- Guide to finding cheap airfare: http://su.pr/2pyOIq #

- As part of my effort to improve every part of my life, I have decided to get back in shape. Twelve years ago, I wor… http://su.pr/6HO81g #

- While jogging with my wife a few days ago, we had a conversation that we haven’t had in years. We discussed ou… http://su.pr/2n9hjj #

- In April, my wife and I decided that debt was done. We have hopefully closed that chapter in our lives. I borrowed… http://su.pr/19j98f #

- Arrrgh! Double-posts irritate me. Especially separated by 6 hours. #

- My problem lies in reconciling my gross habits with my net income. ~Errol Flynn #

- RT: @ScottATaylor: 11 Ways to Protect Yourself from Identity Theft | Business Pundit http://j.mp/5F7UNq #

- They who are of the opinion that Money will do everything, may very well be suspected to do everything for Money. ~George Savile #

- It is an unfortunate human failing that a full pocketbook often groans more loudly than an empty stomach. ~Franklin Delano Roosevelt #

- The real measure of your wealth is how much you'd be worth if you lost all your money. ~Author Unknown #

- The only reason [many] American families don't own an elephant is that they have never been offered an elephant for [a dollar down]~Mad Mag. #

- I'd like to live as a poor man with lots of money. ~Pablo Picasso #

- Waste your money and you're only out of money, but waste your time and you've lost a part of your life. ~Michael Leboeuf #

- We can tell our values by looking at our checkbook stubs. ~Gloria Steinem #

- There are people who have money and people who are rich. ~Coco Chanel #

- It's good to have [things that money can buy], but…[make] sure that you haven't lost the things that money can't buy. ~George Lorimer #

- The only thing that can console one for being poor is extravagance. ~Oscar Wilde #

- Money will buy you a pretty good dog, but it won't buy the wag of his tail. ~Henry Wheeler Shaw #

- I wish I'd said it first, and I don't even know who did: The only problems that money can solve are money problems. ~Mignon McLaughlin #

- Mnemonic tricks. #

- The Wilbur and Orville Wright Papers http://su.pr/4GAc52 #

- Champagne primer: http://su.pr/1elMS9 #

- Bank of Mom and Dad starts in 15 minutes. The only thing worth watching on SoapNet. http://su.pr/29OX7y #

- @prosperousfool That's normal this time of year, all around the country. Tis the season for violence. Sad. in reply to prosperousfool #

- In the old days a man who saved money was a miser; nowadays he's a wonder. ~Author Unknown #

- Empty pockets never held anyone back. Only empty heads and empty hearts can do that. ~Norman Vincent Peale #

- RT @MattJabs: RT @fcn: What do the FTC disclosure rules mean for bloggers? And what constitutes an endorsement? – http://bit.ly/70DLkE #

- Ordinary riches can be stolen; real riches cannot. In your soul are infinitely precious things that cannot be taken from you. ~Oscar Wilde #

- Today's quotes courtesy of the Quote Garden http://su.pr/7LK8aW #

- RT: @ChristianPF: 5 Ways to Show Love to Your Kids Without Spending a Dollar http://bit.ly/6sNaPF #

- FTC tips for buying, giving, and using gift cards. http://su.pr/1Yqu0S #

- .gov insulation primer. Insulation is one of the easiest ways to save money in a house. http://su.pr/9ow4yX #

- @krystalatwork It's primarily just chat and collaborative writing. I'm waiting for someone more innovative than I to make some stellar. in reply to krystalatwork #

- What a worthless tweet that was. How to tie the perfect tie: http://su.pr/1GcTcB #

- @WellHeeledBlog is giving away 5 copies of Get Financially Naked here http://bit.ly/5kRu44 #

- RT: @BSimple: RT @arohan The 3 Most Neglected Aspects of Preparing for Retirement http://su.pr/2qj4dK #

- RT: @bargainr: Unemployment FELL… 10.2% -> 10% http://bit.ly/5iGUdf #

- RT: @moolanomy: How to Break Bad Money Habits http://bit.ly/7sNYvo (via @InvestorGuide) #

- @ChristianPF is giving away a Lifetime Membership to Dave Ramsey’s Financial Peace University! RT to enter to win… http://su.pr/2lEXIT #

- @The_Weakonomist At $1173, it's only lost 2 weeks. I'd call it popped when it drops back under $1k. in reply to The_Weakonomist #

