- RT @bargainr: Life in North Korea is absolutely dreadful http://nyti.ms/dAcL26 #

- RT @bitfs: Weekly Favorites and Gratitude!: My Favorite Posts this Week Jeff at Deliver Away Debt threw together the .. http://bit.ly/9J0gGo #

- @LiveRealNow is giving away a copy of Delivering Happiness(@dhbook). Follow and RT to enter. http://bit.ly/czd31X # #

- Baseless claims, biased assumptions, poor understanding of history. Don't bother. #AnimalSpirits #KeynesianCult #

- RT @zappos: Super exciting! "Delivering Happiness" hit #1 on NY Times Bestseller list! Thanks everyone! Details: http://bit.ly/96vEfF #

- @ericabiz Funny, we found a kitten in a box last week. Unfortunately, it was abandoned there, not playing. Now, we have a 5th cat. in reply to ericabiz #

Credit Peril

When my mother-in-law died, we went through all of her accounts and paid off anything she owed.

The Discover card she’d carried since the 80s–a card that had my wife listed as an authorized user–had a balance of about $700. We paid that off with the money in her savings account. They cashed out the accumulated points as gift cards and closed the account.

A few months ago, we decided it was time to buy an SUV, to fit our family’s needs. We financed it, to give us a chance to take advantage of a killer deal while waiting for the state to process the title transfer on an inherited car we have since sold.

Getting good terms was never a worry. Both of us had scores bordering on 800. Since our plan was to pay off the entire loan within a few months, we asked for whatever term came with the lowest interest rate.

Then the credit department came back and said that my wife’s credit was poor. I chalked it up to a temporary blip caused by closing the oldest account on her credit report and financed without her. No big deal.

Since we decided to rent our my mother-in-law’s house, we’ve discussed picking up more rental properties. That’s a post for another time, but last week, we went to get pre-approved for a mortgage. During the process, the mortgage officer asked me if my wife had any outstanding debt that could be ignored if we financed without her.

Weird.

A few days ago, we got the credit check letter from the bank. Her credit score? 668.

What the heck?

I immediately pulled her free annual credit report from annualcreditreport.com, which is something I usually do 2-3 times per year, but had neglected for 2012.

There are currently two negatives on her report.

One is a 30 day late payment on a store card in 2007. That’s not a 120 point hit.

The other is an $8 charge-off to Discover. As an authorized user. On an account that was paid.

Crap.

We called Discover to get them to correct the reporting and got told they don’t have it listed as a charge-off. They did agree to send a letter to us saying that, but said they couldn’t fix anything with the credit bureaus.

Once we get that letter, it’s dispute time.

Net Worth Update

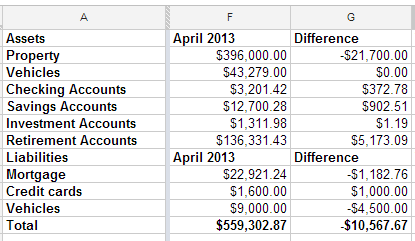

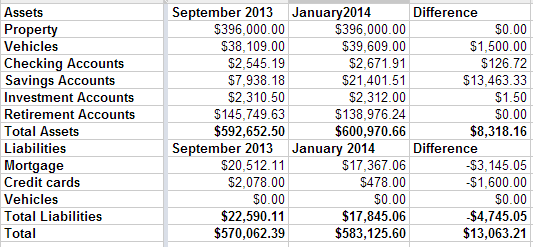

I looked back at the spreadsheet I use to track my net worth, and realized that I have been filling it out quarterly, though I can’t say that has been on purpose. Apparently, I get an itch to see my score about four times per year.

This quarter is the first time in a long time that my net worth has dropped. We got our property tax statements last week and found out that our houses have dropped a combined $21,700. Since we’re not planning to sell, that doesn’t matter much.

What’s interesting to me is that, even though our property values dropped $21,700, our total net worth only fell $10,567. We’ve been hustling trying to get the Tahoe paid off. It’s going a little bit slower than I had hoped, but it’s progressing nicely.

I do feel good that, even if I would have been focusing on my mortgage, I still would have lost the mortgage race. That means my misplaced priorities of acquiring more debt to snatch a fantastic deal didn’t cost me the race. Now, I’ll be forced to take a vacation in Texas, coincidentally in the same town as my wife’s long lost brother. I think we can make that work.

I rounded off the credit card and vehicle totals because one is used every day and paid off every month and the other has a steady stream of money getting thrown at it, so the numbers change often.

