The remodel of our inherited new house is about done. The bills have basically been paid and the insurance checks have been cashed.

Now that it’s all (more or less) done, I’m finding my financial situation has changed a bit. My credit card is paid off, except for our regular monthly expenses and a couple of remodeling expenses that will be paid off in the next week or so. Our mortgage is within site of being paid off, and we have a rental property that is mortgage-free.

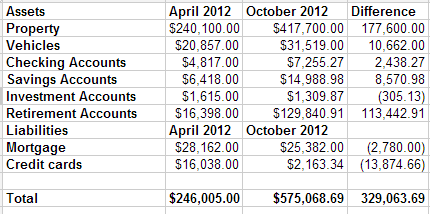

With all of the changes, I took the time to measure the difference.

Let me tell you how nervous this post makes me. My business partner is under the impression that I no don’t care about our business because I no longer have any worries.

That’s crap.

Yes, our net worth has gone up $329,000. That’s not nothing, but it’s hardly enough to retire on.

$113,000 of it is in retirement accounts. I mean, great, we’re a bit ahead of where we need to be, but it’s not like that money is putting food on the table for us this week.

$177,600 of it is in our rental property. Which doesn’t start driving income until February. Today, it’s a $25,000 money sink. That’s money we would have had to spend to sell it, even if we didn’t want to keep it.

There’s a $10,000 car that we need to deal with, we’ve paid off our credit card debt, and we have an extra $10,000 in the bank.

So, yes, we are in a much better place financially. That’s a comfort, long-term. Day-to-day? Our credit card payment has been pushed to our mortgage, so that’s not extra spending money. We don’t know exactly how much of the $10,000 in the bank still needs to be spent on the house, and we don’t know how we’re going to reorganize our vehicle situation.

That’s a lot of uncertainty that, at most, involves $20,000. Again, it’s not nothing, but it’s not a lot. It won’t cover our barebones expenses for 6 months. We pay $15,000 per year just in daycare, and we need to put braces on a kid next year.

We are in a much better place, but I can’t stop hustling.