What would your future-you have to say to you?

The no-pants guide to spending, saving, and thriving in the real world.

What would your future-you have to say to you?

You know exactly how much you make, to the penny. You’ve listed all of your bills in a spreadsheet, including the annual payment for your membership to Save the Combat-Wombat. You know exactly how much is coming in and how much has to go out each month. Your income is more than your expenses, yet somehow, you still have more month than money.

What’s going on?

The short answer is that a budget is not enough.

A budget is not…

…a checkbook register. Do you track everything you spend? Are you busting your budget on $10 lattes or DVDs every few days? Is the take-out you have for lunch every day adding up to 3 times your food budget? Are you sure? If you don’t track what you spend, how do you know what you’ve actually spent? You have to keep track of what you are spending. Luckily there are ways to do this that don’t involve complex calculation, laborious systems or even proper math. The easy options include using cash for all of your discretionary spending(no money, no spendy!), rounding your spending up so you always have more money than you think you do, or even keeping your discretionary money is a separate debit account. That will let you keep your necessary expenses covered. You’ll just have to check your discretionary account’s balance often and always remember that sometimes, things take a few days to hit your bank.

…a debt repayment plan. You may know how much you have available, but if you aren’t exercising the discipline to pay down your debt and avoid using more debt, you not only won’t make progress, but you’ll continue to dig a deeper hole. Without properly managing the money going out, watching the money coming in is pointless.

…an alternative to responsible spending. Your budget may say you have $500 to spare every month, but does that mean you should blow it on smack instead of setting up an emergency fund? I realize most heroin addicts probably aren’t reading this, but dropping $500 at the bar or racetrack is just as wasteful if you don’t have your other finances in order. Take care of your future needs before you spend all of your money on present(and fleeting) pleasures.

A budget is a starting point for keeping your financial life organized and measuring a positive cash flow. By itself, it can’t help you. You need to follow it up with responsible planning and spending.

The idea of working from home is certainly appealing. You get to set your own hours, sleep in some days, and be there when the kids get home from school. You can be there when the packages get delivered and let the dog out before it’s too late. Who doesn’t see the attraction?

Unfortunately, when something is so enticing, there will always be predators looking to take advantage of the dreams of others. They dangle the “be your own boss” bait and reel in the people who their wishes overrule their judgment.

The ads are hard to resist. “Make $2800 per month without leaving your home!” or “Stuff envelopes in your home for $1 per envelopes.” I cases like these, the old saw tends to hold true: If it sounds too good to be true, it probably is.

Common work-at-home scams include:

For only $499.99, you can purchase a “business opportunity”. A lot of medical bill is actually done on paper so there is very real market for medical billing and processing. Unfortunately for the respondents to these ads, the vast majority of this market is already taken by large companies with huge marketing budgets. Finding enough customer to generate enough revenue to recover your investment is almost impossible, but you’ll never see that in an ad.

You answer an ad in the paper, sending $29.95 for a packet that will instruct you in the fine art of stuffing envelopes for $1 each. When you get the information, you find out it is a letter instructing you to place an ad in the papers stating “Stuff Envelopes for $1 Each. $29.95 for Information.” This forces you to become the scammer, just to recover your costs. Bad you.

This one actually sounds like a business. You invest in–for example–a sign-making machine for $1500. The selling company promises to buy a quota of signs from you each month. After you buy the equipment and materials you spend countless hours making the product only to find out that either a) the company has disappeared or b) their undefined “Quality Standards” has rejected the work. Nothing is ever up to standards.

That’s not to say there aren’t legitimate opportunities to make money at home. Bob at Christian Personal Finance recently listed 24 legitimate home-based businesses, including blogging, eBay selling, wedding planning, car mechanic, and mobile oil changes.

Are you exploring any home-based business opportunities?

In April, I was given an advanced reader copy of Delivering Happiness by Tony Hsieh on the condition that I give it an honest review. Delivering Happiness is being released today and here is my review.

Tony Hsieh was one of the founders of LinkExchange, which sold to Microsoft for $256 million in 1999. Shortly thereafter, he became affiliated with Zappos.com and ended up as CEO. Zappos.com was later sold to Amazon.com as a “wholly-owned subsidiary” in a stock-exchange transaction valued at $1.2 billion.

Delivering Happiness is his story and that of the creation and management of Zappos.com.

The book is divided into three sections: Profits, Passion, and Purpose.