All in all, I don’t have any room to complain. I am looking forward to paying off the truck and focusing on the mortgage. We could swing quadruple payments, which would pay off the house shortly after the new year starts.

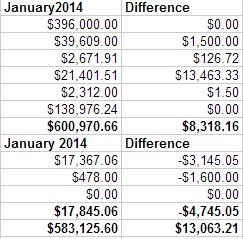

Net Worth Update – January 2014

This may be the most boring type of post I write, but it’s important to me to track my net worth so I can see my progress. We are sliding smoothly from debt payoff mode to wealth building mode.

Our highlights right now are nothing to speak of. We did let our credit card grow a little bit over the last couple of months, but paid it off completely at the end of December. It grew mostly as a matter of not paying attention while we were doing our holiday shopping and dealing with some car repairs.

That’s it. We haven’t remodeled our bathrooms yet, but we have the money sitting in a savings account, waiting for the contractor. We haven’t bought a pony yet, but we did decide that a hobby farm wouldn’t be the right move for us. We’ll be boarding the pony instead of moving, at least for the foreseeable future.

Our net worth is up $13,000 since September. Our savings are up and our retirement accounts are down because there are two inherited IRAs that we need to slowly cash out and convert to regular IRAs.

Twitter Weekly Updates for 2010-06-12

- @ChristianPF Is Giving Away An iPad! and more! RT to enter to win or click to find out other ways to enter… http://su.pr/1cqxH5 #

- No, I won't ship my china cabinet to Nigeria. Kthxbye. #craigslistscam #

- @LiveRealNow is giving away a copy of Delivering Happiness(@dhbook). Follow and RT to enter. http://bit.ly/czd31X #

- @LiveRealNow is giving away a copy of Delivering Happiness(@dhbook). Follow and RT to enter. http://bit.ly/czd31X #

- @punchdebt I vote for the Fuzzy Bunny Gang. in reply to punchdebt #

- Packing for 36 hours in Chicago. #

- @LiveRealNow is giving away a copy of Delivering Happiness(@dhbook). Follow and RT to enter. http://bit.ly/czd31X #

- In the airport. It's been a while. #

- RT @pogpog 8 Month Old Deaf Baby’s Reaction To Cochlear Implant Being Activated – Pogpog http://bit.ly/cL4XEr #

- @LiveRealNow is giving away a copy of Delivering Happiness(@dhbook). Follow and RT to enter. http://bit.ly/czd31X #

Annual Fees: Scam or Service?

Annual fees. For a lot of people, this is the worst possible thing about a credit card. That’s understandable, since paying interest is voluntary. If you don’t want to pay it, you just need to pay off your balance within the grace period. Annual fees, on the other hand, get paid, whether you want to or not, if the are a part of your credit card.

When I was 18, I applied for a credit card that raised an undying hatred of Providian in my heart. I was dumb and didn’t read the agreement before applying. When I got the card, I read the paperwork and nearly made a mess of myself. It had a $200 activation fee, a $100 annual fee, a $500 limit, a 24% interest rate, no grace period, and a anthropomorphic contempt for all things financially responsible.

Yes, you read that right. The day you activate the card, you are 3/5 maxed and accruing interest at rates that would make a loan shark blush like my grandma is a strip club. Instead of activating, I cancelled the card and ran away crying. It was a mistake but didn’t cost me anything.

In exchange for all of that, I got…nothing. The card offered no services of any kind in exchange for the annual fee.

On the other hand, I have a card with an annual fee right now. It’s $59 per year, but it offers value in exchange.

This card’s basic offering is a 2% travel rewards plan. With most of our spending on this card, we’ve managed to accumulate $400 of rewards, so far, counting the 25,000 bonus miles for signing up.

In addition, it offers 24 hour travel and roadside assistance. The roadside assistance itself will pay for the fee, because I think I’ll be canceling my AAA account after 16 years. The card’s plan isn’t as nice, but I haven’t been using the AAA emergency services for the past few years, anyway.

It extends the warranty on anything I buy. It includes car rental insurance and concierge service. Concierge service is sweet. Need reservations for dinner? Call the card. Need a tub of nacho cheese? Call the card. Need a pizza? Well, call Zappos.com.

All in all, the card is paying for itself a couple of different ways, so in this case, the annual fee is definitely worth it. I guess there’s a serious difference between Capital One Venture and Providan Screwyou.

How do you feel about annual fees? Love ’em, hate ’em, have a card with one?