- @mymoneyshrugged It's worse than it looks. Less than 10% of Obama's Cabinet has ever been in the private sector. http://su.pr/93hspJ in reply to mymoneyshrugged #

- RT: @ScottATaylor: 43 Things Actually Said in Job Interviews http://ff.im/-crKxp #

- @ScottATaylor I'm following you and not being followed back. 🙁 in reply to ScottATaylor #

Teaching Kids about Money

Today, Mr Credit Card from www.askmrcreditcard.com is going to contribute with an article about things we can teach our kids about life and money. He asks that you check his best credit card offers page if you are looking for a new card

I honestly think teaching kids about money this is the most overlooked thing that most parents do not teach. Instead, kids learn from our behavior and how we treat money. But I really think the subject of how to manage money must be taught.

I have three kids and teaching them stuff is sure tough. But as a parent, I would like to instill good habits (including money habits). Here are some of the things I think we can do to teach them about various aspects of life that will affect their outlook about hard work and money.

Reward Hard Work hard and Not Just Results – Some kids are talented at certain things like math or baseball. Very often (in their early ages), they excel in school or sports without much effort because of talent. But very often, because of the talent, they do not develop the habit of working hard (because they do not have to). But as they grow older, they are going to face obstacles. If they do not learn the value of hard work and overcoming difficulties, they will hit the brick wall often. Teaching them the value of hard work (even if they are talented) is so important.

What has this got to do with money? Well, I think delayed gratification is one of the hardest thing to teach, so we try to praise our kids when they achieved something due to hard work. We tell them that they accomplished it because they worked at it and we explain that to be able to afford expensive things, they have to study hard, work hard and earn their own money!

Going to Shop Does Not Mean You Have to Shop! – There are various ways to go about doing it. One way is simply to explain concepts as they come along. For example, initially, my kids always wanted to buy stuff when they go to Toys R Us or anywhere else. To put a stop to this nonsense, we had to explain that just because we went to a shop does not mean we have to buy anything. We could be just looking, doing some research or simply buying a gift for someone else.

Ask Them What Happened To Stuff They Bought A While Ago – Another thing that we like to bring up to our kids when they want to buy something on impulse is to remind them of something they bought in the past and whether they are now still excited over it and playing with it. Chances are that they will say no! We found that this was a very effective way to make them realize that they should think twice before buying anything.

Teach Kids to Compare Price – Here is another technique we use: When we go grocery shopping, Mrs Credit Card asks the kids to compare prices of the cheapest cereals. We explain to them that even though they love a particular one, there are times when it is not the best time to buy it. They should only buy it if it is on sale. We also ask them to compare the price relative to the weight of the product to see which gives greater value for money. After a while, they catch on and only buy cereal that is on sale!

Make Them Work – I see lots of kids organizing lemonade stands outside their houses during summer. It could be to draw crowds for a garage sale or to raise money for a fundraiser. I think this is such a great thing as they can learn so many things just from selling lemonade. They can learn the the concept of selling things for a profit.

Another common task kids or teens take is to work to earn some money. It could be as simple as baby sitting, walking your neighbors dog or working at the ice-cream shop. Making them realize that they need to earn before they can spend is a good lesson.

Slowly Give Them More Responsibilities – As kids grow older, I believe in giving them more responsibility. It could be making the oldest kid look after their younger siblings. Or giving them tasks like clearing the trash, doing the dishes, etc. I know of some parents who give their teens prepaid credit cards to start teaching them about using “credit” (though it is not technically credit). Maybe that is a bad idea as you want them to know to manage a student credit card when they are old enough to get one.

Selling Things For Fund Raisers – One of the things that I admire about the Boys Scouts is that they are always doing fundraisers for their scouting trips and events (no money, no outings). It teaches them “cold calling” or more likely, approaching Dad and Mom’s friends to sell things like coffee beans and Christmas wreaths!

Teach Them Not To Waste Stuff – Another thing I like to emphasize to kids is not to waste stuff. Whether it is the water when they brush their teeth or making sure they do not waste food, we are pretty particular about this. I think this is a good mindset to instill in our kids.