Section 1 is largely autobiographical. It tells the story of Hsieh’s business ventures all through his life, from a failed worm farm to a failed newspaper to an abandoned greeting card business. Obviously the business of having children sell greeting cards had improved between his childhood and mine, because, when I did it, there were many more choices than just Christmas cards. I still have both the telescope and microscope I earned selling overpriced greeting cards. An important lesson imparted is that past success is not an indicator of future success. Different personalities, goals, and economics can change the result of two nearly identical activities.

Hsieh tells the story of the excitement of building LinkExchange and how he knew it was time to move on when the excitement faded, largely due to a surprising change to the corporate culture. After leaving, he spent some time just living and reviewing his past activities. He came to the conclusion that the happiest times of his life didn’t involve money. Doing things right beats strictly maximizing profits. Taking business lessons from the poker table, he reminds his readers that the Right Decision may lose sometimes, but it is still Right.

When he gets into building his business on a foundation of relationships, he is reminiscent of Keith Ferrazzi. Don’t network. Build your relationships based on friendship and let the friendship be it’s own reward. The rest will follow.

Section 2–while denying it was intended–reads heavily like marketing copy. It is almost entirely about how wonderful Zappos.com is to work for and with. I think it is fascinating to read about how successful businesses are built and how the corporate culture comes with that, but it’s not for everyone. The important points from this section include being open to necessary change without being reckless and their insistence on transparency. I don’t believe in hoarding information and it’s wonderful to hear others feel the same way. They go as far as giving all of the profitability and sales numbers to the vendors, live, which makes the vendors feel respected and gives the vendors an opportunity to suggest future orders based on past trends. That saves time and effort for the buyers at Zappos.com.

Section 3 attempts to tie the business lessons to life lessons and almost–but not quite–succeeds. After discussing differences in vision and alignment between the Zappos executives and the board, he talks about his growing speaking arrangements. When he started, he nervously memorized his presentations, resulting in mediocre speeches. When he discovered his “flow”, it all improved. His method of writing and speaking involves being passionate about his topic, telling personal stories, and being real. When he adopted that plan, his speaking became natural and popular.

In the final chapter, Hsieh actually discusses happiness. His equation is Perceived Control + Perceived Progress + Connectedness + Vision & Meaning = Happiness. He works to apply all of this as a part of the corporate culture at Zappos, giving the employees a measure of control over their advancement, duties, and culture. The employees help write the Corporate Culture book, which is given to all new hires and vendors. I intend to get a hold of a copy in the near future. It sounds like a fascinating read.

He also addresses the three types of happiness: Pleasure, Passion, and Higher Purpose, also described as Rockstar, In The Zone, and Being a Part of Something Bigger. The first is fleeting, and the last is long-lasting.

Would I recommend the book?

Yes. I found Delivering Happiness to be incredibly interesting, but, if you have no interest in how a successful-but-not-traditional company is built and run, or if you are bored by successful people, this book is not for you. The book is largely autobiographical and a case study in the success of Zappos.com. If that sounds remotely interesting, you will not regret reading this book.

Now, the fun part. I was given two copies of the book. The first one is becoming a permanent part of library. The second is being given away.

Giveaway

There are three ways to enter:

1. Twitter. Follow me and post the following: @LiveRealNow is giving away a copy of Delivering Happiness(@dhbook). Follow and RT to enter. http://bit.ly/czd31X

2. Become a fan on Facebook and post about the giveaway.

3. Post about the giveaway on your blog and link back to this post.

That’s 3 possible entries.

Next Sunday, I will throw all the entries in a hat and draw a name.

Future Reviews

If you have a book you’d like me to review, please contact me.

If you are looking to get out of debt, or you are currently debt-free and want to stay that way, then it is important that you get a grip of your financial situation and live within your means.

A good way to do this is to create a budget as this gives you a clear indication of how much money is coming in, how much is going out and also highlights any areas where you may need to make cut backs should you be falling short each month.

Once you have sorted out the figures and made necessary amendments, for example paying bills by direct debit in order to make savings or cutting existing debts by carrying out a balance transfer to a lower rate credit card, it is time to start focussing on the lifestyle changes.

As you will find, it is one thing to create a budget and quite another to stick to it, but by adhering to the following steps and exercising a certain amount of will power, you should be able to ensure that you live within your means and resist the urge to reach for that credit card.

Keep focussed

Before you start to look at how you can stick to your budget you need to clarify why you need to stick to your budget!

A budget can initially seem like something that has been devised with the sole intention of stopping you having fun and buying or doing the things that you want. So it is important to remember that, though some cutbacks may be necessary in the short term, a budget is a long-term strategy that will allow you to take control of your finances and, all being well, live a happy life that is free from the worry of excessive debt.

