- Dora the Explorer is singing about cocaine. Is that why my kids have so much energy? #

- RT @prosperousfool: Be the Friendly Financial “Stop” Sign http://bit.ly/67NZFH #

- RT @tferriss: Aldous Huxley’s ‘Brave New World’ in a one-page cartoon: http://su.pr/2PAuup #

- RT @BSimple: Shallow men believe in Luck, Strong men believe in cause and effect. Ralph Waldo Emerson #

- 5am finally pays off. 800 word post finished. Reading to the kids has been more consistent,too. Not req’ing bedtime, just reading daily. #

- Titty Mouse and Tatty Mouse: morbid story from my childhood. Still enthralling. #

- RT @MoneyCrashers: Money Crashers 2010 New Year Giveaway Bash – $7,400 in Cash and Amazing Prizes http://bt.io/DDPy #

- [Read more…] about Twitter Weekly Updates for 2010-01-16

Choosing the Best Term Life Insurance

This is a guest post.

Term life insurance is arguably the simplest form of life insurance offered by companies today. It is a dramatically different policy than universal or whole life plans. The latter tend to charge policyholders much higher premiums over the lifetime of their policies. However, whole life plans remain in effect for the lifetime of the insured, until death occurs or the policy is cancelled. On the other hand, term life insurance policies last for a fixed length of time, and the periods usually range from five, 10, 15, 20, or 30 years. With a term plan, the premiums you will pay are much lower, and if you pass away during the term of your policy, your beneficiaries will receive a full death benefit from your plan.

Types

Term life insurance generally falls into one of five different categories. Level, decreasing, renewable, return of premium, and convertible are the five kinds of term life insurance policies that companies typically offer their customers. The best method for selecting term life insurance is to consider your amount available to spend along with your age in order to decide which variety is the best fit for you and your family.

If you choose level term insurance, you will get a predetermined dollar amount of coverage for a set length of time. You will enjoy low overhead and you will have peace of mind knowing that your premiums will never fluctuate with the vicissitudes of the market. The predictability of a level term plan is perhaps the greatest feature of this type. Another type of term life insurance is decreasing term life insurance. It is strikingly similar to a level plan, and the only real variation is the amount of money your beneficiaries will receive if you die. With a decreasing term plan, the amount of your death benefit decreases over time. A good reason for choosing decreasing term life insurance is having small children. You know that you need the money more now while they are young, so paying less for life insurance in the short term is a good idea.

A convertible term plan is a hybrid. It lets a policyholder change their existing term life policy into a whole life plan without facing hefty penalties for doing so. Another option, a return of premium term life insurance plan, is very similar to level term plans. The major dividing factor between the two is that a return of premium plan actually gives back all the money paid in premiums to the beneficiaries if the insured dies during the term of the policy. It’s best to pick this plan if you want coverage for your family but you death is highly unlikely to occur during the term of your policy.

How to Qualify?

The uniting thread between most term life plans is that you are required to fill out a formal application first, and then you must pass a physical exam so that you may qualify for life insurance coverage. Additionally, most life insurance plans force you to repeat the exam each time you choose to renew your policy. However, if you choose a type of term life insurance called renewable term life insurance, you are allowed to bypass this stipulation entirely, so you can score some massive savings on premiums you will pay in the future. It’s best to choose this type of term life insurance if you are already older, or if you have health conditions that you expect to get dramatically worse during the term of your plan.

During the medical exam, your physician will take a full and extensive medical history from you. This is so that the insurance company can get a complete and accurate picture of your health in order to assign you the right amount of premium for your plan. Next, the insurance company will consider your motor vehicle record. This is so the insurance company can get a feel for whether you pose a big enough risk on the road to have a high likelihood of an accident that may cause your death and end your policy.

Then, your doctor may ask you other health and lifestyle questions if the life insurance company requires him or her to do so. You will need Attending Physician Statements (APS) that certify your answers and the results of your medical tests were true and accurate to the best of your knowledge. You will also need Medical Information Bureau (MIB) reports for your application as well as corporate documents if you are applying for business coverage. After you have submitted all of these materials, your insurance company should be able to render a decision about whether they will award you a term life insurance policy, as well as how much your annual premiums will cost you.

Carnival Roundup

The Money Makers was included in the following carnivals recently.

Carnival of Financial Planning hosted by The Skilled Investor

Carnival of Financial Independence hosted by Reach Financial Independence

Carnival of Personal Finance hosted by Reach Financial Independence

Aspiring Blogger Financial Carnival hosted by Aspiring Blogger

Carnival of Money hosted by Financial Nerd

Thank you!

