- RT @MoneyMatters: Frugal teen buys house with 4-H winnings http://bit.ly/amVvkV #

- RT @MoneyNing: What You Need to Know About CSAs Before Joining: Getting the freshest produce available … http://bit.ly/dezbxu #

- RT @freefrombroke: Latest Money Hackers Carnival! http://bit.ly/davj5w #

- Geez. Kid just screamed like she'd been burned. She saw a woodtick. #

- "I can't sit on the couch. Ticks will come!" #

- RT @chrisguillebeau: U.S. Constitution: 4,543 words. Facebook's privacy policy: 5,830: http://nyti.ms/aphEW9 #

- RT @punchdebt: Why is it “okay” to be broke, but taboo to be rich? http://bit.ly/csJJaR #

- RT @ericabiz: New on erica.biz: How to Reach Executives at Large Corporations: Skip crappy "tech support"…read this: http://www.erica.biz/ #

The Magic Toilet

- Image by tokyofortwo via Flickr

My toilet is saving me $1200.

For a long time, my toilet ran. It was a nearly steady stream of money slipping down the drain. I knew that replacing the flapper was a quick job, but it was easy to ignore. If I wasn’t in the bathroom, I couldn’t hear it. If I was in the bathroom, I was otherwise occupied.

When I finally got sick of it, I started researching how to fix a running toilet because I had never done it before. I found the HydroRight Dual-Flush Converter. It’s the magical push-button, two-stage flusher. Yes, science fiction has taken over my bathroom. Or at least my toilet.

I bought the dual-flush converter, which replaces the flusher and the flapper. It has two buttons, which each use different amounts of water, depending on what you need it to do. I’m sure there’s a poop joke in there somewhere, but I’m pretending to have too much class to make it.

I also bought the matching fill valve. This lets you set how much water is allowed into the tank much better than just putting a brick in the tank. It’s a much faster fill and has a pressure nozzle that lies on the bottom of the tank. Every time you flush, it cleans the inside of the tank. Before I put it in, it had been at least 5 years since I had opened the tank. It was black. Two weeks later, it was white again. I wouldn’t want to eat off of it, or drink the water, but it was a definite improvement.

Installation would have been easier if the calcium buildup hadn’t welded the flush handle to the tank. That’s what reciprocating saws are for, though. That, and scaring my wife with the idea of replacing the toilet. Once the handle was off, it took 15 minutes to install.

“Wow”, you say? “Where’s the $1200”, you say? We’ve had this setup, which cost $35.42, since June 8th, 2010. It’s now September. That’s summer. We’ve watered both the lawn and the garden and our quarterly water bill has gone down $30, almost paying for the poo-gadget already. $30 X 4 = $120 per year, or $1200 over 10 years.

Yes, it will take a decade, but my toilet is saving me $1200.

Consumer Action Handbook

- Image by ivers via Flickr

The Consumer Action Handbook is a book published by the federal government for the express purpose of giving you “the most current information on all your consumer needs.” In short, the Consumer Action Handbook wants to help you with everything that takes your money.

The best part? It’s free.

The book covers topics ranging from banking to health care to cell phones to estate planning. It covers both covering your butt in a transaction and filing a complaint if things go poorly. It explains the options and pitfalls involved in buying, renting, leasing, or fixing a car. You can learn about financial aid for college and maneuvering through an employment agency. And more. So much more.

I’m not sure if you’ve noticed, but I spend quite a bit of time explaining scams and how to avoid them. This book has provided some of the source material for that theme.

It’s 170 pages on not getting screwed, either through fraud or ignorance. Every house should have one. Really, the list of consumer and regulatory agencies alone is worth the price of admission, which–if I wasn’t clear earlier–is $0.

To get yours, go to http://www.consumeraction.gov/caw_orderhandbook.shtml and fill out the form. You can order up to 10 at a time, so pick a few up for your friends and family. They won’t complain, I promise.

How to Prioritize Your Spending

Don’t buy that.

At least take a few moments to decide if it’s really worth buying.

Too often, people go on auto-pilot and buy whatever catches their attention for a few moments. The end-caps at the store? Oh, boy, that’s impossible to resist. Everybody needs a 1000 pack of ShamWow’s, right? Who could live without a extra pair of kevlar boxer shorts?

Before you put the new tchotke in your cart, ask yourself some questions to see if it’s worth getting.

1. Is it a need or a want? Is this something you could live without? Some things are necessary. Soap, shampoo, and food are essentials. You have to buy those. Other things, like movies, most of the clothes people buy, or electronic gadgets are almost always optional. If you don’t need it, it may be a good idea to leave it in the store.

2. Does it serve a purpose? I bought a vase once that I thought was pretty and could hold candy or something, but it’s done nothing but collect dust in the meantime. It’s purpose is nothing more than hiding part of a flat surface. Useless.

