- Up at 5 two days in a row. Sleepy. #

- May your…year be filled w/ magic and dreams and good madness. I hope you…kiss someone who thinks you’re wonderful. @neilhimself #

- Woo! First all-cash grocery trip ever. Felt neat. #

- I accidentally took a 3 hour nap yesterday, so I had a hard time sleeping. 5am is difficult. #

- Wee! Got included in the Carnival of Personal Finance, again. http://su.pr/2AKnDB #

- Son’s wrestling season starts in two days. My next 3 months just got hectic. #

- RT @Moneymonk: A real emergency is something that threatens your survival, not just your desire to be comfortable -David Bach # [Read more…] about Twitter Weekly Updates for 2010-01-09

The 10-Step Saving Action Plan

- Image via Wikipedia

Getting started saving money is hard. It’s easy to get used to instant gratification and impulse purchases. Postponing material fulfillment takes discipline and deferred enjoyment. I don’t like deferring my enjoyment, but I do it. The path to successful savings isn’t always easy, but it is gratifying, when you give it the time and effort required to see actual results.

Here’s the 10 step plan to successful savings:

- Recognize the need. If you don’t understand why you need to save, you won’t do it for long. If you think it’s more important to buy a new car, a new TV, or the fanciest portable gadget out there, you won’t prioritize saving. You need to think about how saving a solid nest egg will benefit you and your future self, before you can be sure you will stick to your savings plan.

- Pay yourself first. When you get paid, whether it’s a traditional paycheck or a surprise windfall, immediately drop 10-15% in a savings account you keep completely off-limits, no exceptions. If you make this an unbreakable habit, you will have a surprising amount of money in a surprisingly short amount of time.

- Prioritize. Prioritize your expenses. If you don’t care about a particular optional expense, get rid of it! Examine the rest of the bill for things you can trim. Do you really need 5000 channels? Can you make do with just 300 specialized versions of ESPN?

- Compare prices. If you buy from the lower-priced store, you save money. No s****, huh? Doing this requires that you forgo impulse purchases and do some research before you buy most things. Shop online, at least enough to know what you should be paying.

- Save your change. When you get home at night, put your change in a jar. When the jar gets full, bring it to the bank. A medium-sized mason jar full of silver-colored coins will bring in about $100. Put that directly into savings.

- Save your dollars. I pay cash for everything I buy in person. When my money clip gets too many one-dollar bills, I put them all into a box. This would be a phenomenal addition to my savings account, if I weren’t planning to use it for spending money on our vacation next month.

- Save the extra $$. If you get unexpected money, don’t let it enter you regular cash flow. Get it straight into a savings account. You weren’t expecting it, so you won’t miss it.

- Save the new $$. Save your raise. If you start making more money, save the difference. Like #7, you’ll never miss it. Don’t give yourself a chance to expand your lifestyle.

- Club the naysayers in the knees. There will always be people who denigrate your choices. If they tell you it’s crazy to live within your means, or get upset because you don’t want to go to the fancy restaurant, screw ’em. Not literally of course. We’re trying to apply a punishment here, after all. If they don’t like your choice, kick them in the shins.

- Reward yourself. Don’t be afraid to schedule rewards at certain savings goalposts. When you get $5000 saved, let yourself take $300 to the high-end steakhouse. When you get $10000, look at buying the camera you want. Give yourself a reason to stay motivated. It is, after all, your money.

This is how we’ve managed to build up a small-but-comfortable emergency fund and tackle a nice chunk of our debt. Do you have plan to save?

Money Problems: Day 12 – Paying for College by Doing Without

Today, I am continuing the series, Money Problems: 30 Days to Perfect Finances. The series will consist of 30 things you can do in one setting to perfect your finances. It’s not a system to magically make your debt disappear. Instead, it is a path to understanding where you are, where you want to be, and–most importantly–how to bridge the gap.

I’m not running the series in 30 consecutive days. That’s not my schedule. Also, I think that talking about the same thing for 30 days straight will bore both of us. Instead, it will run roughly once a week. To make sure you don’t miss a post, please take a moment to subscribe, either by email or rss.

On this, Day 11, we’re going to talk about one method of paying for college.

I have a secret to share. Are you listening? Lean in close: College is expensive.

You’re shocked, I can tell.

