Please email me at:

Or use the form below.

[contact-form 1 “Contact form 1”]

The no-pants guide to spending, saving, and thriving in the real world.

This is the 307th Carnival of Personal Finance, the Silver Edition. As of 10:00 PM CDT last night, silver is at $43.76 per ounce. Three years ago, when I last bought silver, it was at $11.30. In honor of that, and inspired by my first editor’s pick below, I’m going to share some facts and history about silver.

The last time prices rose like this was in 1979, when the Hunt brothers bought or controlled close to 50% of the world’s silver. They managed it by leveraging their silver hoard. As they bought more, prices went up, increasing the value of their hoard, which they then used as collateral for more loans to buy more silver, which caused the prices to go up so they’d use it as collateral…. You get the idea. Prices went from $11 per ounce to $50 per ounce in less than a year, before the regulators figured out the game and changed the rules, bringing the whole thing crashing down. The resulting losses and lawsuits bankrupted the former billionaires within 10 years.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/quotes_7a.gif)

First, we have a post from Squirrelers, Is There a Silver Bubble? How High Can Prices Go?. This post reminded me of not only the Hunt brothers story, but the small box of silver I own. Now, I’m debating taking it to a precious metals dealer and cashing out for 400% of my purchase price.

Suba from Wealth Informatics brought Never Pay full price : How to save 10-50% on every purchase. This was entirely new to me, which surprised me. I see a lot of ideas presented in new ways, but rarely see something I know absolutely nothing about.

If you’ve got legal papers you need to fill out, or questions you need answered, you could do far worse than to start with the site Jeff Rose from Good Financial Cents gives us with 7 Free and Cheap Online Legal Resources. If you think you don’t need the resources, that means you a complete estate plan, right? You have a will?

Dimes, quarters, and half-dollars were 90% silver until 1964. Half-dollars continued to be 40% silver until 1971. At that time, the government tightly controlled the price of silver and kept it at $1.29 per ounce so the face value of the coins matched the value of silver they contained. Today, a supply of 90% silver coins with a face value of $5 can be had for the bargain price of $173.74.

Fanny from Living Richly on a Budget – Personal Budget Blog presents How to Build the Crucial $1,000 Emergency Fund, and says, “How do you finance unexpected personal expenses, such as car repairs, medical visits, home maintenance repairs, etc? The most effective way to finance these expenses is through a personal emergency fund.”

Flexo from ConsumerismCommentary presents Silent Inflation is Destroying Your Net Worth, and says, “Inflation continues to deflate individuals net worth and there are no signs of it getting any better.”

Adam Piplica from Magical Penny presents Avoid Hitting the Rocks of Financial Ruin, and says, “This post draws on a famous story in Homer’s Oddessey how a captain made it safely passed the Sirens because he had protected himself from making a poor short-term decision. It’s exactly the same thing you have to do if you want to grow your pennies.”

Clint from Accumulating Money presents Baby-Boomer Generation Must Get Serious About Planning for Retirement, and says, “The “Baby-Boomer” generation has undergone two severe business-cycle reversals in the past ten years alone. Many of these fifty and sixty year-olds are now facing a daunting task – how do you rebuild your net worth in so short a remaining time period?”

Jason from One Money Design presents Planting a Garden to Save Money, and says, “As Spring is here, planting a garden is a great way to help feed your family and save some money at the same time.”

Silver is almost always found with lead. Through most of history, mining silver meant mining lead and breathing lead dust. In the ancient world, silver miners had a life span of about 3 years, so free men refused the job. This was a slave occupation.

Crystal from Budgeting in the Fun Stuff presents Job Experience – Don’t Rock The Boat, and says, “Being young and ambitious may seem like the best thing in the world but knowing your audience and environment is very important. You don’t want to come off as the young new hothead…here’s a story all about exactly that.”

Well Heeled Blog from Well Heeled Blog presents 5 Ways to Spend Your Raise, and says, “Congratulations, you got a raise! Now what? Now, what to do about this extra money? No matter what, don’t want to fritter this raise away. Here are 5 ways for the extra money to work hard for you. ”

Kathryn @ Financial Highway from Financial Highway presents 30 Common Interview Questions and How to Answer Them, and says, “This guide not only tells you what the interview questions are but also provides insight into what the interviewer is really asking and what types of answers will help you get the job.”

