- Up at 5 two days in a row. Sleepy. #

- May your…year be filled w/ magic and dreams and good madness. I hope you…kiss someone who thinks you’re wonderful. @neilhimself #

- Woo! First all-cash grocery trip ever. Felt neat. #

- I accidentally took a 3 hour nap yesterday, so I had a hard time sleeping. 5am is difficult. #

- Wee! Got included in the Carnival of Personal Finance, again. http://su.pr/2AKnDB #

- Son’s wrestling season starts in two days. My next 3 months just got hectic. #

- RT @Moneymonk: A real emergency is something that threatens your survival, not just your desire to be comfortable -David Bach # [Read more…] about Twitter Weekly Updates for 2010-01-09

Hippy Month – September’s 30 Day Project

- Image via Wikipedia

My 30 Day Project for August was…forgotten. I didn’t notice August roll in, and when that fact finally registered, I had already blown the project. With that, and our planned vacation, I decided to take the month off. Yes, I am a slacker.

So, now that it is September, I’m getting back on track. This month, we are going used. For the next 30 days, we are buying nothing new.

The Ground Rules

1. We aren’t buying anything new. No retail purchases. If we need to buy something, it will be used.

2. Food is an exception. Used bananas are gross in too many ways.

3. Consumable hygiene products are an exception. We are not recycling shampoo or deodorant. We are also not willing to spend the month smelling like hippies.

4. My wife is not a loophole. Her shopping counts as my shopping, so this is something we have to do together.

4b. Neither is her mother’s credit card. We are doing this for real.

There is a group called The Compact that started this movement. They went for an entire year. They are hippies. Ick.

I am not a hippy! This did, however, make for a good lesson in how to be environmentally friendly.

My main goal for Hippy Month is to break our consumer addiction. We need to get used to “making do” or doing without. We also need to make a habit out of looking for used and cheaper options, first.

Our secondary goals are to save money and stop accumulation so much danged stuff.

It won’t be easy. Goodwill is far less convenient than Target. It’s so simple to run into a store to replace something that’s broken instead of fixing it or finding a used alternative.

These projects wouldn’t be fun if they were easy.

Anyone care to join me?

The Benefits of Ignorance

For years, we had a sweet deal with day care. We had three kids and we were the only family with three kids, so we got a bulk discount that essentially made my oldest free. Compared to the regular price, I think we were paying about ten dollars a week for him to be in daycare, which was great, since he was only there before and after school.

Then he aged out of daycare, and we lost our sweet, sweet deal.

Then the prices went up across the board.

We lost the sweet deal, and then the price went up and our youngest hit the next age bracket.

On the price sheet, the age brackets went from birth to 1, from 1 to 2, and from 2 to kindergarten. I made the mistake of interpreting that to mean that her fee would change when Baby Brat turned three, not when she turned two. I’ve been making that mistake since December when the price went up.

A few weeks ago, I dropped off the kids and forgot to pay for the week, so my wife paid when she picked up the girls. When my wife picked up the girls, she noticed that we hadn’t paid. She had no idea how much we needed to pay because she has never been the one that’s been responsible for making the payments.

Our provider added up the cost and found it was $15 per week less than we’d been paying.

When I balanced the checkbook the following weekend, I noticed that she paid less than our normal rate. We called daycare and now we’re making up for the last 17 weeks of overpayments by paying less each week. We’re paying about $65 less per week. When we’re caught up, we’ll be paying $60-75 less per month, depending on the month.

All due to sweet, sweet ignorance. Ignorance really can be bliss. Sometimes when you know what’s going on, you just assume that you’re making the right decision and you’re afraid to ask questions for fear of looking stupid. If you don’t know, and there’s nothing you should have known, and it’s possible to save quite a bit of money by just acknowledging the fact that you don’t know.

Also, lesson learned: If you’re not sure, ask! Don’t assume when there’s a chance your assumption could be costing you money.

How to Have a Perfect Life

A few years ago, my wife and I were discussing life improvement, the options in front of us, and our future goals. She said she felt trapped by the scope of our goals and didn’t know where to start. That led to a discussion on

achieving our goals, which led to this.

Examine your life. Take stock of every aspect of your life. What pleases you? What upsets you? What do you do that adds no value to your life? Or worse, removes value? What do you do that adds the most value? What would you like to change? Eliminate? Improve? Count the small things. Nothing is insignificant. Write it all down and be specific.

Analyze your list. Are there any obvious patterns? Is there a single thread that is making you miserable or affecting multiple other items? Would eliminating 1 factor improve 90% of the rest? Is there a bad job or a toxic relationship ruining your happiness? Be honest and be critical.

What are your dreams? Where would you like to be in six months? A year? 5? 10? How would you like to retire? When? Write it all down. This is now your life plan.

Set goals. Set concrete, definable goals. Set goals that have an obvious success point. When you reach your goal, you want to be able to point it out. “Lose weight” is not a goal. “Lose 50 pounds in the next year” is a measurable, definable, concrete goal. Set incremental goals to reach your larger goals and, more importantly, your dreams.

Here’s an example:

Dream: Retire at 50.

- Incremental Goal: Get a 10% raise within 6 months

- Incremental Goal: Eliminate debt within 3 years

- Incremental Goal: Max out 401k contribution

- Incremental goal: Save 150,000 within 10 years

- Incremental Goal: Save 45k each year after that.

- Retire

When you are setting up your goal plan, make sure to include the analyzed items mentioned earlier. These are the things that will make today happier for you.

