- RT @ScottATaylor: Get a Daily Summary of Your Friends’ Twitter Activity [FREE INVITES] http://bit.ly/4v9o7b #

- Woo! Class is over and the girls are making me cookies. Life is good. #

- RT @susantiner: RT @LenPenzo Tip of the Day: Never, under any circumstances, take a sleeping pill and a laxative on the same night. #

- RT @ScottATaylor: Some of the United States’ most surprising statistics http://ff.im/-cPzMD #

- RT @glassyeyes: 39DollarGlasses extends/EXPANDS disc. to $20/pair for the REST OF THE YEAR! http://is.gd/5lvmLThis is big news! Please RT! #

- @LenPenzo @SusanTiner I couldn’t help it. That kicked over the giggle box. in reply to LenPenzo #

- RT @copyblogger: You’ll never get there, because “there” keeps moving. Appreciate where you’re at, right now. #

- Why am I expected to answer the phone, strictly because it’s ringing? #

- RT: @WellHeeledBlog: Carnival of Personal Finance #235: Cinderella Edition http://bit.ly/7p4GNe #

- 10 Things to do on a Cheap Vacation. https://liverealnow.net/aOEW #

- RT this for chance to win $250 @WiseBread http://bit.ly/4t0sDu #

- [Read more…] about Twitter Weekly Updates for 2009-12-19

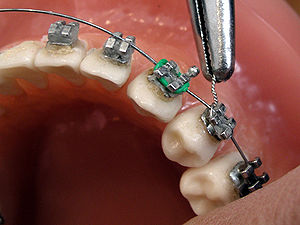

Braces

Grr!

Monday, I brought Punk #1 to the orthodontist. He’s got an underbite and some crooked teeth, but I didn’t realize how off it was until I saw the pictures they took. Some of the closeups could be inspiration for a Halloween mask.

It look like he started with a small underbite that made his teeth line up wrong, which–as they grew–accentuate the wrong. Now, it’s very, very wrong.

Next week he goes in to get his top teeth done.

At a cost of $5800.

If we pay up-front, they’ll knock 5% off, bringing it down to $5500. That covers everything, all of the follow-ups, broken hardware, every stage the whole way through. If we pay monthly, it will be $1450 down and $200 per month (interest free) for almost 2 years.

Almost six grand.

Fortunately, we knew this was coming, so we’ve been saving for this for a few years.

Unfortunately, we’ve only been saving $50-100 a month. We can’t wait much longer. With an underbite, you have more options if you do the work before the kid is done growing. I’d really like to avoid jaw surgery for him, so we have to make things happen.

Our braces account has $3100 in it. My HSA account has $875. That’s from my last job, so that’s as big as it gets. That leaves us almost exactly $1500 short.

I hate the idea of touching our emergency fund, although it does have enough money in it.

We’ve also got some money tucked away in an account leftover from my mother-in-law dying last year. I think that’s where we’re going to come up with the difference.

How else could we save money?

We could shop around, but this isn’t something I want to give to the lowest bidder. I want to do it right, and I know several people who have had braces put on by this office, either by this orthodontist or her father.

I asked about a cash discount and got turned down.

That’s it. Next week, I burn $5500. Hope the kid eventually appreciates it.

Anna Chapman and Edward Snowden: How to afford a long-distance romance?

Recently Russian spy Anna Chapman tweeted a proposal to fellow spy Edward Snowden, as in a marriage proposal. News reports covering the Internet event report that Chapman would not reveal whether she was serious but asked reporters to use their imaginations. So it is yet to be seen whether there will be spy marriage ahead for the two notorious leakers. What is true, however, is that no nuptials can take place at the moment, even if Anna Chapman were serious and Edward Snowden. That is because the United States has revoked Snowden’s U.S. passport, and marriage ceremonies cannot take place in the airport where Snowden is trying to buy time. So how can Chapman and Snowden afford a long-distance relationship? Follow this quick guide of tips for helping the spies survive what could be a long road ahead!

Finding Deals

Anna Chapman has the most mobility right now, so she should be looking out for cheap flights to where Snowden is hiding out. A long-distance relationship can be expensive, so that is why finding deals on air travel is key. She can drop into the airport for a quick rendevouz. Why not?

