LRN got hacked this morning. Thankfully, I backup weekly and subscribe to my own RSS feed. 20 minutes to total restoration.

Twitter Weekly Updates for 2010-06-26

- RT @ScottATaylor: The Guys on "Pickers" should just follow the "Hoarders" teams around- perfect mashup #

- PI/PNK test: http://su.pr/2umNRQ #

- RT @punchdebt: When I get married this will be my marital slogan "Unity through Nudity" #

- http://su.pr/79idLn #

- RT @jeffrosecfp: Wow! RT @DanielLiterary:Stats show 80% of Americns want to write a book yet only 57% have read at least 1 bk in the last yr #

- @jeffrosecfp That's because everyone thinks their lives are unique and interesting. in reply to jeffrosecfp #

- @CarrieCheap Congrats! #CPA in reply to CarrieCheap #

- @prosperousfool I subscribe to my own feed in google reader. Auto backup for in between routine backups. Saved me when I got hacked. in reply to prosperousfool #

- @SuzeOrmanShow No more benefits? I bet the real unemployment rate goes down shortly thereafter. in reply to SuzeOrmanShow #

- Losing power really make me appreciate living in the future. #

20 Happy Thoughts

Since I’ve been on a bit of a death theme lately, I thought I post something purely happy.

Here it is. In no particular order, twenty unequivocated things that make me happy.

- My three year old has the most beautiful blue/silver/gray eyes I have ever seen.

- In the past 32 months, I’ve reduced my total debt load by $42,859.70. That’s an average reduction of $1,339.37 per month.

- My insane work schedule is paying off. I’m more than halfway to making my day job’s income redundant.

- My preteen son is currently showing none of the signs of the horrible rebellion that I put my parents through.

- The world hasn’t imploded, exploded, or tilted its axis recently.

- My parents did a good job of raising me.

- I haven’t touched my overdraft line of credit in more than 2 years.

- My wife loves me.

- I love her.

- Wrestling season starts tomorrow, and Punk ended last season with real promise.

- I’ve dropped 12 pounds in the last 16 days.

- Bacon is good.

- Daughter #1 is starting kindergarten in September and excited about it.

- Our cars are paid off.

- This site helps me stay motivated to eliminate my debt.

- You rock.

- I may get out of debt just before the world ends.

- The Yakezie Network has helped get this blog to where it is. If you’ve got a finance blog, join today. You won’t regret it.

- FINCON 2012 is is Denver and I won’t be napping on my motorcycle on the way there, like I did the last time I went to Denver. It’s not something I recommend, but it makes a neat story.

- I have 20 things to be happy about. That’s a recursive happy-maker right there.

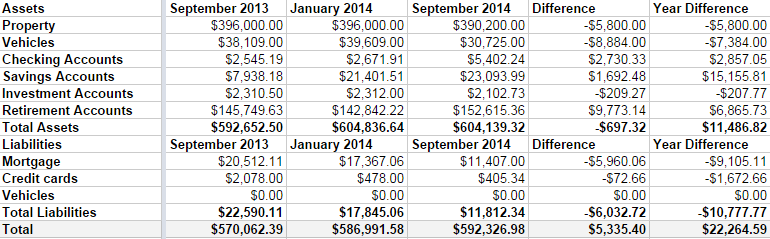

Net Worth Update – September 2014

It’s time for my irregular-but-usually-quarterly net worth update. It’s boring, but I like to keep track of how we’re doing. Frankly, I was a bit worried when I started this because we’ve been overspending this summer and Linda was off work for the season.

But, all in all, we didn’t do too bad.

Some highlights:

- Both of our properties lost around $3000 in value. I’m not worried, because we are keeping them both for the long haul. The rental is basically on auto-pilot, so that’s free money every month.

- We sold a boat that appraised for much less I had estimated in the last few updates. I had it listed for $5000, but it was worth $2000.

- I do have a credit card balance at the moment, but that goes away as soon as my expense check clears the bank, which will be in a day or two.

- We’re in the home stretch with the mortgage. There is $11,407 left to go, and we’ve paid down $9105 in the last year. By this time next year, I want that gone, gone, gone.

I can’t say I’m upset with our progress. We’ve paid down $6000 in debt in 2014, including 3 months with 1 income. We aren’t maxing our retirement accounts, yet, but I’d like to be completely debt free before I do that. It’s bad math, but having all of my debt gone will give me such a warm fuzzy feeling, I can’t not do it.

My immediate goal is to hit a $600,000 net worth by my next update in January. I’m only about $7000 off.

Time to hit the casino. Err, I mean, time to up my 401k contribution from 5% to 7%.

The High Cost of Keeping Richard Ramirez in Prison

Serial killers in the United States often gain cult status due to their strange courtroom antics and dramatic personalities. Recently deceased death row inmate Richard Ramirez was definitely one of the most famous serial killers of all time before he passed away of liver failure in California’s San Quentin State Prison.

