- @ChristianPF Is Giving Away An iPad! and more! RT to enter to win or click to find out other ways to enter… http://su.pr/1cqxH5 #

- No, I won't ship my china cabinet to Nigeria. Kthxbye. #craigslistscam #

- @LiveRealNow is giving away a copy of Delivering Happiness(@dhbook). Follow and RT to enter. http://bit.ly/czd31X #

- @LiveRealNow is giving away a copy of Delivering Happiness(@dhbook). Follow and RT to enter. http://bit.ly/czd31X #

- @punchdebt I vote for the Fuzzy Bunny Gang. in reply to punchdebt #

- Packing for 36 hours in Chicago. #

- @LiveRealNow is giving away a copy of Delivering Happiness(@dhbook). Follow and RT to enter. http://bit.ly/czd31X #

- In the airport. It's been a while. #

- RT @pogpog 8 Month Old Deaf Baby’s Reaction To Cochlear Implant Being Activated – Pogpog http://bit.ly/cL4XEr #

- @LiveRealNow is giving away a copy of Delivering Happiness(@dhbook). Follow and RT to enter. http://bit.ly/czd31X #

Annual Fees: Scam or Service?

Annual fees. For a lot of people, this is the worst possible thing about a credit card. That’s understandable, since paying interest is voluntary. If you don’t want to pay it, you just need to pay off your balance within the grace period. Annual fees, on the other hand, get paid, whether you want to or not, if the are a part of your credit card.

When I was 18, I applied for a credit card that raised an undying hatred of Providian in my heart. I was dumb and didn’t read the agreement before applying. When I got the card, I read the paperwork and nearly made a mess of myself. It had a $200 activation fee, a $100 annual fee, a $500 limit, a 24% interest rate, no grace period, and a anthropomorphic contempt for all things financially responsible.

Yes, you read that right. The day you activate the card, you are 3/5 maxed and accruing interest at rates that would make a loan shark blush like my grandma is a strip club. Instead of activating, I cancelled the card and ran away crying. It was a mistake but didn’t cost me anything.

In exchange for all of that, I got…nothing. The card offered no services of any kind in exchange for the annual fee.

On the other hand, I have a card with an annual fee right now. It’s $59 per year, but it offers value in exchange.

This card’s basic offering is a 2% travel rewards plan. With most of our spending on this card, we’ve managed to accumulate $400 of rewards, so far, counting the 25,000 bonus miles for signing up.

In addition, it offers 24 hour travel and roadside assistance. The roadside assistance itself will pay for the fee, because I think I’ll be canceling my AAA account after 16 years. The card’s plan isn’t as nice, but I haven’t been using the AAA emergency services for the past few years, anyway.

It extends the warranty on anything I buy. It includes car rental insurance and concierge service. Concierge service is sweet. Need reservations for dinner? Call the card. Need a tub of nacho cheese? Call the card. Need a pizza? Well, call Zappos.com.

All in all, the card is paying for itself a couple of different ways, so in this case, the annual fee is definitely worth it. I guess there’s a serious difference between Capital One Venture and Providan Screwyou.

How do you feel about annual fees? Love ’em, hate ’em, have a card with one?

A Look Back

I’m on vacation this week and thought it would be nice to post a look back at some of my early posts. These posts are some of my favorites, but were written when there were only 3 or 4 of you paying attention.

Since I know you don’t want to miss anything, here are 5 of my favorite early posts, in no particular order:

1. Cthulhu’s Guide to Finance. I’m more than a bit of a horror geek. Books, movies, or games; all keep me entertained. Over the weekend, I taught my Mom how to play Zombie Fluxx and Gloom. When Cthulhu approached me about writing a guest post, I couldn’t refuse.

2. Birthday Parties Are Evil. It’s hard to remember to be cheap when your little girl is asking for a bowling party. It can run $200 to get a dozen kids an hour of bowling and a bit of pizza.

3. No Brakes. This is a post about why I had a hard time coming to grips with financial responsibility.

4. 4 Ways to Flog the Inner Impulse Shopper. Who can’t love a BDSM-themed personal finance post? Every blog needs a dominatrix mascot, right?

5. Fighting Evil by Phone. In which I share the method of convincing Big Nasty Telephone Company and their Contracted, Soulless Long Distance Provider to leave me the heck alone and stop demanding $800 they refused to admit was their mistake.

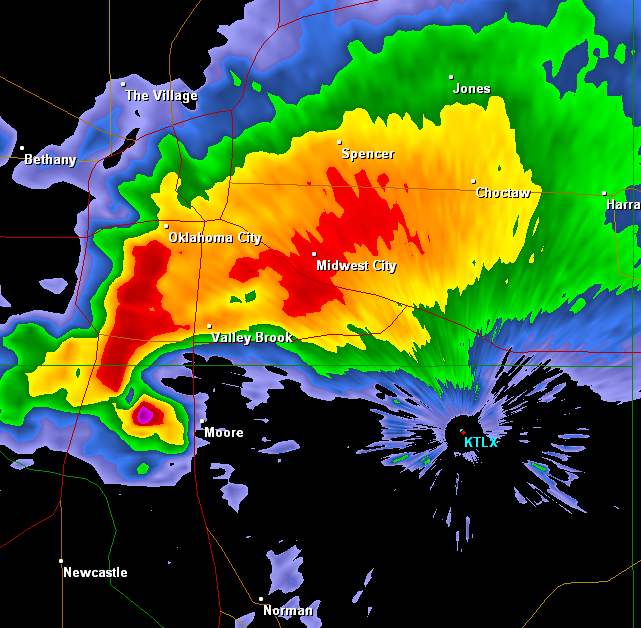

Oklahoma Tornadoes

My heart goes out to all of the victims of yesterday’s tornado in Moore, Oklahoma.

I couldn’t imagine hearing that my kids’ school was demolished around them. Twenty or more dead children in any community is devastating.

On top of the sheer horror of dead children, the town is nearly wiped off of the map. Will they rebuild or cut their losses?

I hope everyone in the town was well insured, but that’s never the case. There will be many in the town that will have lost everything: their homes, their families, their jobs. Family is irreplaceable, but so is your home, if you don’t have insurance. To lose it all and not even have a place to mourn….

Have you checked your insurance policy to make sure you are covered in the event of whatever natural disaster is common in your area?

To help the victims, text REDCROSS to 90999 to make a $10 donation. It’s the least you can do.

Related articles

Yakezie Challenge – I’m In

After watching the Yakezie Challenge progress for 6 months and reading the recap, I’ve decided to participate. Maybe I’m a jerk for waiting until I saw the value instead of immediately jumping in, but I hope not.

The goal for stage 1 was to get to Alexa rank 200,000. I’m currently at 533,108. Six months ago, I was at about 1.8 million, so I’ve improved quite a bit on my own, but I’ve still got a ways to go.

So, here I am.