Around 500 BC, Athenians discovered a huge silver mine on land belonging the city-state. This find was used to finance building their first effective navy, which catapulted them to the heights of power they achieved.

Craig Ford from Money Help for Christians presents Best Ways to Maximize Cash, Credit Card, and Debit Card Rewards, and says, “How to maximize your credit cards or debit card rewards.”

Tim Chen from NerdWallet Credit Card Watch presents Premium Credit Cards: The Value Beyond the Cost, and says, “A premium credit card is a step above your average card: better rewards and extra perks offered at, well, a premium. These exclusive credit cards come with additional goodies like lounge access and free plane tickets, as well as hefty annual fees.”

Kevin (for Moolanomy) from Moolanomy presents How to Avoid Credit Cards and Credit Repair Scams, and says, “Credit cards don’t have to be a bad thing, but they definitely have their fair share of scams out there. Here’s how to avoid them.”

In World of Warcraft, silver is a rare spawn of tin. If you want to find silver, you should try mining tin. Over and over. (Source)

Mike from Green Panda Treehouse presents How Much Should We Spend on Housing?, and says, “How much is the right amount for housing costs?”

Ben from Money Smart Life presents How to Use a Mortgage Calculator to Compare Home Loans, and says, “A post about how to use a mortgage calculator to screen and compare the rates and costs of home loans.”

The early discovery that water, wine, milk and vinegar stayed pure longer in silver vessels, led to its desirability as a container for long voyages. Herodotus wrote that Cyrus the Great, King of Persia, a man of vision who established a board of health and a medical dispensary for his citizens, had water drawn from a special stream, “boiled, and very many four wheeled wagons drawn by mules carry it in silver vessels, following the king wheresoever he goes at any time.” (Source)

Donna Freedman from Surviving and Thriving presents This isn’t your grandparents’ recession, and says, “When the going gets tough, it’s tempting to invoke our grandparents and their tribulations during the Great Depression. But some of their advice wouldn’t help us. ”

Glen Craig from Parenting Family Money presents Inexpensive (Cheap) Date Night Ideas for Parents, and says, “It’s tough getting out with the spouse when you have kids. With babysitting and the date it can get expensive. See some inexpensive date night ideas and how you can save on babysitting as well.”

From 1998 to 2009, Bernard von NotHaus marketed the Liberty Dollar as an alternative to U.S. government fiat currency. Liberty Dollars were made from silver and later, gold and copper. von NotHaus was later convicted of–among other things–counterfeiting coins, even though he only produced his own coinage and didn’t pretend it was the same thing.

N.W. Journey from Net Worth Journey presents What is Compound Interest?, and says, “A basic introduction to compound interest.”

Bret from Hope to Prosper presents Age 21: A Year of Change and Humility, and says, “The year I turned 21 was the most tumultuous of my life. In many ways, that one year shaped my life more than any other and determined the direction of my future.”

Colloidal silver is claimed to be a near-magical cure-all. Its proponents claim it has the ability to “benefit the immune system; kill disease-causing agents such as bacteria, viruses, and fungi; serve as an alternative to prescription antibiotics; or treat diseases such as cancer, HIV/AIDS, diabetes, tuberculosis, syphilis, scarlet fever, shingles, herpes, pneumonia, and prostatitis (inflammation of the prostate).” Scientific evidence for any of this: none. (Source)

Money Beagle from Money Beagle presents The Economy Must Be Improving, and says, “I don’t need a government report to show me that the economy is improving; I look no further than the latest coupon offerings from local restaurants!”

Darwin’s Money from Darwin’s Money presents Stop Complaining About Gas Prices, and says, “Americans are complaining about prices at the pump. I say “Stop Complaining and Look in the Mirror”. Here are some very rational reasons and real solutions.”

The best method of storing silver is in bullet form. When the werewolves attack, none of us will have long to fight back.

Mike from The Dividend Guy Blog presents 7 Deadly Sins of Investments, and says, “Are you making these mistakes with investing?”

Mike Piper from Oblivious Investor presents Replacing Index Funds in Your Portfolio, and says, “For the most cost conscious of investors, it might make sense to build a portfolio of individual securities rather than index funds.”