Saving Money

These two potential spy lovers and super team need to save their money at every turn. Hiding out in secrete is costly, so they should create a special account that they both can add to for getaway and meeting expenses. Meeting at the airport is going to get old after a while, so they need to find a safe space where they can enjoy one another and sustain their relationship. Long-distance relationships are known for their difficulty because a couple spend so much time trying to reconnect every time they see one another.

Pick Your Fights

Long-distance relationships have little room for petty fighting. You see each other so infrequently that you have to cherish the time you have together. Instead of talking spy business, Anna Chapman and Edward Snowden should make sure they are focusing on each other by getting to know each other and focusing on the small things that make them happy together. Petty fighting will destroy a long-distance relationship. Chapman and Snowden should part each meeting feeling good about the other instead of feeling frustrated.

Kiss and Makeup

The key to long-distance relationships is always to kiss and makeup before leaving. No matter what the spies face together or apart, they cannot let their professions and media scrutiny come between them. Instead, they need to focus on their love and passion. Make sure to share a passionate kiss before leaving each meeting so that the memory of love and admiration is fresh on the mind. With a little effort in the romance department, Chapman and Snowden will be well on their way to creating harmony in their relationship. Moving from shallow levels to more deeper levels, however, is going to take time.

Related articles

Walking Dead: Would You Be Ready for the Apocalypse?

Would you be ready for the apocalypse? The Walking Dead asks that question every week. There is a great deal of human intrigue in the show, but the show is always asking you, the viewer, if you would be ready to deal with an apocalypse on that order. The idea goes much farther than dealing with zombies. Truly, zombies are the easy part of the apocalypse.

Lost People

We live in a world where we are very connected. You know people from all over the world, and it the entire world has been overrun by an apocalypse at once, all the people you are connected to around the world are effectively gone. There is no chance you will ever see them again. The people on the show deal with those ideas every day. There are so many people they miss that they never go to to say goodbye to.

Insecurity

The one thing that the apocalypse creates is insecurity. You will have no idea what is going to happen the next morning. You never know when someone in your crew is going to be bitten or killed. You have no idea when you will run into other humans you cannot trust. There is not a safe place on Earth. Even if you lock down a house, there is no way to know for sure that zombies would not get in.

Violence

The Walking Dead graphically depicts the violence that is necessary to kill zombies. You would have to “kill” thousands of people who have become zombies. You can see their wedding rings. You can see them in their uniforms, and you know that they used to be somebody. However, you have to end them in order to save yourself. Many of us believe we could do that, but we need to think twice before we assume we could be that violent.

Order

The lack of order in the world is the thing that would break most of us. We can reconcile loss, but that loss is hard to reconcile when there is no order in the world. There is not one authority on the planet that is still operating. How would you be able to resolve problems without such a structure?

On the show, all these problems are handled violently. Murdering violent people is all part of the job if you want to stay alive. It is one thing to kill a zombie that is no longer a person, but it is something else to kill a real person who is simply a thieving criminal.

You might think that you would do just fine when you are watching The Walking Dead, but you would not know unless it happened in real life. The zombie apocalypse is not all fun and games. At its heart is a tense human emotion called loss that we would all have to confront head on.

What Can Cause Damage to Your Credit?

Credit scores move up and down as new financial data is collected by the credit bureaus. Many factors can cause a credit score to rise or fall, but most people don’t have a clue what they are. Understanding what affects credit can help keep your number in a good score range, where it should be. But, even a bad score can recover more quickly than most people realize, even after a bankruptcy or default. Here are some factors that can help you understand why credit moves up or down:

Late Payments

About 30% of your score is made up from your payment history. This is comprised from things like credit card bills, auto loan payments, personal loans, and mortgages. At this time, bills like utilities or rent are not factored into your score, unless they are sent to a collection agency. If you are late to pay your credit card bill, it will show up on your credit file. One late payment will probably not have much of an effect, but a history of this over time can drop your score. It is very important to keep bill payment current as a courtesy to creditors and the benefit of your own financial history.

