- RT @ScottATaylor: The Guys on "Pickers" should just follow the "Hoarders" teams around- perfect mashup #

- PI/PNK test: http://su.pr/2umNRQ #

- RT @punchdebt: When I get married this will be my marital slogan "Unity through Nudity" #

- http://su.pr/79idLn #

- RT @jeffrosecfp: Wow! RT @DanielLiterary:Stats show 80% of Americns want to write a book yet only 57% have read at least 1 bk in the last yr #

- @jeffrosecfp That's because everyone thinks their lives are unique and interesting. in reply to jeffrosecfp #

- @CarrieCheap Congrats! #CPA in reply to CarrieCheap #

- @prosperousfool I subscribe to my own feed in google reader. Auto backup for in between routine backups. Saved me when I got hacked. in reply to prosperousfool #

- @SuzeOrmanShow No more benefits? I bet the real unemployment rate goes down shortly thereafter. in reply to SuzeOrmanShow #

- Losing power really make me appreciate living in the future. #

My New Windfall

Tax season is over.

This year, TurboTax and Amazon teamed up to offer me a 10% on up to $1200 of my refund if I took it as an Amazon gift card.

$120 free if I spend that money with a company I’m going to spend money with anyway?

Yes, please.

I spend lots of money with Amazon. I subscribe to many of my household items there, because I use them and I don’t want to have to think about buying them. I get my soap, shampoo, toilet paper, paper towels, and garbage bags automatically delivered. There’s a bunch of other stuff, too, but that’s what I remember off the top of my head. If I have 5 items in a monthly delivery, I get 20% off.

Free money, free shipping, and none of the hassles of shopping?

Yes, please.

So now I have a $1320 credit with the company I use for most of my non-grocery shopping.

I also have 962 items on my wishlist with Amazon.

To recap: $1320 burning a hole in my metaphorical pocket and 962 items that I have wanted at some time in the past, begging me to bring them home.

That’s a dilemma.

The smart answer is, of course, to let that money hide in Amazon’s system and slowly drain out to pay for the things I actually need.

The fun answer is to stock up on games and books and toys and gadgets and cameras and, and, and….

Some days, it’s hard being a responsible adult.

I think I’m going to compromise with myself. I’ll leave the vast majority of the money where it is, but I’ll spend a little bit of it on fun stuff, and a little bit more on stuff I don’t quite need, but would be useful, but not so useful that I’ve already bought it.

A new alarm clock to replace the one next to my bed that automatically adjusts for daylight savings time but was purchased before they changed the day daylight savings time hit so I have to adjust the time 4 times per year instead of never. That’s on the list of not-quite-needs.

The volume 2 book of paracord knots is on the list of wants that can’t possibly be considered a need, but it’s going to come home, anyway.

I figure, if I spend a couple of hundred dollars on things I really, really want, I’ll scratch that itch and leave most of the money alone.

What would you do with a $1300 gift card at a store you shop at every week that sells every conceivable thing? Spend it right away, or stretch it out, or something else?

Credit Card Glossary

As evil as credit cards are, most adults have one. Have you ever wondered what percentage of those people know the details of[ad name=”inlineright”] their credit card agreement, or even what all of the terms mean?

Here’s a quick list of the terms and their definitions.

- Average daily balance – This is the balance most card companies use to calculate your interest. They add the balance each day and divide it by the number of days in the billing cycle. This number times the interest rate is (roughly) the interest you have to pay.

- Annual Percentage Rate(APR) – This is the interest rate expressed as the interest accrued in one year. The actual calculation is much more complicated.

- Balance transfer – If you’ve ever paid your VISA with your Mastercard, you’ve done a balance transfer. These often have a great introductory rate and a lousy permanent rate.

- Cardholder agreement – This is the contract that defines all of the terms of your card: interest, default consequences, payment terms, and everything else. You should never sign for a card without reading and understanding this document.

