- @ScottATaylor Thanks for following me. in reply to ScottATaylor #

- RT @ChristianPF: 5 Tips For Dealing With Your Medical Debt http://su.pr/2cxS1e #

- Dining Out vs Cooking In: http://su.pr/3JsGoG #

- RT: @BudgetsAreSexy: Be Proud of Your Emergency Fund! http://tinyurl.com/yhjo88l ($1,000 is better than $0.00) #

- [Read more…] about Twitter Weekly Updates for 2009-12-12

Repo Man

Here is a fun blast from the past. This was originally posted in February 2010.

A few years ago, we bought a new truck. We brought our old truck in as a trade, but the offer was bordering on insulting, so we kept it.

We posted the old truck on CarSoup, the classifieds, and anywhere else we could find to post it. Nothing. After a few weeks, we finally found a

buyer–a friend we had hired to help with a large remodel on our house. He didn’t have all of the money to buy it, but we knew him, we knew his family, and he was work for us. It should have been a low-risk loan. We’d give him the truck, he’d make monthly payments. Simple, right?

That was the plan. He made payments for about six months. When the starter died, we forgave that amount of the debt. When we was short, we’d let him skip a payment. Were were good lenders, at least from his perspective.

Then, “I’m a little short this month” stretched into two months, three, six. Then one day, he fell off the face of the planet. I found out later, he’d canceled his phone and left the state. We were the kind of lenders that get banks closed down by bad business decisions.

What could we do? Fortunately, we’d created a written loan agreement and entered ourselves as the loan holder during the title transfer. I eventually filed the repossession payment…a year after he disappeared. I figured, if by some chance the truck got impounded, we’d get it back.

A few months later, we were driving down the highway that just happened to pass within sight of his brother’s shop. I just happened to glance in that direction as we drove past. I’m sure I caught my wife by surprise with the sudden u-turn. I found our truck. The long-lost friend was back in the state, staying in his brother’s shop.

[ad name=”inlineleft”]The next day, I brought another friend to the shop. We knocked on the door. No answer. I left a note on the shop door and we took the truck, using the spare keys I kept when we sold it. I had just completed my first–and so far, only–repossession. I’m not a bank or a repo man, just a guy who got screwed.

Possession was mine. Wrongs were righted. The truck was tentatively sold immediately. If the buyer couldn’t pay, the truck was gone. He called, offering his apologies and hoping to get the truck back and start making payments again. I accepted his apologies and kept the truck. People are only allowed to rip me off once. Almost two years without a payment or even an excuse is too much for me to accept. So far, I am the only person I know to manage a legal repossession as a private party.

The repo process varies by state, but the basics don’t change much. The loan holder can file for repossession as soon as the loan agreement is broken. They can repossess with no notice and the borrower is on the hook for the difference between what’s owed and twhat’s recovered during resale. If you get to the point of repossession, you are out of options. You are generally left to pay the debt in full, or lose the vehicle. If you are accepting payments from a friend to buy a car, make sure you have a written agreement and are listed as the loan holder on the title. Keep some leverage to avoid getting screwed.

How far have you gone to recover money you are owed?

The Zombie Guide to Saving

Brains!

Nobody has ever accused a zombie of being smart. The are, after all, dead and rotting. Their primary means of education themselves is eating the brains of the living, which is hardly an efficient learning style. Besides, in a strictly Darwinian sense, their victims are among the least qualified to teach useful skills.

Zombies smell. They are little more than flesh-eating monsters. They are lousy in the sack. Yet, for all their flaws, have you ever heard of a zombie in debt or worried about financing retirement? They are obviously doing something right.

What can you learn from a zombie? That depends on the type of zombie. Not all of the life-challenged were created equal.

There are 3 main types of zombies:

1. Slow shamblers are best recognized by their lurching gait and unintelligible grunting, similar to a frat party at 3AM. They are rarely fresh specimens. Arguably the the scariest of all zeds, due to the sheer inevitability of their assault, they do always get where they are going, even if it takes a while. Trapped in a pit or a pool, they will keep trying to reach their goal. A slow shambler, were he able to effectively communicate beyond the basic “Hey, can I eat your brain?” would tell you to approach your goals like the famous tortoise: slowly. Set aside an affordable amount in savings every week, no matter what. Even if your are stuck saving just $10 each month, you will eventually get your sweet, sweet brains.