RJ Weiss from Gen Y Wealth presents How to Convert a 401(k) to Traditional or Roth IRA, and says, “Reviewing your options with your 401(k) when leaving or changing jobs. More specifically, to look at the steps to convert your 401K(k) to an IRA, since this is most likely the optimal choice.”

Michael from DoughRoller presents How Half a Percent Can Ruin Your Retirement, and says, “Investing for retirement is crucial to securing your financial future. Make sure to find the best interest rates available, as even half a percent can ruin your retirement aspirations. ”

I had a silver ring in my septum for almost 10 years and, in fact, still maintain the piercing, but it’s usually empty.

Cathy Moran from Money Health Central presents An Alternate Truth About Financial Literacy, and says, “Financial literacy is grounded in understanding bigger truths about money, not in acting on those truths.”

Kara from Frugal In My Forties presents Worst Money Lessons My Family Taught Me, and says, “My parents had great financial skills: Unfortunately they weren’t really great about passing them on to their children. These are the 4 big things that I think they should have done differently!”

Mike from The Financial Blogger presents Teaching Finance In High School, and says, “A look at getting finance across at the high school level.”

Eric from Narrow Bridge Finance presents How Your Insurance Rates are Calculated, and says, “Ever wonder how insurance companies determine your monthly rates? Find out what you need to know here.”

FMF from Free Money Finance presents How Millionaires Become Millionaires, and says, “Many people mistakenly think that most millionaires have their wealth handed to them from either their relatives or some stroke of luck (like winning the lottery, being gifted with amazing abilities/talent, etc.) This is completely false. Most people with over seven-figure wealth got it the old-fashioned way, they earned it.”

Matt Bell from Matt About Money presents Money Lessons From the Royal Wedding, and says, “Amid all the royal wedding hoopla, did you notice what Prince William and his fiancée, Kate Middleton, asked for in terms of wedding gifts? Since this is one couple that truly does have everything, they asked anyone wanting to get them a gift to consider making a donation instead. For all of us commoners, there are two lessons we can learn from the royal couple’s philanthropic mindset.”

Sterling silver is 92.5% silver and 7.5% other, usually copper. Pure silver is too soft for most applications. It is, however, the most optically reflective element.

Jacob Irwin from My Personal Finance Journey presents Helping A Friend Get Out of Debt – Part 3 – Cut Your Interest Rates In Half, and says, “A look at the steps my friend and I took to get his credit card interest rates lowered, and how you can too!”

Junior Boomer from Consumer Boomer presents Top 5 Bankruptcy Myths Dispelled For You, and says, “For those who have been considering bankruptcy, but are concerned about the overall impact it could have on their financial future, we are going to break a few myths.”

Silver fulminate is an explosive, ionic, fulminic acid salt of silver. Yes, silver goes boom.

Echo from Boomer & Echo presents Assessing Your Estate Plan, and says, “Before making an appointment with your lawyer take some time to assess your situation and review your estate plan.”

Sustainable PF from Sustainable Personal Finance presents Eight Favourite Blogs, and says, “There are some awesome PF blogs out there and these are 8 you shouldn’t miss!”

Nicole from Nicole and Maggie: Grumpy Rumblings presents Dissecting an emergency room bill, and says, “Nicole and Maggie discuss how a recent bead up a preschool nose cost one of them $1400. (Actually $1700– a additional bill just came.)”

Tom Drake from Canadian Finance Blog presents The new breed of financial bloggers: Young, frugal and vocal, and says, “I’ve discovered a lot of young bloggers who do care about personal finance. Young bloggers can fill a void in financial education for young people.”

Tom from Stupid Cents presents What Is Term Life Insurance?, and says, “Life insurance is important for everyone but it can be expensive. That is where term life insurance can be the most helpful.”

Philip from PT Money: Personal Finance presents How to Pick a College that Suits You, and says, “Financial and other considerations when deciding on a college.”

That’s it. If you enjoyed this little journey through silver, please take a moment to subscribe to Live Real, Now.

CNN Money has an article up on 5 things to do this year. After posting a similar article a couple of weeks ago, I thought it’d be interesting to post about someone else’s perspective.