After a dramatic arrest in 1985 in East Los Angeles by residents who recognized Ramirez from photographs displayed all over the news, Ramirez would sit in jail for years while awaiting a trial that finally began in 1989. There would be no more expensive trial in the history of Los Angeles County except for the O.J. Simpson trial that occurred a few years later.

At a cost of $1.8 million dollars, Los Angelinos would pay dearly for the privilege of trying Ramirez in a court of law. Incredibly, however, this massive sum wasn’t the only cost associated with this vicious serial killer. Because he was sentenced to death and due to the incredibly long appeals process associated with death row inmates, Ramirez sat in jail for over two decades without any fear of actually being put to death by the state of California.

Over the past hundred years, the number of individuals incarcerated in the United States has ballooned from a few hundred thousand people to almost 2.5 million prisoners. The most expensive people to incarcerate are death row inmates, who sit in a type of solitary confinement for decades. A moratorium on future executions in California has ensured that inmates like Ramirez have been costing taxpayers millions of dollars for housing and appeals with no likelihood of being put to death.

According to the American Civil Liberties Union, there are around 700 people sitting on death row in California, which require a massive investment of tax dollars. The state’s ongoing budget crisis and inability to balance its budget has put great strain on the prison system to house so many death row inmates at such an incredible cost.

Richard Ramirez’s untimely death at the age of 53 and his decades-long residency within a state prison brings to light a disturbing fact: more inmates die of natural causes while on death row than are actually put to death. Whether support for the death penalty exists or not, the billions of dollars spent by the state to keep inmates on death row has resulted in just 13 executions since the late 1970s.

A study in 2011 that was conducted by a judge and professor in the state suggested that California has spent over $4 billion since the death penalty was reinstituted. Out of those funds spent, at least a billion dollars was used for housing and incarceration of the inmates, including serial killers like Richard Ramirez.

A further study presented by the Commission on the Fair Administration of Justice in 2008 suggested that keeping the system intact with inmates on death row would cost around $137 million dollars a year. On the other hand, if California was to commute those death sentences to life in prison and abolish the death penalty, the yearly cost would drop to $11.5 million a year.

Offering the families of victims of death penalty-worthy crimes the chance to see a killer or other criminal experience the ultimate punishment may offer some sort of closure. Unfortunately, with the expectation that individuals on death row are more likely to die of natural causes than be put to death in California, the implementation of the death penalty in the state must be reexamined.

Related articles

What Is Your Binary Options Strategy?

When you are just entering the world of binary options trading or investing, you may be on the receiving end of a lot of advice. It is not uncommon to hear people tell you to implement different gambling strategies because binary options are based on chance more than anything else. You will also hear a lot of advice from those who say there are many good ways to develop an effective strategy using indicators and market signals. Some will insist that with proper analysis of market data, a solid strategy can be developed too.

When you are just entering the world of binary options trading or investing, you may be on the receiving end of a lot of advice. It is not uncommon to hear people tell you to implement different gambling strategies because binary options are based on chance more than anything else. You will also hear a lot of advice from those who say there are many good ways to develop an effective strategy using indicators and market signals. Some will insist that with proper analysis of market data, a solid strategy can be developed too.

Are they all correct? Interestingly enough, the answer is yes. The reason for this is simple, and as one expert writes, “there is no such thing as a perfect strategy for every trader. There is only a best strategy for each individual trader.” Thus, your strategy has to be shaped around a few things:

- Your willingness and ability to follow your chosen strategy.

- Your personality. For instance, are you restless if you are taking the safe route or a higher risk strategy?

- Your budget and goals,

Identifying the answers to these questions is the first step to formulating a strategy. You should also understand that the winning percentage of most strategies will be somewhat constant, but the total number of successful trades varies on an individual basis and is based entirely on the strategies used.

For instance, some investors want a high percentage of winning trades and are more comfortable with risk averse trading. Others are ready to take more risk and are entirely comfortable winning fewer trades if the returns on winning trades are dramatically higher. This enables them to implement higher risk trades. The interesting thing about strategies and the kinds of trades they generate is that they are all built from the same data.

The Data of Strategy

For example, almost all strategies will look at issues like market trends, trading trends, highs and lows, reversals, and various kinds of indicators. The reason that high and low trends pay off in strategy development is simple: binary options trading applies to whether or not an asset rises above a strike price or doesn’t. It is the proverbial “yes or no” part of the proposition and analysis for either outcome pays off.

As an example, a lot of risk-averse investors will look for breakouts. They use these for trend line investing, which can be as brief as sixty seconds to a day, but can be used to coordinate investing in the direction of a short trend. Although this seems complex, it really is not. The key is that analysis cannot be broad and across all available markets. Instead, focused analysis on a specific area will allow even a novice investor to analyze for a breakout and then invest in binary options accordingly.

Just being able to detect a reversal or a downward trend over the course of a day can yield a very rewarding investment. The key is to understand your strategy based on your budget, personality, and your ability to stick with the strategy, even if it does not yield immediate success. When you do this, and use the right tools for analysis, you can create an effective strategy that brings you closer to your goals.

This is a guest post.