?

That was the focus of a recent study that I can’t find today. There is no celebrity waiting in the wings to deliver the drool, and the study doesn’t name which celebrity it is. That’s an exercise for the reader.

This was a study into how we value nice things.

The fascinating part of the study is that people would be willing to pay more to get the kiss in 3 days than they would to get the tongue slipped immediately.

Anticipation adds value.

Instant gratification actually causes us to devalue the object of our desire.

This goes well beyond “Will you respect me in the morning?”

The last time I talked about delayed gratification, it was in the context of my kids. That still holds true. Kids don’t value the things that are handed to them.

The surprising–and disturbing–bit is that adults don’t, either. If I run out to the store to buy an iPad the first day I see one, I won’t care about it nearly as much as if I spend a week or two agonizing over the decision.

The delay alone adds to the perceived value. The agony turns the perceived value into gold.

If I spend a month searching for the perfect car, the thrill of the successful hunt adds less value than the time it took to do the hunting.

Here’s my frugal tip for today: Delay your purchases. While it may not actually save you any money, you will feel like you got a much better deal if you wait a few days for something you really want.

Grr!

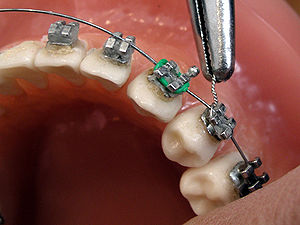

Monday, I brought Punk #1 to the orthodontist. He’s got an underbite and some crooked teeth, but I didn’t realize how off it was until I saw the pictures they took. Some of the closeups could be inspiration for a Halloween mask.

It look like he started with a small underbite that made his teeth line up wrong, which–as they grew–accentuate the wrong. Now, it’s very, very wrong.

Next week he goes in to get his top teeth done.

At a cost of $5800.

If we pay up-front, they’ll knock 5% off, bringing it down to $5500. That covers everything, all of the follow-ups, broken hardware, every stage the whole way through. If we pay monthly, it will be $1450 down and $200 per month (interest free) for almost 2 years.

Almost six grand.

Fortunately, we knew this was coming, so we’ve been saving for this for a few years.

Unfortunately, we’ve only been saving $50-100 a month. We can’t wait much longer. With an underbite, you have more options if you do the work before the kid is done growing. I’d really like to avoid jaw surgery for him, so we have to make things happen.

Our braces account has $3100 in it. My HSA account has $875. That’s from my last job, so that’s as big as it gets. That leaves us almost exactly $1500 short.

I hate the idea of touching our emergency fund, although it does have enough money in it.

We’ve also got some money tucked away in an account leftover from my mother-in-law dying last year. I think that’s where we’re going to come up with the difference.

How else could we save money?

We could shop around, but this isn’t something I want to give to the lowest bidder. I want to do it right, and I know several people who have had braces put on by this office, either by this orthodontist or her father.

I asked about a cash discount and got turned down.

That’s it. Next week, I burn $5500. Hope the kid eventually appreciates it.

This is a guest post.

In today’s day and age, nearly everything that we do in our day-to-day lives can be done online and we’ve come to not only expect that, but somewhat rely on that convenience. Insurance, however, is kind of a grey area when it comes to online purchases – no matter what kind of insurance you’re purchasing. After all, an insurance policy is no small purchase; it’s major and can have a profound financial effect on your life, and the lives of your loved ones.

Think about it like this – how wary are you of even just making a small eBay purchase? Most of us look at the seller’s rating, read their feedback, and try to accurately gauge what the risk is compared to the reward. This same mentality should apply to making a life insurance policy online and is far more deserving of it. You can follow this link to learn more from Suncorp today.

This isn’t to say that making an online life insurance purchase can’t be beneficial; depending on your situation, it can be very beneficial, indeed. However, it is going to take substantially more research on your part to get to where an insurance agent might be able to get you, sometimes in half the time.

Pros of Buying Online

One of the most alluring reason for life insurance seekers to buy online are the prices, the comparing conveniences, and sometimes the lack of medical exam. There’s plenty of aggregator sites out there that can take a sampling from across the internet and return you a quote within a matter of seconds – how’s that for convenience?

Probably the most favored feature, though, is the comparison shopping. Once an aggregator provides you with a slew of options, with a wide variety of price points, you’re able to compare all of the details among them, quickly and easily. Something that would easily take your hours if you were having to do all of that research yourself, one by one.

At the minimalist level, though, you’ll often find that some individuals just truly feel more comfortable making insurance purchases from the comfort of their own home, without any agents or appointments. Either because these situations make them nervous, or because they simply don’t have the time to sit down with an agent.