If you are paying fees for a checking account, go somewhere else. There are so many alternatives available that you shouldn’t be throwing money away. Ally Bank has a great no-fee checking account, as does INGDirect, though ING won’t let you write paper checks against the account. The same principle applies to credit cards. If you have a card with an annual fee and you aren’t getting some monster services or rewards to go with it, run away.

I don’t necessarily agree with this one. If you are in debt, it’s better to use the raise to pay off that garbage, first. When I got my last raise, I immediately boosted the automatic payment for my car to use every new penny. I’ve never had the money available, so I haven’t missed it. Whatever you do, fight lifestyle inflation. Just because you have some more money doesn’t mean you need to spend it. At my last job, I got a substantial raise, so I bought a new car, only to get laid off a few months later.

Wealth doesn’t matter if you squander your health. Go get a physical. Every disease is easier to treat if you catch it earlier as opposed to later. Don’t make the mistake of running your body into the ground. You will regret it later. Effective this year, most health plans will cover a physical with no copay, co-insurance, or deductible allowed.

B***-****. If you’ve still got debt, don’t concentrate on using more of it. Get that crap paid off. If you’re out of debt, look into getting a rewards card that aligns with your goals. If you like to travel, get a card that gives you frequent flier miles. Otherwise, I’d go with a cash-back rewards card.

37% of Americans don’t take all of the vacation to which they are entitled. That’s insane! We work harder and better when we have time to recuperate and relax. Unfortunately, I usually fall into that unfortunate 37%. My vacation resets on February 1st, and this will be the first year in a lot of years that I haven’t had to roll it over or even lose some.

What is your financial plan for the new year?

In this installment of the Make Extra Money series, I’m going to show you how to set up a WordPress site. I’m going to show you exactly what settings, plugins, and themes I use. I’m not going to get into writing posts today. That will be next time.

I use WordPress because it makes it easy to develop good-looking sites quickly. You don’t have to know html or any programming. I will be walking through the exact process using Hostgator, but most hosting plans use CPanel, so the instructions will be close. If not, just follow WordPress’s 5 minute installation guide.

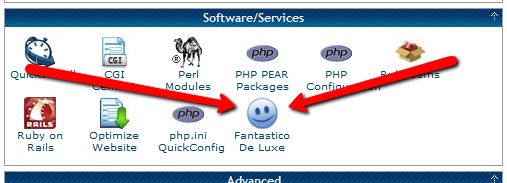

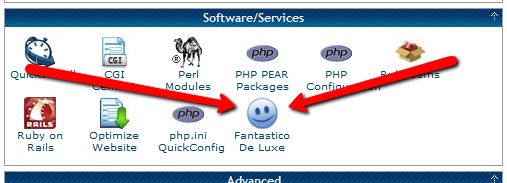

Assuming you can follow along with me, log in to your hosting account and find the section of your control panel labeled “Software/Service”. Click “Fantastico De Luxe”.

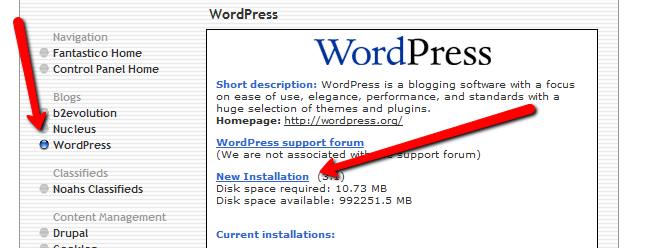

On the Fantastico screen, click WordPress, then “New Installation”.

On the next screen, select your domain name, then enter all of the details: admin username, password, site name, and site description. If you’ll remember, I bought the domain http://www.masterweddingplanning.net. I chose the site name of “Master Wedding Planning” and a description of “Everything You Need to Know to Plan Your Wedding”.

Click “install”, then “finish installation”. The final screen will contain a link to the admin page, in this case, masterweddingplanning.net/wp-admin. Go there and log in.

After you log in, if there is a message at the top of the screen telling you to update, do so. Keeping your site updated is the best way to avoid getting hacked. Click “Please update now” then “Update automatically”. Don’t worry about backing up, yet. We haven’t done anything worth saving.

