This summer, my family took a six-day cheap vacation. Technically, it was a “stay-cation”, but I hate that word. Our goal was a fun time, on a budget, for 3 kids–one, two, and nine–without driving the adults nuts. Obviously, if you’re not herding small children, some of these choices may not be for you.

- Zoo. In St. Paul, there is a free zoo that is more fun than the paid zoo in the area. There’s a small amusement park, a playground, lots of picnic benches, and even animals. We packed a cooler full of food and drinks and hauled the kids to Como Zoo for a day. If there isn’t a free zoo near you, find a local petting zoo. They are good for a few hours.

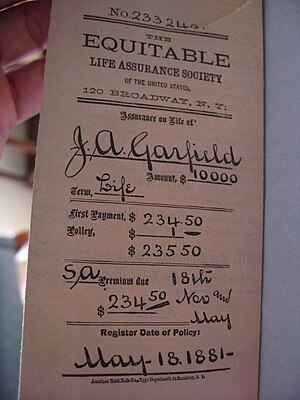

- Go Antiquing. Make sure you stay on a budget. It can be more fun to feel the history in antique stores than to feel the fleeting thrill of an off-budget purchase. This isn’t much fun for small children.

- Children’s Museums. We have access to a “Museum Adventure Pass”. We used one to go to The Works Museum, which is a hands-on science exhibit not far from our home. It wasn’t busy and the kids had a blast. Most metropolitan areas have a wide variety of childre-friendly museums.

- Municipal Pool. We spent an afternoon at the city pool. Aside from gas, this was one of the most expensive events for our vacation. Residents get a discount, but it was still $30. I discovered that my two-year-old loves big waterslides. She comes out of them with a death-grip on the inner tube and a huge smile on her face. It was a double tube and she sat in my lap.

- Game Day. Spend a day with the TV off and games on the table. Make some snacks and prepare for some of the best quality time you can have as a family.

- Picnic. Pack a lunch and go somewhere quiet. Go to the park. Go to the country. Grab a bench on a sidewalk somewhere. Just have a leisurely lunch and take the opportunity to connect with your family.

- Hike. Find a trail somewhere and just walk. I’ve found that it easy to have deep or sometimes even awkward conversations while walking. You may find out things you never would have guessed.

- Visit Family. Hotel on the go? My parents live more than 2 hours away, so they are always thrilled to have us visit with the grandchildren. Be nice, bring some food to help out.

- Bike. The final day of our vacation, my wife and I left the kids in daycare and kept the day to ourselves. We had breakfast in a nice little cafe. We went antiquing. Then we went out to the park where we were married, had a picnic lunch and went for a bike ride together. It was our anniversary.

- Apple Orchard. Around here, they are everywhere. Pick-you-own apples, a petting zoo, pony rides. If you go in the fall, there is usually a corn maze. You can by real apple cider and any number of baked goods.

- University Exhibits. Check your local colleges, especially the public universities. Most of them have a PR program to maintain public interest and funding. Even the private schools will usually have fund-raisers for some programs. We recently attended the raptor show at the University of Minnesota for free with our Adventure Pass.

Vacations don’t have to be expensive to be fun. Counting gas, food, and the occasional souvenir, we took a 6 day cheap vacation packed with activities for well under $400, possibly even under $300.

How do you save money on a vacation?

Update: This post has been included in the Money Hacks Carnivals XCV.

Credit Card

Credit Card