Performance Matters More Than How Good Your Look – I find that kids like to buy fancy stuff and beyond a certain age, they are conscious about brands. I’ve mentioned this before, but when my kids first played baseball and soccer, they keep bugging me to get them the fancy gear. I had to keep telling my kids that how you perform matters more than your gear. After a couple of years of playing, I think they have finally come to realize this and no longer bug me about things.

It’s a Never-Ending Process – Teaching your kids about money and other things that are important is a never-ending process. But you have to do it when they are young because once they grow older, they tend not to listen to their parents anymore and are more likely to be influenced by peers.

Update: This post has been included in the Carnival of Debt Reduction.

13 Things to Know About Sweepstakes, Giveaways, Lotteries, and Contests

- Image via Wikipedia

I don’t know why, but it seems like this time of year breeds sweepstakes, drawings, and giveaways. Maybe it’s to cash in on the people who are afraid to pay for the holidays, maybe it’s because, at the end of the year, people are realizing how much money they didn’t make this year, or maybe I’m only noticing now because I just ran a giveaway to celebrate my 1 year anniversary. Whatever the reason, there are a lot of giveaways going on this month and, because a certain segment of the population sucks, there are a number of scam sweepstakes going on, too.

Knowing some basic facts about sweepstakes–legal and otherwise–can help you stay safe and avoid wasting your time and money. Here are 13 things you should know:

- Foreign sweepstakes are always scams. You didn’t win the Spanish lottery. I’m sorry, but it’s true.

- Sweepstakes winners are always chosen at random. If there’s something you can do to influence your chances, it’s not a sweepstakes.

- Contests involve some skill, whether it’s captioning a photo, answering a trivia question, or showing up in a bikini. It is legal to charge a fee to enter a contest.

- Lotteries cost money and must be random. There are almost no cases where a lottery is legally run by a private enterprise. The government has reserved this privilege for themselves.

- Since a prize, chosen at random for a consideration is the definition of a lottery, there is nothing you can do to influence the results of a legal sweepstakes, aside from not entering. Buying a product will not help.

- Odds suck. You are not likely to win, unless you enter a giveaway at a small-ish blog. Sweepstakes and lotteries are required to disclose the odds of winning, generally, 1 in a gazillion.

- Businesses(and blogs!) hold giveaways or sweepstakes to draw attention to themselves. It’s marketing and advertising, every time. Companies do not give out thousands of dollars in prizes because they like you.

- I give our prizes because I like you. And I want the attention. It’s marketing, advertising, and gratitude.

- If you have to pay to get a random chance to win something, it’s a lottery. If it’s not run by the government, it’s almost definitely an illegal lottery. Sweepstakes are free.

- Sometimes the entry solicitations look official. They are not. The companies do that to get more people to open their envelopes. It is illegal to misrepresent themselves as a government agency.

- Always read the fine print. There are a lot of things that can be included in the fine print to make it less attractive, like the right to sell your contact information, or your soul. Try getting that back after a long weekend.

- If you don’t want to receive sweepstakes garbage in the mail, write to the company soliciting you. The Federal Deceptive Mail Prevention and Enforcement Act requires them to remove you from their mailing list within 60 days.

- If you want to get rid of all of the junk mail, write to the Direct Marketing Association’s Mail Preference Service, Post Office Box 643, Carmel, NY 10512 and they will remove you from the lists of their members for 5 years.

It is possible to make money with sweepstakes, but the odds are low. Personally, I think it’s a waste of time. Do you invest in the sweepstakes hobby?

Make Extra Money Part 4: Keyword Research

In this installment of the Make Extra Money series, I’m going to show you how I do keyword research.

Properly done–unless you get lucky–this is the single most time-consuming part of making a niche site. If you aren’t targeting search terms that people use, you are wasting your time. If you are targeting terms that everybody else is targeting, it will take forever to get to the top of the search results.

Spend the extra time now to do proper keyword research. It will save you a ton of time and hassle later. This is time well-spent.

If you remember from the last installment, when we researched products to promote, we narrowed our choices down to a few products.

What I’ve done is create a spreadsheet to score the products. You can see the spreadsheet here. I’ll explain the columns as we populate them.

The first column contains the name of the product. Easy. We’ve got 10 products. I’m going to walk through scoring 1 product, then, through the magic of the internet, I’ll populate the rest, and you’ll get to see the results instantly. Wow.

The second column is the global search volume for the exact search term. I base my product niche sites primarily on the demand for a given product. Everything else is a secondary consideration.

