- Crap. Replacing the power jack on my laptop means ordering out for the piece. #

- @mymoneyshrugged Engraved pocket knives were a hit with my groomsmen. in reply to mymoneyshrugged #

- Movies that force previews suck. Dangit, Invention of Lying. #

- RT @Lynnae Carnival of Personal Finance #148 http://bit.ly/adRZQo #

- @jimmyjohns – 35 minutes is not "so fast I'll freak". #

- @jimmyjohns "Can you send the store info to bit.ly/jjfeedback? Thx!" – Done. Normally service is excellent. in reply to jimmyjohns #

- Pizzeria with the family. Yum! #

- RT @FrugalYankee: Fact: In 1873, there were 4131 beer breweries pumping in the US. 1973 only 41 brewers operating 89 plants. Now around 1500 #

- Mango pudding is the king of all nummy. #

Net Worth Update

Now that my taxes are done and paid for, I thought it would be nice to update my net worth.

In January, I had:

Assets

- House: $252,900

- Cars: $20,789

- Checking accounts: $3,220

- Savings accounts: $6,254

- CDs: $1,105

- IRAs: $12,001

- Investment Accounts: $1,155

- Total: $297,424

Liabilities

- Mortgage: $29,982

- Credit card: $18,725

- Total: $48,707

Overall: $249,717.00

Here is my current status:

Assets

- House: $240,100 (-12,800) Estimated market value according to the county tax assessor. This will be going down in a few months when the estimates are finalized for the year. I don’t care much about this number. We’re not moving any time soon, so the lower the value, the lower the tax assessment.

- Cars: $15,857 (-4,932) Kelly Blue Book suggested retail value for both of our vehicles and my motorcycle.

- Checking accounts: $4,817 (+1,597) I have accounts spread across three banks. I don’t keep much operating cash here, so this fluctuates based on how far away my next paycheck is.

- Savings accounts: $6,418 (+164) I have savings accounts spread across a few banks. This does not include my kids’ accounts, even though they are in my name. This includes every savings goal I have at the moment. I swept a chunk of this into an IRA to lower my tax bill, which is also why my IRA balance is up as much as it is.

- CDs: $1,107 (+2) I consider this a part of my emergency fund.

- IRAs: $16,398 (+4,397) I have finally started to contribute automatically. It’s only $200 at the moment, but it’s something.

- Investment Accounts: $308 (-847) I pulled most of this out and threw it at a credit card.

- Total: $285,005 (-12,419)

Liabilities

- Mortgage: $28,162 (-1,820)

- Credit card: $16,038 (-2,687) This is the current target of my debt snowball. This has actually grown a bit over the last week. I did a balance transfer that cost $400, but it gives me 0% for a year, versus the 9% I was paying. That will pay for itself in 3 months, while simplifying my payments a bit and saving me almost a thousand dollars in payments this year.

- Total: $44,200 (-4,507)

Overall: $240,805 (-8,912)

Well, I lost some net worth over the last quarter, but it’s still a good report. If I disregard the change in value of my house and cars–two thing I have no control over–my overall total would have gone up almost $9,000.

All in all, it’s been a good year for me, so far, though paying off that credit card by fall is going to be a challenge.

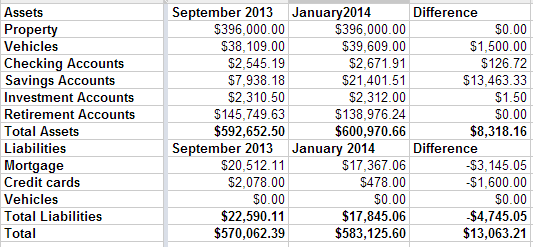

Net Worth Update – January 2014

This may be the most boring type of post I write, but it’s important to me to track my net worth so I can see my progress. We are sliding smoothly from debt payoff mode to wealth building mode.

Our highlights right now are nothing to speak of. We did let our credit card grow a little bit over the last couple of months, but paid it off completely at the end of December. It grew mostly as a matter of not paying attention while we were doing our holiday shopping and dealing with some car repairs.

That’s it. We haven’t remodeled our bathrooms yet, but we have the money sitting in a savings account, waiting for the contractor. We haven’t bought a pony yet, but we did decide that a hobby farm wouldn’t be the right move for us. We’ll be boarding the pony instead of moving, at least for the foreseeable future.

Our net worth is up $13,000 since September. Our savings are up and our retirement accounts are down because there are two inherited IRAs that we need to slowly cash out and convert to regular IRAs.

