- Dora the Explorer is singing about cocaine. Is that why my kids have so much energy? #

- RT @prosperousfool: Be the Friendly Financial “Stop” Sign http://bit.ly/67NZFH #

- RT @tferriss: Aldous Huxley’s ‘Brave New World’ in a one-page cartoon: http://su.pr/2PAuup #

- RT @BSimple: Shallow men believe in Luck, Strong men believe in cause and effect. Ralph Waldo Emerson #

- 5am finally pays off. 800 word post finished. Reading to the kids has been more consistent,too. Not req’ing bedtime, just reading daily. #

- Titty Mouse and Tatty Mouse: morbid story from my childhood. Still enthralling. #

- RT @MoneyCrashers: Money Crashers 2010 New Year Giveaway Bash – $7,400 in Cash and Amazing Prizes http://bt.io/DDPy #

- [Read more…] about Twitter Weekly Updates for 2010-01-16

Carnival Roundup

The Money Makers was included in the following carnivals recently.

Carnival of Financial Planning hosted by The Skilled Investor

Carnival of Financial Independence hosted by Reach Financial Independence

Carnival of Personal Finance hosted by Reach Financial Independence

Aspiring Blogger Financial Carnival hosted by Aspiring Blogger

Carnival of Money hosted by Financial Nerd

Thank you!

Check Your Bills

Today, I discovered our AOL billing information. Turns out we’ve been paying for dial-up via automatic bill paying that we thought we cancelled in 2000. $1,800 later, we called to cancel. Customer service congratulated us on being loyal members for over 13 years. FML -Jay

- Image by roberthuffstutter via Flickr

I am a huge fan of automating my finances. My paycheck is direct-deposited. My savings are automatically transferred from my checking account to my savings account. Almost every bill I receive regularly is set up as an automatic payment in my bank’s bill-pay system. I even have my debt snowball automated.

The only question left is whether it’s possible to automate too far. Can you automate past the point of benefit, straight into detriment? The primary benefit of automation is knowing that you can’t forget a payment. The other benefit is freeing up your attention. You don’t have to give any focus to paying your bills, freeing you to worry about other things.

The problem with the second benefit is the same as the benefit. If you don’t give your bills any attention, how do you know if there is a problem? If something changes–an extra fee or a mis-keyed payment–you won’t notice because you haven’t been giving the bills any focus.

Sometimes, this means you are paying an extra fee without noticing it. Sometimes, if your due date changes, it can mean late fees. Even if nothing goes wrong, you are missing the opportunity to review what you are paying to ensure your needs are being met as efficiently as possible.

What can you do about it? I put a reminder on my Life Calendar to check my bills each month. I pick one bill each month and try to find a way to save money on it. I review the services to make sure they are what I need and if that doesn’t help, I call and ask for a lower price. If it’s a credit card, I ask for a lower interest rate. For the cable company, I ask if they will match whatever deal they have for new customers.

Every company can do something to keep a loyal customer happy. All you have to do is ask.

Do you automate anything? How do you keep track of it all?

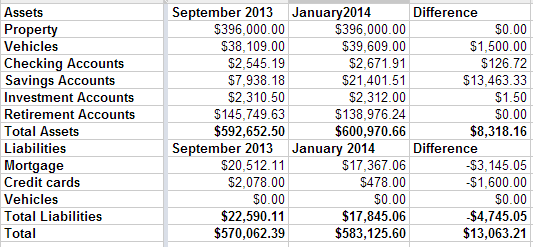

Net Worth Update – January 2014

This may be the most boring type of post I write, but it’s important to me to track my net worth so I can see my progress. We are sliding smoothly from debt payoff mode to wealth building mode.

Our highlights right now are nothing to speak of. We did let our credit card grow a little bit over the last couple of months, but paid it off completely at the end of December. It grew mostly as a matter of not paying attention while we were doing our holiday shopping and dealing with some car repairs.

That’s it. We haven’t remodeled our bathrooms yet, but we have the money sitting in a savings account, waiting for the contractor. We haven’t bought a pony yet, but we did decide that a hobby farm wouldn’t be the right move for us. We’ll be boarding the pony instead of moving, at least for the foreseeable future.

Our net worth is up $13,000 since September. Our savings are up and our retirement accounts are down because there are two inherited IRAs that we need to slowly cash out and convert to regular IRAs.

Family Bed: How to Make It Stop

baby on the cheek.” width=”300″ height=”199″ />

baby on the cheek.” width=”300″ height=”199″ />For years, my kids shared my bed.

When my oldest was a baby, I was working a graveyard shift, so my wife was alone with the baby at night. It was easy to keep a couple of bottles in a cooler by the bed and not have to get out of bed to take care of him when he woke up once an hour to drink a full bottle.

Then he got older. And bigger. And bigger.

We tried to move him to his own bed a few times, but it never worked well. He’d scream if we put him in a crib, so we got him a bed at 9 months old. That just meant he was free to join us whenever he woke up. Brat.

We finally got him to voluntarily move to his own bed after his sister was born. Shortly after she was born, I woke up to see him using her as a pillow. To paint the proper picture, this kid is 5’9″ and wears size 12 shoes. At 11. When I woke him up to tell him what he was doing, he decided to sleep in his own bed.

Method #1 to get your kids in their own bed: Have kid 1 try to crush kid 2 and feel bad about it.

Method #1 isn’t a great solution.

Soon, baby #3 showed up and we had 2 monsters in bed with us again. Once they started getting bigger, it became difficult for the 4 of us to sleep. We tried to get them into their own beds. Unfortunately, even as toddlers, my kids had a stubborn streak almost as big as my own. Nothing worked.

Eventually, they got big enough that I was crowded right out of the bed. At least we had a comfortable couch.

Sleeping on a couch gets old.

When the girls got old enough to reason with, we had a choice: We either had to find a way to convince them they wanted to sleep in their own room, or we had to have a fourth brat for them to attempt to crush at night.

We went with bribery. Outright, blatant bribery.

We put a chart on the wall with each of their names and 7 boxes. Every night they slept in their own beds, they got to check a box. When all of the boxes were checked, they got $5 and a trip to the toy store.

It took 10 days to empty our bed and it’s been peaceful sleeping since. That’s $5 well-spent.

Have you done a family bed? How did it work? How long did it last?

Nigella Lawson and the High Cost of divorce

Heartache and heartbreak are hard enough to endure but imagine having to go through the loss of a relationship while the world looks on. Such is the high price of celebrity divorce and the latest victim is the beautiful and talented television chef, Nigella Lawson. Shocking photos of Nigella apparently being choked by her husband, Charles Saatchi, surfaced in the media following the June 9th dinner at Scott’s restaurant in Mayfair, London, where the incident occurred. Saatchi’s advisors urged him to humble himself and admit a public apology for the assault. Saatchi denied any wrongdoing, saying he never assaulted her and in fact, was actually removing mucous from his wife’s nose. Nigella was stunned by the admonition of “nose-picking” and his refusal to apologize. She left Saatchi and their family home in Chelsea.