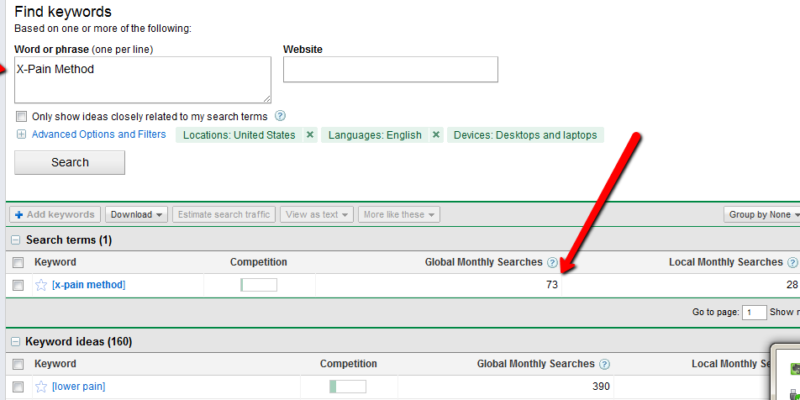

To find the demand for a product, go to the Google Adwords Keyword Tool. In the “word or phrase” box, enter your product name, exactly. In this case, it’s “X-Pain Method”. When the search results come up, change the match type to “Exact”. You should have something like this:

Enter the global search volume in column 2. In this case, it’s 73. Keep this window open, because we’ll be coming back to it.

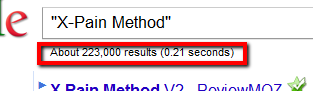

Column 3 is the search competition. Go to google and enter your product name, in quotes. In this case, “X-Pain Method”. Put the total number of search results in column 3: 223000.

Column 4 is the search competition, but only what appears in a page’s title. Your search query is intitle:”X-Pain Method”, which yields 4400 results.

The next column is for the average PageRank of the first page of search results. For this, I use Traffic Travis. I use the 4th edition, which is paid software, but you can get the free version of version 3, instead. I’ll use version 3 for this example. Open the software and click on “SEO Analysis” on the bottom left of the screen. Put your search term (“X-Pain Method”) in the “phrase to analyze” and set the “Analyze Top” to 10, then hit “Analyze”. When it’s done running, just add up all of the PRs and divide by 10. Ignore Travis’s difficulty rating.

Now, for the rest of the columns, we’re going to look at the keyword tool again. We’re going to pick 3 alternate search terms. Here are the criteria:

- At least 1000 global monthly searches. We want terms that people are searching for.

- Competition bar at medium or less. This bar is just a rough guess on competition, so it’s really an arbitrary exclusion factor, but it helps narrow down the choices.

- A “buying” keyword is preferred, but not necessary. This is a term that indicates people are looking to spend money. “Back pain doctor” is a buying keyword, but it’s not an indicator that someone wants to buy a product, so we’ll skip it. A buying keyword isn’t absolutely necessary, because these will also be the terms we’ll use to generate content later.

- It has to be related to our product.

Once we pick the keywords, we’ll throw them into google to get the competition, just like we did to populate column 2.

“Exercises for back pain” has medium competition and 1900 monthly searches. It also has an estimated cost-per-click of $3.02, which means people are paying for this.

“Lower back pain exercises” has 6600 searches and medium competition. It’s actually on the lower end of medium, so it looks really promising.

“Lower back” has 4400 searches and low competition, with a CPC of $6.24. This should be a good one. Scratch that. It has 40 million search results, but only 4400 searches. That’s a lot of competition for a small market.

Instead, I’m going to search for “cure back pain” in the keyword tool and see what I get. “Upper back pain” is better. Low competition, 18000 searches each month, and only 2000000 competing search results. Now, I’ll score it.

You really want at least 500 searches per month for the product name. More than 2500 is better. I’m going to assign 1 point per 500 monthly searches.

You also want a lower number of search results. Less than 10,000 is ideal. Less than 100,000 is still decent. More than 250,000, I’d walk. So, under 10,000 gets 5 points. Under 50,001 gets 4. Under 100,001 gets 3. Under 200,001 gets 2. Under 250,001 gets 1. Any higher gets 0.