Change your habits

Unfortunately, a successful budget can require a change in lifestyle and this can be one of the most difficult things to adhere to.

For example, if you have previously enjoyed eating out regularly then you may have to make cut backs in this area to ensure that you are living within your means. But, instead of seeing this as a negative, try to focus on the positives and remember the reasons why you are budgeting.

And a change in habits doesn’t necessarily mean that you have to cut back on your enjoyment of life and it may actually open your eyes to other pursuits you may not have previously considered.

For example, instead of eating out try preparing a meal at home and turn your dining room into a restaurant. This means that you can still have the fine dining experience but at a fraction of the price and without the worry of making a reservation!

Shop smarter

Lists figure heavily when creating a personal budget and list-making is a habit that you should get used to when trying to stick to your budget.

When budgeting it is vitally important to avoid impulse buying and a great way to do this is to always make a list of things you need before you go shopping.

This means that you will have a clear idea of what you need and you will be less inclined to make random purchases that may just turn out to be an unnecessary drain on your finances. It’s also worth mentioning at this point that you should always differentiate and prioritise the things you need over the things you simply want.

If you are unsure how to make the distinction then put off making the purchase for a couple of days and then reconsider if you actually need it. This cooling off period will often convince you that you can do without it and save you money.

In addition, savings can be made on your shopping by simply swapping big name brands for supermarket own varieties, using discount coupons and looking for any special offers.

Overall, it is important to be fully focussed and committed to your budget plan and to be aware that a change in finances may require a change in lifestyle. But a few short term changes may well add up to better finances in the long term.

Article written by Les Roberts, budget reporter at Moneysupermarket.com.

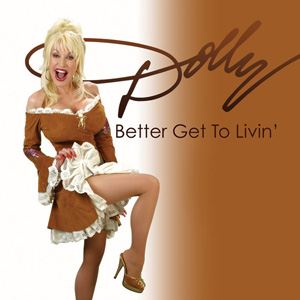

America’s country sweetheart, Dolly Parton, was in a car accident recently. Although she was only a passenger in this minor fender-bender, she still suffered some injuries requiring a quick hospital visit and rest. The offending driver did not stop as he was supposed to and struck Parton’s vehicle. Parton surely has auto insurance, and hopefully the offending driver has coverage as well.

Every month, you pay a premium toward your coverage balance. Coverage varies by state, from hospital bills to repairing damaged street items, like guard rails. People with expensive cars pay higher premiums while inexpensive cars have lower amounts. Some buyers only purchase the bare minimum of coverage, called comprehensive. This coverage does not help in the Parton crash because it typically covers vehicle damage from objects, like flying rocks, rather than a collision situation.

How Much Does That Part Cost?

Repairing a vehicle after a car crash can lead to astronomical figures. A simple dent in the bumper may warrant an entire part replacement costing thousands of dollars. The offending driver in Parton’s accident is at fault. His insurance should cover Parton’s insurance deductible and any other expenses that arise. If he is not covered, she could technically sue him for damages, although there may not be many funds to pay out.

Those Medical Bills

Coupled with a car repair, Parton and her driver also went to the hospital. The offending driver uses his auto insurance to cover their medical bills. Any bills generated from the driver or passenger’s injuries goes directly to the offending driver’s insurance. If he is not properly covered with this policy feature, he must pay for the bills out-of-pocket. With medical bills costing thousand of dollars, he probably called his insurance agent right away to see if his policy has that coverage.

Luckily, Parton’s accident was not severe, but ongoing injuries can slowly siphon funds out of the offending driver’s account. If Parton has whiplash, for example, she may need multiple visits to a chiropractor or other specialty doctor. Each visit should be covered by the offending driver’s insurance. Because she has good insurance coverage does not mean that her policy should pay out. The party at-fault always pays for both car repairs and medical bills. With treatment that takes several weeks to a few months, the offending driver’s insurance rates will typically jump next policy year.

Someone Has To Pay For It

Depending on the insurance company, an accident on your record causes your premiums to rise. You are now considered a risk to the company. It is possible that you will cause another accident incurring more cost. Insurance companies must weigh their risky customers with their good drivers. Hopefully Parton recuperates quickly so the offending driver’s rates do not remain high for several years.

You may not think of auto insurance as a top priority, but the reality of Parton’s fender-bender shows everyone that accidents happen at any time. Even celebrities must cover their vehicles with good insurance to protect their assets.