3. Will you actually use it? A few years ago, my wife an cleaned out her mother’s house. She’s a hoarder. We found at least 50 shopping bags full of clothes with the tags still attached. I know, you’re thinking that you’d never do that, because you’re not a hoarder, but people do it all the time. Have you ever bought a book that you haven’t gotten around to reading, or a movie that went on the shelf, still wrapped in plastic? Do you own a treadmill that’s only being used to hang clothes, or a home liposuction machine that is not being used to make soap?

3. Is it a fad? Beanie babies, iPads, BetaMax, and bike helmets. All garbage that takes the world by storm for a few years then fades, leaving the distributors rich and the customers embarrassed.

4. Is it something you’re considering just to keep up with the Joneses? If you’re only buying it to compete with your neighbors, don’t buy it. You don’t need a Lexus, a Rolex, or that replacement kidney. Just put it back on the shelf and go home with your money. Chances are, your neighbors are only buying stuff so they can compete with you. It’s a vicious cycle. Break it.

5. Do you really, really want it? Sometimes, no matter how worthless something might be, whether it’s a fad, or a dust-collecting knick-knack, or an outfit you’ll never wear, you just want it more than you want your next breath of air. That’s ok. A bit disturbing, but ok. If you are meeting all of your other needs, it’s fine to indulge yourself on occasion.

How do you prioritize spending if you’re thinking about buying something questionable?

Mortgage Race

I spent last week at the Financial Blogger Conference. Saturday night was the big debauch, a 90s themed hip-hop dance party.

Yeah.

Instead, Crystal, Suba, and I hosted a super-secret pizza party to let some of the less “dance party” inclined attendees discuss things like the sanitary concerns of group body shots, sex toys, and horror movies.

During the course of the party, Crystal and I decided to race to pay off our mortgages.

Her balance is just under $25,000.

My balance is $26,266.40.

We both technically have the cash to pay off the balances right now, but we are both dealing with secondary housing issues. She’s building a new one, and I’m updating an inherited house. Neither of us is willing to use our cash reserves to pay off the balance right this moment.

Now that my credit card is paid off, I’ve moved that money to an extra interest-only payment on my mortgage, effectively doubling my mortgage payment, which puts my projected payoff date as about the end of next year. Crystal’s aiming for June, so I’ll have to hurry.

We do have tenants lined up for February, and all of the non-expense related rent will go to the mortgage.

I think I can win.

Update:

I forgot to mention the terms of the bet. The loser has to go visit the winner. When I win, Crystal’s going to fly to Minnesota to experience snow.

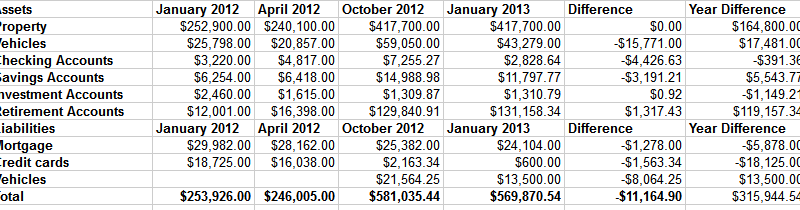

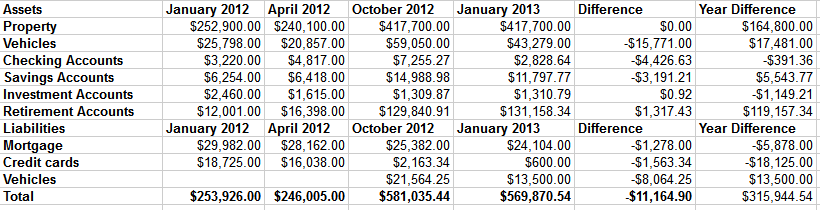

Net Worth Update

Welcome to the New Year. 2013 is the year we all get flying cars, right?

Here is my net worth update, along with the progress we made over the course of 2012.

As you can see, our net worth contracted by about $11,000. Part of that difference is due to selling our spare cars and–against my better judgement–taking payments with a lien on one of them. That is supposed to be paid off within a couple of months. If not, I’ll play repo man again.

The other part of the difference is in the final preparations for our rental property. The only things left to do are sanding and polishing the hardwood floors and cleaning the living room carpet. The final push to get to this point cost some money. All told, we’re nearly $30,000 into getting the house ready to rent. For the naysayers who think we should have sold it, we would have spent more getting it ready to sell.

Other than that, we’re not doing poorly. Our credit card is still being paid off every month and our mortgage is shrinking. If things continue to go well, we’ll have our truck paid off in a couple of months and the mortgage by mid summer.