The fact is, college prices are rising entirely out of proportion to operation costs, salaries, or inflation. The only thing college prices seem to be pegged to is demand. Demand has gotten thoroughly out of whack. The government forces down the interest rates on student loans, then adds some ridiculous forgiveness as long as you make payments for some arbitrary number of years, creating an artificial demand that wouldn’t be there if the iron fist of government weren’t forcing it into place.

Somebody in Washington has decided that the American dream consists of home ownership and a college education. Everything is a failure. He’s an idiot.

College isn’t for everybody.

Read that again. Not everyone should go to college. Not everyone can thrive in college.

Fewer than half of students who start college graduate. The greater-than-half who drop out still have to repay their loans. Do you think college was a good choice for them?

Then you get the people who major in art history and minor in philosophy. Do you know what that degree qualifies you for? Burger flipping.

Yes, I know. Just having a degree qualifies you for a number of jobs. It’s not because the degree matters, it’s because HR departments set a series of fairly arbitrary requirements just to filter a 6 foot stack of resumes. The only thing they care about is that having a degree proves that you were able to stick college out for 4 years. That HR requirement matters less as time goes on and you develop relevant work experience.

A liberal arts education also—properly done—trains your mind in the skill of learning. First, not everyone is capable of learning new things. Second, not everyone is willing to learn new things. Third, a passion for learning can be fed without college. If you don’t have that passion, college won’t create it. Most of the most learned people throughout history managed without college, or even formal education. Even if you want to feed that passion in a formal classroom, you’re assuming the professors are interested in training your mind instead of indoctrinating it with their views.

Now there are some pursuits that outright require a college education. The sciences like engineering, physics, astronomy, and psychiatry all require college. You know what doesn’t require college? Managing a cube farm. Data entry. Sales. I’m not saying those are bad professions, but they can certainly be done without dropping $50,000 on college.

Some careers require an education, but don’t require a 4 year degree, like nursing(in most states), computer programming(it’s not required, but it makes it a lot easier to break into) and others. Do you need to hit a 4 year school and get a Bachelor’s degree, or can you hold yourself to a 2 year program at a technical college and save yourself 40,000 or more?

That should be an easy choice. Don’t go to college just because you think you should or because somebody said you should, or to get really drunk. College isn’t for everybody and it’s possible it’s not for you.

What Can Cause Damage to Your Credit?

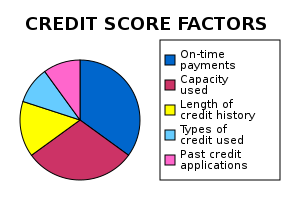

Credit scores move up and down as new financial data is collected by the credit bureaus. Many factors can cause a credit score to rise or fall, but most people don’t have a clue what they are. Understanding what affects credit can help keep your number in a good score range, where it should be. But, even a bad score can recover more quickly than most people realize, even after a bankruptcy or default. Here are some factors that can help you understand why credit moves up or down:

Late Payments

About 30% of your score is made up from your payment history. This is comprised from things like credit card bills, auto loan payments, personal loans, and mortgages. At this time, bills like utilities or rent are not factored into your score, unless they are sent to a collection agency. If you are late to pay your credit card bill, it will show up on your credit file. One late payment will probably not have much of an effect, but a history of this over time can drop your score. It is very important to keep bill payment current as a courtesy to creditors and the benefit of your own financial history.

Credit Inquiries

One of the most misunderstood factors that can cause a credit score to drop are “credit inquiries”. An inquiry takes place anytime your credit is checked. This makes up 10% of your total score. What most people don’t know is that there are two different types of credit inquiries, “hard inquiries” and “soft inquires”. Only hard inquiries affect credit and happen when you apply for a new credit card, loan, or mortgage. Soft inquiries on the other hand happen when someone like an employer, landlord, or yourself check your credit report. These are not factored into your credit score at all. Hard inquiries are a necessary part of applying for a loan or credit, so an occasional inquiry will not cause damage. It can only cause problems if there are many hard inquiries in a short period of time. This can be a signal to creditors that you are in financial trouble and are desperately seeking cash.

Credit to Debt Ratio

Your total amount of available credit compared to the amount of credit you use each month, makes up your credit-to-debt ratio. FICO suggests that you use no more than 30% of your available credit before paying off your balance each month. For example if you have $10,000 of available credit spread across 3 different credit cards, the optimal amount to charge would be $3000 or less each month. Maxing out your credit cards can cause your score to drop even if you pay them off completely each month.

