My son, at 10 years old, is a deal-finder. His first question when he finds something he wants is “How much?”, followed closely by “Can I find it cheaper?” I haven’t–and won’t–introduced him to Craigslist, but he knows to check Amazon and eBay for deals. We’ve been working together to make sure he understands everything he is looking at on eBay, and what he needs to check before he even thinks about asking if he can get it.

The first thing I have him check is the price. This is a fast check, and if it doesn’t pass this test, the rest of the checks do not matter. If the price isn’t very competitive, we move on. There are always risks involved with buying online, so I want him to mitigate those risks as much as possible. Pricing can also be easily scanned after you search for an item.

The next thing to check is the shipping cost. I don’t know how many times I’ve seen “Low starting price, no reserve!” in the description only to find a $40 shipping and handling fee on a 2 ounce item. The price is the price + shipping.

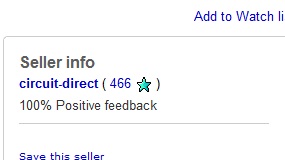

Next, we look at the seller’s feedback. The feedback rating has a couple of pieces to examine. First, what is the raw score? If it’s under 100, it needs to be examined closer. Is it all buyer feedback? Has the seller sold many items? Is everything from the last few weeks? People just getting into selling sometimes get in over their heads. Other people are pumping up their ratings until they have a lot of items waiting to ship, then disappear with the money. Second, what is the percent positive? Under 95% will never get a sale from me. For ratings between 95% and 97%, I will examine the history. Do they respond to negative feedback? Are the ratings legit? Did they get negative feedback because a buyer was stupid or unrealistic? Did they misjudge their time and sell more items than they could ship in a reasonable time? If that’s the case, did they make good on the auctions? How many items are they selling at this second?

[ad name=”inlineright”] After that, we look at the payment options. If the seller only accepts money orders or Western Union, we move on. Those are scam auctions. Sellers, if you’ve been burned and are scared to get burned again, I’m sorry, but if you only accept the scam payment options, I will consider you a scammer and move on.

Finally, we look at the description. If it doesn’t come with everything needed to use the item(missing power cord, etc.), I want to know. If it doesn’t explicitly state the item is in working condition, the seller will get asked about the condition before we buy. We also look closely to make sure it’s not a “report” or even just a picture of the item.

Following all of those steps, it’s hard to get ripped off. On the rare occasion that the legitimate sellers I’ve dealt with decide to suddenly turn into ripoff-artists, I’ve turned on the Supreme-Ninja Google-Fu, combined with some skip-tracing talent, and convinced them that it’s easier to refund my money than explain to their boss why they’ve been posting on the “Mopeds & Latex” fetish sites while at work. Asking Mommy to pretty-please pass a message about fraud seems to be a working tactic, too. It’s amazing how many people forget that the lines between internet and real life are blurring more, every day.

If sending them a message on every forum they use and every blog they own under several email addresses doesn’t work and getting the real-life people they deal with to pass messages also doesn’t work, I’ll call Paypal and my credit card company to dispute the charges. I only use a credit card online. I never do a checking account transfer through Paypal. I like to have all of the possible options available to me.

My kids are being raised to avoid scams wherever possible. Hopefully, I can teach them to balance the line between skeptical and cynical better than I do.