2. Voodoo zombies are the still-living, yet mindless minions on a voodoo priest. These unlucky non-corpses crossed the wrong people–usually by stealing or not repaying their debts–and ended up cursed for it. They are forced to do the bidding of their masters until such time as their debt has been repaid, if ever. Their warning is to always pay your debts and do not steal. Honest, ethical behavior is the best way to avoid this fate.

3. Runners are almost always “fresh” to the game. As they decompose, they slowly transform into slow shamblers. These fellas can often pass for the living…from a distance. By the time you get close enough to identify them as monsters, your brains are on the menu. They are capable of sprinting for short distances and, on occasion, have even been seen to run up vertical walls. To properly categorize the runners, we have to break them down into 2 sub-groups. The first sub-group is the envy of all zombies still capable of envy. They have used their skills to trap enough prey(that’s us, folks!) that they will feel no hunger for the foreseeable future. They are secure. They are the successful runners. The other sub-group tries to emulate the first, but lack both planning and follow-through. While the first group builds momentum to secure their future, the second group tends to use that momentum to smack face-first into the wall, confused at where their lunch went. Constantly charging from one thing to the next, they never manage to sink a claw into their goals. To avoid falling into the second group, you’ll have to settle on a strategy and pursue it with all the single-minded, decomposing determination you can muster.

You know what they say: “Great minds taste alike.” What kind of financial zombie are you?

The Do-Over

This post is from Kevin @ DebtEye.com. Kevin is a co-founder @ DebtEye.com, where he helps consumers manages their finances and find the optimal way to get out of debt. . This is guest post is part of a blog swap for the Yakezie, answering the question “If you had one financial do-over, what would it be and why?”.

I usually look on the brighter side of things. There’s never an incident where I wish I could go back in time and change things. Everyone will eventually make mistakes, but it’s up to them to learn from these mistakes and make sure it never happens again. However, if there was one moment in the past I could change, It would be not buying a house straight out of college.

Throughout my college days, I have been fortunate to have saved up enough money for a down-payment on a house. That’s not enough to maintain debt-free living. I worked with several internet gaming companies and acted as an affiliate for them. I saved up around $25,000 and decided to buy a condo with my brother.

I thought it would be cool to own a condo in the city. I was really looking forward to turning this new place in a bachelor’s pad. This was probably the worst decision I’ve made. I always believed that it was better to buy a property instead of renting one, since some of the payment would go towards paying down the loan. Of course, I realized that this wasn’t the smartest of ideas.

Here are some reasons why I regret it:

- Property Taxes: Property taxes in Chicago are one the highest in the nation. For a $320,000 property, annual real estate taxes were roughly about $5,800/year. Property taxes usually go up every year, it can be difficult for some people to maintain these payments.

- Valuation: Thankfully, the property only decreased 10% in the past 2 years. It’s not as bad as some areas, but the timing to buy a property was poor.

- Cost: Buying a property involves more money to spruce up the place. New paint, new appliances, new floors, etc. Most of us won’t get a free appliance from the government. Many homeowners have to put in extra care of the property, so when they sell it, it’s still in great condition.

Looking hindsight, I definitely wish I rented instead of owning a home. In this day of age, I think most people can make the clear argument that renting is worthwhile to look into.

What Can Cause Damage to Your Credit?