Age of Your Credit History

The length of time you have had an open credit account is a major factor of your credit score. It can help to open a credit card when you are younger by getting a co-signer. If you are the parent of a teenager, it may be helpful to open a credit card in their name, but only allow them to use it for emergencies. Having an open credit card in good standing for a long period of time can help build this history. The length of time that you have had credit makes up about 15% of your score.

Different Types of Credit

The last major factor that makes up about 10% of your score comes from the different types of credit that you use. These credit types include revolving, installment, and mortgage. The ability of an individual to successfully handle all of these credit types can show that they are financially well-rounded. This makes up about 10% of the total credit score.

About:

Ross is an investor and website owner.

Extra Money? What Do I Do With Extra Money?

A couple of months ago, I started a new job. The new job has bonus potential every month, and

getting that bonus is largely under my control. Effectively, if I’m not a total slacker, I’ll get

about $500 every month, but it’s not guaranteed.

We’re also getting a small 4 figure tax refund this year. I wasn’t expecting that at the beginning

of last year, but one of my side hustles has taken a turn down a path I didn’t plan for, which

lowered my tax liability considerably.

Both of these things are money that we can’t plan for, so it’s not in the budget. It is extra

money.

What the heck do you do(responsibly) with extra money? It’s easy to take the money and run to the

spend it someplace fun.

Easy.

And tempting.

Very tempting.

But that wouldn’t be responsible at all.

The Dave Ramsey plan says we should put it on our debt, but our debt is down to just a mortgage,

and that’s down to $9000.

Retirement?

I actually over-contributed to my retirement last year, and had to file a form to get the

overpayment back instead of paying a penalty on that money. My wife’s account isn’t getting maxed,

yet, but she’s also way ahead of me in retirement savings.

So what to do with it?

I added a calculator that let’s me punch in a number and it breaks it out by our optional goals.

It has 6 categories:

- Extra mortgage payment: 25%. My goal is to pay off the mortgage completely this year.

- Retirement contribution: 25%. I do want to max Linda’s retirement contributions this year.

- Emergency fund: 15%. We have an emergency fund, but I want to grow it to 6 months of our expenses.

- Family: 15%. This if for whatever family thing we’re planning to do. It could be pushed into a down payment for another rental property, or a vacation, or a camper. We’ll decide this each time we get the extra money.

- Jason’s Fun Money: 10%. This is for me to blow on something fun, like a 3D printer.

- Linda’s Fun Money: 10%. This if for my wife to blow on something fun, like a present for me.

So, if we get $2500 randomly dropped in our mailbox, we’ll put $625 on the mortgage and a

retirement fund, $375 to the emergency fund and the family fund, and $250 to Linda and I for fun

stuff.

That lets us see progress on a few of our goals, while still rewarding how hard we’ve worked and

how much we’ve done without while becoming financially stable. 65% of it is pure grown-up &

responsible spending. 35% is generally fun, but can be repurposed if necessary.

What do you do with surprise money? Do you blow it or do something responsible with it?

About

I am a husband, father of three, and a software engineer and I think I am going through a mid-life crisis*. I woke up one morning and took stock of my life. There are quite a few things I am not happy with in my life. It’s time to correct that.

We have too much debt. My wife and I have gone through a slow financial meltdown over the last ten years. We spent so much time living beyond our means that, now that we are earning a comfortable salary, we can’t afford to do the things we did on half this income. Our lives are upside down. This is going to change. As a start, I’ve been slashing expenses and selling my toys in an effort to get out of debt.

We have too much stuff. I’ve been downsizing and simplifying everything we own. I have thrown out truckloads of stuff we don’t need or can do without. We recently moved a close friend into our spare bedroom. Making room for him was a chore, due to our excess crap. It’s gotta go. If we don’t know what we have, we don’t need it.

I’m out of shape. I used to be in great shape. Ten years of surburbia and desk jobs has changed that. I’ve started running and will get back in shape. I intend to live long enough to be a happy burden to my children.

I don’t spend enough time with my wife. I’m still completely in love, but we need to be closer. I’m in this for the long haul. Fifty years of watching TV isn’t good enough. We need to be close.

Those are my problems and some hints towards my plans to correct my life. There is nothing I’ve earned that I regret, but definitely some things I want to improve. In short, I want to be the man my children think I am.

*If this is mid-life, I’ve made some very bad life choices.