Next, click “Settings” on the left. Under General Settings, put the www in the WordPress and site URLs. Click save, then log back in.

Click Posts, then Categories. Under “Add New Category”, create one called “Misc” and click save.

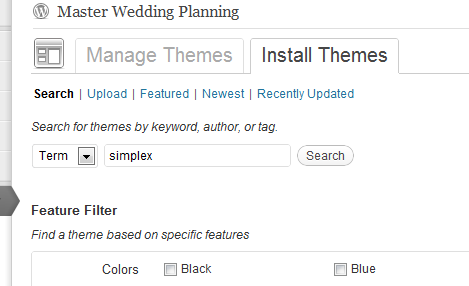

Click Appearance. This brings you to the themes page. Click “Install Themes” and search for one you like. I normally use Headway, but before I bought that, I used SimpleX almost exclusively. Your goal is to have a simple theme that’s easy to maintain and easy to read. Bells and whistles are a distraction.

Click “Install”, “Install now”, and “Activate”. You now have a very basic WordPress site.

A plugin is an independent piece of software to make independent bits of WordPress magic happen. To install the perfect set of plugins, click Plugins on the left. Delete “Hello Dolly”, then click “Add new”.

In the search box, enter “plugin central” and click “Search plugins”. Plugin Central should be the first plugin in the list, so click “install”, then “ok”, then “activate plugin”. Congratulations, you’ve just installed your first plugin.

Now, on the left, you’ll see “Plugin Central” under Plugins. Click it. In the Easy Plugin Installation box, copy and paste the following:

All in One SEO Pack Contact Form 7 WordPress Database Backup SEO SearchTerms Tagging 2 WP Super Cache Conditional CAPTCHA for WordPress date exclusion seo WP Policies Pretty Link Lite google xml sitemaps Jetpack by WordPress.com

Click “install”.

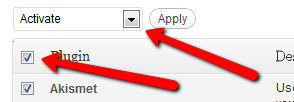

On the left, click “Installed Plugins”. On the next screen, click the box next to “Plugins”, then select “Activate” from the dropdown and click apply.

Still under Plugins, click “Akismet Configuration”. Enter your API key and hit “update options”. You probably don’t have one, so click “get your key”.

The only tool I worry about is the backup. It’s super-easy to set up. Click “Tools”, then “Backup”.

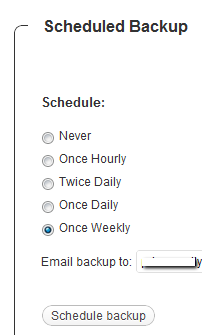

Scroll down to “Schedule Backups”, select weekly, make sure it’s set to a good email address and click “Schedule Backup”. I only save weekly because we won’t be adding daily content. Weekly is safe enough, without filling up your email inbox.

There are a lot of settings we’re going to set. This is going to make the site more usable and help the search engines find your site. We’re going to go right down the list. If you see a section that I don’t mention, it’s because the defaults are good enough.

Set the Default Post Category to “Misc”.

Visit this page and copy the entire list into “Update Service” box. This will make the site ping a few dozen services every time you publish a post. It’s a fast way to get each post indexed by Google.

Click “Save Changes”.

Uncheck everything under “Email me whenever…” and hit save. This lets people submit comments, without actually posting the comments or emailing me when they do so. Every once in a while, I go manually approve the comments, but I don’t make it a priority.

Select “Custom structure” and enter this: /%postname%/

Click save.

Set the status to “Enabled”, then fill out the site title and description. Keep the description to about 160 characters. This is what builds the blurb that shows up by the link when you site shows up in Google’s results.

Check the boxes for “Use categories for META keywords” and “Use noindex for tag archives”.

Click “Update Options”.

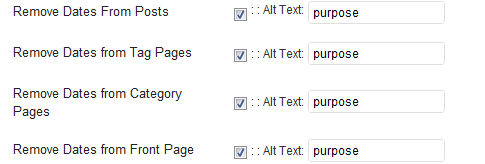

Check the boxes to remove each of the dates and set the alt text to “purpose” or something. This will suppress the date so your posts won’t look obsolete.

This plugin reinforces the searches that bring people to your site. It’s kind of neat. Skip the registration, accept the defaults and hit save.