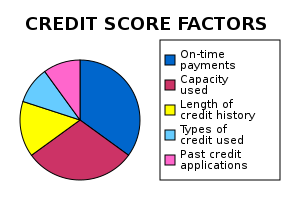

Credit scores move up and down as new financial data is collected by the credit bureaus. Many factors can cause a credit score to rise or fall, but most people don’t have a clue what they are. Understanding what affects credit can help keep your number in a good score range, where it should be. But, even a bad score can recover more quickly than most people realize, even after a bankruptcy or default. Here are some factors that can help you understand why credit moves up or down:

Late Payments

About 30% of your score is made up from your payment history. This is comprised from things like credit card bills, auto loan payments, personal loans, and mortgages. At this time, bills like utilities or rent are not factored into your score, unless they are sent to a collection agency. If you are late to pay your credit card bill, it will show up on your credit file. One late payment will probably not have much of an effect, but a history of this over time can drop your score. It is very important to keep bill payment current as a courtesy to creditors and the benefit of your own financial history.

Credit Inquiries

One of the most misunderstood factors that can cause a credit score to drop are “credit inquiries”. An inquiry takes place anytime your credit is checked. This makes up 10% of your total score. What most people don’t know is that there are two different types of credit inquiries, “hard inquiries” and “soft inquires”. Only hard inquiries affect credit and happen when you apply for a new credit card, loan, or mortgage. Soft inquiries on the other hand happen when someone like an employer, landlord, or yourself check your credit report. These are not factored into your credit score at all. Hard inquiries are a necessary part of applying for a loan or credit, so an occasional inquiry will not cause damage. It can only cause problems if there are many hard inquiries in a short period of time. This can be a signal to creditors that you are in financial trouble and are desperately seeking cash.

Credit to Debt Ratio

Your total amount of available credit compared to the amount of credit you use each month, makes up your credit-to-debt ratio. FICO suggests that you use no more than 30% of your available credit before paying off your balance each month. For example if you have $10,000 of available credit spread across 3 different credit cards, the optimal amount to charge would be $3000 or less each month. Maxing out your credit cards can cause your score to drop even if you pay them off completely each month.

Age of Your Credit History

The length of time you have had an open credit account is a major factor of your credit score. It can help to open a credit card when you are younger by getting a co-signer. If you are the parent of a teenager, it may be helpful to open a credit card in their name, but only allow them to use it for emergencies. Having an open credit card in good standing for a long period of time can help build this history. The length of time that you have had credit makes up about 15% of your score.

Different Types of Credit

The last major factor that makes up about 10% of your score comes from the different types of credit that you use. These credit types include revolving, installment, and mortgage. The ability of an individual to successfully handle all of these credit types can show that they are financially well-rounded. This makes up about 10% of the total credit score.

About:

Ross is an investor and website owner.

I just turned 2!

Update: Over $500 in prizes!

Yesterday was my second anniversary here. For the last two years, I have shared my thoughts, feelings, and finances three times a week and you have been there to watch and share as I figure out my financial future.

I appreciate it.

To show my appreciation, I’m giving stuff away.

Here are the prizes:

1 $100 prize

1 $75 prize

6 $25 prizes, courtesy of ThirtySixMonths, Budgeting in the Fun Stuff, Maximizing Money, Personal Finance Whiz, and Broke Professionals.

1 iPod Shuffle courtesy of Prairie Eco-Thrifter.

1 $25 Amazon gift card courtesy of Beating Broke.

A copy of each of the iPhone and iPad versions of the Pay Off Debt app from The Debt Myth

1 $20 Amazon gift card, courtesy of Money Crush.

1 $25 Starbuck’s gift card, courtesy of Mom’s Plans.

I’m also giving away some books, some of which have been lightly read.

Financial Peace Revisited by Dave Ramsey

Never Pay Retail by Sid Kirchheimer

Delivering Happiness (advanced reader copy) by Tony Hsieh

I Will Teach You To Be Rich by Ramit Sethi

The Art of Non-Conformity by Chris Guillebeau

CreditCards.com Book of Cartoons

Women & Money by Suze Orman

To enter:

Follow the instuctions in the widget below. Following me on Facebook, Twitter, RSS, or email will all earn entries. Following any of the sponsors on Twitter of Facebook will earn you entries. Tweeting about the giveaway as often as you like or linking to this page on your site will earn you entries.

There are lots of ways to enter and 16 prizes to win.

The drawing will be held on December 23rd, just in time to give you some cash before Christmas.

Good luck!