Now, you have examined your life. You have analyzed the results. You’ve gathered your dreams and compiled a goal plan based on your hopes, dreams, goals and desires. What’s next?

We’re going to take a page from David Allen. It’s time to Get Things Done. What do you have to do next to reach your goals? What is the next step? Don’t let yourself be overwhelmed by the scope of the entire list. Select one single item from your plan and look for the one single next step to make on the path to that goal.

Going back to the retirement goal plan, the next step towards a 10% raise could be researching salaries for your job description in your area to give you ammunition in the meeting with your boss. It could be updating your resume to hunt for a better paying job, or even just studying up on some resume tips.

If you want to run a marathon next year, the next step is to start walking every day to train your body.

If you want to improve communication with your spouse, the next step is probably to let her know.

If you want to eliminate debt, the next step may be setting up a budget or canceling unnecessary services like cable.

Every goal has a path leading to it. If that’s not true, you haven’t defined a concrete measurable goal.

Examine your life. Analyze your situation. Know WHAT you want. Know what you want to change. Set goals to get there, one step at a time. Take a single step towards your goals.

Then take another.

What are you doing to reach your goals and improve your life?

What Can Cause Damage to Your Credit?

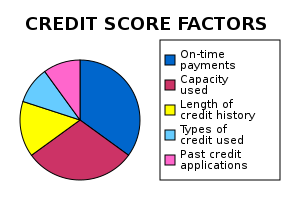

Credit scores move up and down as new financial data is collected by the credit bureaus. Many factors can cause a credit score to rise or fall, but most people don’t have a clue what they are. Understanding what affects credit can help keep your number in a good score range, where it should be. But, even a bad score can recover more quickly than most people realize, even after a bankruptcy or default. Here are some factors that can help you understand why credit moves up or down:

Late Payments

About 30% of your score is made up from your payment history. This is comprised from things like credit card bills, auto loan payments, personal loans, and mortgages. At this time, bills like utilities or rent are not factored into your score, unless they are sent to a collection agency. If you are late to pay your credit card bill, it will show up on your credit file. One late payment will probably not have much of an effect, but a history of this over time can drop your score. It is very important to keep bill payment current as a courtesy to creditors and the benefit of your own financial history.

Credit Inquiries

One of the most misunderstood factors that can cause a credit score to drop are “credit inquiries”. An inquiry takes place anytime your credit is checked. This makes up 10% of your total score. What most people don’t know is that there are two different types of credit inquiries, “hard inquiries” and “soft inquires”. Only hard inquiries affect credit and happen when you apply for a new credit card, loan, or mortgage. Soft inquiries on the other hand happen when someone like an employer, landlord, or yourself check your credit report. These are not factored into your credit score at all. Hard inquiries are a necessary part of applying for a loan or credit, so an occasional inquiry will not cause damage. It can only cause problems if there are many hard inquiries in a short period of time. This can be a signal to creditors that you are in financial trouble and are desperately seeking cash.

Credit to Debt Ratio

Your total amount of available credit compared to the amount of credit you use each month, makes up your credit-to-debt ratio. FICO suggests that you use no more than 30% of your available credit before paying off your balance each month. For example if you have $10,000 of available credit spread across 3 different credit cards, the optimal amount to charge would be $3000 or less each month. Maxing out your credit cards can cause your score to drop even if you pay them off completely each month.

Age of Your Credit History

The length of time you have had an open credit account is a major factor of your credit score. It can help to open a credit card when you are younger by getting a co-signer. If you are the parent of a teenager, it may be helpful to open a credit card in their name, but only allow them to use it for emergencies. Having an open credit card in good standing for a long period of time can help build this history. The length of time that you have had credit makes up about 15% of your score.

Different Types of Credit

The last major factor that makes up about 10% of your score comes from the different types of credit that you use. These credit types include revolving, installment, and mortgage. The ability of an individual to successfully handle all of these credit types can show that they are financially well-rounded. This makes up about 10% of the total credit score.

About:

Ross is an investor and website owner.

Chains of Servitude Update

It’s been almost exactly one year since I told my wife that we were either going to take control of our finances or file bankruptcy.

At that time, we were spending at least $500 more each month than we made, and often, it was $1000 more. We had more than $5000 accumulated on our overdraft line of credit, more than $30,000 in credit card debt, $2500 on a student loan, $12,000 on a car note, and our mortgage.

Our savings were nonexistent. We had automatic deposits established, but we’d transfer the money out right away to cover other expenses. Everything that came up was an emergency and a surprise. We had no real idea how much our lifestyles cost or what it actually took to maintain.

Maintaining our finances took several hours every payday to balance the checkbook and pay bills.

Fast forward 1 year. The student loan is gone, the line of credit will be gone next month, and the car loan will be paid off before the end of the year. We’ve reduced our total debt load by more than 20%.

We have a useful emergency fund and we’re meeting our other savings goals, including a college fund for the kids. We don’t have extremely high balances, but it’s reassuring to have more than a couple of months of expenses in our savings accounts.

We’ve automated almost everything and gone to a cash-only system. I now spend about 20 minutes a month balancing the checkbook and less than 5 minutes paying bills.

A year ago, we were in a hole, digging as fast as we could. Now, we can see the end of the debt tunnel and we are rushing as fast as we can to get there. According to my debt spreadsheet, we will be completely debt free in just under 4 years, ignoring any money coming from our side-hustles and work bonuses.

We’re making better progress than I had hoped for, and it keeps getting easier. Smart spending is becoming a habit, instead of a just wishful thinking.

Update: This post has been included in the Carnival of Debt Reduction.