- Charge-back – If you dispute a charge on your card, the issuer may issue a charge-back, and take the money back from the merchant to return to you.

- Credit line – This is the amount you are able to charge. You should fear this number and stay as far away from it as possible.

- Default – When you stop paying your card, you become delinquent. If it goes on too long, you will be in default. Read: screwed. This is when they crank your interest rate to the sky and cut your limit to match your balance. It’s also the point that affects your credit rating.

- Due date – This is the day which, if you miss it, will cause you to acquire an extra $15-39 fee for the privilege of misreading your calendar. Always pay your bill before this date.

- Finance charge – This is the actual interest accrued for the billing period. This is money you are paying for the privilege of borrowing the rest of the money. Next month, you’ll pay a finance charge on this money, too. Yay!

- Grace period – For most cards worth owning, you get 20-25 days before the issuer starts charging interest. The best way to manage your card is to pay it off completely twice a month. That way, you’ll never use up your grace period and never pay a cent of interest.

- Introductory rate – Many cards will offer a crazy-low interest rate for six months to lure you in…like crack. They’ll get you hooked, then raise the rate and force you to charge new toys at the higher rate. Ideally, you’ll never carry a balance, so you’ll never have to worry about the introductory rate.

- Minimum payment – If debt has an evil heart, this is it. If you pay nothing but the minimum required payment, you will be in debt for the rest of your life. Always pay more, even if it’s just an extra $20.

- Over-the-limit fee – If you ignore your credit limit and keep spending, you’ll get hit with another $15-39 fee for the privilege of not controlling your irresponsible impulses.

- Periodic rate – This is your APR expressed in relation to a specific time frame, usually as a daily periodic rate. For example, if your interest rate is 18%, your daily periodic rate is 18/365 or 0.0493%

- Pre-approved – When you get a pre-approved card, you are actually just getting a notice that you have been pre-screened as not being too much of a deadbeat for that particular card. You will still have a full credit check before the card is issued.

- Secured card – If you’ve got lousy credit, sometimes your only choice to repair it is to get a prepaid card. You give the company $200 and they will let you charge $200. They are almost always loaded with fees and are usually a very bad deal, but if it’s the only game in town…?

- Universal default – Sometimes, if you default on one card, every other card you have decides to gang up on you, because your “risk profile” has changed. Yet more proof of the evil that is credit-card debt.

- Variable interest rate – Some card tie your rate to the Prime interest rate, so when that changes, your rate does, too.

Did I miss any terms?

Saturday Roundup

- Image via Wikipedia

I wrote this yesterday. According the forecast, when this post goes live, I’ll be moving 5-8 inches of snow off of my driveway.

That, or watching TV and thinking about moving snow.

Maybe I’ll just sleep in and wait for spring to melt the snow.

Don’t forget to enter my drawing for a $100 Amazon gift card! Go here for details. It ends on the 15th, so don’t wait too long.

Best Posts

Crazy-easy ice cream bread. How could this possibly be bad?

Tron comes out in 2 weeks. I’d love to show up on a custom street-legal Troncycle.

Arsenic-based lifeforms are shaking up the way we understand life to work. I’m of the opinion that life will probably exist almost everywhere that isn’t a completely dead dry rock. I say that as an expert in…well, nothing related to astrobiology.

Following Erica’s advice is currently making me a few hundred dollars per month, with every sign of growing as time goes on. I hate to sound like a fanboy, but if she pimps a product, I’m at least going to give it some serious consideration.

Carnivals I’ve Rocked

10 Dumb Money Moves was featured in the Carnival of Debt Reduction.

Book Review: The Art of Non-Conformity was included in the Carnival of Personal Finance.

Things You Should Buy Online to Save Money was included in the Festival of Frugality.

Thank you! If I missed anyone, please let me know.

LRN Timewarp

This is a new feature to share the gift that is me with anyone new to LRN. This week, I’m going to share some posts from my first week blogging here.