Scroll to the bottom and click import. We’ll come back to this.

Select “Caching On” and hit save.

Across the top of the screen should be a giant banner telling you to connect to WordPress.com and set up Jetpack. You’ll need an account on WordPress.com, so go there and set one up. After authorizing the site, you’ll be brought back to the Jetpack configuration screen. Click “Configure” under “WordPress.com Stats”. Take the defaults and hit save.

On the contact configuration page, copy the code in the top section. You’ll need this in a moment.

Now, we going to create a couple of static pages. On the left, click “Pages”, then “Add new”.

Name the first page “Contact” and put the contact form code in the body of the page. Hit publish.

Under Appearance, click “Menu”. Enter a menu name and hit save.

Then, under “Pages”, click the box next to “Contact”, “Disclaimer”, and any other policies you’d like to display. Hit save.

Also under Appearance, click “Widgets”. This is where you’ll select what will display in the sidebar. All you have to do is drag the boxes you want from the middle of the page to the widget bar on the right. I recommend Text, Search, Recent Posts, Popular Search Terms and Tag Cloud. In the text box, just put some placeholder text in it, like “Product will go here”. We’ll address this next time.

We’re not going to worry about getting posts in place, yet. That will be the next installment. However, the steps in the next installment could take 2 weeks to implement, and we want Google to start paying attention now. To make that happen, we need to get a little bit of content in place. This won’t be permanent content. It’s only there so Google has something to see when it comes crawling.

To get this temporary, yet legal content, I use eZineArticles. Just go search for something in your niche that doesn’t look too spammy.

Then, click “Posts”, then delete the “Hello World” post. Click “Add new”. Copy the eZine article, being sure to include the author box at the bottom, and hit publish.

To see your changes, you may have to go to Settings, then WP Cache and delete the cache so your site will refresh.

Congratulations! You now have a niche blog with content. It’s not ready to make you any money, yet, but it is ready for Google to start paying attention. In the next installment, I’ll show you how I get real unique content and set it up so Google keeps coming back to show me the love.

This is a guest post written by Andreas Nicolaides, a financial author for UK based MoneySupermarket.com.

Whether your aim is to save money for a special occasion or you just want to make sure you don’t have to struggle financially when it comes to the end of the month, a budget can be a saving grace. Budgets help us quickly and easily identify our total income and all our expenditure, allowing us to plan for the best and prepare for the worst financial situations.

Set yourself a target

If you have decided to set up a budget, then there must be a reason. Are you looking to save for an upcoming event? Or maybe you have realised that you are struggling to make your payments every month and you would like to feel more financially secure. Based on what you would like to get out of your budget, you should set yourself a specific, measurable objective.

My first objective I set for myself was to save $100 every month for a year. This sort of objective is easy to manage and easy to monitor and this is what we are trying to achieve. One important thing I would mention here is to ensure your objective is achievable; don’t set yourself a target that is too far out of your reach, being realistic is extremely important.

How do you set up your budget?

The main key thing when you start to put your budget together is to make sure you’re as honest as possible. Get yourself a pen and some paper and on one page detail all of your income. Include the obvious and also remember to include any benefits you are entitled too. Then grab another piece of paper and detail all of your monthly outgoings, remember to be honest and thorough and try not to forget anything. Once you have both figures, deduct your expenditure from your monthly income that will give you your monthly figure.

You have some extra cash?

If when you have your figure you realise that there is some cash left over, you can then decide what you want to do with it. My advice here depends on your own personal circumstances, for example if you have high levels of debt, your main aim should be tackle your high interest debt aggressively and as often as possible.

If you have some money left over and your aim is to save, then set up an interest bearing bank account. If you are based in the US then you could look to set up an LSA or lifetime savers account. In the UK we have the equivalent, that is called a cash ISA saving account.

No money left over?

If after working out your budget you find you have no money left over, then you need to do something about it. Debt is one of those things that won’t just disappear overnight; it’s something that takes time and commitment, but not giving up is paramount.

How to cut down your expenditures?

