- Uop past midnight. 3am feeding. 5am hurts. Back to bed? #

- Stayed up this morning and watched Terminator:Salvation. AWAKs make for bad plot advancement. #

- Last night, Inglorious Basterds was not what I was expecting. #

- @jeffrosecfp It's a fun time, huh. These few months are payment for the fun months coming, when babies become interactive. 🙂 in reply to jeffrosecfp #

- RT @BSimple: RT @bugeyedguide: When we cling to past experiences we keep giving them energy…and we do not have much energy to spare #

- RT @LivingFrugal: Jan 18, Pizza Soup (GOOOOOD Stuff) http://bit.ly/5rOTuc #budget #money #

- Free Turbotax for low income or active-duty military. http://su.pr/29y30d #

- To most ppl,you're just somebody [from casting] to play the bit part of "Other Office Worker" in the movie of their life http://su.pr/1DYMQZ #

- RT @MoneyCrashers: Money Crashers 2010 New Year Giveaway Bash – $8,300 in Cash and Amazing Prizes http://bt.io/DQHw #

- RT: @flexo: RT @wisebread: Tylenol, Motrin, Rolaids, and Benadryl RECALLED! Check your cabinets: http://bit.ly/4BVJfJ #

- New goal for Feb. 100 pushups in 1 set. Anyone care to join me? #

- RT @BSimple: Your future is created by what you do today, not tomorrow"— Robert Kiyosaki So take action now. #

- RT @hughdeburgh: "Everything you live through helps to make you the person you are now." ~ Sophia Loren #

- Chances of finding winter boots at a thrift store in January? Why do they wear our at the worst time? #

- @LenPenzo Anyone who make something completely idiot proof underestimates the ingenuity of complete idiots. in reply to LenPenzo #

- RT @zappos: "Lots of people want to ride w/ you in the limo, but what you want is someone who will take the bus w/ you…" -Oprah Winfrey #

- RT @chrisguillebeau: "The cobra will bite you whether you call it cobra or Mr. Cobra" -Indian Proverb (via @boxofcrayons) #

- RT @SuburbanDollar: I keep track of all my blogging income and expenses using http://outright.com it is free&helps with taxes #savvyblogging #

- Reading: Your Most Frequently Asked Running Questions – Answered http://bit.ly/8panmw via @zen_habits #

6 Questions to Financially Get to Know Each Other

This topic has been blatantly stolen from Budgets are Sexy.

1) How do you spend: cash, debit or credit? I use cash almost exclusively. I live in Minnesota and have two small children, so bundling the brats up to go inside the gas station to pay is nuts. Gas stations get the debit card. Online shopping, or automatic payments set up in the payee’s system are done on a credit card that gets paid off every month.

[ad name=”inlineright”]2) Do you bank online? How about use a financial aggregator (Mint, Wesabe, Yodlee, etc.)? I bank online. I use USBank for my daily cash flow, INGDirect for savings management and Wells Fargo for business. I used Mint strictly as a net worth calculator and alerting system. I use Quicken to manage my money and a spreadsheet for my budget, but I really like the quick, hands-off way that Mint gathers my account information and emails low balance alerts.

3) What recurring bills do you have set on autopay? Absolutely everything except daycare, 2 annual payments, and 1 quarterly payment.

4) How are your finances automated? I use USBank’s billpay system, instead of setting up autopayments at every possible payee. This gives me instant total control and reminders before each payment. The exceptions are my mortgage, netflix, and Dish. My mortgage company takes the money automatically from my checking. The other two hit a credit card automatically. Our paychecks are direct-deposited and automatically transferred to the different accounts and banks, as necessary.

5) Do you write checks? If so, how often? Once per week, for daycare. Occasionally for school fundraisers.

6) Where do you stash your short-term savings? I have quite a few savings accounts with INGDirect to meet all of my savings goals. For the truly short term, I add a line item in Quicken and just leave the money in my checking account.

Who’s next?

Experiences v. Stuff

- Image by hunterseakerhk via Flickr

On Friday, I went to see Evil Dead: The Musical with some friends. The play obviously isn’t a good match for everyone, but we are all horror movie fans, I’m a Bruce Campbell fan, and all of us had seen and enjoyed at least Army of Darkness. It was a good fit for us.

The play, followed by a late dinner and drinks with people I care about, was easily the most money my wife and I have spent on a night out in years. That’s including an overnight trip for my cousin’s wedding.

Now, several days later, I keep thinking about that night, but not with regret about the price. I keep thinking about the fun I had with my wife and some of our closest friends. We saw a great play that had us in stitches. We had a few hours of good conversation. We had a good time. I would happily do it all over again. In fact, I would happily reorganize our budget to make something similar happen every month.

I don’t remember the last time I spent 3 or 4 days happily thinking about something I bought.