Cons of Buying Online

One of the big ones revolves around the last “pro” that I mentioned – if you don’t have the time to sit down with an agent for a limited amount of time, and let them do all of the work from there, you certainly don’t have the time to handle all of the research that comes along with going through this process on your own.

Also, you shouldn’t always assume that shopping around yourself is going to save you money with it comes to life insurance – after all, life insurance agents have personal connections, favors to call in, and think-on-their-feet knowledge that might drum up an innovative solution; something that online aggregators can’t do.

Furthermore, building that one-on-one relationship with your life insurance agent can be incredibly beneficial. For one thing, you can have every last little thing that you don’t understand about the fine print thoroughly explained to you – this is a big one. Another thing is having such a relationship with you agent, that you can call them at any time, when anything comes up, or when you need sound financial advice. Try calling an aggregator and see if you get much beyond the auto-answering system – I assure you, it’ll be a challenge.

If You Do Decide to Buy Online…

I’m overbanked.

The National Bank, Oamaru, built 1871: a prostyle Palladian portico on a neoclassical facade (Photo credit: Wikipedia)I’ve mentioned that before.

I won’t give up my herd of CapitalOne 360 accounts. I use those to track my savings goals, all 17 of them. I can’t drop my business accounts, my kids’ savings accounts, or the personal accounts that I actually use to spend money.

I do, however, need to simplify a bit.

Last month, I went through the hassle of transferring my 401k from two jobs ago and my IRA from my last job. Now, I’m down to just two retirement accounts. One is for my current job, and the other is a self-managed IRA with Sharebuilder.

Two down.

A few months ago, I went to yet another bank to close an account. My last job offered crappy health insurance, but balanced it out with an HSA. It complicated things, but the actual costs came to almost the same as the previous plan that didn’t have a high deductible. When I left, my HSA just sat there.

Last year, my oldest got braces, so I cleaned out the HSA ahead of time so we could pay up front and save 5% without paying interest.

Another one down.

That’s three accounts down out of 34.

Thirty-four?

Crap. That’s retirement accounts, business accounts, and personal accounts for two adults and three kids.

Bank 1 has the checking account we use, plus two savings accounts, one of which is where we store the rent money until we take a payday.

Bank 2 has a checking account, 16 savings accounts, and stock-trading account, a CD, and two IRAs for my wife and I.

Bank 3 has a checking account, and savings account for each of two businesses I own, a spare set of personal accounts, a savings account for each of the kids, and a checking account for my teenager.

Bank 4 holds nothing but my current 401k.

The only thing I can simplify without sacrificing my organizational jungle is to combine the personal accounts from bank 1 and 3. The problem is that Bank 1 has all of my bill pay information and there is still an account open for my mother-in-law’s estate. We keep that open just in case we find any other checks we need to cash. Bank 3 has my business accounts tied to my personal account and is the bank that my business partner uses, so that’s convenient to move money around.

I may be stuck.

I have a confession, but it’s probably not going to be a big shocker if you read the title of this post.

I hide money from my wife.

Some of you just started screaming at your monitor that I’m a horrible person.

That’s cool.

You’re wrong, but the fact that I got that reaction out of you makes me smile.

Ok, I might be a little bit horrible, but not because I hide money.

My wife has an admitted shopping problem. If she thinks we’re broke, she shops less. That’s a win and allows me to save up for our long-term goals and provide for our financial security.

I don’t lie about it. If she asks how we’re doing, I tell her. At least in general terms.

But I didn’t tell her about my annual bonus, until we had a bunch of car repairs come up that would have swamped our emergency fund.

I also haven’t told her about the cash I’ve been stockpiling.

A couple of years ago, the power went out here for four days. It wasn’t just our house, it was 75% of everything within 5 miles of our house.

When the power came on in some places after a day or two, the phone lines were still down, which meant gas stations couldn’t process credit cards.

Quick, look in your wallet and tell me how much cash you have on you….

Most people live on their credit or debit cards.

Could you buy food or water if your plastic was gone?

I could that week, but not for long, so I started taking the cash payments from my side hustle and putting it aside. I’d come home, give my wife a little cash, keep a little cash for myself, and put at least 80% of it away. I absolutely refuse to touch that money for anything.

Part of the “set it aside and forget about” means not revealing its existence. It would be too easy to dip into it to pay the pizza guy or when we go to Rennfest.

So I don’t talk about, and it gets to sit all by itself in the safe, comfy and warm. It’s my security blanket, and nobody gets to touch my binky.