One of the main things you can do when you realise you are in a bad situation is to try and cut down on your expenditure. Here’s a couple of quick ways:

A budget is used by many just to monitor what they spend month to month, but I hope I have detailed how it can be a helpful financial tool that can help you reach your financial goals. I hope my tips to budget successfully will help you get started on your way to financial freedom.

Last night, a friend called me up and asked me to accompany him to the police station. The police had knocked on his door, waking up his girlfriend while he was out. When he called, they wouldn’t tell him why they wanted to talk to him. Was it an ex trying to make his life difficult or one of his employees getting investigated?

This friend has had a number of interactions with the police, but never learned how to deal with them. Before we left, I gave him a crash course in “stay out of jail”.

During an investigation, you are a suspect. They are looking for a conviction. There may be a “good cop” trying to “help you out”, but he is trying to put you in jail. “Protect and Serve” doesn’t mean you. In general, it means society as a whole. During an investigation, they are serving the interests of the prosecutor.

Generally, they are going to look at you–as the target of their investigation–as the enemy. This is normal. They spend all of their time dealing with scumbags and s***heads. Naturally, they start to assume that everyone who isn’t a cop will fall into one of those categories.

Don’t get pissed when they act rude, ignore you, or anything else. It isn’t a lack of professionalism, it’s just a different profession. They are using interrogation techniques that have been proven successful. Ignore it and focus on Lesson 2.

It will feel wrong to disobey the authority you’ve been taught your entire life to obey. You’re not. You are standing by your rights. Nobody cares about your future more than you do. Certainly not the guy investigating you.

The second a police interaction starts to look like they are investigating you, demand your lawyer, then see Lesson 4. When you demand an attorney, they stop asking you questions. You can take it back and start talking, so again, see Lesson 4. It’s your attorney’s job to talk to the police and, if necessary, the media. It’s your job to talk to your attorney.

You don’t need an attorney ahead of time. Criminal defense attorneys are used to getting calls at 3AM. It’s part of their job. If you have a low enough income as defined by whatever jurisdiction you are being investigated in, you can get a public defender. That’s better than nothing, but I’d prefer to hire a professional shark, even if it means mortgaging my future. Prison is a big gamble.

The right of the people to be secure in their persons, houses, papers, and effects, against unreasonable searches and seizures, shall not be violated, and no Warrants shall issue, but upon probable cause, supported by Oath or affirmation, and particularly describing the place to be searched, and the persons or things to be seized.

“Officer, I do not consent to any search and I would like to speak to my attorney.” Remember this. Memorize it.

They need probable cause, a warrant, or permission to search your stuff. Never agree to it. Don’t stop them if they search anyway, but never, ever agree to a search. If the search is done improperly, your lawyer(see Lesson 2) will get the results of that searched thrown out.

It isn’t possible to get into more trouble for standing by your rights. There is no crime on the books anywhere in the US called “Refused Consent to Search”. Your day will not go worse because you defended your Constitutional rights.

I know a few defense attorneys. According to them, most of the people in jail either committed a crime in front of a bunch of witnesses, or they talked their way into jail. Shut up. You’ll want to either justify or defend yourself depending on the circumstances. Don’t. Shut up. It may be one of the hardest things you ever do, but keep your mouth closed. The only thing worse than talking is lying. Don’t lie, just keep quiet.

There is nothing you are going to say that will make your interrogator invite you home for Christmas. He isn’t your friend, you won’t meet his parents, you aren’t going to his birthday party. There is absolutely no win in talking to him. Shut up. The answer to every question is “Lawyer.” If the only thing you say babble is “Lawyerlawyerlawyerlawyerlawyerlawyer”, you’re probably not going to do too badly.

In your car, the dynamic changes a bit, but the principles don’t. When a cop pulls you over, don’t argue. You can’t win an argument with a cop on the side of the road. Be nice, be polite, and as soon as possible, pull into a parking lot and take as many notes about the encounter as you can. If you are planning to fight whatever he pulled you over for, don’t give him any reason to remember you or spin his official report to make you look bad. Again, shut up. Catching a theme?

If you are being investigated by the police, your future–or some part of it–is on the line. While you are gambling with your criminal record and your freedom, don’t forget that you are an amateur in this arena. The police, the prosecutor, and your attorney are the professionals and the stakes can be huge. Keep your mouth shut, call your attorney, and thank me later.