The ideal intitle search will have less than 2000 results. More than 100,000 is too time-consuming to deal with. 0-2000: 5 points; 2001-10,000: 4 points; 10001-25000: 3 points; 25001-50000: 2 points; 50001 to 100000: 1 point.

The perfect product will have the first page of search result all with a PageRank of 0. That’s a 5 point product. I’ll knock off half a point for every point of average PR.

The related terms are more relaxed. They are what’s known as “Latent Semantic Indexing” (LSI) terms. We will be creating articles to match those search terms, mostly to make our niche site look as natural and real as possible. Any actual traffic those pages drive is just gravy. Points for the related searches start at 10 and get 1 point knocked off for each 3 million results. We’ll be treating the 3 terms as one for this score.

That gives us a perfect score of about 25. There’s no actual upper limit, since the score for the search volume has no upper limit. X-Pain Method scored 18.22.

Now, excuse me a moment while I score the rest.

I’m back. Did you miss me?

I’ve finished scoring each of the products and sorted the results by score. The clear winner is the back pain product, but the lack of searches bothers me. The wedding guide looks much nicer, especially if I target the phrase “wedding planning guide” during the SEO phase of the project. That change alone brings the score almost to first place.

Frankly, I’d take either 2nd or 3rd place over the back pain product. The bare numbers don’t support it, but my judgement tells me they are better products to promote.

There is one final step before deciding on the product. I have to buy it. I can’t review the product without seeing it and I can’t promote it without approving of it.

That’s the secret to ethical niche marketing, you know. Only promote good products that you’ve personally read, watched, or used.

Budgeting Bulimia

As the President is so quick to point out, ten years ago, there was a large budget surplus. Naturally, the government went into a massive cycle of lifestyle expansion. That expansion, combined with lower tax revenue and a recession has brought us from a $230 billion surplus to a $1.4 trillion deficit. That’s a bit above the trivial level. A definite binge.

In Minnesota, there was a $2 billion surplus just a few years ago, which was obliterated by, once again, government expansion and a recession. During the boom years, government programs were enacted with no thought to sustainability. Nobody thought about the fact that a surplus isn’t a balanced budget, either. We just kept adding to the budget, thinking the good times would last forever. Another binge.

Last year, the governor of Minnesota had to “unallot” money from the budget. He went through the budget with a red pen and struck line items until the budget was balanced, a requirement in this state. This infuriated his political opposition. They were not prepared for the purge.

Federally, the purge hasn’t happened, yet. Give it time. Excessive spending using imaginary money can only last so long. It will stop. The longer the binge, the harder the purge.

Families are doing the same thing. Four years ago, I got a raise and immediately bought a new car. Binge. Two months later, I was laid off and had to cut everything possible to make ends meet. Purge. Tax refunds, inheritances, drawings. So many of these things give us an excuse to commit to long-term expenses without planning for long term sustainability. If I inherit $5000, is that a good time to add $500 to my monthly bills? No! That’s an unhealthy binge. In ten months, if the money lasts even that long, I will be forced to purge something to keep afloat.

The responsible, healthy way is the same as healthy, responsible eating. Diet and exercise. Spend less, save and earn more. That’s the strategy that will let you level out life’s valleys, instead of puking all over the floor. Don’t spend every cent you see, just because it is there. Set some aside for a rainy day.

Leave the binge-and-purge financing to the politicians.

Update: This post has been included in the Festival of Frugality.

Is Your Budget Doing More Harm Than Good?

Do you stress over your money?

Is your spouse under the impression that you are constantly fighting over money?

Are you constantly fighting over money?

Have you completely eliminated your quality of life?

Do you spend hours each week analyzing where your money has gone?

A total budget can have a negative effect on the other parts of your life. If your spouse isn’t 100% on board, maybe he/she needs some “blow money” that doesn’t need to be tracked. If you aren’t spending enough time with your children because you are tracking expenses and adjusting your budget every day, you need to automate something, or at least loosen your standards. Maybe tracking every penny isn’t the right method of budgeting for you.

Don’t let the perfect budget destroy the rest of your life. If money is still a fight, you’re going to need to compromise on something, now, or you’ll end up compromising with the help of a divorce attorney.

Don’t forget, you are living now, not in the future. Plan for the future, but live in the present. There is a balance there, somewhere. Find it, or you and your loved ones won’t be happy.

Update: This post has been included in the Money Hacks Carnival.