The $10 College Fund. In the last year, not only have I not changed my mind about the $10 college fund, but I haven’t raised the amount. The point is to just get started. I’ve done that. I’ll raise the amount when my debt is paid off. We are now up to $166.09. The numbers are off because I stuck a little bit extra in one month.

In the last year, our dreams haven’t changed. We haven’t made any direct progress, but indirectly we are doing well. First things first. We need to pay the debt off before we look at a hobby farm.

My second day blogging, I wrote about why we handled money so poorly.

20 Happy Thoughts

Since I’ve been on a bit of a death theme lately, I thought I post something purely happy.

Here it is. In no particular order, twenty unequivocated things that make me happy.

- My three year old has the most beautiful blue/silver/gray eyes I have ever seen.

- In the past 32 months, I’ve reduced my total debt load by $42,859.70. That’s an average reduction of $1,339.37 per month.

- My insane work schedule is paying off. I’m more than halfway to making my day job’s income redundant.

- My preteen son is currently showing none of the signs of the horrible rebellion that I put my parents through.

- The world hasn’t imploded, exploded, or tilted its axis recently.

- My parents did a good job of raising me.

- I haven’t touched my overdraft line of credit in more than 2 years.

- My wife loves me.

- I love her.

- Wrestling season starts tomorrow, and Punk ended last season with real promise.

- I’ve dropped 12 pounds in the last 16 days.

- Bacon is good.

- Daughter #1 is starting kindergarten in September and excited about it.

- Our cars are paid off.

- This site helps me stay motivated to eliminate my debt.

- You rock.

- I may get out of debt just before the world ends.

- The Yakezie Network has helped get this blog to where it is. If you’ve got a finance blog, join today. You won’t regret it.

- FINCON 2012 is is Denver and I won’t be napping on my motorcycle on the way there, like I did the last time I went to Denver. It’s not something I recommend, but it makes a neat story.

- I have 20 things to be happy about. That’s a recursive happy-maker right there.

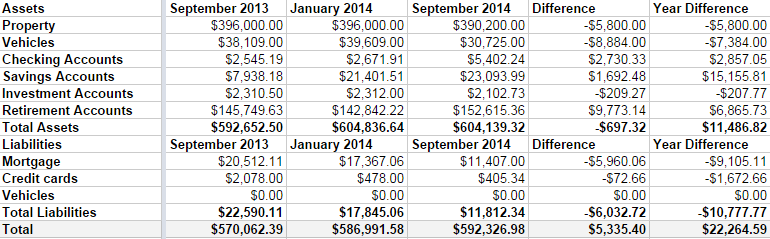

Net Worth Update – September 2014

It’s time for my irregular-but-usually-quarterly net worth update. It’s boring, but I like to keep track of how we’re doing. Frankly, I was a bit worried when I started this because we’ve been overspending this summer and Linda was off work for the season.

But, all in all, we didn’t do too bad.

Some highlights:

- Both of our properties lost around $3000 in value. I’m not worried, because we are keeping them both for the long haul. The rental is basically on auto-pilot, so that’s free money every month.

- We sold a boat that appraised for much less I had estimated in the last few updates. I had it listed for $5000, but it was worth $2000.

- I do have a credit card balance at the moment, but that goes away as soon as my expense check clears the bank, which will be in a day or two.

- We’re in the home stretch with the mortgage. There is $11,407 left to go, and we’ve paid down $9105 in the last year. By this time next year, I want that gone, gone, gone.

I can’t say I’m upset with our progress. We’ve paid down $6000 in debt in 2014, including 3 months with 1 income. We aren’t maxing our retirement accounts, yet, but I’d like to be completely debt free before I do that. It’s bad math, but having all of my debt gone will give me such a warm fuzzy feeling, I can’t not do it.

My immediate goal is to hit a $600,000 net worth by my next update in January. I’m only about $7000 off.

Time to hit the casino. Err, I mean, time to up my 401k contribution from 5% to 7%.