Check Your Bills

Today, I discovered our AOL billing information. Turns out we’ve been paying for dial-up via automatic bill paying that we thought we cancelled in 2000. $1,800 later, we called to cancel. Customer service congratulated us on being loyal members for over 13 years. FML -Jay

- Image by roberthuffstutter via Flickr

I am a huge fan of automating my finances. My paycheck is direct-deposited. My savings are automatically transferred from my checking account to my savings account. Almost every bill I receive regularly is set up as an automatic payment in my bank’s bill-pay system. I even have my debt snowball automated.

The only question left is whether it’s possible to automate too far. Can you automate past the point of benefit, straight into detriment? The primary benefit of automation is knowing that you can’t forget a payment. The other benefit is freeing up your attention. You don’t have to give any focus to paying your bills, freeing you to worry about other things.

The problem with the second benefit is the same as the benefit. If you don’t give your bills any attention, how do you know if there is a problem? If something changes–an extra fee or a mis-keyed payment–you won’t notice because you haven’t been giving the bills any focus.

Sometimes, this means you are paying an extra fee without noticing it. Sometimes, if your due date changes, it can mean late fees. Even if nothing goes wrong, you are missing the opportunity to review what you are paying to ensure your needs are being met as efficiently as possible.

What can you do about it? I put a reminder on my Life Calendar to check my bills each month. I pick one bill each month and try to find a way to save money on it. I review the services to make sure they are what I need and if that doesn’t help, I call and ask for a lower price. If it’s a credit card, I ask for a lower interest rate. For the cable company, I ask if they will match whatever deal they have for new customers.

Every company can do something to keep a loyal customer happy. All you have to do is ask.

Do you automate anything? How do you keep track of it all?

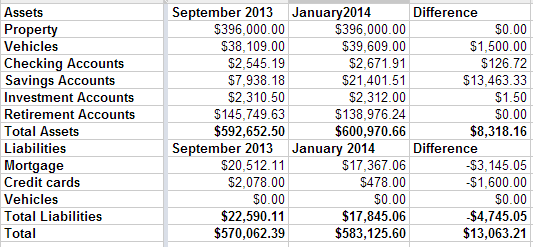

Net Worth Update – January 2014

This may be the most boring type of post I write, but it’s important to me to track my net worth so I can see my progress. We are sliding smoothly from debt payoff mode to wealth building mode.

Our highlights right now are nothing to speak of. We did let our credit card grow a little bit over the last couple of months, but paid it off completely at the end of December. It grew mostly as a matter of not paying attention while we were doing our holiday shopping and dealing with some car repairs.

That’s it. We haven’t remodeled our bathrooms yet, but we have the money sitting in a savings account, waiting for the contractor. We haven’t bought a pony yet, but we did decide that a hobby farm wouldn’t be the right move for us. We’ll be boarding the pony instead of moving, at least for the foreseeable future.

Our net worth is up $13,000 since September. Our savings are up and our retirement accounts are down because there are two inherited IRAs that we need to slowly cash out and convert to regular IRAs.

Family Bed: How to Make It Stop

baby on the cheek.” width=”300″ height=”199″ />

baby on the cheek.” width=”300″ height=”199″ />For years, my kids shared my bed.

When my oldest was a baby, I was working a graveyard shift, so my wife was alone with the baby at night. It was easy to keep a couple of bottles in a cooler by the bed and not have to get out of bed to take care of him when he woke up once an hour to drink a full bottle.

Then he got older. And bigger. And bigger.

We tried to move him to his own bed a few times, but it never worked well. He’d scream if we put him in a crib, so we got him a bed at 9 months old. That just meant he was free to join us whenever he woke up. Brat.

We finally got him to voluntarily move to his own bed after his sister was born. Shortly after she was born, I woke up to see him using her as a pillow. To paint the proper picture, this kid is 5’9″ and wears size 12 shoes. At 11. When I woke him up to tell him what he was doing, he decided to sleep in his own bed.

Method #1 to get your kids in their own bed: Have kid 1 try to crush kid 2 and feel bad about it.

Method #1 isn’t a great solution.

Soon, baby #3 showed up and we had 2 monsters in bed with us again. Once they started getting bigger, it became difficult for the 4 of us to sleep. We tried to get them into their own beds. Unfortunately, even as toddlers, my kids had a stubborn streak almost as big as my own. Nothing worked.

Eventually, they got big enough that I was crowded right out of the bed. At least we had a comfortable couch.

Sleeping on a couch gets old.

When the girls got old enough to reason with, we had a choice: We either had to find a way to convince them they wanted to sleep in their own room, or we had to have a fourth brat for them to attempt to crush at night.

We went with bribery. Outright, blatant bribery.

We put a chart on the wall with each of their names and 7 boxes. Every night they slept in their own beds, they got to check a box. When all of the boxes were checked, they got $5 and a trip to the toy store.

It took 10 days to empty our bed and it’s been peaceful sleeping since. That’s $5 well-spent.

Have you done a family bed? How did it work? How long did it last?