Credit Inquiries

One of the most misunderstood factors that can cause a credit score to drop are “credit inquiries”. An inquiry takes place anytime your credit is checked. This makes up 10% of your total score. What most people don’t know is that there are two different types of credit inquiries, “hard inquiries” and “soft inquires”. Only hard inquiries affect credit and happen when you apply for a new credit card, loan, or mortgage. Soft inquiries on the other hand happen when someone like an employer, landlord, or yourself check your credit report. These are not factored into your credit score at all. Hard inquiries are a necessary part of applying for a loan or credit, so an occasional inquiry will not cause damage. It can only cause problems if there are many hard inquiries in a short period of time. This can be a signal to creditors that you are in financial trouble and are desperately seeking cash.

Credit to Debt Ratio

Your total amount of available credit compared to the amount of credit you use each month, makes up your credit-to-debt ratio. FICO suggests that you use no more than 30% of your available credit before paying off your balance each month. For example if you have $10,000 of available credit spread across 3 different credit cards, the optimal amount to charge would be $3000 or less each month. Maxing out your credit cards can cause your score to drop even if you pay them off completely each month.

Age of Your Credit History

The length of time you have had an open credit account is a major factor of your credit score. It can help to open a credit card when you are younger by getting a co-signer. If you are the parent of a teenager, it may be helpful to open a credit card in their name, but only allow them to use it for emergencies. Having an open credit card in good standing for a long period of time can help build this history. The length of time that you have had credit makes up about 15% of your score.

Different Types of Credit

The last major factor that makes up about 10% of your score comes from the different types of credit that you use. These credit types include revolving, installment, and mortgage. The ability of an individual to successfully handle all of these credit types can show that they are financially well-rounded. This makes up about 10% of the total credit score.

About:

Ross is an investor and website owner.

Year of the Unfair Fees

The year 2011 was a challenging economic year for many, with housing prices continuing to fall in many parts of the country, with unemployment numbers remaining high and with a credit crunch making it challenging for many to get new cards or unsecured loans.

Those going through economic turmoil were, unfortunately, faced with little understanding from many corporate conglomerates. In fact, so many companies instituted so many silly fees and surcharges that 2011 may as well be known as the year of unfair fees.

Whether you are taking out unsecured loans, opening a bank account or signing a TV service contract, it is up to you to read the contract carefully and be mindful of the fees you are being assessed.

Debit Card Use Fees

Many people who are trying to get out of debt and pay off credit cards, unsecured loans and other obligations may consider making a commitment to avoiding credit and using their debit card instead. Unfortunately, in 2011, many banks wanted to try to make this more expensive for consumers who were trying to be financially responsible.

Faced with a limit on the fees they could charge for debit transactions, a number of banks began to explore the idea of a monthly charge to consumers of between $4 and $5 just for using their debt card. Politicians and the public reacted so strongly against this, however, that the banks relented and gave up the plan. [ed. Just like Suze Orman’s new blunder!]

Fees for Depositing Cash

Also near the top of the list are the fees that certain banks institute to business customers who deposit large sums of money. Some banks will charge a small fee if you deposit in excess of a certain amount, depending upon the type for account you have. For instance, one major bank charges .20 for each $100 in cash deposited over $10,000. The fees are small, but some customers are still upset at the principle. After all, just what is that fee justified by since all you are going is giving the bank your cash to put into your account.

Airline Fees

Airline fees aren’t a new thing and almost everyone is now aware that they’ll be charged for bags on many flights. However, in 2011, some airlines decided to try to take things a step further. Passengers faced fees for booking a ticket, for printing a boarding pass at the counter instead of at home and even for taking a carry-on bag. These surprise fees that hit you may make it difficult to comparison shop for the best flights, making it harder for cash-strapped consumers to find affordable travel.

Early Termination Fees

Early termination fees have become standard for cell phone contracts, but the dreaded charges are now spreading to other industries as well. Some television service providers have now instituted early termination fees for consumers who end their contracts with the service providers early. The cable and satellite companies attempt to justify this by saying they need to cover the prices of the expensive equipment used to provide you with service, but the companies have come under fire anyway. In fact, one major satellite company recently had to settle with regulators over its business practices and cancellation policy.

Watching for Fees

Only by being diligent will you avoid the excessive fees that banks and other companies are beginning to institute in a time when every cent counts.

Post by MoneySupermarket.