How We Handled The Windfall

Three years ago, my mother-in-law died. She didn’t have a will, but that’s a story for another day.

My wife, being an only child, inherited everything. All of the assets, and all of the problems.

She inherited the house, which was completely paid off. That was nice.

My mother-in-law was a hoarder who didn’t buy into the idea of maintaining your property. That was not nice.

Between the life insurance policies and the ready cash, she inherited about $60,000. Also nice.

It’s all gone. Not so nice.

Now, I know you’re asking where it went. Lucky for you, that’s what this post is about.

We paid off the last $10,000 of our credit card debt, and haven’t accumulated a balance since. Now our cards are paid off in full every month.

We put $5,000 down on the Chevy Tahoe we bought in 2012 and paid off in full 9 months later.

Every last cent of the rest went into the house we inherited.

Huh? 45 fricking grand to get the house ready to rent?

Yep.

- $3000 to clear out the brush and landscape the yard

- A few hundred to have the hardwood floors sanded, stained, sealed, and buffed

- An intense carpet-cleaning

- Painting every single room

- 3 large dumpsters to handle the garbage we pulled out of the house

- New refrigerator

- New washing machine

- New boiler

- New stove

- New patio door

- New locks for the doors and windows

- Security lights

- Food for all of our helpers whom we can never thank enough

- Finishing the basement

All of that pretty, pretty money, gone in less than a year.

What did we get out of it? A rentable asset that is bringing in $1200 every month, with minimal work.

We could have chosen to sell the place, but we would have had to do nearly all of that work, anyway, so it wouldn’t have saved anything.

I like having the new stream of income, even though it will take several years to turn a profit. That house isn’t going anywhere, and since it’s only 3 miles from Minneapolis and 5 miles from downtown Minneapolis, it will always be an in-demand area for renters.

It was just a lot of work turning it into a useful property instead of a year-long drain on time, patience, and money.

My Net Worth

While I find it fascinating to read about other people’s net worth, I’ve never bothered to figure out my own. With the start of the new year, I thought it would be fun to do. This is me, upping my personal transparency bar.

Assets

- House: $255,400. Estimated market value according to the county tax assessor.

- Cars: $23,445. Kelly Blue Book suggested retail value for both of our vehicles and my motorcycle.

- Checking accounts: $2,974. I have accounts spread across three banks.

- Savings accounts: $4,779. I have savings accounts spread across a few banks. This does not include my kids’ accounts, even though they are in my name. This includes every savings goal I have at the moment.

- CDs: $1,095. I consider this a part of my emergency fund.

- IRAs: $11,172 (Do you know your IRA contribution limits? Do you have a Roth IRA?)

- Total: $298,865

Liabilities

- Mortgage: $33,978

- Car loan: $1,226. This will be paid off this month.

- Credit card: $23,524. This is the next target of my debt snowball.

- Total: $58,728

Overall: $240,137

Update: I wrote and scheduled this before I paid off my car loan.

Twitter Weekly Updates for 2010-02-06

- @fcn Yahoo Pipes into GReader. 50 news sites filtered to max 50 items/day–all on topic. in reply to fcn #

- @fcn You can filter on keywords, so only the topics you care about come through. in reply to fcn #

- It's a sad day when you find out that your 3 year old can access anything in the house. Sadder when she maces herself with hairspray. #

- 5 sets of 15 pushups to start my day. Only 85 to go! Last 5 weren't as good as first 5. #30DayProject #

- What happens to your leftover money in your flex-spending account? http://su.pr/9xDs6q #

- Enter to Win iPod Touch from @DoughRoller http://tinyurl.com/y8rpyns #DRiPodTouch #

- Arrrgh! 3 year old covered in nail polish. And clothes. And carpet. And sister. #

- Crap. 5 sets of 5 pushups. #30dayproject #

- Woo! My son just got his first pin in a wrestling meet! #

- RT @Doughroller: Check out this site that gives your free credit report AND score without asking for a cc# or social… http://bit.ly/bRhlMz #

- Breaking news! Penicillin cures syphilis, not debt. https://liverealnow.net/KIzE #

- Win a $25 Amazon GC via @suburbandollar RT + Fllw to enter #sd1Yrgvwy Rules -> http://bit.ly/sd1Yrgvwy2 #

- This won't be coming to our house. RT @FMFblog: Wow! Check out the new Monopoly: http://tinyurl.com/ygf2say #

- @ChristianPF is giving away a Flip UltraHD Camcorder – RT to enter to win… http://su.pr/2ZvBZL #