I look around my house at the years of accumulated crap we own and I see a big rock tied around my neck. Even after a major purge this spring, we’ve got more stuff than we can effectively store, let alone use. When something new comes in the house, we spend days discussing whether we really need it or if it should get returned. When we plan a big purchase, we debate it, sometimes for weeks.

Getting stuff is all about stress.

My wife and I are both familiar with the addictive endorphin rush that comes with some forms of shopping. I wish the rational recognition of a shopping addiction was enough to make it go away. Buying stuff makes us feel good for a few minutes, while high-quality experiences make us feel good for days or weeks, and gives us things to talk about for years to come.

It’s really not a fair competition between experiences and stuff. Experiences are the hands-down winner for where we should be spending our money.

Why then, does stuff always seem to come out ahead when it comes to where our money actually goes?

Business Failure: Learn From My Mistakes

I am a failure.

Ten years ago, I started a small web-design company with a friend. I had a larger-than-average stack of geek points and the ability to build a decent website.

We lacked two things.

- Design talent. For me, design–whether graphic, web, or print–is a very iterative process. I build something, even if it’s crap, and incrementally improve it into something good. I understand the technical details of good design, but lack that particular creative spark.

- Sales skill. I’m an introvert. As such, sales–particularly the act of initiating a sale–doesn’t come naturally to me. I’m bad at cold-calling and door-knocking. This was supposed to be my partner’s responsibility. As it turns out, his main talent was convincing me that he had one.

In short, we were trying to launch a tech company on a shoestring budget with nothing but technical skill.

The missing elements doomed us. We never had more than a couple of customers and eventually surrendered to the inevitable.

Ah, well. My investment was time.

The time investment came with some valuable lessons.

- Get complementary talent. You have weaknesses. Find partners who are strong where you are weak and weak where you are strong. That guarantees every will realize actual value in the partnership. The whole will be greater than merely the sum of its parts.

- Hire the skills you need. Make an honest assessment of your talents and skills. Do the same for your partners. If that talent pool is lacking something you need, buy it. If you need a graphic designer, a writer, or a marketer, spend the money to get it. If you lack something truly necessary, your business will stagnate.

- Learn the skills you need. Sales is a learnable skill. So is almost everything else. Even if you lack the talent and won’t be doing the work, you need to have a solid understanding of the skills necessary to run your business. Fluency isn’t necessary, but understanding is. Learn about the principles of good design, the art of cold-calling, and whatever else you are going to be relying on others to handle.

Starting a business can be rewarding, both emotionally and financially. I’ve never let myself be limited to just one income stream, but I try not to let my emotional investment cloud my judgment. Do things right and you’ll stand a better chance of making your business a success.

Let me check….

A few days ago, I asked a coworker if she wanted to go out for lunch. She said she’d have to check her bank account before she decided.

What?

If you have to check your bank balance to know if you can afford something, you can’t afford it. It really is that simple.

Now, strict budgets aren’t for everyone, but everyone should know how much money they have available to spend. If you don’t know what you have to spare, you need to set up a budget.

Period.

After you’ve done that, you can ignore it, with the exception of knowing how much you have available to blow on groceries, entertainment, and other discretionary purchases.

If you don’t know where your money needs to go, how can you determine how much you can spend on the things you want?

Net Worth Update

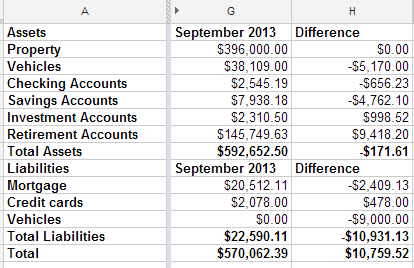

Time to update my net worth. Here are the highlights:

We paid off the Tahoe we bought last fall, but the value of my Pacifica fell $5,000 since April. That made me sad.

In August, we had $1000 worth of car repairs and $5500 for braces. We had most of the money saved for braces, but had to juggle some savings accounts around to cover it. We didn’t have enough money in our car repair fund to cover the repairs. Between the two, we beat up our credit card a bit more than usual last month. I’m not happy about it, but I’m confident we’ll catch up this month. My current goal is to get that paid off by the end of September. If I do, I should be able to avoid paying any interest on the balance.

All in all, it’s not bad progress. Our assets dropped $171.61, but our liabilities dropped $10,931.13, so our net worth is up $10,000. You won’t catch me complaining about that.

What’s going to happen in the future? We’re going to remodel both of our bathrooms this winter. We’re hoping to buy a pony before spring.

I’m excited to see our budget evolve over the next few months.

My wife is working and my kids are all in school. With the way our schedules work, we’ve pulled the youngest two out of daycare, so that expense is gone. And there are a couple of other things in the works that I’ll be sharing when they are finalized. If things progress the way they are looking, we’re going to spend the winter living off of my income, and saving her’s. That makes me feel like putting on an ant costume and kicking grasshopper’s butt all over town.